Crude Oil WTI Forecasts & Analysis

**Market Fundamentals**

Recently, tensions in the Middle East have eased, and the market’s expectations for the Federal Reserve’s Crude Oil WTI Forecasts & Analysis interest rate cuts have been unstable. Because of this, oil prices have continued to drop and stay low. Overnight, the EIA reported that crude oil inventories increased more than expected. Additionally, the Federal Reserve’s meeting minutes suggested that inflationary pressures might delay interest rate cuts. This news boosted the U.S. dollar and bond yields but put pressure on oil prices.

In the short term, the only positive factor for oil prices is the expectation that OPEC+ will extend production cuts. However, some doubt whether these cuts will be extended. Unlike other commodities like gold, silver, and copper, which have been rising quickly, oil prices are not expected to perform as well in the near term.

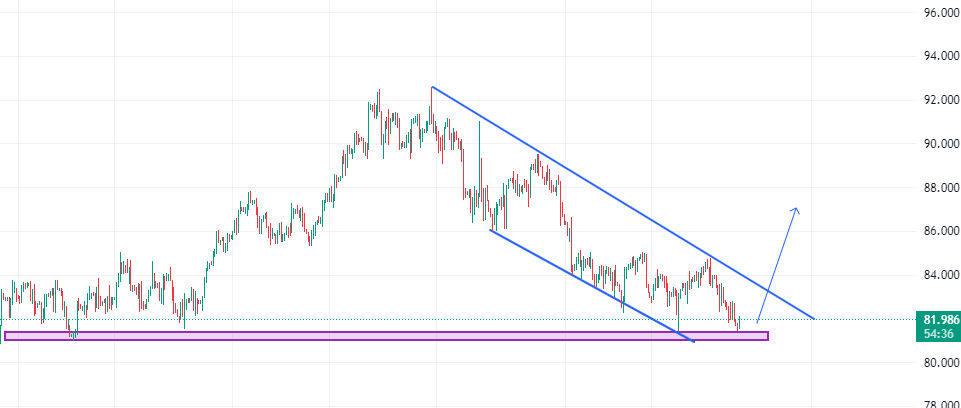

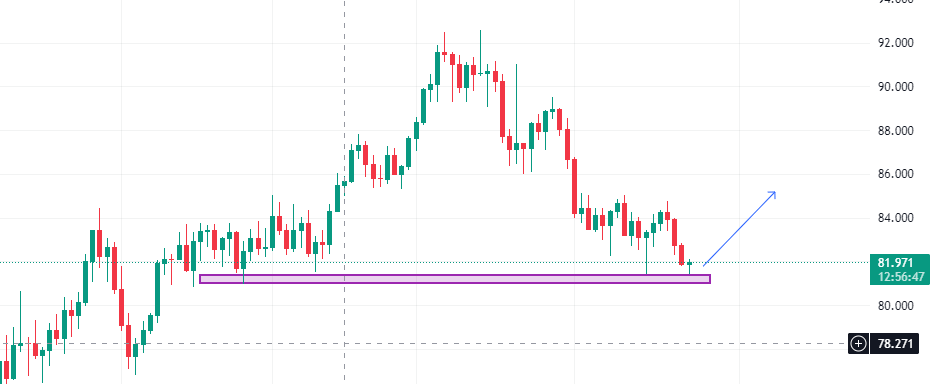

**Technical Analysis**

On the 4-hour chart, WTI (West Texas Intermediate) crude oil has been making lower lows and lower highs below a downtrend line. It has been trading between $77 and $80, which is the same range seen in February. Without new events to influence the market, WTI is expected to stay in this range in the short term.

**Trading Strategy**

We can use a range trading strategy. Since the current price is at the lower end of the range, aggressive traders can consider going long (buying) near $76.9, aiming for a target near the upper edge of the range at $80.0, with a stop loss set below $75.5.

**Trading Recommendations**

– **Direction**: Long (buy)

– **Entry Level**: $76.9

– **Target**: $80.0

– **Stop Loss**: $75.0

– **Support Levels**: $75.5 / $76.0

– **Resistance Levels**: $79.5 / $80.0

**Risk Warnings and Disclaimers**

Trading involves a high degree of risk. You could lose money. The information provided here is for informational purposes only. You are responsible for deciding whether any trading asset, security, strategy, or product is suitable for you based on your investment objectives and financial situation.

By following our **Crude Oil WTI Forecasts & Analysis**, you can better understand the current market situation and make more informed trading decisions. Remember, the oil market can be unpredictable, so always trade with caution and use risk management strategies.

Rana Das, CEO and Founder. Forex Wave Expert.

Add a Comment

You must be logged in to post a comment