Forex Fundamental News Facts for 12th June, 2024

➖➖➖➖➖➖➖➖➖

[Quick Facts]

➖➖➖➖➖➖➖➖➖

1. Israel thinks Hamas has rejected the ceasefire proposal.

2. “Political black swans” hit France, causing fluctuations in markets.

3. OPEC monthly report shows major central banks will ease policy in H2.

4. IEA Warns Supply Surplus Could Hit Covid Lockdown Levels By 2030.

5. WSJ’s Timiraos thinks the Fed will keep interest rates unchanged.

6. UK Economy Stalls In Blow To Rishi Sunak.

7. Traders Run for Safety as Anxiety in Europe Grows: Markets Wrap.

8. US May CPI Outlook: Rate-Cut Expectations May Cool Again.

9. Gold Price Seems Vulnerable.

10.. China Inflation Stays Low Amid Tepid Consumer Spending.

11. India To Remain Fastest-growing Economy, To Log 6.7 Pc GDP Growth In Next 3 Years: World Bank.

➖➖➖➖➖➖➖➖➖

[News Details]

➖➖➖➖➖➖➖➖➖

Hamas, the Palestinian Islamic Resistance Movement, responded to the U.S. ceasefire proposal for the Gaza conflict on Tuesday. However, Israel interpreted the response as a rejection. An Israeli official stated that Hamas had altered all the significant parameters of the proposal, including President Biden’s hostage release proposition. Hamas, on the other hand, insists that it merely restated demands unfulfilled by the current plan.

➖➖➖➖➖➖➖➖➖

French President Emmanuel Macron’s decision to call an early parliamentary election has led to significant market fluctuations. The French stock market experienced its largest two-day drop in a year, with bank shares and French government bonds falling. The market did not foresee any major political risks in France and Europe, but these risks are expected to rise in the coming weeks, leading to increased volatility.

➖➖➖➖➖➖➖➖➖

The OPEC Monthly Report suggests that major global central banks, including the Federal Reserve, the European Central Bank, and the Bank of England, may adopt more lenient monetary policies in the second half of the year. This will depend on the development of their economies and inflation. The report also highlights the steady global growth momentum of the services sector, which is expected to significantly contribute to economic growth in the second half of the year.

➖➖➖➖➖➖➖➖➖

The International Energy Agency (IEA) recently reported that global oil production, led by the U.S., is predicted to outpace demand growth until the end of the decade. This could lead to an unprecedented level of spare capacity and potentially disrupt the market management of OPEC+.

The IEA’s medium-term market report, “Oil 2024,” suggests that oil demand growth will slow down and is expected to peak at around 106 million barrels per day by 2030, up from just over 102 million barrels per day in 2023. On the other hand, total oil production capacity is forecasted to rise to nearly 114 million barrels per day by 2030, which is 8 million barrels per day more than the projected global demand.

This excess production capacity could lead to a level of spare capacity unseen since the peak of the COVID-19 lockdowns in 2020. The IEA warns that this could have significant implications for oil markets, including potential impacts on the U.S. shale industry and producer economies within OPEC and beyond.

As the recovery from the pandemic slows down, the growth in global oil demand is also slowing down due to the advancement of clean energy transitions and changes in China’s economic structure. The IEA’s report comes as countries worldwide are seeking to transition away from fossil fuels, with increasing momentum behind clean and energy-saving technologies.

The IEA noted that the share of fossil fuels in the global energy supply has remained around 80% for decades but expects this to decline to approximately 73% by 2030. Despite the projected slowdown in oil demand growth, the IEA emphasized that without stronger policy measures or behavioral changes, crude demand is still expected to be around 3.2 million barrels per day higher by 2030 than in 2023.

In advanced economies, however, the IEA forecasts a decrease in oil demand, projecting it to fall below 43 million barrels per day by 2030, down from nearly 46 million barrels per day in 2022. The last time oil demand from advanced economies was this low was in 1991, aside from the coronavirus pandemic.

The findings of this report build on a landmark 2021 IEA report that urged against new oil, gas, or coal developments if the world aims to achieve net zero emissions by 2050. That report faced criticism from several OPEC+ producers who advocate for dual investment in hydrocarbons and renewables until green energy can fully meet global consumption needs.

OPEC+, led by Saudi Arabia, is an influential energy alliance composed of OPEC and non-OPEC partners. The potential supply surplus forecasted by the IEA poses challenges for OPEC+ in managing market stability and pricing. The June report also revised short-term global oil consumption downward by 100,000 barrels per day in 2024, bringing the expected demand to 960,000 barrels per day for the year.

➖➖➖➖➖➖➖➖➖

Nick Timiraos of the Wall Street Journal anticipates that the Federal Reserve will maintain the federal funds interest rate at 5.25%-5.5%. He suggests that Fed officials might hint at a potential rate cut rather than a hike in their upcoming policy statement. While there is division among Fed policymakers about rate cuts, these are future considerations. For now, the consensus is to hold steady, especially given the solid economic growth and slightly above-target inflation. The focus for the upcoming FOMC meeting this Wednesday will be on the new quarterly interest rate projections, known as the “dot plot”.

➖➖➖➖➖➖➖➖➖

Despite a promising start to 2024, the UK economy saw no growth in April, largely due to inclement weather. This lack of growth has been seized upon by the opposition Labour Party to challenge Prime Minister Rishi Sunak’s claims of an economic turnaround ahead of the election. The Office for National Statistics reported that the Gross Domestic Product remained flat in April, following a 0.4% rise in March. This comes on the heels of labour market data showing a decrease in employment and an increase in unemployment, despite continued wage growth.

Rachel Reeves, the potential future finance minister if Labour wins the election, used these figures to counter Sunak’s campaign message, stating that the economy has stalled with no growth. Current opinion polls suggest that the Labour Party, led by Keir Starmer, is set to win the national election on July 4 with a significant lead over the Conservatives.

Despite this, Sunak can still highlight the strong economic growth in the three months to April, reflecting a recovery from last year’s brief recession. The economy grew by 0.7% during this period, marking the fastest expansion in nearly two years. However, the economy is only 0.6% larger than it was in April 2023 and 2.2% larger than at the time of the last national election in 2019, indicating a historically poor performance.

Paul Dales, chief economist at Capital Economics, does not believe the stagnation in April increases the risk of a recession, attributing it to the rainy weather that impacted the construction and retail sectors. He predicts that the dual drags on economic growth from higher interest rates and inflation will fade throughout the year, providing a slight economic boost for the next government. The Bank of England is expected to start reducing interest rates from their 16-year high of 5.25% later this year.

Growth in April was solely driven by the services sector, particularly information and technology and the professional and scientific sectors. However, manufacturing and construction output both fell by 1.4% in monthly terms, performing worse than any economist polled by Reuters had predicted.

In April, the UK’s economic growth came to a standstill, posing a challenge to Prime Minister Rishi Sunak’s efforts to revive a struggling election campaign. The Office for National Statistics (ONS) reported zero growth for the month, a significant decrease from the 0.4% expansion in March and the 0.6% growth in the first quarter that ended last year’s technical recession. Despite this, GDP was 0.7% higher in the three months to April compared to the previous three-month period.

The stagnation in April, which was the wettest in over a decade, adversely affected the services sector and construction. Sunak, in his campaign speeches, has often referred to the UK’s first-quarter growth as an indicator of the country’s economic resilience. However, the ONS later clarified that the term “going gangbusters,” used by their chief economist to describe the expansion, was not meant to comment on the overall state of the economy.

The Conservative party, currently trailing the Labour party by about 20 percentage points in opinion polls, responded to the ONS data by stating that while there is more work to be done, the economy is on the mend and inflation is returning to normal levels. However, critics argue that the economy has stalled and there is no growth.

Despite the stagnation in April, economists believe that output is likely to grow over the second quarter as a whole, thanks to strong wage growth, lower inflation, and drier weather boosting consumption. This could provide a slight economic boost for the next government.

The figures showed that services output grew by a healthy 0.9% over the three months to April, driven by the tech sector, scientific research and development, and advertising. However, the growth rate slowed down in April due to wet weather affecting consumer spending and disrupting construction sites. Manufacturing output also fell by 1.4% between March and April, primarily due to a decline in pharmaceutical manufacturing.

Despite the data release, Sterling remained stable against the dollar at $1.274. Investors are expecting the first Bank of England interest rate cut by November, and a second quarter-point reduction by March next year. Economists believe that the broader picture is still one of a solid recovery from last year’s recession, and that the latest data will not change the outlook for interest rates. They predict that a June rate cut by the BoE is very unlikely, but a move in August is still possible.

The longer-term outlook will depend on how effectively the winner of the election addresses long-standing structural issues. Despite April’s stumble, lower inflation is expected to boost real incomes and the Euro 2024 football tournament is set to lift consumer activity.

➖➖➖➖➖➖➖➖➖

As political turmoil in Europe escalates, investors are increasingly seeking safe-haven assets, leading to a rise in US Treasuries ahead of the upcoming inflation data and Federal Reserve interest rate decision. The Stoxx 600 index fell by over 1%, marking a third consecutive day of losses. US equity futures also declined, and 10-year Treasury yields dropped four basis points. The euro weakened against a stronger dollar, making it the second-worst performer among major currencies.

The most significant market movements were observed in France, where the yield on 10-year notes surged by up to 10 basis points to 3.32%. This increase, the largest two-day rise since the early stages of the pandemic, has expanded the spread over equivalent German bonds to its highest level since October. Italian debt, considered some of the riskiest in the euro area, was also affected by the market downturn, with spreads over German bonds rising to 150 basis points.

Market speculation is currently centered on French President Emmanuel Macron, who is rumored to be considering resignation if his party underperforms in the upcoming legislative elections. However, Macron has stated that his position will not be affected by the election results. The election, scheduled for later this month, could become a critical test of Macron’s economic policies, which have generally reassured investors since he took office in 2017. The election was called after far-right parties won the majority of French votes in the recent European Parliament election.

Jane Foley, head of FX strategy at Rabobank, suggests that the possibility of France’s parliament being led by the far-right could draw attention to France’s poor fiscal situation and destabilize the euro. She believes that the political situation in France is another reason to expect the euro to remain weak for an extended period.

In other news, global investors are bracing for potential volatility on Wednesday, with the release of the latest US consumer price data and the Federal Reserve’s decision. While it is widely expected that policymakers will maintain current borrowing costs, there is less certainty about their rate projections. According to a Bloomberg survey, 41% of economists anticipate that policymakers will indicate two cuts in their “dot plot,” while an equal number expect the forecasts to show only one or no cuts.

In the US premarket, Apple Inc. shares continued to fall after the company’s long-awaited artificial intelligence features failed to impress traders. In contrast, General Motors Co. shares rose by up to 1.3% following the announcement of a new $6 billion buyback plan.

In the UK, an unexpected increase in the unemployment rate has raised expectations for rate cuts later this year. Traders fully expect the first quarter-point reduction by November and see a roughly 40% chance of a second cut the following month. Additionally, the country set a record for gilt sales, attracting over £104 billion ($132 billion) of orders for bonds.

➖➖➖➖➖➖➖➖➖

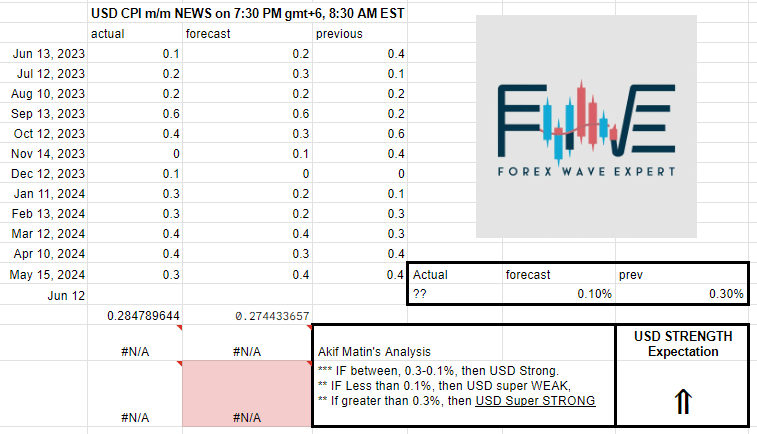

May CPI Special: The disinflation process in the US has been uneven since the start of the year, with inflation data from January to March exceeding expectations. The market’s perception of the disinflation process has evolved from attributing it to seasonal factors to stagnation and then reversal. It was only after a slight slowdown in inflation in April that the market calmed down.

Housing and Energy Inflation: Housing and energy inflation were the main contributors to April’s CPI, accounting for over 70% of the increase. Transportation services also contributed significantly. Energy inflation is expected to slow in May due to fluctuating crude oil prices. Housing inflation, which holds a significant weight in the CPI, is generally trending downward.

Transportation Services: Transportation services have significantly impacted the data in recent months, primarily due to vehicle insurance. The costs of repairing and replacing cars and trucks in the US are rising, leading to increased premiums. This sector is expected to maintain high growth in the upcoming CPI release.

New/Used Vehicles: Lower commodity inflation, mainly due to lower prices of new and used vehicles, has contributed to the decline in inflation. Used vehicle prices are likely to continue to show declines in the upcoming data, while new vehicle prices are likely to maintain growth.

Overall, headline CPI is likely to decline as highly volatile “energy inflation” may slow. Core inflation will likely remain elevated as the decline in new and used vehicle prices slows, and tenant’s rent as well as OER rise modestly. The upcoming CPI release may disappoint the market, particularly concerning housing inflation, and could drive the US dollar index higher.

From FWE, we are also hoping for a BULLISH and Strong USD on CPI news release.For any mixed news, USD may act a bit weaker because there is FOMC meeting later on the day.

➖➖➖➖➖➖➖➖➖

The gold price (XAU/USD) has demonstrated some stability below the $2,300 level, recording slight increases for two consecutive days. However, these gains lack a strong bullish sentiment as the market awaits the latest US consumer inflation data and the results of the upcoming Federal Open Market Committee (FOMC) meeting. These events are expected to provide new insights into when the Federal Reserve might begin to lower interest rates, a factor that will significantly influence the future direction of gold, a non-interest-bearing asset.

As we approach these key data and event risks, the prevailing belief that the Fed will maintain higher interest rates for an extended period due to a robust US labor market and persistent inflation continues to pose challenges for gold prices. This hawkish outlook supports the US Dollar (USD), which is currently near a one-month high, further limiting the potential for gold price increases. However, the downside is somewhat protected due to political instability in Europe and ongoing geopolitical tensions, suggesting caution before anticipating a continuation of the recent retreat from the record high.

Market participants are currently less inclined to expect an immediate interest rate cut by the Federal Reserve in September, and China’s decision to halt purchases are major factors limiting the rise in gold prices. The market currently predicts that the Fed may only reduce rates by 25 basis points this year, either in November or December, which continues to support the US Dollar.

The USD Index (DXY), which measures the value of the US Dollar against a basket of currencies, remains near its highest level since May 9, further suppressing the dollar-denominated commodity. However, traders seem hesitant and are waiting for more indications about when the Fed might start reducing interest rates before making new directional bets on the XAU/USD.

Therefore, attention will be focused on the release of the latest US consumer inflation data on Wednesday and the crucial FOMC monetary policy decision, which will be announced later during the US session. Strong jobs and wage data released last Friday have raised concerns that inflation may remain high in the context of a resilient US economy, reinforcing the narrative of prolonged high interest rates.

The headline US Consumer Price Index is projected to decrease to 0.1% in May from the previous 0.3%, with the annual rate expected to remain at 3.4%, significantly above the Fed’s annualized target of 2%. Furthermore, the Core CPI is expected to remain at 0.3% for the reported month and decrease slightly to a 3.5% YoY rate from 3.6% in April, confirming persistently high inflationary pressure.

Meanwhile, the US central bank is expected to keep interest rates unchanged and release updated economic projections, including the so-called “dot plot”, which will impact the precious metal.

From a technical perspective, the $2,300 level now appears to serve as immediate support ahead of the $2,285 horizontal zone. Given the breakdown below the 50-day Simple Moving Average (SMA) last Friday, any further selling below this level could trigger bearish traders. If the oscillators on the daily chart remain in negative territory, the gold price might accelerate its decline towards the next significant support near the $2,254-2,253 region, potentially extending further towards the $2,225-2,220 area and even the $2,200 mark.

Conversely, any rise beyond the $2,325 level is likely to attract new sellers and be limited near the 50-day SMA support breakpoint, currently around the $2,345 region. This is followed by the $2,360-2,362 resistance zone, which, if decisively breached, could allow the gold price to retest last week’s high, around the $2,387-2,388 area and retake the $2,400 level. A sustained rise beyond this level would negate any short-term negative bias and open the way for further gains in the near term.

➖➖➖➖➖➖➖➖➖

10. China Inflation Stays Low Amid Tepid Consumer Spending:

China’s crude oil imports in the first five months of the year fell by 130,000 barrels per day (bpd) compared to the same period last year. While this might be considered normal in other countries, in China, the world’s largest crude oil importer, it could signal a potential downturn for oil prices.

China’s oil demand is often used as a barometer for the country’s oil demand. For instance, the average daily intake in May was 11.06 million bpd, an increase from April’s average of 10.88 million bpd, indicating a rise in demand. However, this figure is lower than the average of 12.11 million bpd for May 2023.

Last year, China set a record in oil imports, with a 10% increase over 2022, averaging 11.3 million bpd for the year. It’s worth noting that maintaining record imports over a long period is challenging, so a decrease in imports after such a record year was expected, especially considering that much of the oil imported in 2023 was used to stockpile discounted Russian crude.

However, there’s a discrepancy between actual figures and OPEC’s forecast that China’s demand would increase by over 700,000 bpd this year, leading to a global growth of 2.25 million barrels daily. For this to happen, China’s oil demand would need to rebound significantly in the second half of the year, which some doubt will occur.

OPEC’s forecast for demand growth is among the most optimistic, while others, including the International Energy Agency (IEA), are less so. For example, Energy Intelligence predicts China’s oil demand growth at 494,000 bpd this year, accounting for 40% of global demand growth. Interestingly, the IEA expects stronger Chinese oil demand growth than Energy Intelligence, at over 600,000 bpd.

The weaker demand observed in the first half of the year was anticipated by some forecasters, who predicted that a downturn in the real estate sector would reduce diesel demand, thereby slowing overall oil demand growth despite an increase in demand for other fuels as travel resumed.

There were also more pessimistic forecasts, suggesting that growth in China’s oil demand could fall to half of pre-Covid levels as early as this year due to developments in the construction and auto sectors. Eurasia Group estimated the rate of demand growth for this year at between 250,000 bpd and 350,000 bpd, stating that the steady increase in fuel demand growth in China that the oil industry has relied on for the past two decades is no longer present.

Expecting a consistent, sustained upward trend in demand for any commodity is unrealistic, particularly in the case of oil and especially after a year of record imports. The slowdown after such a record year was essentially inevitable and should not have been surprising. While demand growth may pick up in the second half of the year, it is doubtful it will reach OPEC’s forecast. However, this is not a catastrophe; it’s simply the usual business cycle in a cyclical industry.

In May, China saw a slight increase in consumer prices while factory-gate prices continued to drop, indicating a sustained weak demand as Beijing strives to boost sluggish consumption. The consumer-price index rose for the fourth consecutive month in May, increasing by 0.3% from the previous year, according to the National Bureau of Statistics. This matched economists’ expectations and was the same as April’s increase.

Factory-gate prices, on the other hand, continued their downward trend in May, marking the 20th consecutive month of contraction. However, the rate of decline was less than in April. These figures underscore the challenges policymakers face in encouraging consumers to spend more, especially as a prolonged property slump continues to affect Chinese households’ spending.

To counteract the negative impact of the property sector and shift the economy away from an overdependence on real estate and debt-fueled investment, Beijing has been channeling resources into manufacturing. However, this supply-side strategy could potentially depress prices further and heighten trade tensions.

Zhang Zhiwei, chief economist at Pinpoint Asset Management, noted that deflationary pressure is still present. He pointed out that the slight improvement in producer prices was largely driven by commodity prices such as copper and gold, rather than reflecting China’s domestic demand.

China’s core consumer inflation, which excludes more volatile categories like food and energy, rose by 0.6% in May, a decrease from 0.7% in the previous month. Food prices fell by 2.0%, compared to a 2.7% drop in April, while non-food item prices increased by 0.8%, compared to a 0.9% rise in the previous month.

Other indicators also suggest weak consumer sentiment. Despite more Chinese tourists traveling during this year’s Dragon Boat holiday than before the pandemic, they spent less. Data from China’s leading online travel-service providers also showed that tourists continue to prefer smaller cities, where costs are generally lower.

Without a significant recovery in the struggling property sector, where Chinese families traditionally invest much of their wealth, economists believe Beijing’s efforts to stimulate household consumption and restore business confidence will have limited effectiveness.

Economists have generally welcomed Beijing’s recent measures to rescue the property sector, announced in May, but believe more needs to be done. Local governments have been encouraged to purchase unsold properties for use as affordable housing, but analysts warn that the 300 billion yuan ($41.39 billion) in liquidity provided by the central bank for this initiative is far from sufficient to clear the large amount of inventory.

Aggressive cuts to mortgage rates and down-payment ratios introduced last month to stimulate home-buying demand are also unlikely to be very effective. Concerns about falling property prices and undelivered and unfinished homes are preventing potential home buyers from entering the property market, according to Nomura economist Harrington Zhang.

New home sales have seen little improvement despite more easing measures on home purchases and mortgage loans in top-tier cities, Nomura economists informed clients in a Tuesday note. In a sign that more policy support is on the way, China’s cabinet, known as the State Council, urged officials on Friday to continue implementing new policies to stabilize the market.

➖➖➖➖➖➖➖➖➖

Fueled by robust domestic demand, a surge in investment, and a thriving services sector, India is projected to sustain its position as the world’s fastest-growing economy. The World Bank forecasts a steady growth rate of 6.7% for the country over the next three fiscal years. Despite an anticipated moderation in the pace of expansion, India will continue to outpace other major global economies.

The World Bank’s ‘Global Economic Prospects’ report maintains its growth forecast for India at 6.6% for FY25. For FY26 and FY27, the economy is projected to grow at 6.7% and 6.8%, respectively. Private consumption growth is expected to be bolstered by a recovery in agricultural production and a decrease in inflation. Meanwhile, government consumption is projected to grow slowly, aligning with the government’s objective of reducing current expenditure relative to GDP.

Earlier, the International Monetary Fund (IMF) had upgraded India’s growth forecast for 2024-25 to 6.8% from 6.5%, citing strong domestic demand and a growing working-age population. The Reserve Bank of India (RBI) also recently increased India’s GDP growth forecast from 7% to 7.2% for the current financial year (2024-25), expecting the economy to maintain its high growth trajectory.

RBI Governor Shaktikanta Das anticipates GDP growth to be at 7.3% in the first quarter of 2024-25, 7.2% in Q2, 7.3% in Q3, and 7.2% in the last quarter. The Indian economy recorded a robust GDP growth of 7.8% in the January-March quarter, and for the full financial year 2023-24, the growth rate was an impressive 8.2% — up from 7% in FY 2022-23. This high growth rate has been driven by the strong performance of the manufacturing and mining sectors.

➖➖➖➖➖➖➖➖➖

🔥News releases on THIS WEEK :

12/06 Wed 7:30am CNY CPI y/y

12/06 Wed 12:00pm GBP GDP m/m

12/06 Wed 6:30pm USD CPI & Core CPI m/m

12/06 Wed 8:30pm USD Crude Oil Inventories

13/06 Thu 12:00am USD Federal Funds Rate & FOMC Statement

13/06 Thu 1:15am CAD BOC Gov Macklem Speaks

13/06 Thu 7:30am AUD Employment Change

13/06 Thu 6:30pm USD PPI & Core PPI m/m

13/06 Thu 10:00pm USD Treasury Sec Yellen Speaks

14/06 Fri Tentative JPY Monetary Policy Statement & BOJ Press Conference

14/06 Fri 8:00pm USD Prelim UoM Consumer Sentiment

14/06 Fri 11:30pm EUR ECB President Lagarde Speaks

N.B. Time mentioned here is on Gmt +6

➖➖➖➖➖➖➖➖➖

Sources :

– CNBC, Bloomberg, Reuters, Fastbull, Yahoo Finance, CNN, ForexFactory News, Myfxbook News etc

Prepared to you by “Akif Matin“

Join our FWE telegram, Facebook Page & Group

➖➖➖➖➖➖➖➖➖

Add a Comment

You must be logged in to post a comment