Forex Market Update 28th Jun,2024 : Dollar Gains Strength as Inflation Data Approaches, Yen Faces Challenges Despite Tokyo CPI Rise

The Dollar is gaining strength in the Asian session, especially against commodity-linked currencies. The market’s reaction to the recent debate between US President Joe Biden and former President Donald Trump has been subdued, with traders now shifting their attention to upcoming inflation figures. Both headline and core PCE inflation in the US are projected to drop to 2.6% for May. For the Federal Reserve to consider lowering interest rates, a consistent decline in inflation is necessary over the coming months. Currently, Fed fund futures suggest a 65% probability of a 25bps rate cut in September.

Meanwhile, the Yen continues to weaken despite stronger-than-expected Tokyo CPI core readings. The Bank of Japan (BoJ) has hinted at a possible rate hike in July, but even if it happens, it is expected to be more symbolic than substantial. Recent global inflation surprises indicate that the interest rate gap between Japan and other major economies will remain significant for the foreseeable future. Japan has appointed a new chief currency diplomat, Atsushi Mimura, who will replace Masato Kanda starting July 31. It remains uncertain if Mimura will implement significant changes to Japan’s strategy concerning the Yen’s prolonged depreciation.

**Currency Market Performance**

In the broader currency markets, the Dollar is currently the week’s top performer, followed by the Euro and the British Pound. The New Zealand Dollar is the weakest, followed by the Yen and the Swiss Franc. The Australian and Canadian Dollars are positioned in the middle.

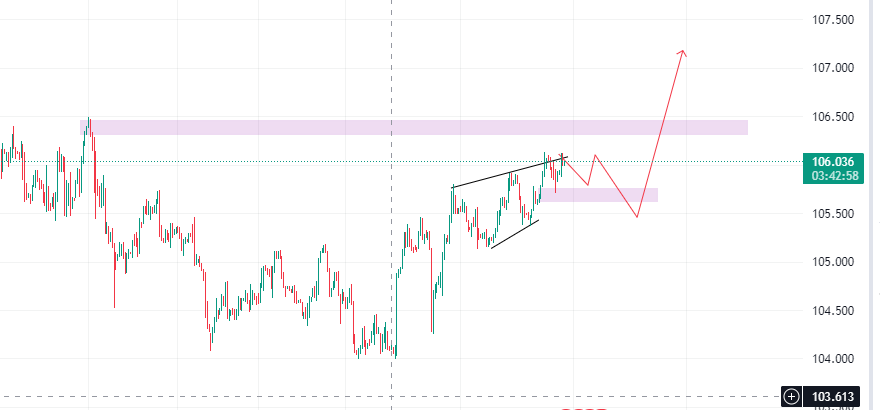

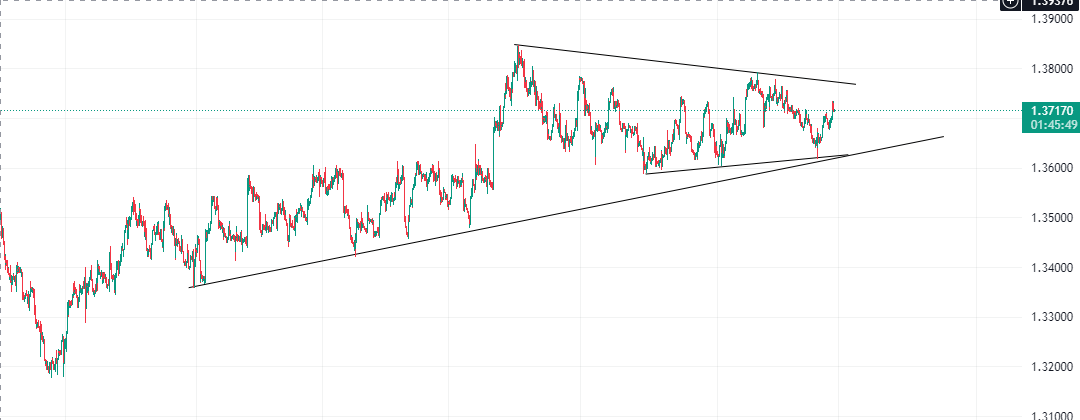

**Technical Analysis: USD/CAD**

The USD/CAD pair’s recent break above the 1.3717 resistance level indicates that the decline from 1.3790 has ended at 1.3626. This suggests that the corrective pattern from 1.3845 might have concluded with three waves to 1.3626. Further gains are now expected towards the 1.3790 resistance. A decisive break there will increase the likelihood of a larger uptrend resumption through 1.3845. The next significant movements will likely be influenced by today’s US PCE inflation data and Canada’s GDP release.

**Asian Market Overview**

In Asia, at the time of writing, the Nikkei is up 0.71%, the Hong Kong HSI is up 0.56%, China’s Shanghai SSE is up 0.98%, and Singapore’s Strait Times is down -0.24%. Japan’s 10-year JGB yield is down -0.0025 at 1.071. Overnight, the DOW rose 0.09%, the S&P 500 rose 0.09%, and the NASDAQ rose 0.30%. The 10-year yield fell -0.028 to 4.288.

**Tokyo CPI Beats Expectations, Japan’s Industrial Output Improves**

Japan’s Tokyo CPI core (excluding food) rose to 2.1% year-over-year in June, surpassing expectations of 2.0% and up from May’s 1.9%. The CPI core-core (excluding food and energy) increased from 1.7% to 1.8% year-over-year. Headline CPI also rose from 2.2% to 2.3% year-over-year. Monthly figures showed Tokyo’s CPI core increased by 0.4%, core-core by 0.3%, and headline CPI by 0.3%.

Additionally, Japan’s industrial production saw a significant boost in May, increasing by 2.8% month-over-month, exceeding the forecasted 2.0%. Of the 15 industrial sectors surveyed, 13 reported higher output while only two experienced declines. A Ministry of Economy, Trade and Industry official noted, “The private sector’s sentiment toward output is improving as auto production started to pick up.” Despite this, the ministry stated that industrial production has shown signs of fluctuating and weakness. According to a poll of manufacturers, output is expected to decrease by -4.8% in June but rise by 3.6% in July.

**Fed’s Bowman Highlights Inflation Risks, Rules Out Immediate Rate Cuts**

In an overnight speech, Fed Governor Michelle Bowman emphasized that it is too early to consider lowering the policy rate. She noted several risks to inflation, including the possibility of supply-side improvements stalling and geopolitical events disrupting global supply chains.

Furthermore, Bowman mentioned that increased immigration and continued tightness in the labor market could lead to persistently high core services inflation. She stressed that monetary policy is adaptable and not on a fixed path, indicating that she is prepared to raise interest rates if incoming data shows that progress on controlling inflation has stalled or reversed.

**Looking Ahead**

In the European session, Germany will release its import price index and unemployment data, France will release consumer spending figures, the UK will release Q1 GDP final data, and Switzerland will publish its KOF economic barometer. Later in the day, Canada will release GDP figures, and the US will release personal income and spending data, the PCE price index, and the Chicago PMI.

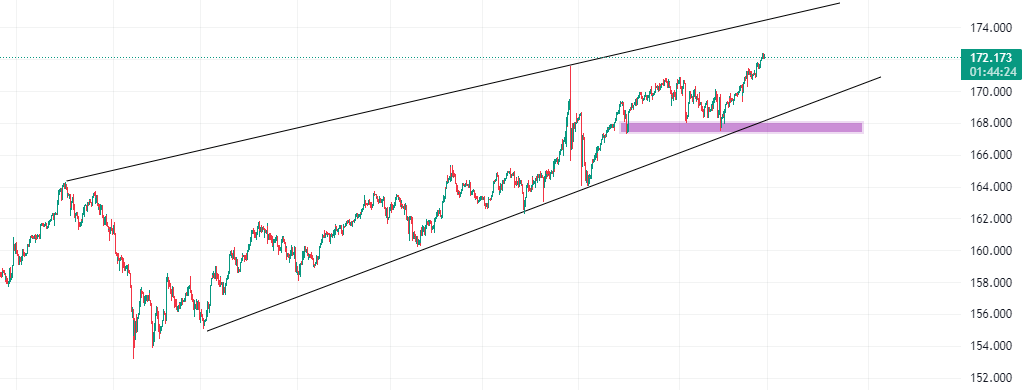

**EUR/JPY Daily Outlook**

Intraday bias in EUR/JPY remains on the upside as the uptrend continues. The next target is the 100% projection of 164.01 to 170.87 from 167.52 at 174.38. On the downside, a move below the 171.37 minor support will turn the intraday bias neutral and bring consolidations first before staging another rally.

In the bigger picture, strong support from the 55-day EMA indicates that the long-term uptrend is still in progress. A decisive break of 171.58 will confirm the resumption and target the 100% projection of 139.05 to 164.29 from 153.15 at 178.38. For now, the outlook will stay bullish as long as the 164.01 support holds, even in the case of a deep pullback.

**Conclusion**

Stay tuned for today’s key inflation data, as it will likely influence the next significant moves in the forex market. Keep an eye on the Dollar’s performance, the Yen’s challenges, and other major currency pairs for trading opportunities. Happy trading!

Add a Comment

You must be logged in to post a comment