**Introduction: Unlocking the Power of Pin Bar Candlestick Patterns in Trading**

Pin Bar Candlestick patterns have long been revered as invaluable tools in technical analysis, providing traders with visual cues that reveal market sentiment and potential trend reversals or continuations. Among these patterns, the Pin Bar stands out as a compelling signal, marked by its distinctive long shadow or “wick.” This article delves into the intricacies of Pin Bar Candlestick patterns, exploring their characteristics, various entry strategies, and practical tips for traders seeking to harness their power.

**Understanding Pin Bar Candlestick Patterns: Reversal or Continuation?**

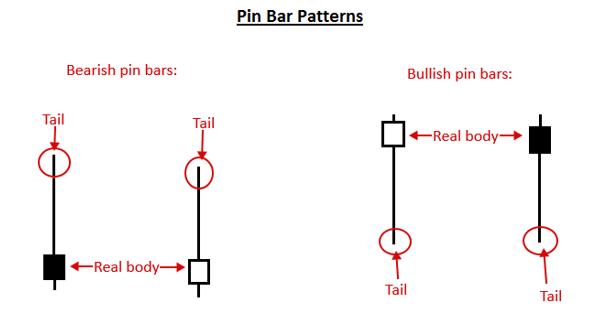

A Pin Bar is a single-price candlestick pattern that holds significant information about market dynamics. When the price bar undergoes a sharp reversal, the Pin Bar visually presents itself with a small body and a long shadow, representing a rejection against the prevailing trend. The wick, extending beyond the open and close, reveals the level of price resistance or support, often termed as the “real body.”

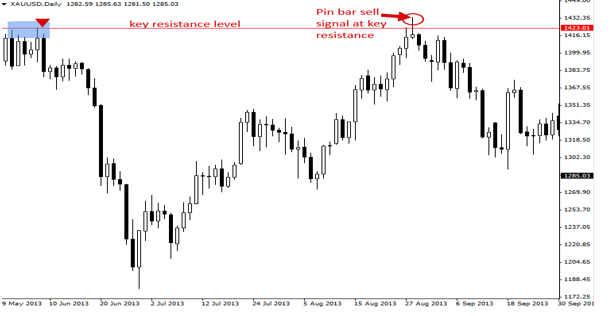

The direction of the Pin Bar’s wick provides key insights into potential future price movements. An upward-pointing Pin Bar suggests resistance at a high price, indicating an imminent decrease. Conversely, a downward-pointing Pin Bar, with its lower wick, indicates resistance at a low price, signaling an expected price increase.

**Trading Strategies with Pin Bars: Entry Options Unveiled**

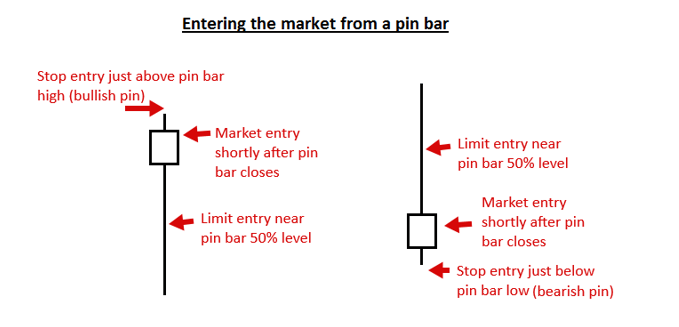

Traders employing Pin Bars in their strategies have several entry options at their disposal. One common approach is entering at the current market price as indicated by the Pin Bar. However, a crucial note of caution is sounded – the Pin Bar Candlestick pattern must close before entering the market to be considered valid.

Alternatively, traders may opt to wait for a 50% retracement of the Pin Bar, placing the entry price at the midpoint of the price move within the complete range of the Pin Bar. This approach introduces a nuanced strategy that combines the power of Pin Bars with retracement analysis.

For those seeking a more immediate entry, the “non-stop” option involves placing an entry just below (for bearish Pin Bars) or above (for bullish Pin Bars) the low or high of the Pin Bar, respectively. This strategy aims to capitalize on the momentum generated by the Pin Bar pattern.

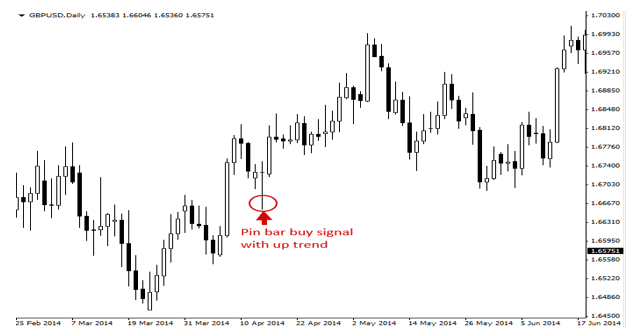

**Pin Bars in Different Market Conditions: Trending and Counter-Trend Strategies**

Pin Bars offer versatile applications in various market conditions. In trending markets, these patterns can serve as high-probability entry signals with favorable risk-to-reward ratios. For instance, a bullish Pin Bar in an uptrend signifies rejection at the low price, indicating potential upward momentum.

Conversely, traders can employ Pin Bars to trade against the prevailing trend, choosing strategic entry points on the main chart level. This approach, akin to counter-trend inside bar patterns, adds extra weight to the Pin Bar analysis.

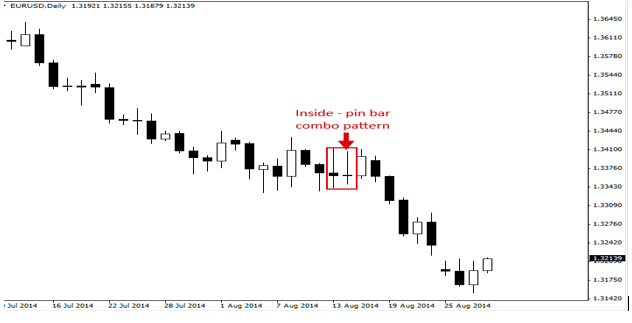

**Pin Bar Candlestick Combo Patterns and Double Pin Bar Formations: Amplifying Signals**

Pin Bar Candlestick patterns can be further enhanced by combining them with other price action patterns. One notable example is the Inside Pin Bar Combo pattern, where an Inside Bar pattern forms within a Pin Bar. These combinations often lead to significant breakouts, providing traders with powerful signals.

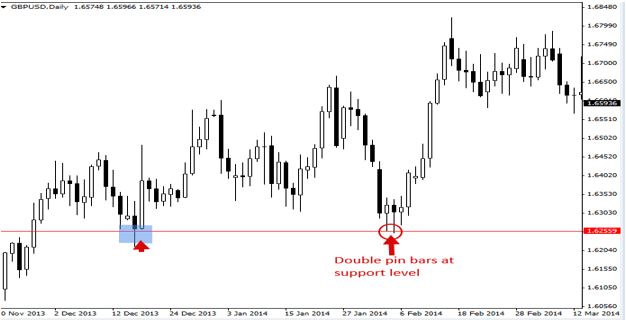

Double Pin Bar Candlestick patterns, featuring multiple Pin Bars at the same price level, are common occurrences in the market. These patterns add an extra layer of certainty, representing a double rejection at the same level and signaling potential strong market reactions.

**Trading Tips for Pin Bars: Navigating the Dynamic Landscape**

For novice traders, a prudent starting point is to focus on recognizing Pin Bars on daily and 1/2/4-hour charts, aligning with or against the trend. Counter-trend Pin Bars may pose additional challenges, requiring time and experience to master.

Understanding Pin Bars as potent supply and demand imbalances underscores their effectiveness after strong trends or at critical levels in significant price moves. Not every Pin Bar should be traded; the most promising opportunities often arise after a strong trend retracement or at key support/resistance levels within a trend.

The length of the Pin Bar’s wick serves as a psychological indicator, showcasing rejection and resistance against the price. Pin Bars with extended wicks tend to retrace around 50% of their range quickly, offering traders valuable insights into potential price movements.

It’s essential to note that Pin Bars can emerge anywhere on the chart. Identifying and trading them effectively demand rigorous training and confidence gained through practice on a demo account.

**Conclusion: Mastering Pin Bar Patterns for Informed Trading Decisions**

In conclusion, the Pin Bar Candlestick pattern emerges as a powerful ally for traders, providing nuanced insights into market dynamics and potential price movements. From its role in trending markets to counter-trend strategies, Pin Bars offer a diverse set of applications. The synergy of Pin Bars with combo patterns and double formations further amplifies their signaling capabilities.

However, successful integration of Pin Bars into trading strategies necessitates thorough education and practice. This article serves as a comprehensive guide, emphasizing the importance of diligent research, professional advice, and disciplined risk management. Trading involves inherent risks, and prudent decision-making is paramount for sustainable success. As you embark on your journey with Pin Bars, remember that each candle tells a story – a story that, when deciphered correctly, can unlock opportunities in the dynamic world of financial markets.

Add a Comment

You must be logged in to post a comment