Stop-loss hunting is a market manipulation technique where large institutions—such as banks, hedge funds, or liquidity providers—intentionally drive the price to levels where retail traders typically place their stop-loss orders. Once these stop-losses are triggered and retail traders are forced out of their positions, the big players enter the market at a more favorable price.

This tactic often frustrates small traders and creates a false impression of market direction, only for the price to reverse shortly afterward.

🏦 How Do Banks and Institutions Hunt Stop-Losses?

Here are some common techniques used by institutions to trigger retail traders’ stop-losses:

1. Order Book Analysis

Big players can see the order flow and liquidity in the market. By analyzing this data, they identify areas where a large number of stop-loss orders are clustered—often just above resistance or below support.

2. News Time Manipulation

During high-impact news releases, institutions may rapidly move prices up or down to trigger stop-losses. The sudden volatility gives them the chance to grab liquidity before the market returns to its intended direction.

3. Breaking Key Support/Resistance Levels

Retail traders often place stop-losses around obvious chart levels such as support or resistance. Institutions exploit this by breaking these levels temporarily, triggering stop-losses, and then reversing the price in the opposite direction.

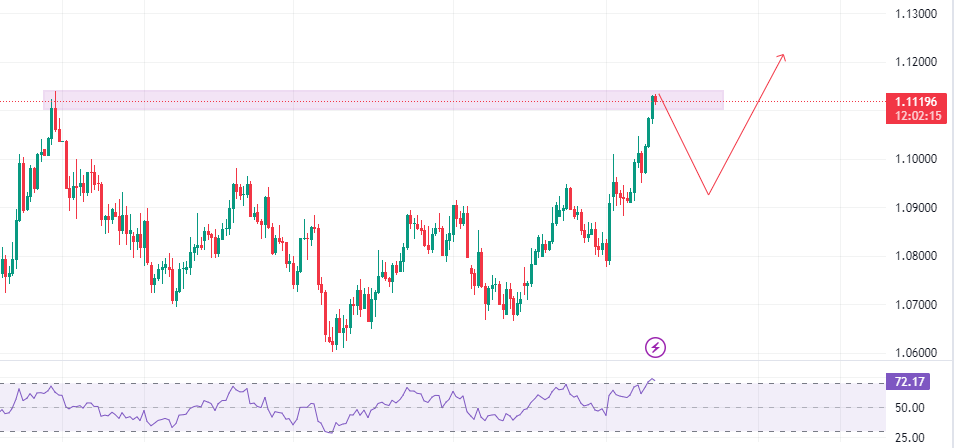

4. Creating Fakeouts

A large candle may appear to break out of a key zone, tricking traders into thinking a strong move has begun. In reality, it’s a false breakout (fakeout) meant to trap traders. After triggering stop-losses, the market quickly reverses.

🧠 How Can Retail Traders Protect Themselves?

While stop-loss hunting can’t be avoided entirely, smart strategies can help minimize your risk:

✅ Avoid placing stop-losses in obvious and easily predictable areas (e.g., right below support).

✅ Learn to identify liquidity pools and fakeouts on the chart.

✅ Understand price action thoroughly instead of relying solely on indicators.

✅ Always ask yourself:

“If I were a bank, where would I hunt liquidity?”

Thinking like an institution helps you stay one step ahead.

⚠️ A Word of Caution

The CFD market is largely decentralized and can be heavily manipulated, especially when you’re trading with a small retail account. Institutions don’t move the market randomly — they seek liquidity to fill their large positions, and that often means targeting retail stop-loss zones.

If your stop-loss is placed too obviously, you’re making yourself an easy target.

🔚 Final Thoughts

Stop-loss hunting isn’t a conspiracy—it’s just smart business from the perspective of large institutions. But with proper education and experience, you can recognize these tactics and position yourself better in the market.

Add a Comment

You must be logged in to post a comment