Forex Fundamental News Facts for 06th June, 2024

➖➖➖➖➖➖➖➖➖

[Quick Facts]

➖➖➖➖➖➖➖➖➖

1. U.S. ADP shows labor market slowing.

2. The U.S. services sector expanded in May.

3. The Bank of Canada cuts interest rates by 25bp.

4. The ECB may start cutting rates, but what about after that?

5. The Fed Was Too Focused on the Soft Landing?

6. Stocks Dropping 10% Due to a ‘Moderate Form of Stagflation’?

7. ECB to Begin Cuts But Path Beyond Gets Murkier.

8. BOJ’s Toyoaki Nakamura Warns Of Risks To 2% Inflation Goal From 2025.

9. Why OPEC+ Failed To Put $80 Floor Under Oil Prices.

10. Dramatic Rise in Geopolitical Risk in Focus at HK Wealth Forum.

➖➖➖➖➖➖➖➖➖

[News Details]

➖➖➖➖➖➖➖➖➖

In May, the U.S. ADP employment report showed an increase of 152,000 jobs, a figure that fell short of market expectations and marked a three-month low. This was also lower than the job growth observed in April, and the data for April was subsequently revised to a lower number. The goods manufacturing sector saw a marginal increase of 3,000 jobs, a significant drop from the previous month’s 47,000. The services sector added 149,000 jobs, with trade, logistics, and utilities industries contributing 55,000. However, the information industry saw a decline of 7,000 jobs. The data for May suggests a softening labor market in certain districts and industries, with both job growth and wage gains slowing down since the beginning of May. Following the release of this data, swap contract pricing indicated that investors anticipate at least one rate cut by the Federal Reserve this year, likely in November.

➖➖➖➖➖➖➖➖➖

The U.S. ISM non-manufacturing PMI for May showed an increase to 53.8 from April’s 49.4, marking the highest level since the previous August. The business activity index saw a significant jump of 10.3 points to 61.2, the largest increase since March 2021 and the highest level since November 2022. New orders growth picked up after slowing in the prior two months, rising to 54.1, while a measure of services input costs eased. The employment index remained in contractionary territory at 47.1. This data contrasts with the ISM manufacturing report, which showed a contraction in factory activity for the second consecutive month in May.

➖➖➖➖➖➖➖➖➖

On June 5, the Bank of Canada (BOC) reduced its key policy rate by 25 basis points to 4.75%, marking the first rate cut by the central bank in four years. This move also made the BOC the first among G7 countries to cut rates. BOC officials agreed that monetary policy no longer needs to be as restrictive, as evidence continues to show slowing underlying inflation. Recent data have increased the central bank’s confidence that inflation will continue to move towards its 2% target. The path to further easing depends on sustained progress on inflation, which is expected to be uneven. Global tensions, faster-than-expected house price rises, and high wage growth relative to productivity are all potential risks to the economic outlook.

➖➖➖➖➖➖➖➖➖

Following the rate cut by the Bank of Canada, the first among G7 countries, the European Central Bank (ECB) is likely to follow suit. The ECB believes that inflation has been curbed sufficiently to ease the burden on the economy. Recent indications of confidence from ECB officials suggest that they could lower rates in June. This has led the market to anticipate a rate cut by the ECB at the June meeting. However, the course of action following the June rate cut remains uncertain and is a focal point for the market. ECB officials are divided on this issue, with many adopting a more cautious stance after data showed stronger-than-expected economic growth and wage gains, as well as high inflation.

➖➖➖➖➖➖➖➖➖

Stifel’s chief economist, Lindsey Piegza, suggests that the Federal Reserve’s decision to halt interest rate hikes in July 2023 may not have sufficiently tightened the economy, contributing to inflation rates remaining above the Fed’s target. The Federal Reserve had been focused on achieving a ‘soft landing’, aiming to reduce inflation while maintaining full employment, particularly in the wake of the post-pandemic economic struggles.

Despite a series of rate hikes, Piegza argues that inflation has not been sufficiently lowered and that a true ‘soft landing’ cannot occur until prices decrease further. She notes that the economy remains strong and consumer spending is high, factors which prevent significant reductions in inflation.

Some Federal Reserve officials have suggested that further rate hikes may be necessary, a stark contrast to market expectations at the start of the year, which predicted multiple rate cuts. However, Piegza believes that the Federal Reserve should not raise rates, but instead work to restore price stability to the previously indicated 2% level.

Piegza predicts that there will be no rate cuts in 2024 due to persistent inflation and a solid economy. She also highlights the strength of the labor market as a reason for the Federal Reserve to refrain from changing interest rates.

In conclusion, while Wall Street anticipates the Federal Reserve’s next steps, Piegza warns that the situation could worsen, reminding that “Every hard landing starts with a soft landing”.

➖➖➖➖➖➖➖➖➖

Despite the persistent inflation and higher interest rates, the stock market has shown resilience with the S&P 500 index rising over 12% to a record high this year. This performance surpasses the average annual rise of the index since 1957 in less than six months. The robust first-quarter earnings and a sturdy economy have bolstered the stocks. However, some top strategists on Wall Street anticipate a potential downturn.

Barry Bannister, Stifel’s chief equity strategist, predicts a roughly 10% drop in the S&P 500 to 4,750 by summer’s end. Bannister’s bearish outlook is based on three main factors. Firstly, he points to persistent inflation, arguing that the Federal Reserve has already reaped all the disinflation typically associated with a recession during a “pseudo-recession” that ended in the second quarter of 2023. He believes that the Fed’s goal of returning inflation to 2% is unattainable.

Bannister also expresses concern about strong services spending and rising costs in health care, finance, and insurance leading to sustained inflation. Coupled with higher-than-expected housing inflation, slowing productivity growth, and ongoing wage growth, he warns of a “moderate form of stagflation.” This scenario could reduce the S&P 500’s price-to-earnings ratio by 500 points as investors adjust for lower potential revenue growth and increased costs.

Scott Wren of Wells Fargo also cautions investors to prepare for more volatility. He identifies the timing of the Fed’s interest-rate cuts as a potential trigger for a market pullback. Wren suggests that the Fed’s economists may only plan for one or two cuts at the upcoming Federal Open Market Committee (FOMC) meeting in June, which could cause problems for stocks as many investors are still expecting multiple rate cuts this year.

Wren also warns that high food and energy prices will continue to impact consumer sentiment, and the U.S. election is likely to bring market volatility. He advises investors to focus on larger, “quality” companies with strong balance sheets, low debt, and solid profitability in sectors like industrials, materials, energy, and health care. Bannister echoes this sentiment, recommending “quality” stocks in more stable “defensive value equity industries” such as health care, consumer staples, and utilities sectors.

Despite these warnings, both strategists remind investors that potential market downturns can also present opportunities. They advise investors to be prepared, have a plan, and stay resilient.

➖➖➖➖➖➖➖➖➖

ECB Anticipated to Reduce Deposit Rate: After maintaining a peak of 4% for nine months, Bloomberg analysts predict a reduction in the deposit rate to 3.75% on Thursday, a move that has been hinted at by ECB officials. Despite inflation in the 20-nation euro zone being declared “under control” by President Christine Lagarde, the path to the 2% goal has been uneven. This puts the ECB on track to ease monetary policy ahead of the Federal Reserve or the Bank of England.

Uncertainty Surrounds ECB’s Future Moves: The future direction of the ECB is uncertain due to cautious views following data showing stronger-than-expected economic growth, inflation, and wage increases. While most economists predict three rate cuts this year, investors have scaled back their expectations to two.

Interest Rates and New Forecasts: Expectations for a 25 basis-point cut this week have been fueled by officials, despite recent economic reports. Economists don’t anticipate significant changes in this round of ECB forecasts, which are expected to show inflation returning to target in 2025. However, growth this year may be revised upwards after first-quarter GDP exceeded estimates.

Global Backdrop: The ECB’s divergence from the Fed has been challenged by persistent inflation categories in Europe. US policymakers have had to reconsider monetary easing after price gains exceeded expectations. The Bank of England is unlikely to cut rates this month, while the Bank of Canada has already done so. Outside of the euro zone, Sweden’s Riksbank and the Swiss National Bank have already begun to ease policy.

➖➖➖➖➖➖➖➖➖

Toyoaki Nakamura, a policymaker at the Bank of Japan (BOJ), has expressed concerns about the country’s economic outlook. He suggests that if consumer spending stagnates, inflation may not reach the central bank’s 2% target next year. Nakamura, who opposed the BOJ’s decision to move away from negative interest rates in March, points to recent signs of weak consumption and a slowdown in global growth as factors clouding Japan’s economic future.

Despite resilience in the economy, household spending has been sluggish due to small growth in disposable income compared to wage increases. Nakamura is not confident that wage increases will continue, particularly as small and medium-sized firms have not yet implemented sufficient reforms to boost profits and maintain pay raises.

The BOJ’s current projections, made in April, forecast core consumer inflation to reach 1.9% in the fiscal years 2025 and 2026. However, Nakamura believes that inflation may not reach the 2% target if households reduce spending and companies are discouraged from raising prices.

While large firms have offered significant pay increases this year, there is uncertainty about whether smaller firms, which employ 80% of Japan’s workforce, can do the same. Nakamura also notes that rising social welfare costs and an increasing number of pensioners mean that households’ disposable income has not increased as much as wage hikes suggest.

Nakamura’s views underscore the ongoing uncertainties about whether the BOJ will be able to raise interest rates this year from near-zero levels. Japan’s economy contracted by an annualized 2.0% in the first quarter due to reduced spending by companies and households, casting doubt on the central bank’s view of a moderate recovery.

Analysts expect growth to rebound in the current quarter, but a weak yen is negatively impacting household sentiment by increasing the cost of imported fuel and food. BOJ Governor Kazuo Ueda has stated that the central bank will raise rates again if underlying inflation accelerates towards 2% as projected. However, market players are divided on whether this will occur in the third or fourth quarter of the year.

➖➖➖➖➖➖➖➖➖

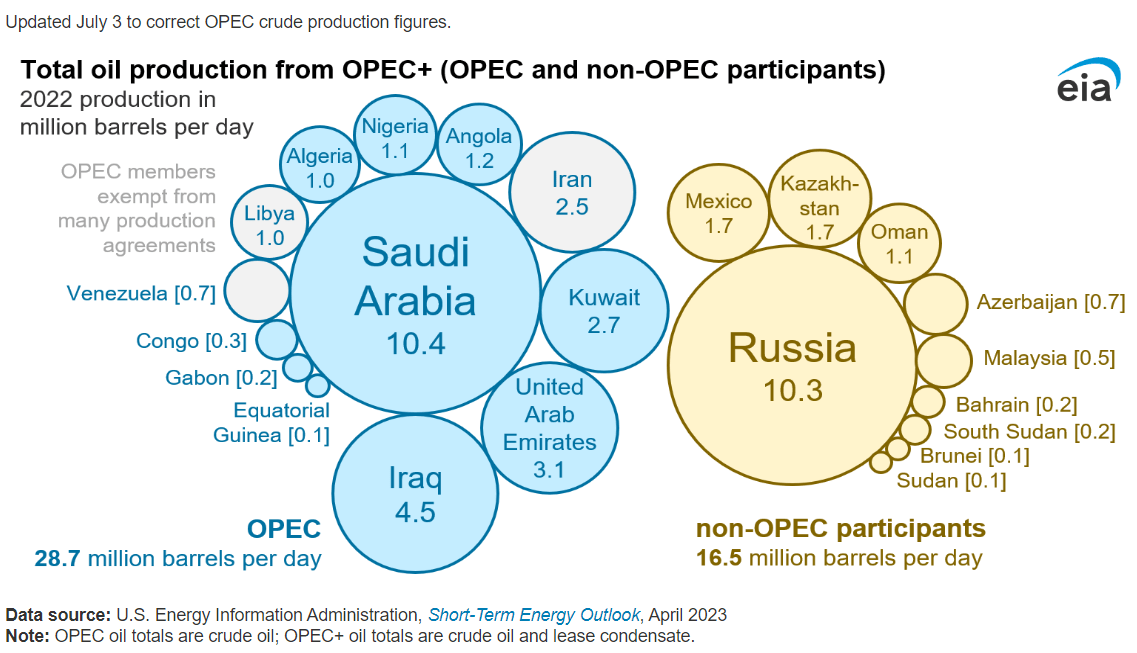

For a long time, market players have expressed dissatisfaction with OPEC+’s lack of clear communication regarding their production plans beyond the immediate three months. However, this past weekend, the alliance provided a comprehensive schedule of their intended production levels up until September 2025, which was not well-received by oil enthusiasts.

The primary cause for disappointment was the decision to start reducing some of the additional voluntary production cuts as early as October this year. While OPEC+ extended most output reductions into 2025, it stated that it could begin reducing some voluntary cuts after the third quarter of 2024, depending on market conditions.

Most analysts perceive the OPEC+ alliance’s announcement as negative for oil prices towards the year-end due to the plan to start reducing the cuts. However, they don’t foresee market conditions that would allow the group to gradually increase supply in the fourth quarter of 2024.

OPEC+’s announcement of a detailed production plan up to 2025 coincided with a bearish sentiment that had already gripped the market, driven by fears of weaker-than-expected oil demand in the short term. The prospect of slow demand growth, falling below OPEC’s estimates of 2.25 million bpd growth in 2024, combined with the plan to potentially start tapering the cuts as early as this year and a 300,000-bpd increase to the UAE’s quota next year, led to a drop in oil prices this week.

Oil hit a four-month low, with Brent Crude prices falling below $80 per barrel for the first time since early February. Goldman Sachs stated that the OPEC+ plan to start reintroducing some production is negative for oil prices as it indicates producers’ desire to pump more crude as soon as market conditions permit.

Despite these warnings, both strategists remind investors that potential market downturns can also present opportunities. They advise investors to be prepared, have a plan, and stay resilient.

➖➖➖➖➖➖➖➖➖

Geopolitical risks are increasingly becoming a concern for wealthy investors as they navigate through wars, escalating superpower tensions, and a year of crucial elections worldwide. This concern was highlighted by participants from UBS Group AG to Hang Lung Group Ltd.

The geopolitical risk and the possibility of a tail risk event have significantly increased, according to Sonja Laud, Chief Investment Officer at Legal & General Investment Management Ltd. This sentiment is echoed by family offices worldwide, who ranked geopolitics as the biggest risk over the next 12 months in a recent UBS survey.

Recent events such as the tumble of Indian stocks following the loss of Prime Minister Narendra Modi’s party majority in parliament and the plunge of the peso and equities in Mexico after the ruling party’s landslide victory have further fueled these concerns.

Investors are seeking the safest and strongest financial centers and institutions to mitigate these risks. However, the ability to hedge against political risk remains a challenge. The only viable strategy, as per Laud, is preparation and not prediction.

In response to the geopolitical situation, some of the wealthiest families are diversifying into gold, including physical gold, as stated by Amy Lo, UBS’s Asia wealth chief.

Issues of inequality have also come to the forefront, triggering protest votes. In Europe, this has led to a shift to the right, while in India, wealth disparity was a significant factor in Modi’s inability to extend his majority.

Despite the challenges, some businesses have benefited from geopolitical tensions. Southeast Asia, for instance, has received a substantial amount of capital diverted from the US or China, as it is seen as “neutral” in the US-China trade war.

Investors are urged to distinguish between politics, which tends to be short-lived, and longer-term economic fundamentals. As Ronnie Chan, former chairman of Hang Lung Group, puts it, “Over time, the whole world will have to rebalance. So let’s make sure that our heads are clear: what is political and what is purely economic.”

➖➖➖➖➖➖➖➖➖

05/06 Wed 8:30pm CAD BOC Press Conference

06/06 Thu 2:30pm GBP Construction PMI

06/06 Thu 6:15pm EUR Main Refinancing Rate & Monetary Policy Statement

06/06 Thu 6:30pm CAD Trade Balance

06/06 Thu 6:30pm USD Unemployment Claims & Trade Balance

06/06 Thu 6:45pm EUR ECB Press Conference

07/06 Fri Day 2 EUR European Parliamentary Elections

07/06 Fri 6:30pm CAD Employment Change & Unemployment Rate

07/06 Fri 6:30pm USD Average Hourly Earnings m/m & Non-Farm Employment Change & Unemployment Rate

N.B. Time mentioned here is on Gmt +6

➖➖➖➖➖➖➖➖➖

Sources :

– CNBC, Bloomberg, Reuters, Fastbull, Yahoo Finance, CNN, ForexFactory News, Myfxbook News etc

Prepared to you by “Akif Matin“

Join our FWE telegram, Facebook Page & Group

➖➖➖➖➖➖➖➖➖

Add a Comment

You must be logged in to post a comment