### Middle East Tensions Trigger Sharp Oil Price Rise: Traders Brace for Volatility

Oil prices may rise globally because of ongoing tensions in the Middle East, particularly the escalating military conflict between Israel and Hezbollah. On Sunday, Israel responded to Monday’s intensified attacks from Hezbollah with a large-scale military operation in southern Lebanon, deploying over 100 warplanes to target missile launchers. In retaliation, Hezbollah, an Iran-backed group designated as a terrorist organization by the US, launched more than 200 rockets, causing minimal damage, according to Israeli officials.

Hezbollah announced a temporary suspension of its military activities but warned that it would resume attacks if Israel continues its operations in Gaza without a ceasefire. Meanwhile, efforts to broker a ceasefire between Israel and Hamas began as planned in Cairo on Sunday, despite the ongoing violence.

### Impact on Oil Rise and Global Markets

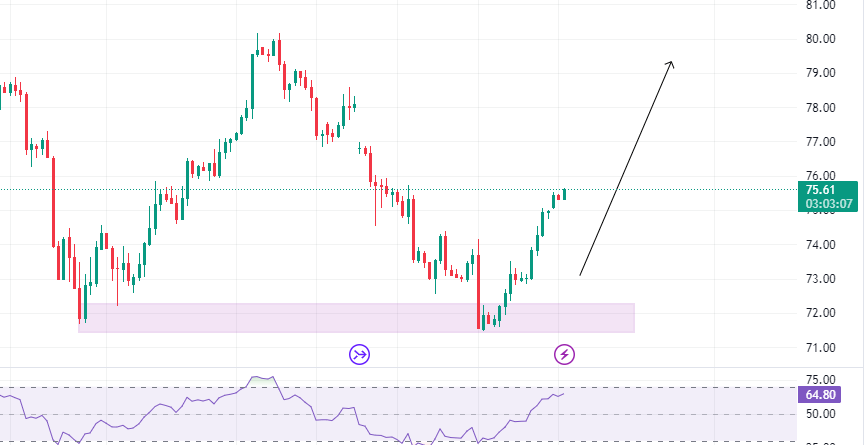

The conflict has significantly impacted global markets, resulting in a marked **oil rise**. Brent crude, the world benchmark, surged above $79 per barrel, while US West Texas Intermediate (WTI) approached $75 per barrel. This **oil rise** has pushed prices into positive territory for the year, driven by heightened political risks and the increasing likelihood of a US interest rate cut.

At the Jackson Hole Economic Symposium in Wyoming, Federal Reserve Chairman Jerome Powell hinted at potential monetary policy adjustments, suggesting that a rate cut could be on the horizon. This prospect has fueled optimism for stronger economic growth, leading to increased demand for oil and contributing to the **upward oil price** trend.

### Key Questions for Traders

In light of these developments, traders in the forex and oil markets are focused on strategies to navigate the current volatility. Here are some critical questions they are likely considering:

1. **How Do Geopolitical Tensions Impact Oil Prices?**

– Geopolitical tensions, especially in oil-rich regions like the Middle East, can lead to supply disruptions and volatility in oil prices. Forex traders closely monitor these events as they significantly impact currency values, particularly for countries that export oil.

2. **What Are the Best Strategies for Trading Oil During Geopolitical Conflicts?**

– During times of geopolitical instability, traders often turn to hedging strategies, such as futures contracts or options, to mitigate risk. Diversifying portfolios with less oil-sensitive investments is another approach. Additionally, using tools like TradingView charts for technical analysis can help traders identify key entry and exit points in the oil market.

3. **How Do Interest Rate Fluctuations Impact Forex Trading and Oil Prices?**

– Changes in interest rates can have a profound effect on both forex trading and oil prices. Lower interest rates typically weaken the US dollar, making crude oil more affordable for buyers using other currencies. This can increase global demand for oil, driving prices higher. Forex traders must stay attuned to central bank decisions, as these can lead to significant market shifts.

4. **What Are the Latest Economic Updates from Forex Factory and Myfxbook?**

– Platforms like Forex Factory and Myfxbook provide real-time economic news and data that are crucial for forex trading. These sites offer insights into key economic indicators, central bank activities, and market sentiment, all of which can impact forex and oil prices. Staying informed through these platforms helps traders make more strategic decisions.

5. **How Can TradingView Charts Be Used to Analyze Oil Price Movements?**

– TradingView offers advanced charting tools that allow traders to analyze oil price trends, identify support and resistance levels, and spot potential breakout points. Understanding how to use these tools effectively is essential for anyone involved in oil or forex trading, as it enhances decision-making based on solid technical analysis.

### Copyright Considerations and Best Practices

When writing about current events and using information from reputable sources like Yahoo Finance, CNBC, BBC, and Bloomberg, it’s essential to adhere to copyright laws. This means summarizing information in your own words, providing proper attribution, and avoiding direct copying. If you need to quote specific figures or statements, make sure to cite the source and include a link to the original article for readers seeking more detailed information.

By following these guidelines, you can ensure that your content is both informative and legally compliant, providing value to your readers while respecting the rights of others.

Add a Comment

You must be logged in to post a comment