What Moves Gold Prices? Crucial Reasons Behind the Rise and Fall

What Moves Gold Prices? Discover Gold Trading Secrets. Gold has always been seen as a symbol of wealth and a dependable store of value. But why do gold prices go up and down? Understanding the reasons behind these oscillations can help traders, investors, and anyone interested in the gold market make better decisions. In this article, we’ll explore the crucial factors that move gold prices, using simple language to make it easy for everyone to grasp.

What Moves Gold Prices?

1. Geopolitical Pressures

Gold is frequently called a “safe-haven” asset. This means that during times of political or economic uncertainty, investors turn to gold to protect their wealth. For example, when there are conflicts, wars, or political insecurity in major economies, the demand for gold generally rises, causing prices to increase. Trade controversies, such as those between the U.S. and China, also add to this uncertainty, leading more investors to buy gold.

2. Government Policies and Central Bank Actions

Government policies can have a big impact on gold prices. Changes in mining regulations, environmental laws, and taxes can affect how much gold is produced, impacting its supply and price. Central banks also play a pivotal part. For instance, when central banks lower interest rates or engage in policies like quantitative easing (which means they print more money), gold becomes more attractive because it doesn’t earn interest, making it a good hedge against inflation. Central bank decisions are closely watched by forex traders and gold traders alike, as these moves often signal changes in the economy that can affect currencies and goods.

3. Technological Advancements

Advances in technology can affect gold prices in different ways. Advancements in mining technology can make it cheaper and easier to extract gold, which might increase supply and lower prices. On the wise side, technological advancements in electronics, medical devices, and other industries can boost the demand for gold, driving prices higher. Gold’s unique properties make it valuable in many high-tech operations, and as these uses expand, so does the demand for this precious metal.

4. Speculative Trading and Market Sentiment

Speculative trading in the futures and options markets can lead to significant price swings in gold. Traders and large investors, such as hedge funds, often buy and sell gold based on short-term market movements rather than long-term fundamentals. This speculative activity can cause volatility, making gold prices go up and down quickly. Sometimes, rumors or market manipulations can also impact prices, even though such actions are illegal. Traders often look to platforms like Myfxbook and Forex Factory for economic news that could impact gold prices, as changes in economic conditions can alter trader sentiment quickly.

5. Global Economic Health

Gold prices are closely tied to the global economy. When the economy is doing well, people tend to invest in risky assets like stocks, and gold might lose some of its appeal. But when there’s an economic downturn, recession, or financial crisis, gold becomes more attractive as a safe place to put money. High levels of national debt and fears of currency devaluation also make gold a go-to investment during tough economic times. Gold traders and forex traders alike monitor economic indicators to gauge when the market might shift in favor of gold.

6. Cultural and Seasonal Demand

In countries like India and China, gold holds significant cultural importance, especially during weddings and festivals. This leads to seasonal spikes in demand, which can push prices up. In India, gold isn’t just an investment but also a part of social customs, making it a major player in the gold market. Similarly, in China, gold symbolizes wealth and prosperity, leading to consistent demand throughout the year.

7. Environmental and Social Factors

There is growing awareness about the environmental and social impacts of mining. Companies are under pressure to adopt sustainable and ethical mining practices, which can increase production costs. When the cost of producing gold goes up, it can lead to higher gold prices. Labor controversies, strikes, or political unrest in major gold-producing countries can also disrupt supply, further impacting the market. These environmental and social factors are increasingly relevant to traders and investors who are considering the broader impact of their investments.

8. Inflation and Currency Fluctuations

Gold is often viewed as a hedge against inflation. When inflation rates rise, the value of currency declines, and people turn to gold to preserve their purchasing power. This increased demand can drive gold prices up. Currency fluctuations, especially in the U.S. dollar, also play a significant role. Since gold is priced in dollars, a weaker dollar makes gold cheaper for investors using other currencies, boosting demand and lifting prices.

9. Interest Rates and Opportunity Cost

Interest rates have a direct impact on gold prices. When interest rates are low, the opportunity cost of holding gold (which doesn’t pay interest or dividends) is also low, making it more attractive compared to other investments like bonds. Conversely, when interest rates rise, investors might prefer assets that generate returns, reducing the demand for gold. Traders in the forex and gold markets pay close attention to interest rate announcements, as these can signal major shifts in investment strategies.

10. Market Sentiment and Investor Behavior

Finally, market sentiment and the behavior of investors are crucial in driving gold prices. When investors are fearful, whether due to economic uncertainty, market crashes, or other factors, they flock to gold as a safe haven. This behavior can drive up prices even when other factors remain constant. For example, during the 2008 financial crisis and the recent global pandemic, gold prices surged as investors sought safety amid widespread market volatility.

Conclusion

Understanding what moves gold prices is key to making informed decisions in the gold and forex trading markets. From geopolitical tensions to central bank policies, technological advancements, and market sentiment, various factors can cause gold prices to rise or fall. As a gold trader or forex trader, staying aware of these dynamics, along with keeping an eye on economic news through platforms like Myfxbook and Forex Factory, can give you an edge in navigating the market.

By recognizing these influences, you can better predict price movements and position yourself to make profitable trades. Remember, the gold market is complex, but with the right knowledge, you can turn its fluctuations to your advantage.

Written by Rana Das, CEO of Forex Wave Expert

What Moves Gold Prices?

Analysis by Rana Das, CEO of Forex Wave Expert

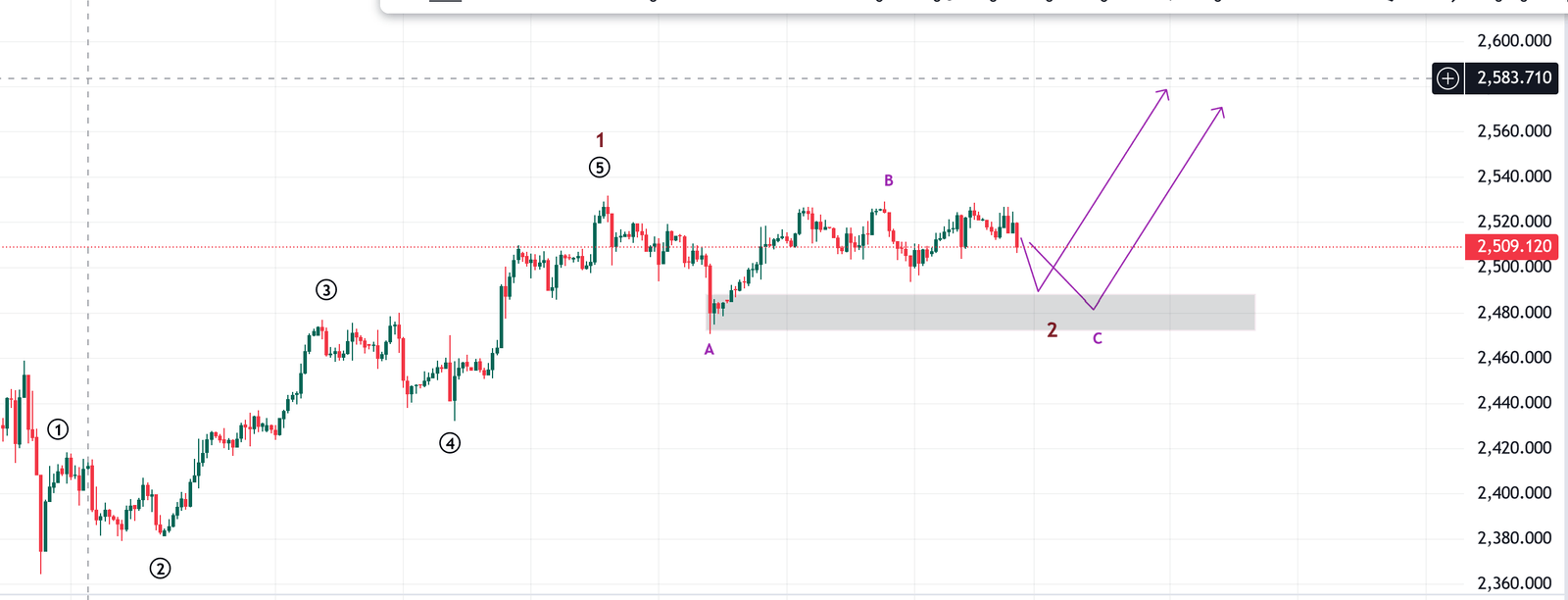

Here’s a snapshot of my gold price analysis using Elliott Wave Theory:

-

Before Analysis:

This image shows my initial Elliott Wave analysis of gold prices, outlining projected movements and key levels.

This image shows my initial Elliott Wave analysis of gold prices, outlining projected movements and key levels. -

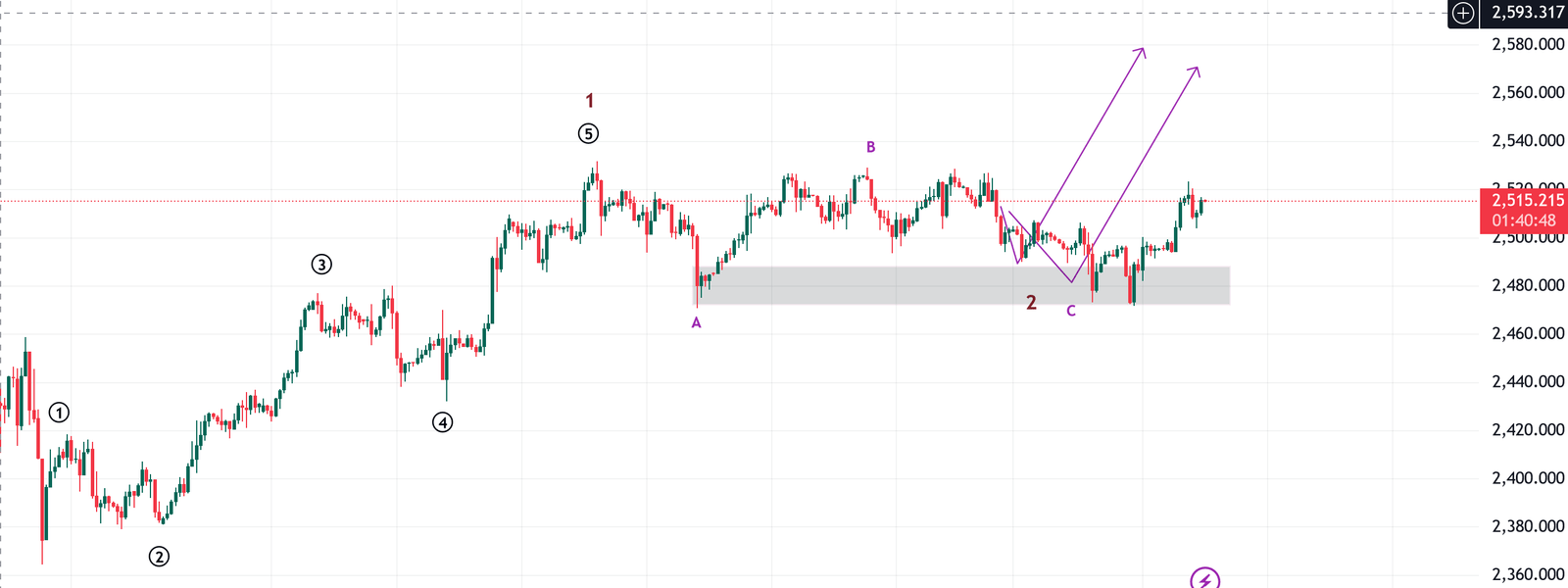

After Results:

This image illustrates the actual price movements and how they aligned with my predictions.

This image illustrates the actual price movements and how they aligned with my predictions.

What is the best strategy for trading gold?

What makes the price of gold go up?

What controls the price of gold?

This image illustrates the actual price movements and how they aligned with my predictions.

This image illustrates the actual price movements and how they aligned with my predictions.

Add a Comment

You must be logged in to post a comment