An In-Depth Review of BrightFunded: The New Contender in Prop Trading

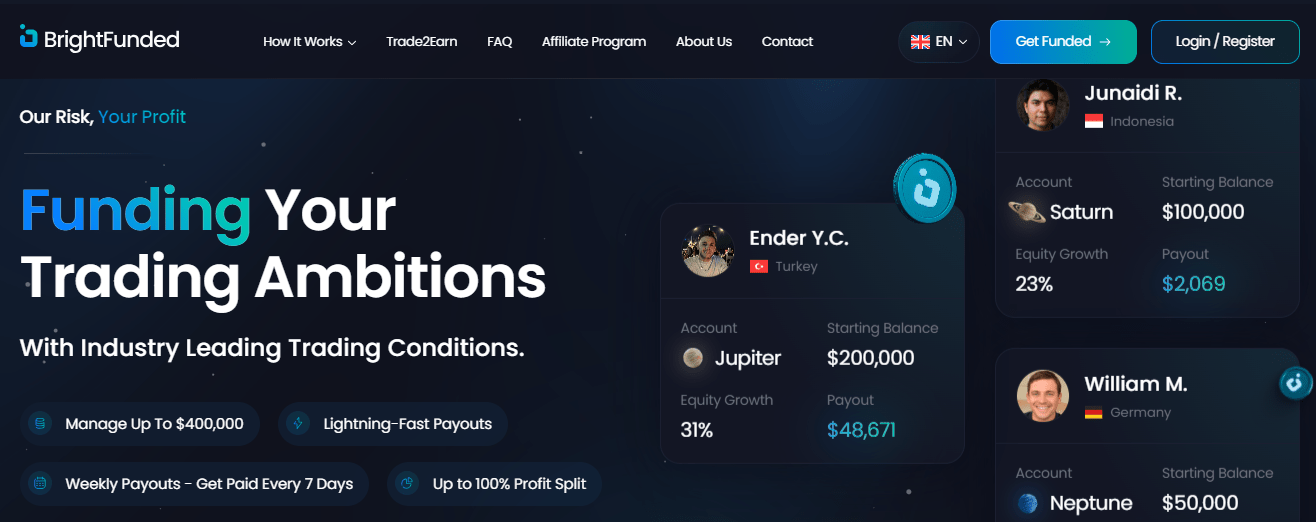

BrightFunded Review: BrightFunded is an up-and-coming proprietary trading firm that has quickly garnered attention since its establishment in September 2023. With a focus on providing traders of all skill levels with a transparent, supportive, and rewarding trading environment, this Netherlands-based firm is making its mark in the competitive world of prop trading. Owned by Jelle Dijkstra, BrightFunded promises to deliver a user-friendly experience backed by a solid set of tools and educational resources. In this review, we’ll explore what makes BrightFunded unique, highlighting both its strengths and areas where it could improve.

Trading Platforms at BrightFunded

One of the standout features of BrightFunded is its custom-built trading platform, designed with ease of use in mind. Available for desktop, Android, and iOS devices, the platform allows traders to execute trades, track performance, and manage their accounts seamlessly across multiple devices. Whether you’re at home or on the go, you can stay connected to the markets and execute your strategies without any hassle. This accessibility ensures that traders, whether beginners or experienced, can make the most of their trading opportunities.

Diverse Range of Trading Instruments

BrightFunded offers an impressive selection of trading instruments to suit a variety of strategies and trading preferences. Here are the key asset classes available:

- Cryptocurrencies: The platform supports a wide range of digital assets, including popular cryptocurrencies like Bitcoin, Ethereum, and Solana.

- Major Forex Pairs: Trade the most liquid and widely recognized currency pairs, including EUR/USD, GBP/USD, and more.

- Minor and Exotic Forex Pairs: For those seeking higher volatility, Bright Funded also supports less common and exotic currency pairs.

- Indices: Exposure to popular stock market indices such as the S&P 500 and NASDAQ.

- Commodities: Traders can access hard metals like gold and silver, as well as agricultural commodities such as wheat and coffee.

This diverse range of instruments provides ample opportunities for traders to diversify their portfolios and capitalize on various market conditions.

Account Sizes and Profit Split Structure

BrightFunded caters to a broad spectrum of traders by offering six account sizes in different currencies (USD, EUR, GBP):

- $5k

- $10k

- $25k

- $50k

- $100k

- $200k

Each account comes with an 80% profit split, meaning traders keep the lion’s share of their profits, while the firm retains 20%. This is a favorable split in the prop trading space, offering traders an attractive incentive to succeed.

Profit Targets and Drawdown Limits

BrightFunded has a two-step evaluation process, which includes the Challenge and Verification stages. To pass the evaluation, traders must meet the following profit targets:

- Challenge Stage: Achieve an 8% profit on the account balance.

- Verification Stage: Achieve a 5% profit on the account balance.

The firm’s risk management is designed to be fair and trader-friendly. The maximum daily drawdown is capped at 5%, while the total maximum drawdown is set at 10% of the account balance. This gives traders ample room to navigate market fluctuations without the constant fear of hitting a margin call. Additionally, the firm requires at least five trading days to be completed during the challenge phase, though there are no limits on how many days you can take to complete the challenge.

Fees and Commission Structure

BrightFunded maintains transparency with its fee structure, making it easy for traders to understand the costs involved. The initial fee for entering the challenge varies depending on the account size:

- $5k account: €55

- $10k account: €95

- $25k account: €195

- $50k account: €295

- $100k account: €495

- $200k account: €975

Aside from the challenge fee, there are no additional or hidden fees. The commission structure is also quite reasonable:

- Currency Pairs: $3 per lot

- Indices: $0 per lot

- Crypto: 0.024% per volume (0.012% per side)

- Commodities: 0.0010% per volume

This low-cost environment ensures that traders can retain more of their profits, making BrightFunded an appealing option for cost-conscious traders.

Payment Methods and Payouts

BrightFunded offers a variety of payment methods for both deposits and withdrawals, catering to traders who prefer traditional or digital payment options. Traders can fund their accounts using credit cards, bank transfers, iDeal, or cryptocurrencies, including:

- Bitcoin (via both the Bitcoin and Lightning networks)

- USDT (Tron Network)

- USDC (ERC-20 Network)

- Ethereum (ERC-20 Network)

- Litecoin (Litecoin Network)

- Tron (Tron Network)

- Solana (Solana Network)

It’s important to note that when making a crypto deposit, traders must ensure they select the correct network to avoid the risk of losing funds.

Once traders are funded, they can request their first payout 30 days after placing their initial trade. After the first payout, subsequent payouts occur bi-weekly, which is relatively fast in the industry.

Educational Resources and Customer Support

BrightFunded prides itself on being a trader-focused firm, offering a range of educational resources to help users sharpen their skills. These resources are tailored to traders of all levels, from beginners to advanced, and include strategies, tutorials, and market analysis.

The firm’s customer support is another strong point, with a team that responds quickly and effectively to queries. Whether you need assistance with your account, trading issues, or any other inquiries, the support team is known for providing helpful and timely responses.

Scaling Opportunities and Reward Structure

One of the most exciting features of BrightFunded is its scaling plan. Successful traders who meet certain profitability and balance targets can increase their funded account by up to 30% every four months. This scaling opportunity allows traders to grow their accounts steadily, with the potential to scale indefinitely based on performance.

Additionally, starting from the third scale-up, traders are eligible for a 100% profit split on all trades, meaning they keep all of the profits they generate. This is an attractive incentive for those who demonstrate consistent success.

Special Offers and Discounts

For traders who use the Forex Wave Expert services, BrightFunded offers an exclusive 20% discount with the code FWE20. This discount can provide valuable savings on professional trading tools and services, enhancing the overall trading experience.

Pros of BrightFunded

- Low Commissions: With transparent and competitive fees, traders can keep a higher percentage of their profits.

- Bi-weekly Payouts: Traders can expect quick payouts after the first 30 days, with bi-weekly payouts thereafter.

- Refundable Fees: The firm refunds challenge fees upon successful completion of the evaluation process.

- Diverse Instruments: A broad selection of trading instruments ensures that traders can diversify their portfolios.

- Scalable Accounts: The scaling plan offers traders a clear path for account growth and financial success.

- 100% Profit Split After Scaling: From the third scale-up onwards, traders keep all of their profits.

Cons of Bright Funded

- No Free Trials: BrightFunded does not offer a free trial, which means traders must pay to participate in the challenge.

- Limited Challenge Options: Currently, the firm offers only one challenge type, which may not cater to all traders’ needs.

Final Thoughts

BrightFunded is an exciting new player in the prop trading space, offering a transparent, fair, and flexible environment for traders. The firm’s low commissions, generous profit split, and educational resources make it an appealing choice for both novice and experienced traders. Its scalable accounts and potential for a 100% profit split on successful trades provide a clear incentive for traders to perform well.

However, it’s important to note the absence of free trials and the limited challenge types. Additionally, a few users have raised concerns over account terminations, which the firm should address to ensure complete customer satisfaction.

In conclusion, BrightFunded presents a solid opportunity for traders looking for a reliable and rewarding prop trading firm, with plenty of room for growth and success.

Add a Comment

You must be logged in to post a comment