Crude Oil Analysis: Key Insights and Market Outlook

Crude oil prices have experienced notable volatility today, reflecting ongoing concerns about global economic conditions and supply dynamics. With oil trading near its lowest levels of the year, traders are closely watching for signs of potential reversals or further declines. Here’s an in-depth look at today’s crude oil market analysis:

Current Price Movements

WTI crude oil prices have continued to hover around the $71 per barrel mark, maintaining a bearish trend as weak demand and ample supply persist. The market remains pressured by disappointing economic data from China, one of the largest oil consumers globally. Chinese factory demand fell more than anticipated in August, signaling continued struggles in its economic recovery efforts. Meanwhile, in the U.S., oil consumption figures for June were reported by the EIA to be at their lowest seasonal level since 2020, adding to the negative sentiment in the market.

Supply Factors: OPEC’s Potential Actions

OPEC has hinted at the possibility of increasing production in the fourth quarter of this year. This move could further weigh on prices, especially if demand does not pick up in key markets. Production cuts from members like Libya have created some supply tightness; however, an overall increase in OPEC+ production could offset these reductions, contributing to a sustained oversupply scenario in the near term.

Demand Concerns

Demand concerns remain a central theme in the crude oil market. Weak economic data from major economies, including China and the Eurozone, suggest that global demand for oil may remain subdued. With manufacturing indices and consumer spending showing signs of weakness, the outlook for a demand rebound appears limited in the short term. This ongoing demand weakness is likely to keep oil prices under pressure unless significant bullish catalysts emerge.

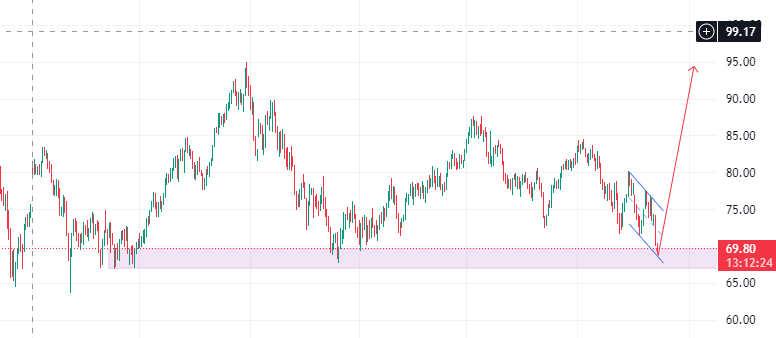

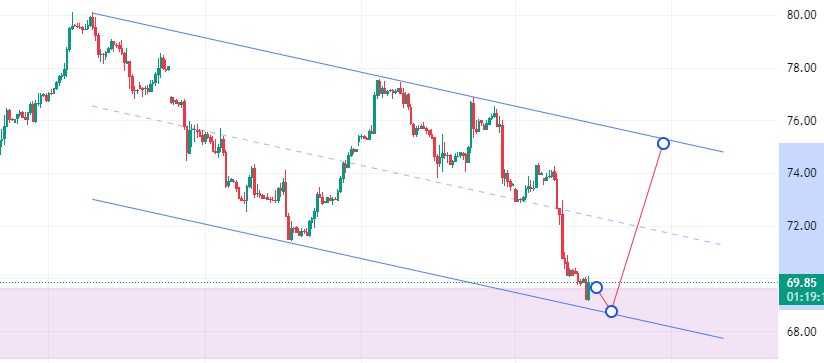

Technical Analysis

From a technical standpoint, WTI crude oil is currently trading within a major demand zone. This area has historically provided strong support, and a rejection from this level could trigger a bullish reversal. Traders should monitor price action closely around this zone; if prices bounce decisively, we could see a recovery back towards higher resistance levels. However, if the demand zone fails to hold, further declines could be in store, potentially pushing prices to new lows for the year.

Trade Recommendations

Given the current market dynamics, traders are advised to remain cautious and consider the following strategies:

- Watch for Reversal Signs: If crude oil prices reject the current demand zone, it could present a buying opportunity. A clear rejection could lead to a strong rally, making it a favorable time for long positions with tight stop losses.

- Risk Management: Due to the volatile nature of the market, it’s essential to set appropriate stop losses and manage trade sizes effectively to mitigate potential losses.

- Focus on Economic Data: Keep an eye on upcoming economic reports, including manufacturing data and inventory reports, as they could provide further direction for crude oil prices.

Impact of Canada’s Economic Policies

As Canada is a significant oil producer and an OPEC member, the country’s economic policies can influence oil markets. With the Bank of Canada expected to cut rates by 0.25% today, traders should be aware of potential implications for the Canadian dollar and broader oil market dynamics. A weaker Canadian dollar could impact oil prices, given Canada’s role in the global oil supply chain.

Conclusion

Crude oil remains under pressure from a combination of weak demand and potential increases in supply. Traders should stay alert to key demand levels and be prepared for possible market reversals or further declines. By carefully monitoring economic indicators and OPEC’s actions, traders can better navigate the current volatility in the crude oil market. Stay tuned with Forex Wave Expert for more daily updates and expert insights.

Key Economic Events Today (GMT+6)

- Australia GDP (q/q): 04:30

- German Services PMI (m/m): 10:55

- Eurozone Services PMI (m/m): 11:00

- UK Services PMI (m/m): 11:30

- Eurozone Producer Price Index (m/m): 12:00

- Canada Trade Balance (m/m): 15:30

- US Trade Balance (m/m): 15:30

- Canada BoC Interest Rate Decision: 16:45

- Canada BoC Rate Statement: 16:45

- US JOLTs Job Openings (m/m): 17:00

- Canada BoC Press Conference: 17:30

Add a Comment

You must be logged in to post a comment