Forex Market News Today and Forecast – August 21, 2024

Inflation in Canada and Sweden’s Surprise Rate Cut

Forex Market News Today : So, let’s start with Canada. You’ve probably heard that inflation has been a hot topic lately, right? Well, good news: inflation in Canada seems to be cooling off. In July, the annual inflation rate slipped down to 2.5%, which is a bit lower than June’s 2.7%. This is actually what the Bank of Canada was hoping for. They’re aiming to get inflation close to 2.5%, so it seems like things are moving in the right direction. However, there’s a bit of a catch—gasoline prices might push inflation up again in the future, so it’s not all smooth sailing just yet.Over in Sweden, things took an interesting turn. The Riksbank decided to cut its key interest rate by 0.25%, bringing it down to 3.5%. This move was widely anticipated, but it still made waves in the market. Sweden’s inflation has been dropping, which is great news, and it’s getting closer to the Central Bank’s target of 2%. But here’s the kicker—the Riksbank hinted that if inflation keeps behaving, we might see more rate cuts down the line. So, it looks like Sweden is in a delicate balancing act right now, trying to keep the economy stable while inflation cools off.

US Stock Market Takes a Hit

Let’s talk about the US stock market next. It’s been a turbulent ride lately. On Tuesday, things didn’t look too rosy. The Dow Jones (US30) slipped by 0.15%, the S&P 500 (US500) dropped by 0.20%, and the NASDAQ (US100) was down by 0.33%. Investors are on edge because of the upcoming Jackson Hole Symposium—a big deal in the financial world—and the release of the Fed’s meeting minutes. Everyone’s trying to figure out if the Fed is going to cut rates in September, and that uncertainty is making the markets jittery.

Also, we saw a bit of a slump in microchip stocks and energy producers, which dragged the market down further. Boeing had a particularly rough day, plummeting 4.2% after they had to ground their 777x test fleet due to some structural issues. Ouch.

European Markets: A Mixed Bag

Now, across the pond in Europe, it wasn’t much better. European stocks also struggled. Germany’s DAX (DE40) fell by 0.35%, the French CAC 40 (FR40) lost 0.22%, Spain’s IBEX 35 (ES35) decreased by 0.13%, and the British FTSE 100 (UK100) took a bigger hit, dropping by 1.00%.

But it’s not all doom and gloom. There’s some good news from the Eurozone—construction output jumped by 1.7% in June, marking the biggest increase in over a year. However, Germany’s Producer Price Index continued its downward trend, which has been happening for over a year now. This is adding pressure on the European Central Bank (ECB), which might still consider cutting rates in September if inflation doesn’t ease up.

Forex Market News Today Forecast:

Oil Prices Remain Stable Despite Ongoing Middle East Tensions

Oil prices have been in a bit of a holding pattern lately, sitting near $74 a barrel on Tuesday after dropping earlier. This stability comes from hopes that a ceasefire in the Middle East might actually happen. If things calm down over there, we might see some relief in oil prices, but for now, it’s just a waiting game.

Forex Market News Today: Forex and Commodity Insights: What’s Moving the Market?

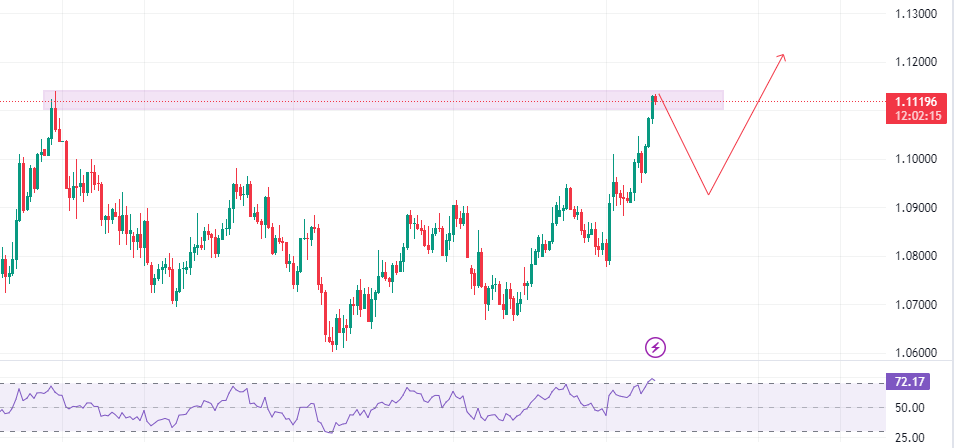

EUR/USD: The euro is enjoying a strong rally, climbing to its highest point in nearly eight months. This momentum is largely driven by market expectations that the Federal Reserve may soon cut interest rates. As traders anticipate a softer stance from the Fed, the U.S. dollar has weakened, allowing the euro to push higher. However, the market isn’t without its risks. If the EUR/USD pair drops to key support levels around 1.1060, we could see a temporary pullback. This would offer a potential buying opportunity for traders who believe in the euro’s longer-term strength, but caution is warranted as the market could react sharply to any changes in Fed rhetoric or unexpected economic data.

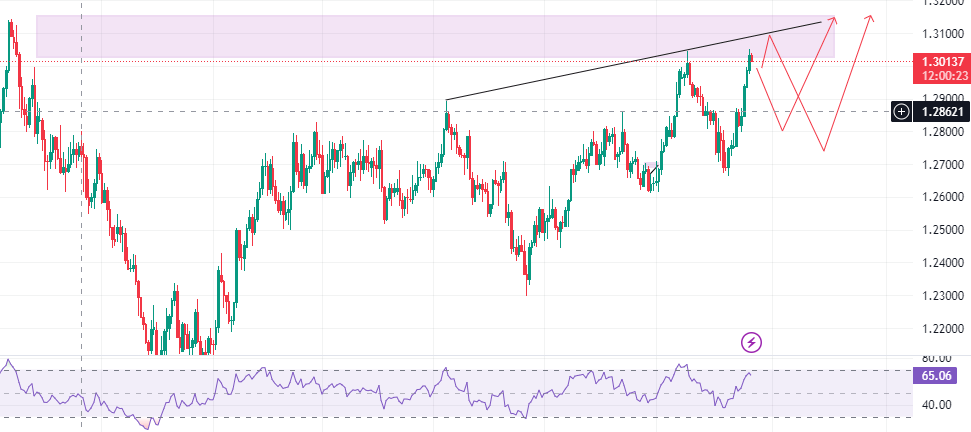

GBP/USD: The British pound has also been performing well, buoyed by a generally weak dollar and expectations of a steady UK economic outlook. However, the pound is encountering significant resistance as it approaches the 1.3043 level. This suggests that the market might be pausing for breath, and a retracement could be on the cards. If the GBP/USD pair pulls back, look for support around the 1.2973 mark. Traders should keep an eye on any news from the Bank of England, as hints of future rate hikes or economic concerns could influence the pound’s direction. For now, the pair is in a consolidation phase, with the potential for either a continuation of the uptrend or a deeper correction.

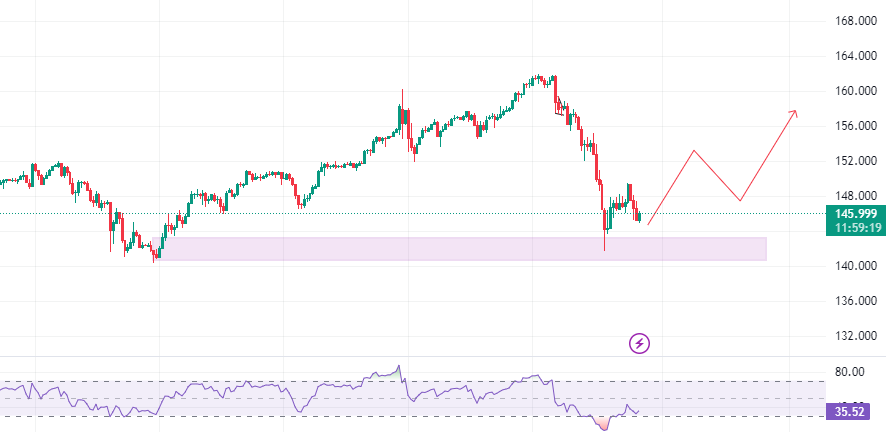

USD/JPY: The Japanese yen has been gaining traction, largely due to growing speculation that the Bank of Japan may continue raising interest rates. This has created a more favorable environment for the yen, leading to a decline in the USD/JPY pair. The yen’s strength is a reflection of Japan’s persistent inflationary pressures, which may prompt the BoJ to tighten its monetary policy further. As a result, the U.S. dollar has weakened against the yen. Traders should be mindful of the upcoming economic data from Japan, as well as any signals from the BoJ regarding their future policy moves. If the USD/JPY breaks below key support levels, we could see further downside momentum.

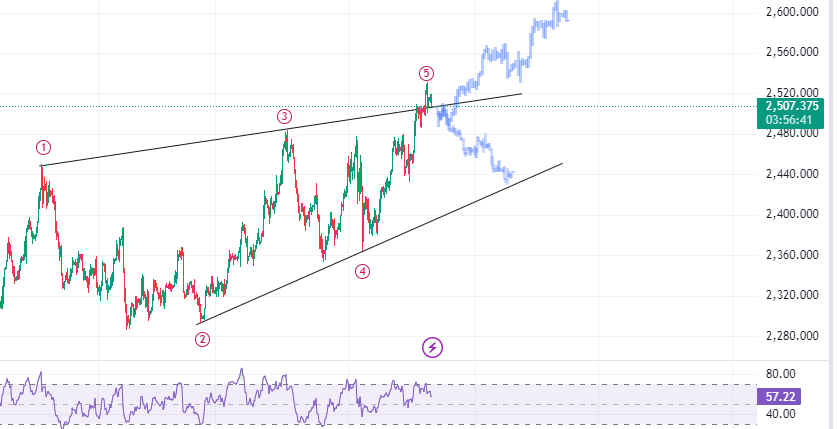

Gold (XAU/USD): Gold has been a standout performer, recently hitting a new record high of $2,530 per ounce. The precious metal is benefiting from a flight to safety as investors brace for global monetary easing. With major central banks, including the Fed, expected to cut rates, gold has become increasingly attractive as a hedge against inflation and economic uncertainty. However, as gold approaches significant resistance levels, the pace of the rally may slow. Traders should watch for signs of a short-term correction, particularly if profit-taking sets in or if there’s any unexpected strength in the U.S. dollar. Despite this, the long-term outlook for gold remains bullish, supported by ongoing geopolitical tensions and concerns over economic growth.

This expanded section provides a more comprehensive view of the market dynamics and potential trading strategies.

Forex Market News Today : What to Watch Next

Here’s what you need to watch closely:

- Japan Trade Balance: We’ll get an update at 12:00 (GMT+6). This could give us some clues about the health of the Japanese economy.

- US Crude Oil Reserves: The report is coming out at 20:30 (GMT+6). It’s always interesting to see how these numbers impact oil prices.

- US FOMC Meeting Minutes: Set your alarms for 00:00 (GMT+6). These minutes could give us some insight into the Fed’s thinking and whether a rate cut is on the horizon.

That’s the lowdown on what’s happening in the markets right now. There’s a lot of movement, and it’s clear that the next few days could bring even more surprises. Whether you’re trading or just keeping an eye on the news, it’s definitely a time to stay informed and ready for whatever comes next.

Remember, this is just an overview to help you understand what’s going on, not financial advice!

Prepared by Rana Das, CEO of Forex Wave Expert.

- #ForexNews

- #MarketUpdate

- #JacksonHoleSymposium

- #RateCut

- #GoldPriceForecast

Add a Comment

You must be logged in to post a comment