Fundamental News Facts for 07th June, 2024

➖➖➖➖➖➖➖➖➖

[Quick Facts]

➖➖➖➖➖➖➖➖➖

1. US Dollar Bounce Potential if NFP Jobs Data Doesn’t Disappoint.

2. Jerome Powell Could Spark a Serious Stock Market Surge.

3. ECB wants to be a forward-looking central bank again.

4. RBI Keeps Rates on Hold as New Modi Administration Awaited.

5. A Majority of BOJ Watchers Expects Cut in Bond Buying Next Week.

6. PBOC’s Bond-Trading Drumbeat Leaves Market Debating the How.

7. The Philippines Goes All in for Natural Gas, a Climate Pollutant.

8. Iron Ore May Have Bottomed As Trading Volumes Surge.

9. Russia’s Economy Is Growing, But Can It Last?

10. Canadian Dollar “Looks Like the Least Attractive”.

➖➖➖➖➖➖➖➖➖

[News Details]

➖➖➖➖➖➖➖➖➖

- US Dollar Bounce Potential if NFP Jobs Data Doesn’t Disappoint:

The U.S. economy, after a strong start to the year, appears to have slowed down in the second quarter. However, the Federal Reserve’s key indicators, employment and inflation (as gauged by the Core PCE), haven’t shown significant changes, suggesting that the Fed is likely to maintain the current interest rates in the upcoming policy meeting.

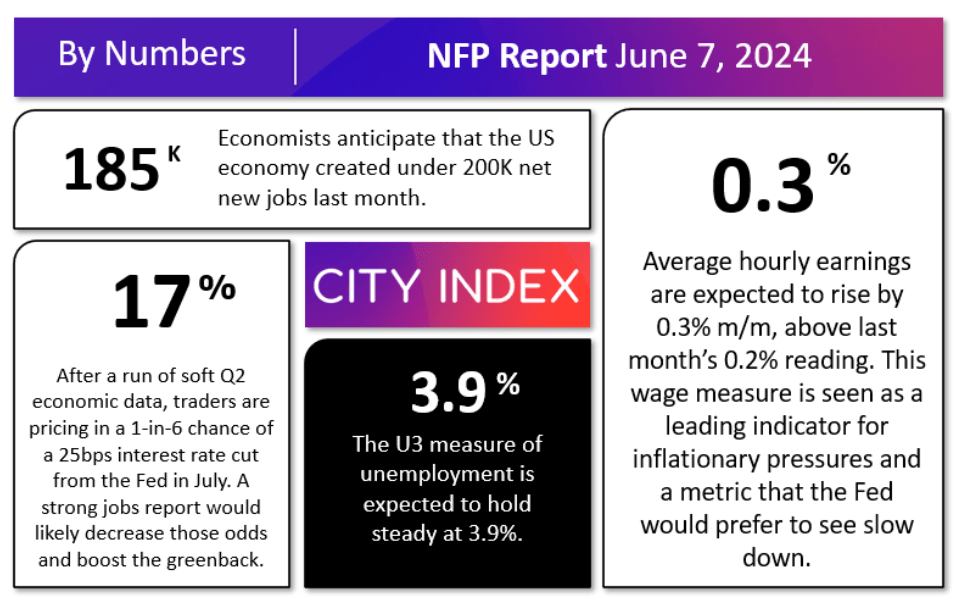

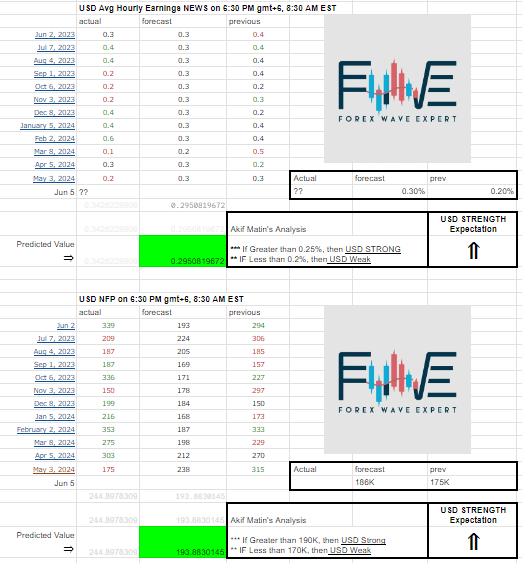

For the NFP report, market experts predict a slight decrease from the previous month’s robust job growth, with wages and unemployment rate expected to align with recent trends. The possibility of an interest rate cut in the July Fed meeting would require a significant weakening in the labor market. Therefore, unless there’s a substantial slowdown in the labor market, the market’s reaction to the NFP might be relatively muted.

NFP Forecast

Four reliable leading indicators are used to estimate each month’s NFP report:

The ISM Services PMI Employment component increased to 47.1 from 45.9.

The ISM Manufacturing PMI Employment component rose to 51.1 from 48.6.

The ADP Employment report showed a decrease in net new jobs to 152K from 188K.

The 4-week moving average of initial unemployment claims increased to 222K, near the highest level in 9 months.

Considering these data and internal models, the indicators suggest a slightly above expectation reading for this month’s NFP report, with potential job growth in the range of 175-225K. However, given the current global situation, there is a significant degree of uncertainty.

Despite this, predicting the month-to-month changes in this report is notoriously challenging. Therefore, it’s advised not to rely heavily on any forecasts. The average hourly earnings figure, which was just 0.2% m/m in the most recent NFP report, remains a crucial aspect of the release.

The U.S. Dollar Index has been consolidating just above the critical previous support at the 104.00 area. This area has supported the price on five previous occasions since late March. A significant miss in the NFP report could lead to a breakdown, but if the jobs report meets expectations, there might be a potential bounce in DXY (and equivalent drops in pairs like EUR/USD, GBP/USD, and AUD/USD).

On the other side, the Analysts predict a softer Non-Farm Payroll (NFP) for May, continuing the trend of underestimating U.S. job creation. The consensus is a drop to 151.0K from 175K, which, while indicating a slowdown, still signifies growth.

The market has been leaning towards the narrative of the Federal Reserve (Fed) initiating easing measures soon, backed by data points such as falling inflation and a declining Core PCE. The Fed, however, maintains that more data is needed to confirm a convincing decline in inflation.

The key concern for the Fed and the markets is the inflationary pressure from wages. With inflation falling below wage increase rates, strong wage growth could hinder efforts to reduce inflation. Therefore, signs of a “loosening” labor market are being sought.

The JOLTS report indicated that the number of open jobs still significantly exceeds the number of job seekers, suggesting that the labor market remains tight. The unchanged ratio of quits and rehires further supports this.

The average hourly earnings figure, expected to remain at 3.9% annual growth, is a crucial data point. A decrease would likely be interpreted as a sign of a loosening labor market, as workers may be accepting smaller salary increases due to concerns about finding better alternatives.

The unemployment rate, expected to remain at 3.9%, is generally considered to be below the structural level, contributing to labor market tightness. An increase in the job seeker rate could be seen as another sign of a loosening labor market, which the Fed is looking for to start easing confidently.

We’re expecting a STRONG USD scenario on NFP news. (In the figure above).

Every first Friday of the month, the U.S. Bureau of Labor Statistics releases new job figures. These statistics often lead to simplified narratives that can mislead investors and influence financial markets. For instance, on June 7, 2024, it’s predicted that financial markets may overreact to the headlines.

The Bureau of Labor Statistics releases two job reports each month, which contain a wealth of information. However, focusing on headline numbers without considering the nuances can lead to poor investment strategies. The economic reality is often more complex than what can be captured in a headline.

For example, the April jobs numbers, released on May 3, were worse than expected. The unemployment rate increased slightly, and both nonfarm payrolls and private nonfarm payrolls were lower than anticipated. Despite this, the stock market rallied, interpreting the disappointing jobs reports as a sign of potential slowing inflation. This could prompt the Federal Reserve to consider interest rate cuts in 2024.

However, a closer look at the data reveals a different story. The unemployment rate increase was minimal, rising from 3.83% in March to 3.86% in April, an increase of just 3 basis points. This suggests that the official unemployment numbers weren’t as disappointing as they initially appeared.

Similarly, the March jobs figures, released on April 5, were better than expected, leading to a celebration in the financial markets. However, a deeper dive into the data shows that more than 20% of the new jobs added were in government, and no manufacturing jobs were created. This indicates that the job market may not be as robust as the headline numbers suggested.

In conclusion, it’s crucial to look beyond the headlines when considering job statistics. Simple narratives can often be misleading when it comes to the economy.

➖➖➖➖➖➖➖➖➖

- Jerome Powell Could Spark a Serious Stock Market Surge:

Investors are keenly awaiting Federal Reserve Chairman Jerome Powell’s upcoming press conference. The Federal Open Market Committee (FOMC) is expected to maintain the current interest rates on June 12, given that inflation remains above the 2% target and consumers are showing resilience to increased borrowing costs. However, Powell’s words at the press conference could hint at potential rate cuts this year, potentially triggering a stock market rally.

Veteran Wall Street strategist Ed Yardeni predicts a 20% chance of a stock market “melt-up”, which could increase if Powell adopts a dovish stance at his press conference. Powell’s comments have previously caused significant market movements, such as the stock market drop following his commitment to combat inflation at the Fed’s Jackson Hole symposium in August 2022.

Yardeni believes there’s no need for the Fed to cut rates as the economy is slowing as anticipated, allowing inflation to gradually decrease without causing a recession. He argues that the U.S. is experiencing the “soft landing” Powell has aimed for since 2022, despite higher interest rates. Yardeni warns that cutting rates in the coming months could reignite inflation.

For investors, however, Fed rate cuts could boost the stock market rally, which has already seen a nearly 13% rise year to date. Yardeni suggests that premature rate cuts, before inflation is convincingly back down to the 2.0% target, could fuel a stock market melt-up.

Most experts, including Yardeni, expect Powell to avoid sounding overly dovish in his post-FOMC press conference. Michael Gapen, chief U.S. economist at Bank of America, predicts Powell will advocate for patience at the press conference. He expects the Fed to revise its outlook to reflect slower economic growth, which would typically call for rate cuts, but also firmer inflation, which would call for rate hikes.

The Fed’s preferred inflation measure, the core personal consumption expenditures (PCE) price index, has only slightly decreased from 2.9% last December to 2.8% in April. This would usually indicate that interest rates need to stay high. However, GDP growth has slowed from 3.4% in the last quarter of the previous year to just 1.3% in the first quarter of this year.

Given these mixed economic signals, Gapen suggests that Powell is likely to maintain rates for as long as necessary to ensure inflation is under control. However, his fundamental inclination towards cuts won’t change due to weaker economic growth. Gapen concludes that the Fed’s view is that the next move will be a cut, but it hasn’t seen enough data to think that cut is imminent.

The stock market experienced a “spring wobble” from March to May, but it has now rebounded to record highs. The market is set up reasonably well for the second half of the year, with positive earnings growth. Last year, the market was focused on interest rates and the Federal Reserve’s actions due to a lack of earnings growth.

The fair value of the stock market is determined by the present value of future cash flows, with earnings growth in the numerator and the interest rate in the denominator. When earnings are growing, as they are now, interest rates don’t need to decrease significantly for the market to function well. However, when earnings aren’t growing, the market can’t tolerate much of a rise in the cost of capital.

The relationship between rates and earnings was more sensitive last year than it is this year. The market has handled the Federal Reserve’s “unpivoting” well, despite initial expectations of multiple rate cuts this year. The market has adjusted to the reality of zero to one rate cuts.

The “wobbles” in the market are caused by rate changes, with the 10-year yield playing a significant role. The market has returned to a previous pattern where bonds were positively correlated to stocks, and rising yields created market instability. The strength of the earnings picture in the stock market determines its ability to withstand these “wobbles”. The earnings picture is better this year than last, making the market more resilient to rising rates.

➖➖➖➖➖➖➖➖➖

- ECB wants to be a forward-looking central bank again:

The European Central Bank (ECB) recently reduced interest rates by 25 basis points, lowering the deposit rate to 3.75%. This move was well-anticipated and marks a shift in the ECB’s approach to being more forward-looking. ECB President Lagarde emphasized that the decision was driven by increased confidence in their macro projections, particularly the inflation forecast for Q4 2025, which fluctuates between 1.9% and 2.0%.

The ECB’s latest forecasts predict GDP growth of 0.9% in 2024, 1.4% in 2025, and 1.6% in 2026. Inflation is expected to be 2.5% in 2024, 2.2% in 2025, and 1.9% in 2026. These forecasts, previously questioned by the ECB, have regained their influence, marking the ECB’s attempt to become a truly forward-looking central bank.

However, the recent rate cut does not necessarily indicate the beginning of an easing cycle. This is the first time the ECB has cut rates post a tightening cycle without an economic crisis or recession. The decision was influenced by recent macroeconomic data, including increased wage growth and inflation, and positive economic momentum. Despite this, the ECB has not committed to a specific path for future rates.

There is a risk of a ‘reversed Trichet moment’, referring to past mistakes made under former ECB President Jean-Claude Trichet. In 2008 and 2011, the ECB increased interest rates shortly before significant crises, leading to negative consequences. These fears persist even after the recent meeting.

Overall, the rate cut meets the criteria for a ‘hawkish cut’. The persistence of inflation has made some ECB members more cautious. If the Eurozone economy performs as per the ECB’s forecasts, further rate cuts are likely. However, any negative inflation surprises could prompt the ECB to tread more carefully or even reverse the recent cut. The ECB has slightly eased its monetary policy, but with potential inflation challenges ahead, it’s too early to completely lift the brakes.

➖➖➖➖➖➖➖➖➖

- RBI Keeps Rates on Hold as New Modi Administration Awaited:

The Monetary Policy Committee (MPC) decided to maintain the benchmark repurchase rate at 6.5% last Friday, adhering to its hawkish stance of “withdrawal of accommodation.” This decision was made in the wake of a less-than-anticipated election victory for Prime Minister Narendra Modi’s party, leading to a coalition government. This political shift raises concerns that the new government might deviate from its conservative fiscal approach by increasing welfare spending, potentially keeping inflation above the central bank’s 4% target.

Despite this, the additional dissenting MPC member suggests that the central bank might be inching towards a rate cut after over a year of unchanged policy. The two policymakers who advocated for a rate reduction were external members, Ashima Goyal and Jayanth Varma. However, most economists predict that any easing will not occur until the final quarter of this year, likely after the US Federal Reserve makes its move.

Governor Shaktikanta Das hinted on Friday that the RBI might act before the Fed, emphasizing that its monetary policy actions are guided by domestic growth and inflation conditions. The RBI has increased its economic growth projection for the current fiscal year through March 2025 to 7.2% from 7% and has kept its inflation forecast at 4.5%.

With robust growth, the monetary policy has more flexibility to pursue price stability to ensure inflation aligns with the target on a durable basis. Policymakers should remain alert to inflation risks, particularly uncertainties related to food prices. Despite a severe heat wave across the country raising fears of a price spike, the timely arrival of monsoon rains, which irrigate half of India’s farmlands, has provided relief to farmers.

Kanika Pasricha, chief economic adviser at Union Bank of India, expects inflation dynamics to remain comfortable, thereby projecting the start of a shallow 50 basis-point rate cut cycle from October 2024. This is even as strong growth provides room to further delay the timing, with the US Fed also playing a key role.

➖➖➖➖➖➖➖➖➖

- A Majority of BOJ Watchers Expects Cut in Bond Buying Next Week:

Over half of the Bank of Japan (BOJ) observers predict a reduction in government bond buying at the upcoming meeting, with many anticipating a rate hike in July. A Bloomberg survey revealed that 54% of economists expect the bank to decrease bond buying from around ¥6 trillion per month. This expectation is due to the recent depreciation of the yen.

The survey also indicated a shift in the expected timing of the next interest rate hike, with a third of respondents predicting a July move, up from 19% in April. Only one economist anticipates a rate increase at the next meeting.

The BOJ is under pressure to respond to the weak yen, which recently hit a 34-year low, prompting aggressive intervention by the Ministry of Finance. With the economy contracting for three consecutive quarters and bond yields at a decade high, many believe the BOJ will prioritize reducing bond purchases over increasing the short-term benchmark rate.

The BOJ ended its negative rate with a hike in March, pledging to maintain monthly bond buying at around ¥6 trillion per month. Officials are likely to discuss slowing the pace of bond buying at the upcoming meeting and consider providing more details on the outlook to improve predictability.

There is increased focus on the BOJ’s regular bond operations, especially after it reduced its buying on May 13. With the BOJ having ended its yield curve control mechanism and its pledge to expand the monetary base, it’s become more challenging to predict the bond market’s trajectory. Therefore, 65% of survey respondents believe the BOJ should present a roadmap showing how it plans to adjust its government debt purchases.

Currently, there’s no consensus on how the BOJ will approach quantitative tightening next week. Some economists expect a reduction by ¥1 trillion, while others anticipate a smaller initial cut. Some believe the BOJ will simply announce a plan for reducing bond buying in the coming months.

The yen was trading around 156 per dollar late Thursday in Tokyo. In late April, it slid to 160.17, its weakest level since 1990, shortly after Governor Ueda expressed little concern about the currency. He later changed his tone to signal increased concern. As a result, there is little room for the BOJ to send a dovish message this time.

➖➖➖➖➖➖➖➖➖

- PBOC’s Bond-Trading Drumbeat Leaves Market Debating the How:

The People’s Bank of China (PBOC) is considering the use of bond trading as a tool for better liquidity management in the financial system. This decision was influenced by a speech by President Xi Jinping, which clarified that the PBOC does not intend to make large bond purchases like quantitative easing. Instead, it is more likely to sell bonds to prevent excessively low yields that could endanger financial stability and weigh on the yuan.

The Chinese bond market has seen a rally, pushing benchmark yields to their lowest in over two decades. This has led to warnings from the PBOC about the risks of a bond bubble, especially in longer-dated debt. The PBOC may sell bonds before buying, as controlling the interest rate on long-term bonds could be a good reason to start the program.

However, there may not be enough bonds for the PBOC to sell, particularly those with the maturities it wants to guide. Unlike its counterparts, the Federal Reserve and the Reserve Bank of Australia, the PBOC has only bought a few batches of special sovereign bonds over a decade ago. It has typically used banks as proxies to manage liquidity and adjust financial conditions.

The PBOC currently holds about 1.5 trillion yuan ($207 billion) of government debt on its balance sheet. Initially, the PBOC will need to find a way to acquire bonds so that it can buy and sell in the market. This could involve buying bonds from market makers in the interbank market when aggregate liquidity is tight, and then selling them when conditions loosen.

Trading of sovereign bonds may be an additional tool for the PBOC to manage liquidity in the market. If the PBOC’s goal is to cool the rally, it may not need to act, as a warning may be enough. The central bank might also wait for guidance from top officials before taking action, potentially after the Third Plenary session, a top-level meeting by the Communist Party’s Central Committee scheduled in July.

➖➖➖➖➖➖➖➖➖

- The Philippines Goes All in for Natural Gas, a Climate Pollutant:

The serene coastal region of Batangas Bay, Philippines, once known for its rich marine life, is undergoing a significant transformation. The fishing village of Santa Clara is now encircled by four natural gas power stations, with plans for four more in the pipeline. This shift is part of the Philippines’ ambitious plan to become a major hub for natural gas in the Asia Pacific region, despite the environmental implications.

The global trade in liquefied natural gas (LNG) is expanding rapidly, and the Philippines is at the forefront of this growth. However, this development is contributing to climate change at a time when renewable energy sources are more affordable than ever. Critics argue that it’s paradoxical for the Philippines, a country vulnerable to climate change, to continue pursuing fossil fuels that exacerbate climate disasters.

The impact of this shift is already being felt by local communities. Wilma Abanil, a grandmother of four, has witnessed a decline in fish catch since the first plant opened in 2002. The situation worsened as more plants were established. While fish exports are increasing nationally, official records show a decline in the catch from Batangas Province. Many residents attribute this to the power plants and overfishing.

Despite these concerns, the Philippine Department of Energy defends its plans, arguing that natural gas is the least expensive and cleanest energy source. They also emphasize that no new coal-burning power plants, which are dirtier, are being built. However, many energy experts dispute this claim, arguing that renewable energy sources like solar, wind, and geothermal electricity are cheaper in the long run.

The environmental impact of these coastal power plants is another concern. Their operations can disrupt delicate ecosystems, kill corals, and risk importing invasive species. Despite these risks, some companies insist that their operations have not affected marine life and that a “thriving marine ecosystem” remains.

However, evidence suggests that natural gas power is not much better for the climate than coal. This is because natural gas, primarily composed of methane, is over 80 times more harmful to the climate than CO2 when it leaks out unburned. Despite this, the Philippines continues to invest heavily in natural gas, partly due to the advice of the U.S. Agency for International Development.

This shift towards natural gas has also sparked social unrest, with some protestors against the LNG buildout claiming they’ve been threatened. Back in Santa Clara, most communities report seeing no benefit from the power plants built so far, even though Philippine law requires financial support for livelihoods in affected areas. This situation raises questions about the true cost of the Philippines’ shift to natural gas and its impact on local communities and the environment.

➖➖➖➖➖➖➖➖➖

- Iron Ore May Have Bottomed As Trading Volumes Surge:

Iron ore futures are experiencing a significant rise, driven by substantial increases in Chinese steel prices. However, the sustainability of this upward trend is questionable, particularly given the current high levels of inventory.

In anticipation of the Dragon Boat Festival, transaction volumes at Chinese ports have seen a sharp increase of 35% compared to the previous day, as reported by Mysteel Consultancy. This surge in restocking by steel mills, a common occurrence before holidays, suggests that the increase may be short-lived.

Fueling the optimistic outlook, market rumors suggest that China may cut crude steel production by up to 20 million tons in 2024. This speculation triggered a significant rebound in steel prices during the trading session, pulling up upstream prices, including iron ore.

While higher steel prices can enhance mill margins and potentially stimulate demand for raw materials, the surge in steel prices was primarily due to rumored production cuts, which could prevent such an increase in demand. This factor should be considered when interpreting recent market movements.

Despite the importance of context, the price signals from SGX iron ore futures this week are undeniable. After hitting multi-month lows on Wednesday, buyers took control on Thursday, spurred by high trading volumes. This resulted in a morning star pattern, often observed at market bottoms. The rally continued into the night session on Thursday, reflecting significant gains in other commodity futures such as crude oil, copper, and silver, indicating that the move may not be solely related to iron ore.

For now, the 50-day moving average has held as resistance during the session, marking the first hurdle that bulls will need to clear to prolong the upward move. With the downtrend in RSI broken, momentum may be shifting upwards, suggesting a possible retest on Friday.

If the resistance gives way, a push towards $117.90 could be possible, providing traders with an opportunity to buy the break with a stop below the 50-day moving average for protection. Alternatively, if there is another retest and failure at the resistance zone, consider shorting with a tight stop above the 50-day moving average, aiming for a return to $116.10.

➖➖➖➖➖➖➖➖➖

- Russia’s Economy Is Growing, But Can It Last?:

Despite the freezing of Russia’s foreign assets and its exclusion from the global financial system, the country’s economy has shown resilience. Western sanctions, initially deemed “crippling” and “debilitating,” have not led to the anticipated economic collapse. Instead, Russia’s economy is projected to grow by 3.2% this year, outpacing many advanced economies.

Contrary to expectations, sanctions have not resulted in widespread shortages. While some Western companies have exited the Russian market, their products continue to find their way into the country. Russia has also been successful in developing new markets in the East and the Global South, countering attempts at political and economic isolation.

Sanctions have disrupted the Russian economy, but adaptation is evident. Russia has found workarounds, such as redirecting its oil exports from Europe to China and India. Despite attempts to cap the revenue from its oil exports, Russia has managed to circumvent these measures.

China has become a crucial ally for Russia, not only as the largest buyer of its oil but also as a lifeline for its economy. Trade between the two countries reached a record $240 billion last year. The importance of China to Russia is evident in the prevalence of Chinese products and brands in the Russian market.

However, the driving force behind Russia’s economic growth is military spending. Increased employment in the defense sector has led to higher wages. But this focus on military expenditure has diverted funds from other sectors, potentially damaging the economy in the long term.

While Russia has managed to adapt to the pressures of war and sanctions so far, the threat of secondary sanctions on foreign banks aiding transactions with Moscow poses new challenges. If unresolved, Russia could face a financial crisis by the autumn. Therefore, it would be premature to conclude that Russia has overcome the impact of sanctions. The pressure on the Russian economy persists.

➖➖➖➖➖➖➖➖➖

- Canadian Dollar “Looks Like the Least Attractive”:

Francesco Pesole, an FX Strategist at ING Bank, suggests that the market may be underestimating the extent of the Bank of Canada’s upcoming rate cuts, rendering the Canadian Dollar (CAD) as the least appealing G10 commodity currency. The Bank of Canada recently reduced interest rates by 25 basis points, with Governor Tiff Macklem indicating the possibility of further cuts.

Despite an initial drop, the Canadian Dollar managed to recover most of its losses against its G10 counterparts by the end of the day. Pesole attributes this to the Bank of Canada’s cautious communication and the already weakened state of the Canadian Dollar prior to the event.

ING economists predict an additional 75 basis points of cuts from the Bank of Canada this year, a more dovish stance compared to the market’s expectation of 50 basis points. They also note the market’s apparent disregard for Macklem’s hesitance to dismiss a potential rate cut in July. ING speculates that another dip in inflation could prompt a rate cut as early as July.

Commerzbank economists suggest the possibility of “frontloading,” or implementing two rate cuts in quick succession, to avoid more drastic cuts later if the real economy deteriorates without adequate support. However, this would require favorable developments in inflation and other risk factors cited by the Bank of Canada, such as wage pressures and housing price pressures.

Pesole maintains that the CAD remains the least attractive G10 commodity currency, with the Norwegian Krone (NOK), Australian Dollar (AUD), and New Zealand Dollar (NZD) all backed by hawkish domestic central banks and being more undervalued. These currencies are expected to rally faster in a scenario where USD rates decline this summer.

➖➖➖➖➖➖➖➖➖

🔥News releases on THIS WEEK :

06/06 Thu 6:15pm EUR Main Refinancing Rate & Monetary Policy Statement

06/06 Thu 6:30pm CAD Trade Balance

06/06 Thu 6:30pm USD Unemployment Claims & Trade Balance

06/06 Thu 6:45pm EUR ECB Press Conference

07/06 Fri Day 2 EUR European Parliamentary Elections

07/06 Fri 6:30pm CAD Employment Change & Unemployment Rate

07/06 Fri 6:30pm USD Average Hourly Earnings m/m & Non-Farm Employment Change & Unemployment Rate

N.B. Time mentioned here is on Gmt +6

➖➖➖➖➖➖➖➖➖

➖➖➖➖➖➖➖➖➖

Sources :

– CNBC, Bloomberg, Reuters, Fastbull, Yahoo Finance, CNN, ForexFactory News, Myfxbook News etc

Prepared to you by “Akif Matin“

Join our FWE telegram, Facebook Page & Group

➖➖➖➖➖➖➖➖➖

Add a Comment

You must be logged in to post a comment