Today’s Forex Markets Update: January 21, 2025

Welcome to today’s forex market update! As we head into the final trading session of the week, the markets are showing mixed signals across different regions. With key events and economic data releases lined up, traders are keeping a close eye on potential market-moving developments. Let’s dive into the latest trends and market movements.

Key Highlights:

- Hong Kong Stocks Extend Bullish Run for the Sixth Consecutive Session

- Oil Prices Dip After Trump’s Push for Increased US Oil Production

- Bitcoin Retraces After Reaching Record Highs

- European and Asian Equity Markets Show Positive Momentum

- Precious Metals Display Mixed Performance Amid Global Economic Trends

Global Equity Markets

US Markets

- The US stock markets were closed on Monday in observance of Martin Luther King Jr. Day, which paused regular trading activity. However, futures indicated a positive outlook, with traders expressing optimism about potential changes in trade policies under the new administration. Investors are watching closely for signals regarding trade agreements, fiscal policies, and corporate tax reforms. While the absence of new tariffs from the Trump administration helped alleviate concerns about a global trade war, market sentiment remains cautiously optimistic, and attention is turning to upcoming corporate earnings reports and key economic data releases that could drive market movement in the coming days.

European Markets

- Germany’s DAX (DE40), a key index representing the German stock market, rose by 0.42%, closing at 20,990.31. This gain comes as the country’s industrial sector showed signs of stability, with manufacturing data outpacing expectations. Investors are also hopeful that the European Central Bank (ECB) will continue to support the region’s economic recovery with accommodative policies in the near future.

- France’s CAC 40 (FR40) saw a modest increase of 0.31%, with the French market benefiting from strong performances in sectors such as luxury goods, technology, and banking. Investors are keeping an eye on political developments within the EU and France’s ongoing economic reforms, which have the potential to boost growth in the medium term.

- The UK’s FTSE 100 (UK100) made history by hitting a record high of 8,521, marking a significant milestone for British equity markets. This surge was supported by strong corporate earnings and investor optimism surrounding the post-Brexit trade deals and the UK’s economic recovery, despite ongoing uncertainties in the region.

Asian Markets

- Hong Kong’s Hang Seng Index (HK50) continued its upward momentum, surging by 1.75% and extending its gains for the sixth consecutive session. This rally was fueled by improved investor sentiment, as concerns over the geopolitical landscape in Hong Kong and China appear to be easing. The index’s performance has been buoyed by strong gains in financial stocks, technology companies, and industrial sectors.

- Japan’s Nikkei 225 (JP225) rose by 1.17%, driven by growing speculation that the Bank of Japan (BoJ) might soon raise interest rates from their ultra-low levels. A potential rate hike would signal the BoJ’s confidence in the nation’s economic recovery and the effectiveness of its long-standing monetary policies. In addition, Japanese companies have reported stronger-than-expected earnings, which has helped support the market’s bullish outlook.

- China’s FTSE A50 (CHA50) gained 0.69%, with the Chinese market continuing to show positive signs of stabilization after a year of economic slowdown. The country’s commitment to regulatory reforms and its push for innovation in technology and green energy have bolstered investor confidence, despite ongoing concerns about the global economic environment.

Forex Markets

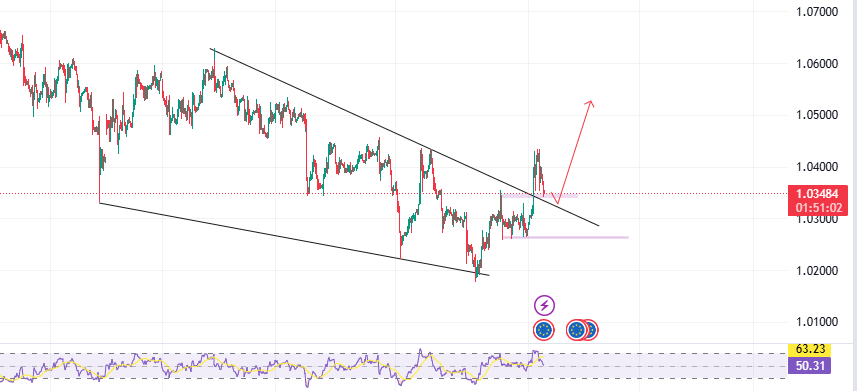

EUR/USD

- Previous Close: 1.0415 (+1.28%)

- The US dollar saw a pullback as markets awaited new developments on tariffs and trade policies. The lack of new trade restrictions from the Trump administration contributed to a weakening of the dollar, which in turn gave the euro a chance to rise. The EUR/USD currency pair broke through key resistance at 1.0434, reflecting growing confidence in the European economy.

- Trading Strategy: Consider buying the euro on pullbacks, with a potential target of 1.0354 if the pair retests lower levels. This pullback could offer a solid entry point for traders looking to capitalize on further euro strength as the global economic outlook improves.

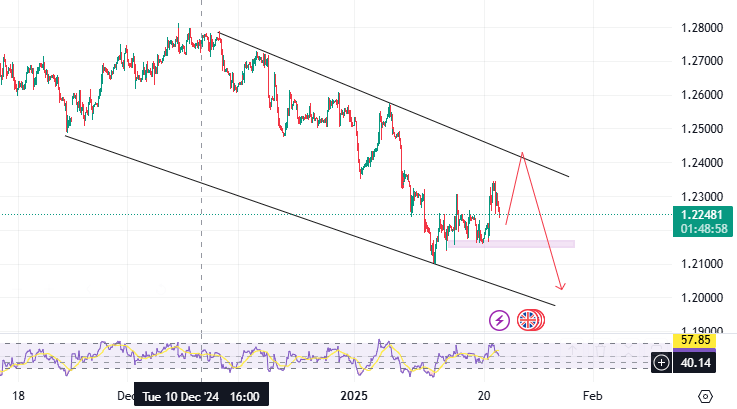

GBP/USD

- Previous Close: 1.2328 (+1.28%)

- The British pound is poised for potential volatility as UK labor market data is set to be released today. Expectations are mixed, as investors await signs of recovery in the labor market after the challenges posed by Brexit and the COVID-19 pandemic. Any surprises in the data could result in sharp movements in GBP/USD.

- Trading Strategy: Watch for buying opportunities near 1.2255 after a potential test of support, particularly if the data indicates positive momentum in the UK job market. Traders may also look for breakouts above 1.2400 if the pound rallies on strong economic data.

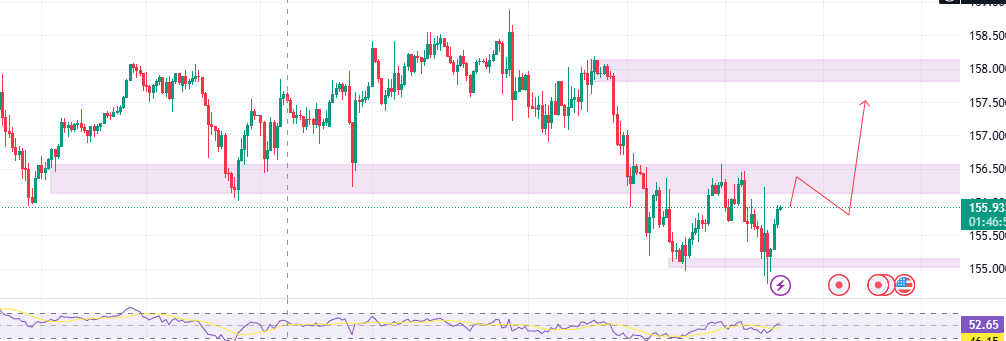

USD/JPY

- Previous Close: 155.31 (-0.39%)

- The Japanese yen gained strength as expectations of a possible rate hike from the Bank of Japan (BoJ) gained traction. With inflation data showing signs of improvement and the economy gradually recovering, many investors believe the BoJ may start to tighten monetary policy in the near future. This has led to increased demand for the yen, which has pushed the USD/JPY pair lower.

- Trading Strategy: Focus on intraday buying opportunities around 154.93, with targets set at resistance near 156.74. The potential for a BoJ rate hike remains a key driver for yen strength, making this pair one to watch closely in the coming days.

Commodities

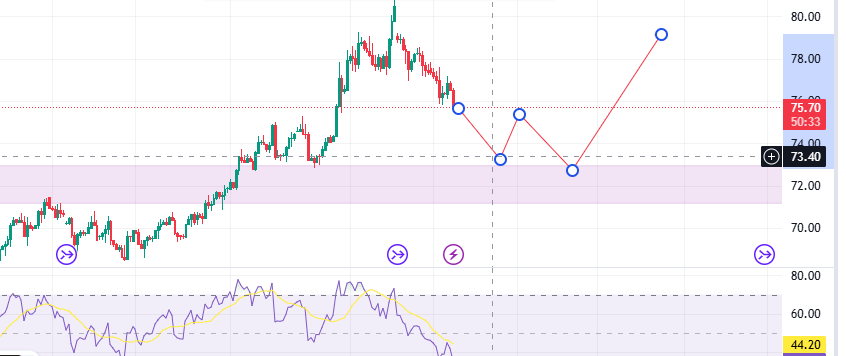

Oil

- WTI Crude: Prices dipped below $76.9 per barrel after US President Donald Trump reiterated his push for increased domestic oil production. The US administration’s stance on energy independence and its desire to boost oil production has created headwinds for crude prices, which have struggled to maintain upward momentum in recent weeks. Traders are looking for clarity on how production increases will affect global supply-demand dynamics and what it means for future pricing trends.

- The oil market continues to be influenced by geopolitical tensions, particularly in the Middle East, as well as global supply chain disruptions. Market watchers are also keeping an eye on OPEC’s policies and the broader energy transition toward renewables.

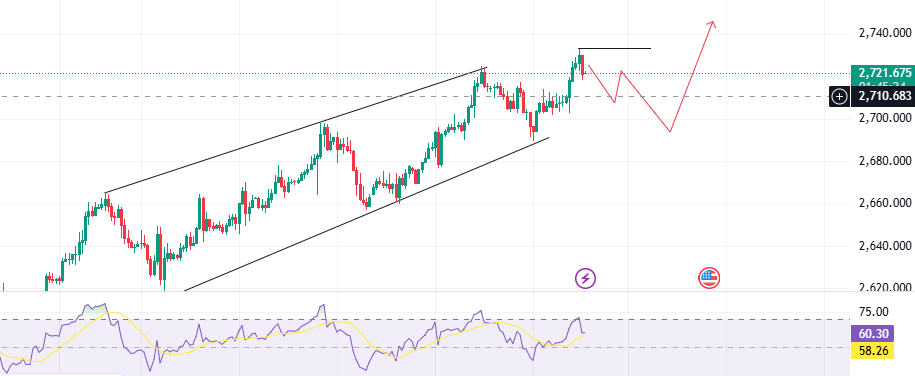

Gold (XAU/USD)

- Previous Close: $2,711

- Gold remains firmly supported amid a weakening US dollar and growing global geopolitical uncertainties. With rising inflation concerns in many economies and continued market volatility, investors have turned to gold as a safe-haven asset. Additionally, geopolitical instability in regions such as the Middle East and Asia has provided further tailwinds for gold prices.

- Gold’s ability to hold above key support levels suggests that the precious metal will continue to attract buyers looking for long-term value protection.

Silver (XAG/USD)

- Silver prices rose to $30.34, benefiting from the increase in industrial demand and market optimism, driven by easing trade tensions. The metal is often seen as a barometer for industrial health, and with signs of recovery in global manufacturing and infrastructure projects, demand for silver has picked up. Additionally, the ongoing shift toward clean energy technologies, which use silver in solar panels and electric vehicles, has bolstered the outlook for the metal.

Platinum (XPT/USD)

- Platinum struggled to maintain its upward momentum, falling below $950 amid weaker-than-expected industrial demand. The automotive industry, which is a major consumer of platinum for catalytic converters, has faced headwinds due to lower production and shifting market dynamics toward electric vehicles. While platinum has some appeal as a precious metal and a component of green energy technologies, its near-term prospects remain uncertain.

Cryptocurrency Market

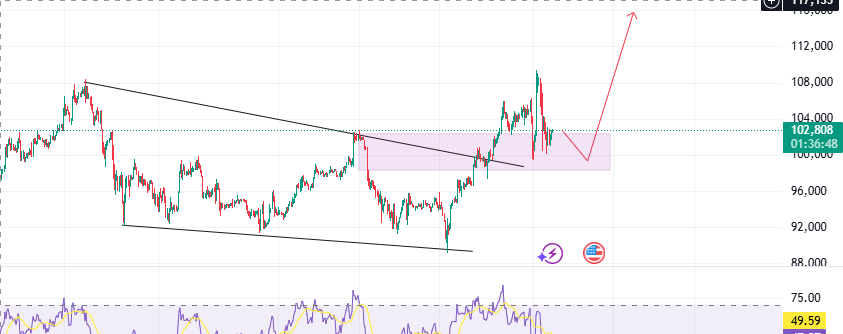

Bitcoin (BTC)

- Bitcoin retraced to $100,000 after briefly touching an all-time high of $109,000. The recent surge in Bitcoin’s price reflected a growing institutional interest in cryptocurrencies, as well as a desire for diversification in uncertain times. However, the pullback may be due to investors consolidating gains, with many awaiting more regulatory clarity from the US administration.

- As the regulatory landscape for digital currencies continues to evolve, Bitcoin’s price is expected to remain volatile, with major developments likely to influence the market direction.

Upcoming Economic Events (GMT+6)

- UK Economic Data (15:00)

- Average Earnings Index

- Claimant Count Change

- Unemployment Rate

The UK labor market data is expected to provide important clues about the strength of the British economy as it continues to recover from the effects of Brexit and the pandemic.

- Eurozone Sentiment Data (18:00)

- German ZEW Economic Sentiment

- Eurozone ZEW Economic Sentiment

The German and Eurozone ZEW sentiment indices will offer insight into investor confidence in the region and could influence the direction of the euro in the near term.

- Canada CPI (21:30)

The Canadian Consumer Price Index (CPI) data will provide valuable information about inflationary pressures in Canada and may impact the Canadian dollar’s strength. - World Economic Forum Annual Meeting (Day 2)

Global leaders, policymakers, and business leaders will continue to discuss key issues such as climate change, economic recovery, and technological innovation.

Today’s Forex Markets Update is for informational purposes and should not be considered financial advice.

Author: Rana Das, CEO of Forex Wave Expert

Add a Comment

You must be logged in to post a comment