Crude Oil Analysis:

Crude Oil Prices Surge Beyond $80: Geopolitical Tensions and Robust Demand Outlook Fuel Rally

Crude oil prices have continued their upward trajectory this week, surpassing the $80 per barrel mark for the first time this month. This surge extends a 2.3% gain recorded last week, driven by a confluence of factors, including heightened geopolitical tensions in the Middle East and a promising long-term demand outlook.

### Geopolitical Uncertainty Ignites Risk Premium

Recent events in the Middle East have injected a significant dose of uncertainty into the global oil market, pushing prices higher. The tragic helicopter crash that claimed the lives of Iranian President Ebrahim Raisi and Foreign Minister Hossein Amirabdollahian, coupled with concerns surrounding the health of Saudi Arabia’s King Salman, has raised fears about potential supply disruptions. Additionally, ongoing conflicts such as attacks on Russian refineries by Ukraine and a Houthi missile strike on a Chinese oil tanker further exacerbate market anxieties.

### OPEC Demand Forecast Offers Silver Lining

Despite OPEC member countries exceeding their production quota by 568,000 barrels per day in April, the organization remains optimistic about future demand. Their latest report projects a solid growth trajectory, with global oil demand expected to rise by 2.25 million barrels per day in 2024 and 1.85 million barrels per day in 2025. This positive outlook provides some comfort to investors amidst the current market volatility.

### OPEC Meeting on June 1st in Focus

All eyes are now on OPEC’s upcoming meeting on June 1st, where the group will decide on its production policy beyond the second quarter. This decision will be crucial in determining the future direction of oil prices.

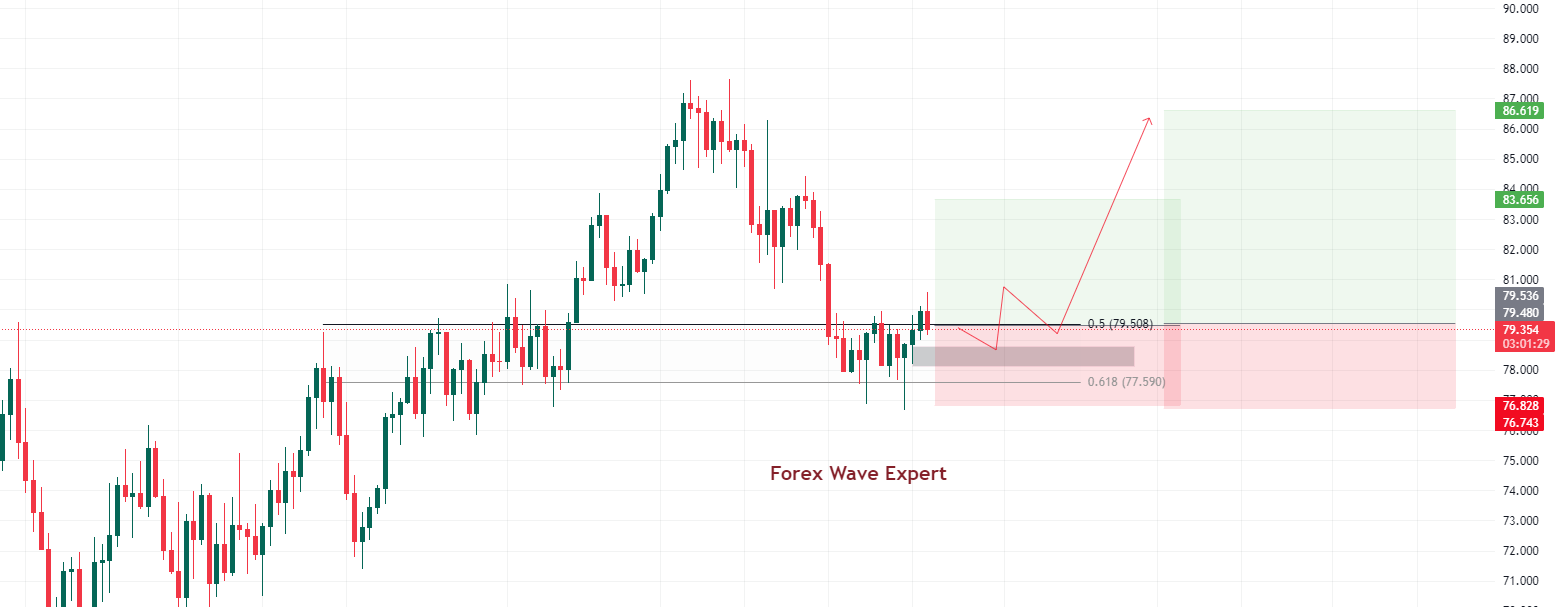

### Oil Technical Analysis

From a technical standpoint, the recent price action offers a bullish perspective. Crude oil prices successfully breached the $79.60 resistance level and closed the daily candlestick above it. This breakout suggests an exit from the previous sideways range, opening the door for further gains. The 50-day exponential moving average (EMA50) is also providing additional support for the bullish momentum, pointing towards a potential test of the $81.50 resistance zone in the near term.

However, a break below the $79.60 level could signal a pause in the uptrend and a potential return to a corrective downside move.

### Trade Recommendation

*BUY WTI*

– *Entry Price*: 78.797

– *Stop Loss*: 76.53

– *Take Profit*: 83.5

### Risk Warnings and Investment Disclaimers

You understand and acknowledge that there is a high degree of risk involved in trading with strategies. Following any strategies or investment methodologies carries the potential for loss. The content on this site is provided by our contributors and analysts for informational purposes only. You alone are solely responsible for determining whether any trading assets, securities, strategy, or any other product is suitable for you based on your investment objectives and financial situation.

Ceo and Founder.

Forex Wave Expert

Add a Comment

You must be logged in to post a comment