Gold Trading Update : Navigating Gold’s Volatility: Insights for Forex Traders

Understanding the Recent Ups and Downs in Gold Prices and What They Mean for Your Investment Strategy

In the fast-paced world of forex trading, few commodities capture attention quite like gold. Known for its allure as a safe-haven asset and store of value, gold recently embarked on a rollercoaster ride that left many traders and investors alike pondering its future trajectory.

**The Rise and Fall of Gold Prices**

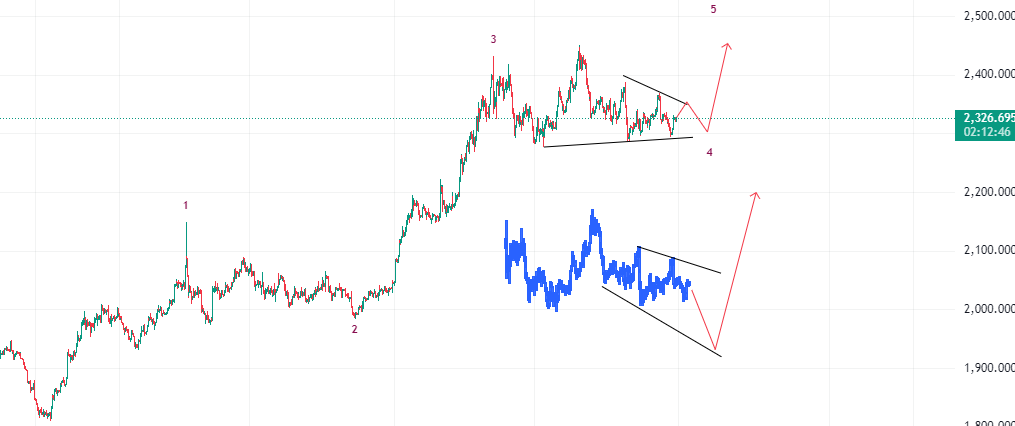

At the beginning of the year, gold surged to record highs, igniting optimism among traders who envisioned even loftier price targets. Predictions of $2,500 or even $3,000 per ounce fueled a buying frenzy as investors sought to capitalize on the precious metal’s upward momentum.

However, the euphoria was short-lived. In a surprising turn of events, gold prices sharply reversed course, dropping from a peak of $2,450 to approximately $2,300. This abrupt decline underscored the inherent volatility in commodity markets and prompted a reevaluation of gold’s role in diversified investment portfolios.

**Factors Influencing Gold’s Performance**

Several factors contributed to the downturn in gold prices. One significant factor is the escalating costs associated with holding gold as its price climbs higher. This cost dynamic has prompted caution among investors, particularly following China’s central bank’s decision to pause its gold purchases in May, signaling a shift in sentiment among major buyers.

Moreover, the uncertain stance of the Federal Reserve on interest rates has added to the market’s uncertainty. Initially anticipated to lower rates multiple times throughout the year, the Fed’s plans have been complicated by persistent inflationary pressures, casting doubt on gold’s appeal as a hedge against inflation.

**Geopolitical Tensions and Market Sentiment**

Amidst the financial market turbulence, geopolitical tensions have emerged as a critical driver of gold prices. Ongoing conflicts in the Middle East and Eastern Europe have heightened global uncertainty, bolstering demand for gold as a safe-haven asset.

Furthermore, as countries seek to diversify their reserves away from the US dollar, gold remains an attractive alternative. This strategic move underscores gold’s enduring role as a store of value and protector against economic instability.

**Navigating the Future of Gold Trading**

While recent fluctuations in gold prices have sparked concerns, it’s essential to maintain perspective. The fundamental drivers supporting gold’s value—geopolitical uncertainty, inflationary pressures, and global economic instability—remain intact.

For forex traders, navigating gold’s volatility requires a nuanced approach. Patience and a keen understanding of market dynamics are essential. Monitoring geopolitical developments, central bank policies, and economic indicators will provide critical insights into gold’s future price movements.

**Conclusion**

In conclusion, while the road ahead for gold may be uncertain, its status as a cornerstone of diversified investment strategies remains resilient. As traders navigate the complexities of the forex market, staying informed and adaptable will be key to capitalizing on opportunities presented by gold’s volatility.

By understanding the factors influencing gold prices and their implications for the broader financial markets, traders can position themselves strategically to navigate fluctuations and make informed trading decisions.

Stay tuned to our blog for more insights into forex trading strategies, market analysis, and the latest developments in the global economy.

**Call to Action:** Explore our comprehensive resources on forex trading strategies and market analysis to enhance your trading proficiency. Subscribe to our Telegram for regular updates and insights directly in your inbox.

Rana Das, CEO and Founder .

Add a Comment

You must be logged in to post a comment