Forex Technical Analysis and Fundamental – Details Explained

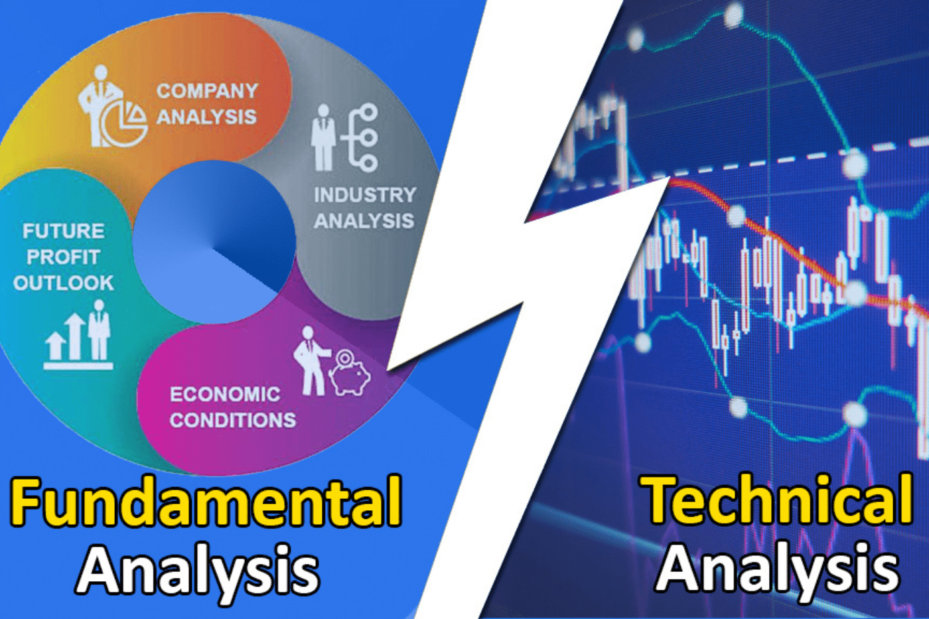

In the world of forex trading, success hinges on your ability to analyze the market and make informed trading decisions. Two primary methods dominate this landscape: technical analysis and fundamental analysis. Each approach offers a unique perspective on how to navigate the complex world of currency exchange. In this comprehensive guide, we will delve into these two methods, explore their intricacies, and help you understand how to choose the right approach for your trading style and goals.

Technical Analysis:

Forex Technical Traders vs. Fundamental Analysis – Detailed ExplanationTechnical analysis is a widely practiced method among traders in the forex market. It focuses on historical price data, charts, and various technical indicators to predict future price movements. Here’s a more in-depth look at this approach:

- Price Action and Charts: Technical traders primarily concentrate on studying price action, patterns, and charts. They believe that past price behavior holds vital clues about future price movements. By recognizing specific patterns, such as head and shoulders, flags, or triangles, traders aim to make predictions about where the market is headed.

- Indicators: A hallmark of technical analysis is the extensive use of indicators. These tools, such as Moving Averages, Relative Strength Index (RSI), and Fibonacci retracements, help traders identify potential entry and exit points. For instance, Moving Averages can highlight trends, while RSI can indicate overbought or oversold conditions.

- Short-Term Focus: Technical analysis is typically associated with short-term trading. Traders using this approach aim to profit from short-lived price movements and trends. It provides insights into immediate price fluctuations and is ideal for day traders or scalpers.

- Objective and Data-Driven: One of the strengths of technical analysis is its objectivity. It relies on quantifiable data and systematic analysis, making it attractive to traders who prefer a more data-driven approach.

- Weaknesses: However, critics argue that technical analysis may not account for external factors or unexpected news events. This can lead to losses when significant market-moving events occur, catching traders off guard.

Fundamental Analysis:

In contrast to technical analysis, fundamental analysis takes a broader view of the market. It focuses on the economic, political, and financial factors that can influence currency values. Here’s a closer look at this approach:

- Economic Indicators: Fundamental traders scrutinize economic indicators, including GDP growth, employment figures, and interest rates, to assess a country’s economic health. By understanding these factors, they can predict currency movements more accurately.

- News and Events: In the world of fundamental analysis, current events and news headlines matter greatly. Traders closely monitor central bank policy decisions, political developments, and geopolitical tensions, as these events can significantly impact forex markets.

- Long-Term Perspective: Fundamental analysis often aligns with longer-term trading strategies. The effects of economic and political events may take time to play out in the market. Therefore, fundamental traders typically have a more patient approach.

- Subjective Analysis: Unlike technical analysis, fundamental analysis can be somewhat subjective. Interpreting economic data and news events may vary from one trader to another, leading to differing opinions on market direction.

- Risk Management: Fundamental traders often place a strong emphasis on risk management. They frequently use stop-loss orders and position sizing to protect their capital in case the market moves against their expectations.

Choosing the Right Approach:

The choice between technical analysis and fundamental analysis hinges on your trading style, risk tolerance, and goals:

- Short-Term Traders: If you’re looking for quick profits and engaging in day trading or scalping, technical analysis may be your preferred choice. Its ability to identify short-term trends and patterns aligns well with short-term trading strategies.

- Long-Term Investors: On the other hand, if you’re an investor with a longer-term horizon, fundamental analysis can provide you with valuable insights into the broader economic and political landscape. It helps you make informed decisions that align with your long-term investment goals.

- Combining Both: Some traders opt to blend both approaches. They use technical analysis for precise entry and exit points while considering fundamental factors as a backdrop to understand the bigger picture. This hybrid approach can provide a well-rounded view of the market.

In the complex world of forex trading, your choice between technical analysis and fundamental analysis ultimately boils down to your individual preferences, risk tolerance, and goals. Both approaches have their merits and limitations. Many successful traders have achieved their goals by mastering one or even both of these methods over time. As you gain experience in the forex market, you may find that your preference evolves, or you may choose to incorporate elements of both approaches into your trading strategy. Understanding the strengths and weaknesses of each method is a crucial step toward becoming a more informed and profitable trader.

Add a Comment

You must be logged in to post a comment