Daily Forex Market News & Analysis: Key Currency Pair Insights for September 2, 2024

As we dive into today’s Forex market, traders and investors are closely analyzing the major currency pairs to navigate the shifting tides of global finance. This edition of Daily Forex Market News & Analysis will provide a comprehensive look at the EUR/USD, GBP/USD, USD/JPY, and XAU/USD pairs, incorporating the latest technical indicators, economic data, and trading recommendations. We will also touch on broader market trends, including stock indices and commodity prices, to give you a well-rounded perspective.

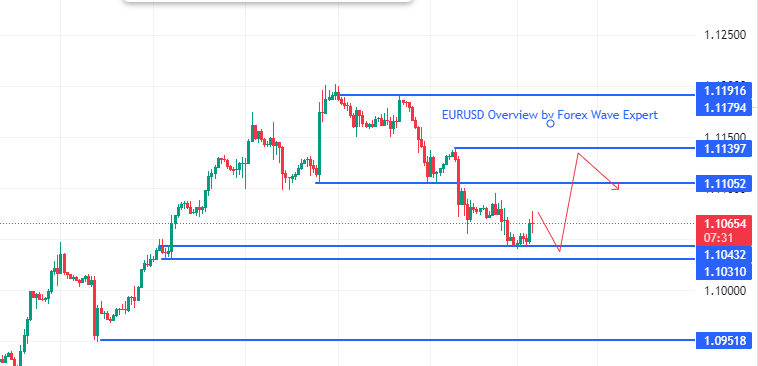

EUR/USD: European Economic Dynamics and Trading Insights

Technical Overview

In the latest Daily Forex Market News & Analysis, the EUR/USD currency pair closed at 1.1077, marking a decrease of 0.36% from the previous day’s close. The pair opened at 1.1117, indicating a continuation of the bearish trend that has characterized recent trading sessions.

European Central Bank Commentary

Isabel Schnabel of the European Central Bank (ECB) has recently emphasized the need for caution regarding interest rate cuts. Despite some signs of easing inflation, Schnabel stressed that the ECB should avoid rapid rate reductions due to ongoing inflationary risks. The Eurozone’s recent inflation data, while showing some improvement, remains above the ECB’s target, complicating the central bank’s policy decisions. Moderate wage growth in the Eurozone suggests that a rate cut in September could be a possibility, especially given the inflation slowdown to a three-year low in August.

Trading Recommendations

- Support Levels: Key support levels for the EUR/USD pair include 1.1050, 1.1017, 1.0950, 1.0905, and 1.0884. These levels are crucial for identifying potential buying opportunities.

- Resistance Levels: Resistance is observed at 1.1100, 1.1146, 1.1191, and 1.1275. Breaking these levels could signal a shift in market sentiment.

- Current Trend: On an hourly time frame, the EUR/USD trend is bearish, with the price trading below key moving averages. Currently testing support at 1.1050, the market is seeing partial stabilization in selling pressure. Given that today is a US bank holiday, expect a narrow trading range. Consider intraday buying opportunities with tight stop-loss orders. Alternatively, a break above 1.1191 could indicate a potential reversal and resumption of the uptrend.

Important Economic Data Today:

- German Manufacturing PMI at 10:55 GMT+3

- Eurozone Manufacturing PMI at 11:00 GMT+3

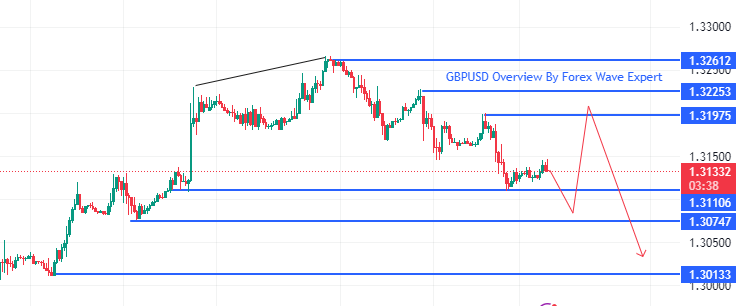

GBP/USD: Sterling’s Performance Amid Bank of England Expectations

Technical Overview

In today’s Daily Forex Market News & Analysis, the GBP/USD pair closed at 1.3127, showing a decline of 0.27% from its opening level of 1.3163. This decrease reflects ongoing market sentiment and expectations related to the UK’s monetary policy.

Bank of England Rate Decision

Looking ahead to September 19, the Bank of England (BoE) is expected to announce its rate decision. Market expectations currently do not foresee any immediate changes, which is generally positive for the British pound. The BoE is anticipated to adopt a cautious approach, potentially delaying significant rate adjustments until after the fall budget. This stance is likely to support sterling, although any shifts in economic outlook could lead to a weakening of the pound.

Trading Recommendations

- Support Levels: The GBP/USD pair finds support at 1.3103, 1.3055, 1.2973, 1.2932, 1.2848, and 1.2800. These levels are essential for assessing potential buying opportunities.

- Resistance Levels: Resistance levels are at 1.3158, 1.3201, and 1.3306. Breaking these levels could indicate further gains for the pound.

- Current Trend: The GBP/USD pair displays a bullish trend but is at a critical point. The recent decline has brought the price closer to support levels, with buyers attempting to halt the downtrend. Intraday trading might involve looking for buying opportunities with a tight stop loss. Conversely, a break below 1.3109 may resume the downtrend.

Important Economic Data Today:

- UK Manufacturing PMI at 11:30 GMT+3

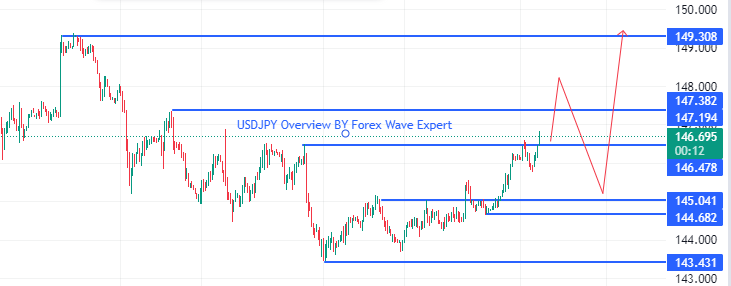

USD/JPY: Yen’s Weakness Amidst Economic Data

Technical Overview

The USD/JPY pair closed at 146.15, reflecting an increase of 0.85% from the opening level of 144.92. This rise highlights the yen’s current weakness in response to recent economic data.

Japanese Economic Data

Recent reports from Japan have indicated weaker economic performance. Industrial production for July increased by 2.8%, below the expected 3.5%. Retail sales also grew by only 0.2% compared to the anticipated 0.4%. Additionally, Japan’s unemployment rate rose to 2.7%, the highest in 17 months, signaling a softening labor market.

Trading Recommendations

- Support Levels: Key support levels for USD/JPY include 145.22, 144.70, 144.09, 142.69, 142.80, 140.22, and 137.26. These levels could offer potential buying opportunities.

- Resistance Levels: Resistance levels are found at 146.48, 146.62, 148.29, 150.88, 151.26, and 153.80. The pair faces potential obstacles at these points.

- Current Trend: In the medium term, the USD/JPY pair is bearish but approaching a potential reversal. The price is near a key change level, with sellers maintaining pressure. Intraday trading might focus on sell positions with tight stop losses, considering the proximity of resistance levels. A break above 146.48 could signal an uptrend.

Important Economic Data Today:

- No specific news feed.

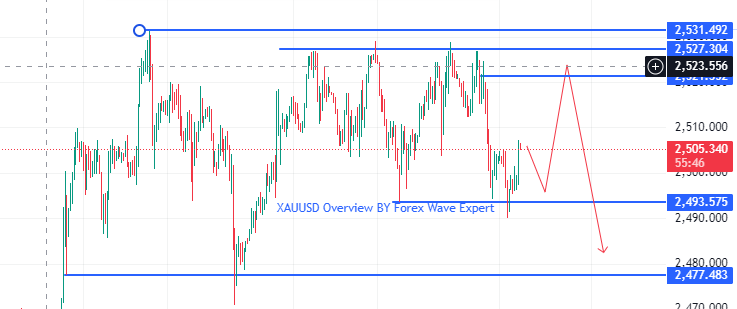

XAU/USD (Gold): Precious Metals Under Pressure

Technical Overview

Gold, represented by the XAU/USD pair, closed at 2503, down 0.72% from the previous opening level of 2521. This decline reflects ongoing pressure on gold prices.

Market Dynamics

The strengthening US dollar and recent hawkish comments from ECB officials have put pressure on gold. Economic data showing stable core PCE prices and resilient US economic conditions have reduced expectations for a substantial Federal Reserve rate cut in September. Nevertheless, market expectations for a total of 100 basis points in rate cuts over the remaining Fed meetings this year may continue to support gold prices.

Trading Recommendations

- Support Levels: Key support levels for gold are at 2494, 2479, 2451, 2440, 2416, 2367, and 2343. A breach of these levels might lead to further declines.

- Resistance Levels: Resistance levels are observed at 2509 and 2532. These points could act as price ceilings.

- Current Trend: The overall trend for gold remains bullish, although recent price movements have pushed it towards key support levels. Intraday traders might consider buying near 2494 with tight stop-loss orders, targeting the resistance zone around 2509. A significant drop below 2494 could lead to a more pronounced sell-off.

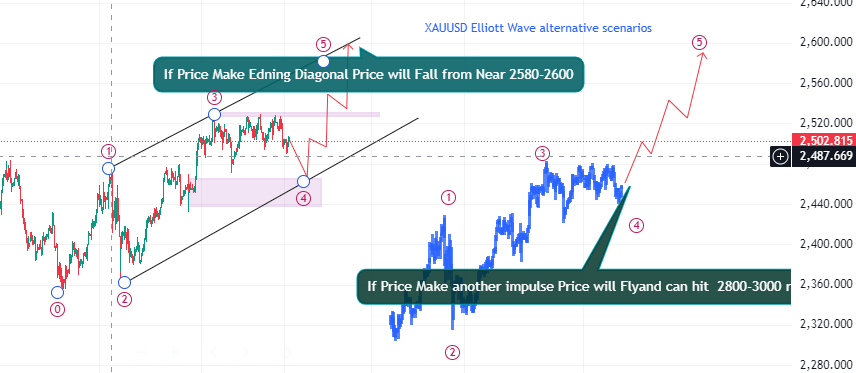

Elliott Wave Overview :

Elliott Wave Overview

In today’s Daily Forex Market News & Analysis, we observe that gold is in the final stages of Wave 5 of the Elliott Wave cycle. The price is forming a sub-wave correction, with the potential to establish a running flat pattern if it consolidates between 2460 and 2440. This could lead to an ending diagonal structure and a subsequent price surge to 2580-2600 before a major correction. Alternatively, if a regular flat correction occurs, gold could extend its rise to 2800-3000.

Elliott Wave Analysis from CEO Rana Das

CEO Rana Das emphasizes that gold is in Wave 5, with particular focus on its sub-wave correction. If gold completes a running flat pattern in the 2460-2440 range, it may form an ending diagonal structure, driving the price to 2580-2600. Conversely, a regular flat correction could push gold’s price even higher, potentially reaching 2800-3000. Traders should monitor these patterns closely to navigate potential price movements effectively.

Important Economic Data Today:

- No specific news feed.

Broader Market Context

US Stock Indices

In recent Daily Forex Market News & Analysis, US stock indices displayed mixed performance. The Dow Jones Industrial Average (US30) rose by 0.55%, reaching new all-time highs, while the S&P 500 (US500) gained 1.01%. The NASDAQ Technology Index (US100) showed a positive 1.13%, though it lagged behind other indices. Positive corporate earnings and favorable economic data, such as the PCE core price index and personal spending figures, have supported equity markets.

European Stock Indices

European equities generally declined, with Germany’s DAX (DE40) and the UK’s FTSE 100 (UK100) experiencing slight losses. Eurozone inflation data has been a key focus, as markets assess potential implications for ECB policy. Spain’s IBEX 35 Index managed a modest gain, reaching a near three-month high.

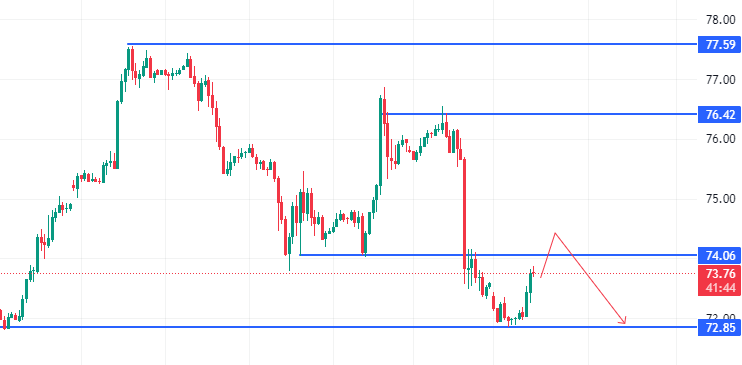

Oil Prices

WTI crude oil prices fell to $73 per barrel, continuing a decline influenced by OPEC’s decision to increase production in the upcoming quarter. The increase in production and concerns over weaker demand, particularly from China, have contributed to the drop in oil prices.

Asian Markets

Asian stock indices showed varied performance. Japan’s Nikkei 225 (JP225) rose by 1.29%, and Hong Kong’s Hang Seng (HK50) gained 1.58%. However, China’s FTSE China A50 (CHA50) declined by 0.86%, and Australia’s ASX 200 (AU200) posted a modest 0.85% increase. Market sentiment was affected by mixed economic data and ongoing concerns about the Chinese economy’s growth prospects.

Australian Market

Australia’s manufacturing sector continued to face challenges, reflecting the impact of high borrowing costs and weak demand. Markets are awaiting further comments from Reserve Bank of Australia Governor Michele Bullock, who has suggested that it may be premature to consider rate cuts despite signs of weakening inflation.

Conclusion

This detailed edition of Daily Forex Market News & Analysis provides a thorough examination of the key currency pairs and broader market trends. By understanding the current technical indicators, economic data, and trading recommendations, traders and investors can make informed decisions in today’s dynamic financial landscape. Stay tuned for further updates and insights as we continue to monitor these developments.

Rana Das, CEO , Forex Wave Expert.

Add a Comment

You must be logged in to post a comment