Forex Market News, Analysis, and Trading Ideas

By Rana Das, CEO, Forex Wave Expert

Forex Market News, Analysis, and Trading Ideas: In this article, we provide a comprehensive overview of the main currency pairs with key insights and trading recommendations, all tailored for forex traders looking to stay ahead in the market. Whether you’re monitoring economic news on Forex Factory, checking charts on TradingView, or following updates on Myfxbook, this guide will help you navigate the forex trading landscape with ease.

The EUR/USD Currency Pair

Technical Indicators of the Currency Pair:

- Prev. Open: 1.1037

- Prev. Close: 1.1019

- % Change Over the Last Day: -0.16%

The Eurozone GDP growth for the second quarter was revised downward to 0.2%, aligning with concerns that restrictive monetary policy has a greater impact on the bloc’s economy, especially in Germany. Consequently, markets have increased bets that the European Central Bank (ECB) will continue on its rate-cutting path. Today, all eyes are on the US inflation report. Lower inflationary pressures could heighten the likelihood of the Federal Reserve cutting rates by 0.50%, which might weigh on the US dollar. Conversely, if the inflation data aligns with or exceeds expectations, the dollar could receive temporary support.

Trading Recommendations:

- Support Levels: 1.0884, 1.0905,1.1013, 1.1028, , 1.0950,

- Resistance Levels: 1.1059, 1.1140, 1.1191, 1.1275

The EUR/USD currency pair’s hourly trend is currently bearish. Yesterday, the price tested the support level of 1.1013, where buyers stepped in. A new support zone formed near 1.1028. Given the US inflation news today, the price is likely to test the resistance level at 1.1059. A break above this level could lead the price towards 1.1140. However, if sellers defend the 1.1059 level, the price may sharply drop, potentially renewing the week’s low.

Alternative Scenario:

- If the price moves above the resistance level of 1.1191 and manages to hold steady above that point, it could signal a continuation of the uptrend.

Economic News:

- US Consumer Price Index (m/m) at 17:30 (GMT+6).

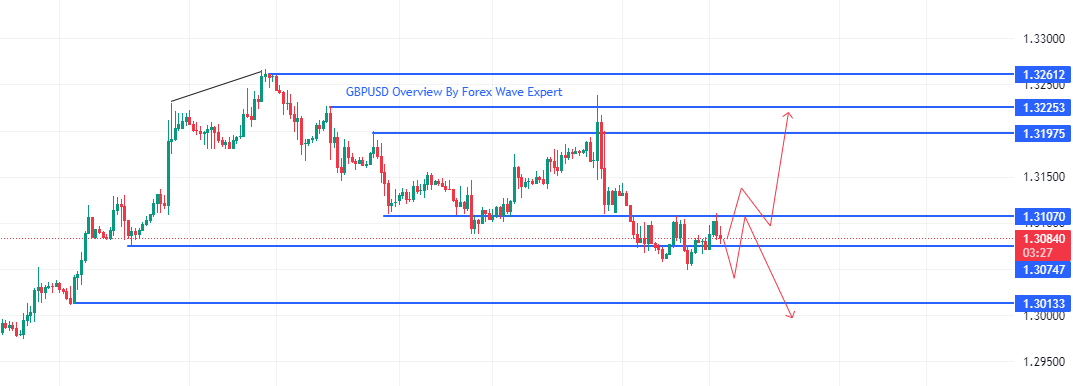

The GBP/USD Currency Pair

Technical Indicators of the Currency Pair:

- Prev. Open: 1.3070

- Prev. Close: 1.3080

- % Change Over the Last Day: +0.07%

The British pound strengthened slightly to $1.3 after the latest labor market data. UK wage growth slowed to 5.1%, the lowest in two years, while private sector wage growth, closely watched by the Bank of England, also dropped to a 2022 low of 4.9%. The unemployment rate fell to 4.1%, in line with expectations. Given this backdrop, the Bank of England is not expected to cut rates until at least November.

Trading Recommendations:

- Support Levels: 1.3055, 1.3031, 1.2973, 1.2932, 1.2848, 1.2800

- Resistance Levels: 1.3120, 1.3150, 1.3202, 1.3306

From a technical analysis perspective, the GBP/USD trend is downward, similar to the euro. The price tested the support level of 1.3055 yesterday, where buyers were active. The nearest resistance to watch is 1.3120. If sellers react strongly at this level, sell trades targeting 1.3055 could be considered. Conversely, consolidation above 1.3120 could lead the price towards 1.3150.

Alternative Scenario:

- If the price surpasses the resistance level of 1.3202 and remains stable above it, the uptrend could potentially continue.

Economic News:

- UK GDP (m/m) at 11:00 (GMT+6);

- UK Industrial Production (m/m) at 11:00 (GMT+6);

- UK Manufacturing Production (m/m) at 11:00 (GMT+6);

- UK Trade Balance (m/m) at 11:00 (GMT+6).

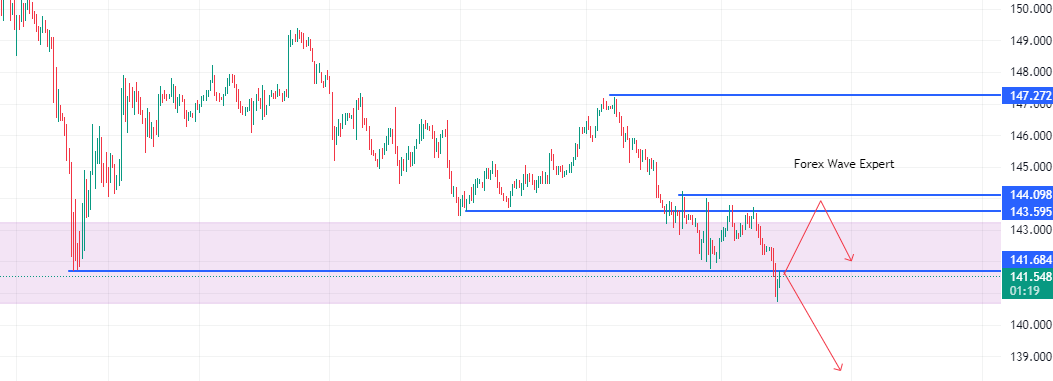

The USD/JPY Currency Pair

Technical Indicators of the Currency Pair:

- Prev. Open: 143.10

- Prev. Close: 142.45

- % Change Over the Last Day: -0.45%

Bank of Japan officials see no need to raise interest rates at next week’s meeting due to ongoing financial market volatility and the effects of the July rate hike. The yen’s recent decline was influenced by news of Japan’s machine tool orders falling by 3.5% y/y in August, the biggest decline in four months. Market swaps estimate a 0% probability of a BoJ rate hike at the September 20 meeting and a 12% chance at the October 30–31 meeting.

Trading Recommendations:

- Support Levels: 141.08, 140.22, 137.26

- Resistance Levels: 141.93, 144.42, 147.17, 148.29, 150.88, 151.26

The medium-term trend for USD/JPY is a downtrend. The Japanese yen continues to strengthen amid expectations of a US Federal Reserve rate cut, while the BoJ may raise rates later this year. The yen has strengthened to 141.08 and could decline to 140.22. For those looking to join the downtrend, entry points at 141.08 (post-breakdown) or 141.93 are advisable. There are currently no optimal buying opportunities.

Alternative Scenario:

- If the price breaks through and consolidates above the resistance at 143.72, the uptrend is likely to resume.

Economic News:

- No specific news for today.

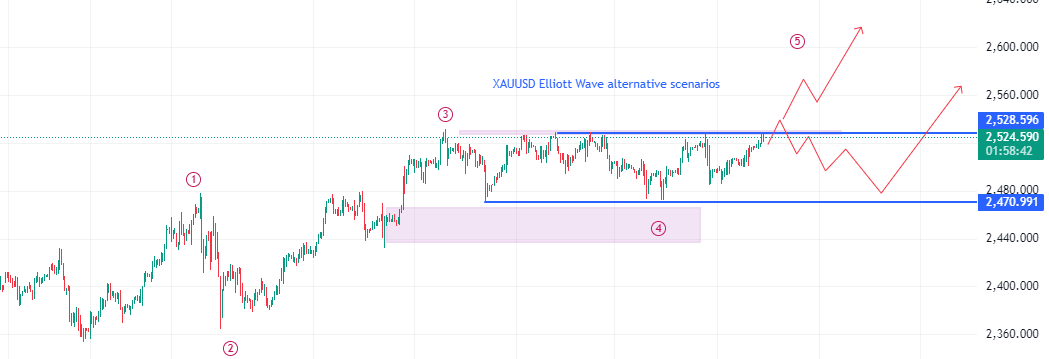

The XAU/USD Currency Pair (Gold)

Technical Indicators of the Currency Pair:

- Prev. Open: 2506

- Prev. Close: 2516

- % Change Over the Last Day: +0.40%

Lower inflation expectations reduced the demand for gold as an inflation hedge after the US 10-year breakeven inflation rate fell to a 5-week low. Although this is a short-term negative for gold, the medium-term outlook remains positive. With both the ECB and the US Federal Reserve expected to cut rates by year-end, further appreciation in gold and silver prices is anticipated.

Trading Recommendations:

- Support Levels: 2511, 2488, 2471, 2451, 2440, 2416, 2367, 2343

- Resistance Levels: 2526, 2532

From a technical analysis standpoint, the trend for XAU/USD is bullish. The price is approaching the key resistance level at 2526, which has been tested five times previously. Sellers have managed to defend their positions at this level, but today’s inflation news could lead to a breakthrough, triggering a significant upward movement towards new highs. Buying from the support level at 2511 is also a viable strategy. Currently, there are no optimal selling points.

Alternative Scenario:

- If the price breaks down the support level of 2451, the downtrend is likely to resume.

Economic News:

- US Consumer Price Index (m/m) at 17:30 (GMT+6).

This article reflects a personal opinion and should not be interpreted as investment advice, an offer, or a request for conducting financial transactions, nor as a guarantee or forecast of future events. Always perform your own research and consult a professional before making any investment decisions.

Stay tuned for more updates on forex trading, market news, and analysis! For the latest charts and economic updates, don’t forget to check Forex Factory and Myfxbook for valuable insights.

Add a Comment

You must be logged in to post a comment