WTI Crude Oil Market Update

**Fundamentals:**

WTI Crude oil prices have been moving carefully due to new geopolitical tensions. Recently, a helicopter crash in Iran killed the President and several senior officials, adding to the unrest. However, without any updates on the Middle East conflict in the past 24 hours, WTI Crude prices have dropped from their earlier gains.

During the Asian session on Tuesday, May 21, WTI Crude fluctuated in a narrow range and is currently trading around $79.2. After a surge, oil prices fell back due to strong resistance near $80. This movement was largely driven by news that Russia might lift its gasoline export ban. This reaction indicates that investors are assessing oil prices with caution and lack confidence. Additionally, uncertainties surrounding political situations in major oil-producing countries like the unexpected death of the Iranian president and health issues with the Saudi King have stirred market concerns.

With the OPEC+ ministerial meeting just a week away, the short-term direction of oil prices remains unclear, dominated by range-bound fluctuations.

**Brent Crude and Market Trends:**

Brent Crude spot prices have also changed, with the gap between spot prices narrowing to the smallest since January this year. Fund managers are reducing their bets on higher prices for this global benchmark crude. Futures are trading in a tight range, with volatility at its lowest since 2019. Earlier this year, crude prices rose about 9% due to OPEC+ production cuts, but Brent Crude futures have fallen since mid-April. Traders are now looking forward to the OPEC+ meeting in early June, where the supply policy for the second half of the year will be decided. Most expect OPEC+ to continue with the current production cuts.

**Upcoming Inventory Reports:**

This week, crude oil prices will be influenced by the latest inventory reports from the American Petroleum Institute (API) and the Energy Information Administration (EIA). These reports will give insights into supply and demand.

– **Larger Inventories:** Could indicate weaker consumption or higher supply, leading to lower crude oil prices.

– **Smaller Inventories:** Could suggest sustained demand or production constraints, potentially pushing prices higher.

The American Automobile Association projects that 43.8 million Americans will travel 50 miles or more during the Memorial Day holiday from May 23-27, 2024, the highest level in nearly two decades.

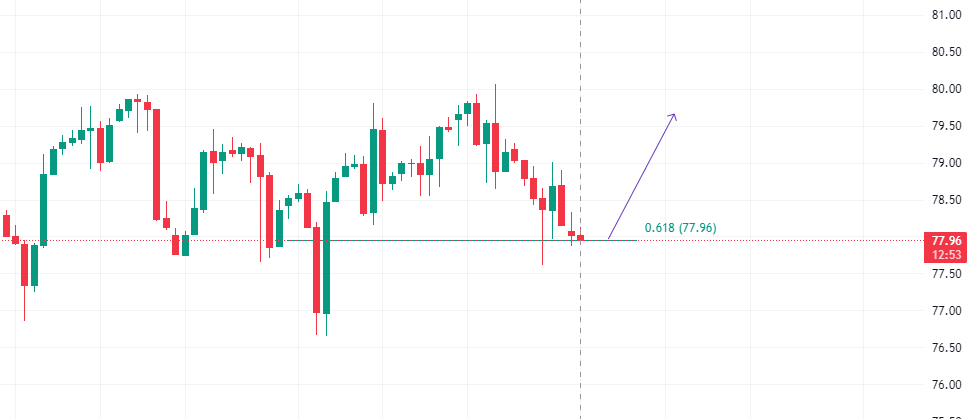

**Technical Analysis:**

WTI Crude tried to break above the 200-day Simple Moving Average (SMA) on Monday but was rejected, indicating strong resistance and that sellers are still in control. Currently, WTI Crude is trading between support at $77.00 and resistance just below $80.00.

– **Current Range:** WTI Crude is fluctuating within $76.00 – $80.60. It is recommended to buy low and sell high within this range.

– **Downside Momentum:** If prices fall below $76.50, it could trigger a drop to $75.00, near the 200-week SMA. Breaking below $71.00 – $70.00 could lead to further declines to $68.50 and possibly $65.00.

**Indicators:**

– The stochastics suggest sellers are still in control but are nearing an oversold zone, meaning the downward momentum might be weakening.

– The Relative Strength Index (RSI) also has room before becoming oversold, indicating prices may continue to trend down but could soon see a rebound.

In the short term, the MACD death cross in the 1-hour timeframe suggests a potential correction, followed by a rebound once support is found. In the 4-hour timeframe, the MACD death cross near the 0-axis indicates potential selling pressure. In the daily timeframe, oil prices closed with a small bearish candlestick, breaking a three-day uptrend and transitioning the market from bullish to neutral. The MACD golden cross below the 0-axis suggests that if sentiment improves, bullish momentum may follow.

**Trading Recommendations:**

– **Long Position:**

– **Entry Price:** $78.00

– **Target Price:** $80.60

– **Stop Loss:** $77.30

– **Support:** $77.30, $75.50

– **Resistance:** $80.60, $81.80

– **Short Position:**

– **Entry Price:** $79.20

– **Target Price:** $67.70

– **Stop Loss:** $83.00

– **Deadline:** June 4, 2024, 23:55

– **Support:** $76.49, $75.49, $73.28

– **Resistance:** $79.60, $80.00, $80.31

Risk Warnings and Investment Disclaimers

Trading carries a high degree of risk and potential for loss. The content provided is for informational purposes only. You are solely responsible for determining the suitability of any trading assets, securities, or strategies based on your investment objectives and financial situation.

**Summary:**

Given the current market conditions, it is wise to consider both long and short positions at key price points. Monitor the inventory reports from the API and EIA closely as they will provide crucial insights into supply and demand. Patience is needed to wait for opportunities to buy low and sell high within the $78.00 – $80.60 range. Stay tuned for the upcoming inventory reports and the OPEC+ meeting for more direction on crude oil prices.

Rana Das, CEO and Founder,

Add a Comment

You must be logged in to post a comment