Daily Forex Market Technical Overview – 2024.09.04

Welcome to today’s Daily Forex Market Technical Overview, where we dive into the latest technical insights and trading recommendations for major currency pairs. This analysis will help you stay informed and make strategic decisions in the forex market.

The EUR/USD Currency Pair

Technical Indicators:

- Prev Open: 1.1062

- Prev Close: 1.1043

- % Change Over Last Day: -0.17%

The EUR/USD pair reached a 2-week low on Tuesday. Traders are anticipating a potential interest rate cut by the ECB at its September 12 meeting, especially after German retail sales for May fell by 1.1% y/y, missing the expected 0.7% y/y. Swaps currently price in a 99% chance of a 25 bps rate cut by the ECB.

Trading Recommendations:

- Support Levels: 1.1028, 1.1017, 1.0950, 1.0905, 1.0884

- Resistance Levels: 1.1100, 1.1146, 1.1191, 1.1275

In the daily forex market technical overview, the EUR/USD pair shows a bearish trend on the hourly chart. The price is testing the support level of 1.1028, where some selling activity is evident. For intraday traders, consider selling from the trend line to aim for the week’s low. Buying opportunities may arise if the price breaks and consolidates above the downtrend line.

Alternative Scenario: A break above the resistance level of 1.1191, with consolidation, could signal a resumption of the uptrend.

News Feed for 2024.09.04:

- German Services PMI (m/m) at 10:55 (GMT+6)

- Eurozone Services PMI (m/m) at 11:00 (GMT+6)

- Eurozone Producer Price Index (m/m) at 12:00 (GMT+6)

- US Trade Balance (m/m) at 15:30 (GMT+6)

- US JOLTs Job Openings (m/m) at 17:00 (GMT+6)

Stay updated with forex trading insights on Myfxbook and Forex Factory.

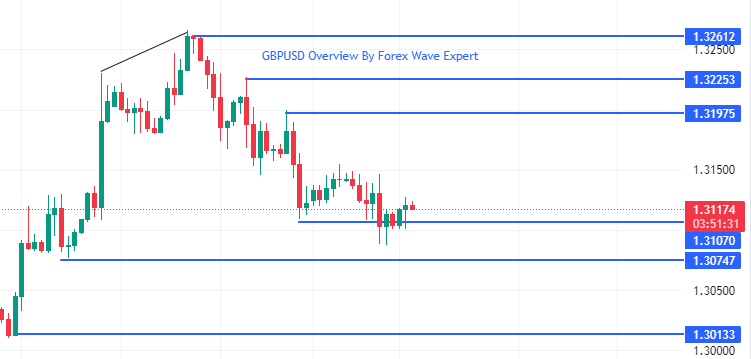

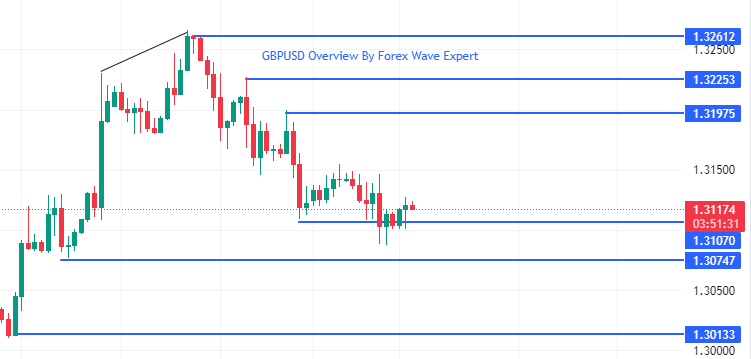

The GBP/USD Currency Pair

Technical Indicators:

- Prev Open: 1.3142

- Prev Close: 1.3113

- % Change Over Last Day: -0.22%

Recent disappointing data from the US manufacturing sector and construction spending has rekindled concerns about the US economy. Traders are awaiting further economic data this week to better assess the Federal Reserve’s potential rate cut. The Bank of England’s recent interest rate reduction to 5% has led to expectations of an additional 41 bps cut by year-end. This divergence in monetary policy may support the British pound in the medium term.

Trading Recommendations:

- Support Levels: 1.3055, 1.2973, 1.2932, 1.2848, 1.2800

- Resistance Levels: 1.3158, 1.3202, 1.3306

In today’s daily forex market technical overview, the GBP/USD pair is in a downtrend. The price has consolidated below key levels, with recent volumes indicating sales fixation. Look for selling opportunities from the moving averages. Buying can be considered if the price breaks the downtrend line or the support level of 1.3055.

Alternative Scenario: A break above the resistance level of 1.3202, with consolidation, may lead to a resumption of the uptrend.

News Feed for 2024.09.04:

- UK Services PMI (m/m) at 11:30 (GMT+6)

The USD/JPY Currency Pair

Technical Indicators:

- Prev Open: 146.85

- Prev Close: 145.47

- % Change Over Last Day: -0.94%

The yen appreciated on Tuesday following hawkish comments from Bank of Japan (BoJ) Governor Ueda. The yen’s rise was further supported by weaker-than-expected US manufacturing data, which led to lower T-note yields. Swaps estimate a 0% chance of a 10 bps BoJ rate hike at the September 20 meeting, with a 15% chance at the October 30-31 meeting.

Trading Recommendations:

- Support Levels: 145.22, 144.47, 144.09, 142.69, 142.80, 140.22, 137.26

- Resistance Levels: 147.17, 148.29, 150.88, 151.26, 153.80

From a technical standpoint in our daily forex market technical overview, the USD/JPY currency pair remains in a medium-term bullish trend. The price is correcting to the support level of 145.23, offering potential long opportunities with a tight stop loss. A break below this level could lead to further declines towards 144.47 and beyond.

Alternative Scenario: A break and consolidation below the support level of 144.47 could signal a resumption of the downtrend.

News Feed: No major economic releases scheduled for today. Stay informed with Myfxbook and Forex Factory for live updates on forex trading.

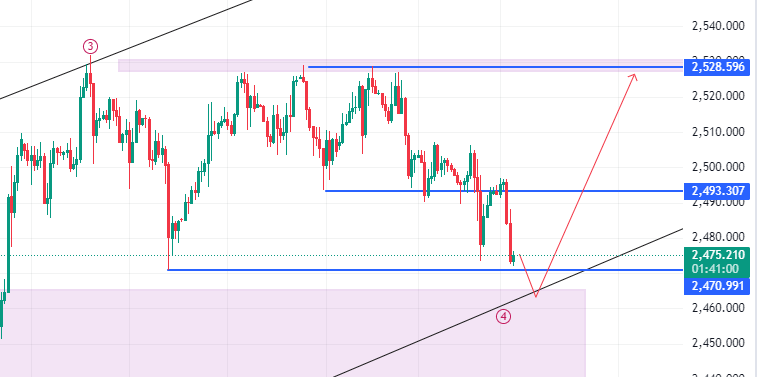

The XAU/USD Currency Pair (Gold)

Technical Indicators:

- Prev Open: 2499

- Prev Close: 2493

- % Change Over Last Day: -0.24%

The dollar index’s rise to a 2-week high weighed on gold prices, pushing them to a 1-week low. Focus this week includes ISM surveys, JOLTs job openings, the ADP employment report, and non-farm payrolls data. With Fed officials highlighting risks in the labor market, markets expect a 100 bps rate cut over the remaining meetings this year, which could lower the opportunity cost of holding gold.

Trading Recommendations:

- Support Levels: 2471, 2451, 2440, 2416, 2367, 2343

- Resistance Levels: 2509, 2532

In our daily forex market technical overview, gold’s trend remains bullish, but the recent decline below 2500 has put the uptrend at risk. The price is at moving average levels, where sellers may test liquidity below 2471. There are currently no optimal buying points.

Alternative Scenario: A break below the support level of 2451 could lead to a downtrend.

For more insights on forex trading and to keep up with market developments, follow Forex Wave Expert, and check out Myfxbook and Forex Factory for live updates and trading tips from Rana Das, CEO of Forex Wave Expert.

Add a Comment

You must be logged in to post a comment