RSI and Price Action-Based Forex Trading Strategy

By Rana Das, CEO of Forex Wave Expert

Introduction:

In the dynamic world of forex trading, having a reliable strategy is crucial for success. One effective approach combines the Relative Strength Index (RSI) with price action techniques. This strategy allows traders to identify potential entry and exit points based on market behavior and can significantly enhance profitability. By understanding how to interpret RSI levels and recognizing candlestick patterns, traders can make more informed decisions. In this article, I’ll guide you through the practical application of this RSI and Price Action-based Forex Trading Strategy.

You can easily trade and make a profit using an RSI and Price Action-based strategy. Especially if you combine proper money management with this system and trade correctly, you can achieve good profits.

If the RSI setup shows between 70 and 30, that’s fine, no need to change it. We usually see the 70 level as overbought and the 30 level as oversold. But this strategy can’t depend only on RSI. You also need to understand chart patterns, candlesticks, and Elliott Waves, and try to figure out the waves. Remember, a fixed auto strategy will never always work well; it will cause losses at some point. Making a profit in Forex is not that easy. So, you must be able to read market prices and do proper analysis.

To trade with this strategy, you first need to place the RSI on a blank chart. There’s no need to change the RSI settings here.

In this strategy, you can take entries using RSI as follows: Look for the 70 and 30 levels as overbought or oversold signals and confirm with reversal candlesticks. You can also take entries in the direction of the trend by checking for divergences above or below the 50 level of RSI. Additionally, if you understand Elliott Waves, you can enter based on the wave levels along with overbought or oversold levels or divergences.

Entry Looking For Buy :

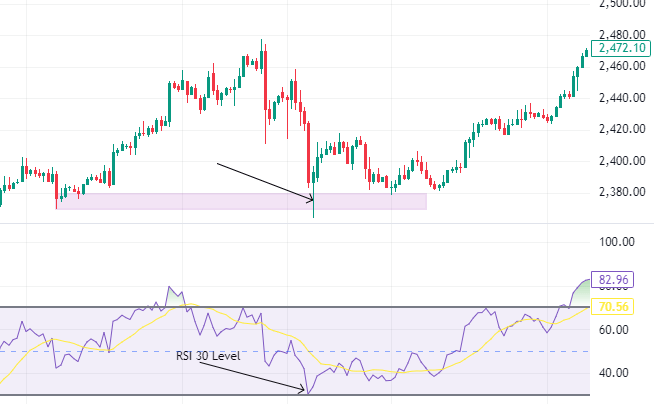

To look for a buy entry, you need to check if the market RSI has dropped below the 30 level. If it has, use price action to see if the market confirms a reversal with a candlestick near a trend line or demand zone. If the price action suggests that a reversal is likely, you can take the entry. For example, I’ve added a few pictures; please take a look at them.

Look at the buy confirmation in the picture below. First, the demand zone has been identified. In that zone, the price dropped below the 30 level on the RSI and then crossed back up. At this time, the chart showed a reversal pin bar candlestick. In this moment, you can take a buy entry using the pin bar strategy based on price action, and you can see that the entry resulted in a good profit.

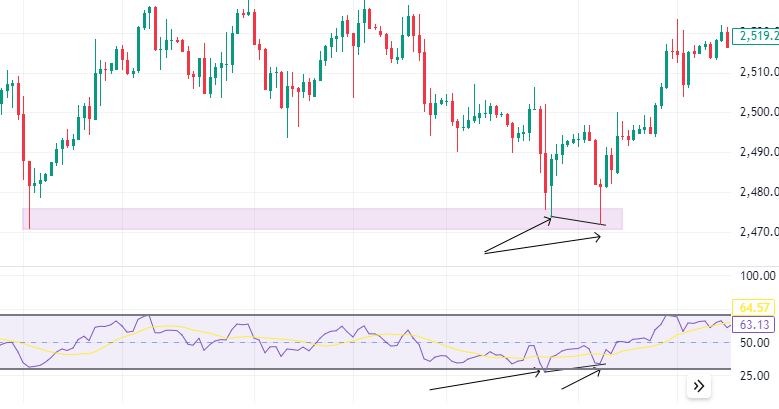

Now, let’s see how the second buy confirmation happened. The price reached the demand zone, and there was a reversal candlestick while the RSI was below 30. As the price came down again, an RSI divergence occurred along with a pin bar reversal candlestick. At this point, you should take the buy entry. You can choose to take profits either twice or once from this buy.

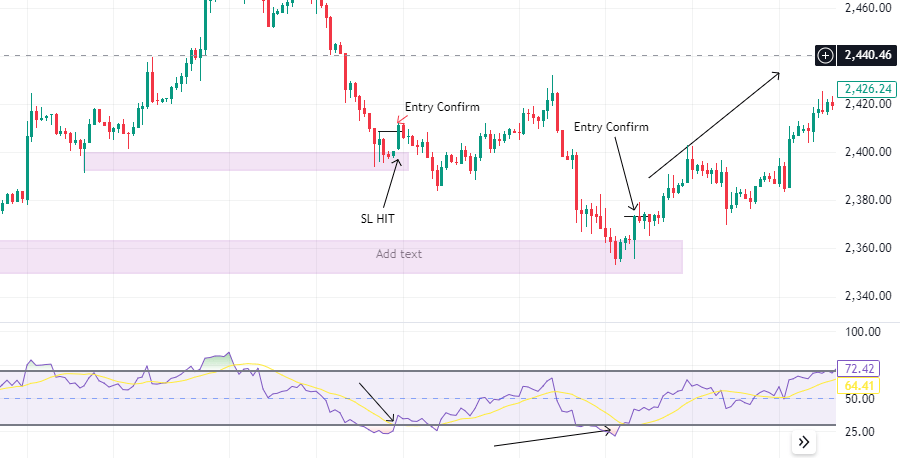

Now, I’ll give examples of the 3rd and 4th entries together. In the 3rd entry, after confirmation, the stop loss was hit, but the price went up again. If you hold on hoping to regain losses without taking the stop loss, you might face a bigger loss. So, you need to have the mindset to accept losses. However, the 4th entry confirmed and went on to make a very good profit.

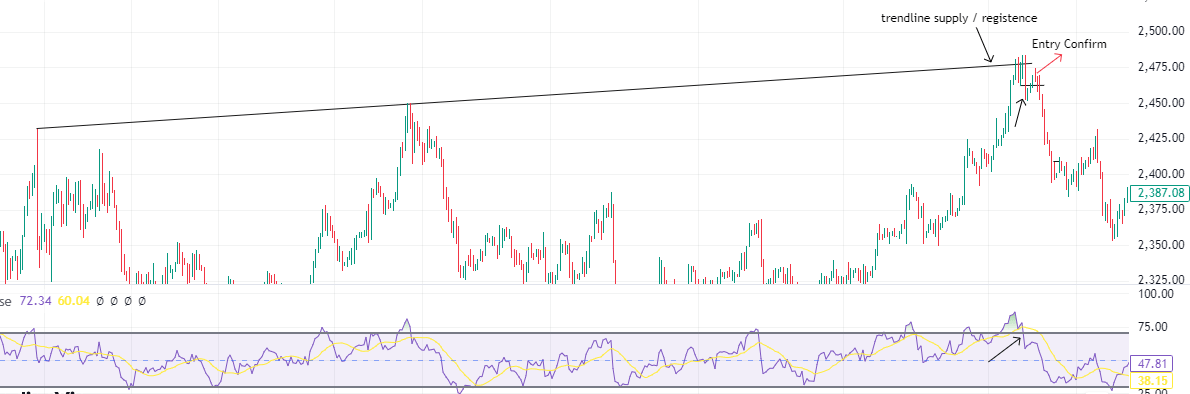

Entry Looking For Sell:

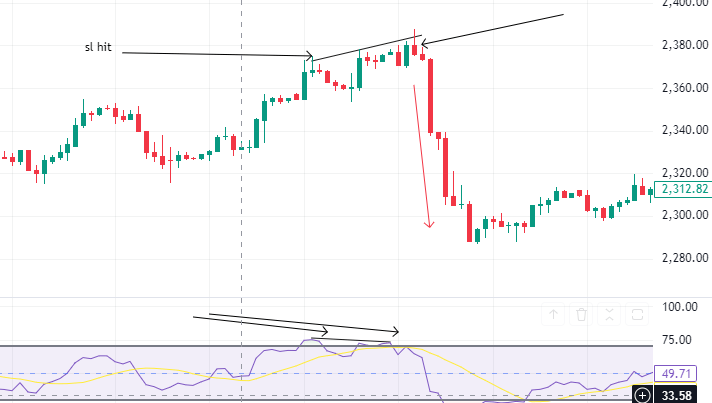

Look at the sell confirmation in the picture below. First, the trendline resistance zone has been identified. In that zone, the price rose above the 70 level on the RSI and then crossed back down. At this time, the chart showed a reversal candlestick pattern. In this moment, you can take a sell entry using the price action strategy, and you can see that the entry resulted in a good profit.

Now, I’ll give examples of the 2nd and 3rd entries together. In the 2nd entry, after confirmation, the stop loss was hit, but the price went down again. If you hold on, hoping for the next profit without taking the stop loss, you may face a bigger loss. So, you need to have the mindset to accept losses. However, the 3rd entry, after confirmation, went into a very good profit, and the entry was confirmed very close to the previous stop loss price. This entry was also confirmed with a divergence.

Now, let’s see how the 4th sell confirmation happened. The price reached the supply zone, formed a reversal pin bar candlestick, and the RSI was above 70. At this point, a pin bar reversal candlestick appeared, and this is where you should take the sell entry.

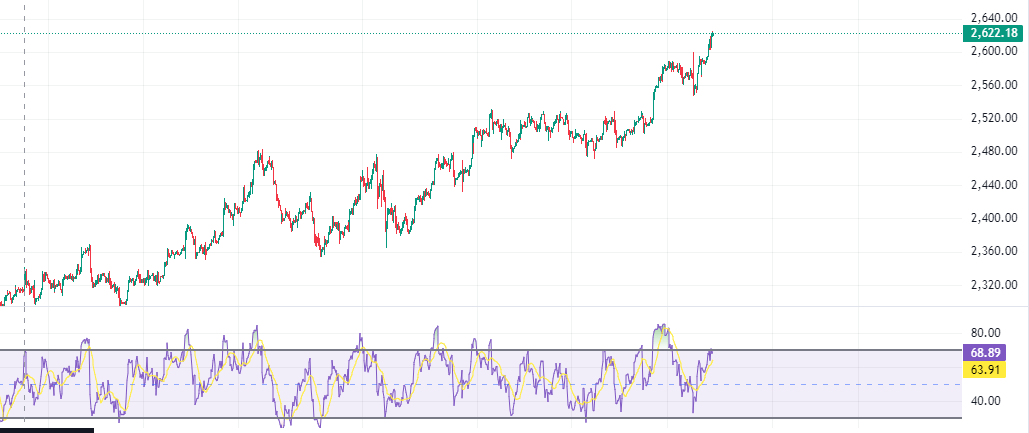

Divergence: Buy when the RSI is above the 50 level and sell when it’s below the 50 level.

In RSI divergences, you can take a buy when there’s a divergence below the 50 level and a sell when there’s a divergence above the 50 level. To do this, you need to understand RSI divergences better. Look at the picture below to see how divergences provide entry points. This will give you the most profit in a ranging market movement.

Additionally, you can combine this model with Elliott Wave in several ways to get 90% accurate entries. If you carefully read the market and analyze everything properly, you can make accurate entries. However, if you rely only on RSI-based entries, there’s a chance of making losses.

I use this entry model RD Trading Zone strategy in my own trading, and earlier I shared the “Uradhura entry model.” This is the second version of the Uradhura model, and it is very effective. In my Pro Trader Course 2, I have detailed classes on these entry models. I have shared two forex trading strategies on our website blog for our followers.

Conclusion:

To succeed in forex trading, it’s essential to employ a strategy that combines multiple indicators and techniques. The RSI and Price Action-based Forex Trading strategy I’ve outlined can provide traders with valuable insights into market movements and potential reversals. Remember, effective trading is not just about following indicators; it’s about understanding market psychology, price action, and using sound risk management. By applying this strategy and continuously educating yourself, you can enhance your trading performance and achieve consistent profits. For deeper insights into these models, consider joining my Pro Trader Course 2.

Add a Comment

You must be logged in to post a comment