FOREX Fundamental News Facts for 1st May, 2024

-

WSJ’s Timiraos writes that the Fed intends to keep rates high for longer.

2. Dollar Firms as Markets Brace for Hawkish Fed Shift, Swiss Franc Under Pressure.

3. World Gold Council (WGC) says global gold demand hits an 8-year high in Q1.

4. Hope rises for a Gaza ceasefire as Hamas is considering a new truce deal.

5. U.S. labor cost increase accelerated in the first quarter.

6. It’s Going to Be A Massive Week for the Stock Market.

7. Bank of Japan’s Hawkish Whispers Drowned Out by Rowdy Yen Sell-off.

8. Hard-Right Tidal Wave About to Hit Europe – And It Will Only Make the Economic Crisis Worse.

Federal Reserve’s Interest-Rate Policy:

According to WSJ’s Timiraos, the Federal Reserve is planning to maintain high interest rates for an extended period. This is reflected in their decision to keep the benchmark federal funds rate at around 5.3%, the highest in over two decades. The Fed’s stance is influenced by the higher-than-expected inflation in the first quarter of the year, leading them to consider delaying rate cuts. They aim to keep rates steady, significantly impacting economic activity, and plan to maintain this level longer than initially anticipated. However, if wage growth picks up in the coming months, it could reignite concerns among Fed officials about rising services inflation.

The U.S. Federal Reserve’s interest rate, which has remained steady at 5.25%-5.50% since July, is unlikely to change soon. Despite the anticipation of rate cuts late last year, the process has stalled due to stagnant inflation. Policymakers are now uncertain about the possibility of rate cuts this year. The Fed’s stance, once clear about rate cuts, is now ambiguous.

Economist Tim Duy likens the Fed to an athlete waiting to play, with housing inflation data being a key factor in deciding rate cuts. Although housing costs have been driving inflation, officials expect it to decrease. However, strong data continue to undermine confidence in a quick return to the Fed’s 2% inflation target.

Fed Chair Jerome Powell is expected to emphasise that rate cuts will only occur when there is confidence in stable inflation, a confidence that is currently lacking. Diane Swonk, KPMG’s chief economist, describes the Fed’s situation as “monetary policy purgatory,” uncertain of its future direction.

With inflation exceeding expectations this year, the Fed is unsure if it has done enough to control inflation and reduce rates. Any further acceleration in inflation could force the Fed to consider additional rate hikes.

Evercore ISI Vice Chairman Krishna Guha believes the Fed is on a detour, trying to maintain the current view of upcoming rate cuts while acknowledging unhelpful recent data. Depending on future wage and other data, this could lead to a more significant hawkish reset.

Chicago Fed President Austan Goolsbee, who previously described the Fed’s journey as a “golden path” of falling inflation without associated unemployment or growth decline, now refers to it as a “golden tributary,” indicating a more complex route for the central bank to navigate.

The US Federal Reserve is predicted to maintain steady interest rates for the sixth consecutive meeting on Wednesday (May 1), with the prospect of initiating cuts in the summer appearing less likely due to persistent inflation. The US central bank has kept its benchmark lending rate at a 23-year peak to suppress demand and control price increases, with last year’s inflation slowdown sparking hope for imminent cuts.

However, inflation has picked up pace, leading analysts to widely anticipate that the Federal Open Market Committee (FOMC) will retain its target range at 5.25% to 5.50%. As expectations for rate cuts in the first half of the year fade, the Fed confronts the increasing likelihood that eventual reductions will align with the lead-up to November’s presidential election. This could stimulate the economy as Democrats and Republicans compete for voter support, although the overlapping timeline might be problematic as the Fed, being the independent US central bank, strives to evade any semblance of politicisation.

Dan North, a senior economist at Allianz Trade North America, asserts that there is “no chance” the FOMC will adjust rates on Wednesday. Financial markets had anticipated the central bank to initiate cuts in June a few weeks ago, but recent inflation reports have “definitively pushed the lift-off date substantially into the future,” according to North. He added that “the September meeting now seems like the most likely time for the first cut.”

Ryan Sweet, chief US economist at Oxford Economics, stated that “given the incoming data on inflation, risks are weighted toward fewer cuts this year.” Sweet predicts two reductions, in September and December. The Fed’s reliance on incoming data also introduces “uncertainty in the forecast for the path of monetary policy,” Sweet noted in a recent report.

When Fed Chair Jerome Powell holds a press conference after the two-day meeting, analysts will be closely examining his remarks on progress in reducing inflation, searching for indications that the first cut has been postponed to September. Another point of interest is Powell’s response to whether the Fed might consider raising rates again, although it is generally expected that the threshold for such a move would be quite high.

Economists also believe that the Fed could shed light this week on a policy that allows assets it purchased to aid the US economy during the pandemic to “run off,” or expire without replacement. The bank permits up to US$95 billion in assets to mature each month without replacement. It currently possesses about US$7.4 trillion in assets and is deliberating when to begin decelerating the current runoff rate. This ongoing measure shrinks the overall size of the Fed’s balance sheet and is also intended to tighten monetary policy. Powell recently stated that it will likely be suitable to slow the runoff pace “fairly soon,” which would mitigate the risk of “liquidity problems,” likely referring to last year’s banking crisis. Analysts widely expect an announcement on runoff to be made this week or at the next interest rate meeting in June.

Dollar Firms as Markets Brace for Hawkish Fed Shift, Swiss Franc Under Pressure:

The U.S. dollar has seen a broad recovery, remaining strong in the Asian market. This comes as investors adopt a cautious approach ahead of the Federal Reserve’s rate decision and press conference. With recent data indicating persistent inflation, expectations are growing that the Fed may adopt a more hawkish tone. The Swiss Franc is experiencing the most significant sell-off in the currency markets due to diverging monetary paths with other major central banks.

In other news, the New Zealand Dollar has slightly weakened following weaker than expected employment data. The Yen is currently the strongest performer, with the Dollar and Sterling also showing resilience.

U.S. stocks experienced a sharp decline overnight, ending a turbulent April as traders anticipate a hawkish pivot from Fed Chair Jerome Powell. The Dow recorded a 5% loss for the month, marking its worst monthly performance since September 2022.

The Fed is widely expected to maintain the federal funds rate at its current level of 5.25-5.50%. All eyes are on Powell’s statement and subsequent press conference, with market speculation suggesting Powell might confirm that a rate cut in June is unlikely.

Japan’s PMI Manufacturing was finalised at 49.6 in April, suggesting that the sector is moving towards stabilisation in the near term. New Zealand employment fell by 0.2% in Q1, with the unemployment rate rising from 4.0% to 4.3%.

The Reserve Bank of New Zealand (RBNZ) has warned of persistent inflation risks and financial market volatility. The RBNZ’s semi-annual Financial Stability Report noted that expectations for monetary policy easing have spurred rallies in equity markets across major economies. However, these gains could be vulnerable to a swift reversal.

Looking ahead, the main focus is on the Fed rate decision and post-meeting press conference, with the release of the UK PMI manufacturing final, Canada PMI manufacturing, and US ISM manufacturing also expected.

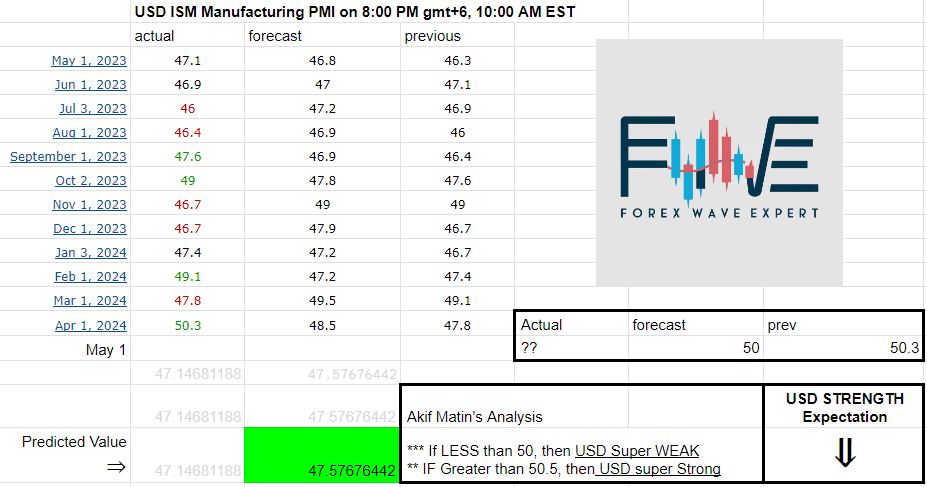

To our concern, there is a high chance that US ISM Manufacturing PMI data will be less than previous value. If that happens, after the news release, USD will act much weaker and it may directly reflect on USD supply and commodity demand. (BULLISH Gold).

Alternatively, if the value rises than the previous, then USD will act much stronger and it may directly reflect on USD demand and commodity supply (Bearish Gold).

Final Manufacturing PMI data will also be released today.

To our concern, there is a high chance that US Final Manufacturing PMI data will be less than previous value. If that happens, after the news release, USD will act much weaker and it may directly reflect on USD supply and commodity demand. (BULLISH Gold).

Alternatively, if the value rises than the previous, then USD will act much stronger and it may directly reflect on USD demand and commodity supply (Bearish Gold).

Global Gold Demand:

The World Gold Council (WGC) reports that the global demand for gold, including the over-the-counter (OTC) market, has reached an eight-year high in the first quarter. The total demand rose by 3% year-on-year to 1,238 metric tons, marking the strongest quarterly performance since 2016. Factors contributing to this increase include solid investment demand from the OTC market, continued gold purchases by central banks, and growing demand from Asian buyers. These factors pushed the average price of gold to a record high of $2,070 per ounce in the first quarter.

Gaza Ceasefire Negotiations:

There is renewed hope for a ceasefire in Gaza as Hamas considers a new truce deal. An Israeli delegation is participating in negotiations with Hamas in Cairo, Egypt. The proposed framework by Egypt involves Hamas releasing 33 hostages taken from Israel in exchange for a ceasefire in Gaza. Both Israeli and diplomatic sources are hopeful about reaching an agreement, reducing the risk of further escalation in the Middle East.

U.S. Labor Cost Increase:

The U.S. Bureau of Labor Statistics reports an accelerated increase in labor costs in the first quarter. The Employment Cost Index (ECI), a measure of labor costs, rose by 1.2% from the previous quarter, surpassing the 0.9% increase in the last quarter of the previous year. The rise in labor costs, driven by increases in wages and benefits, was higher than expected. This surge in U.S. inflation at the start of the year could potentially delay the anticipated Federal Reserve interest rate cut later this year.

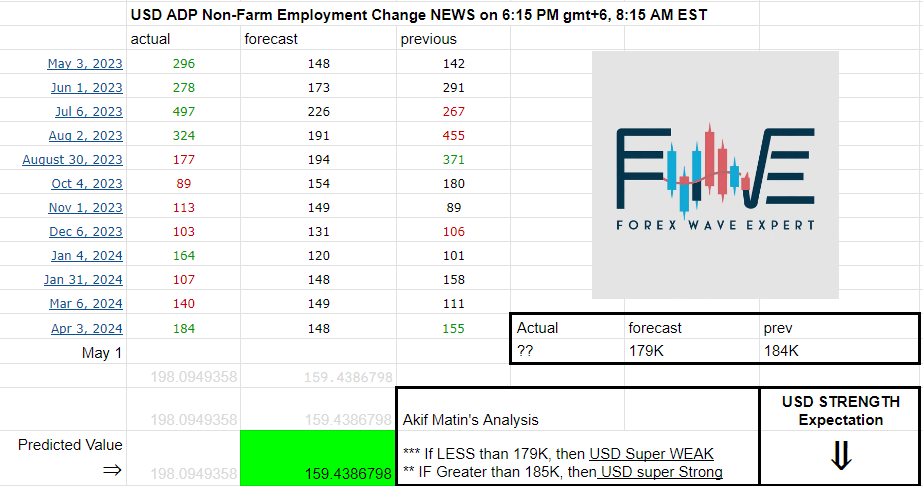

Today, ADP Non-Farm Employment Change data will also be released.

To our concern, there is a high chance that US ADP Non-Farm Employment Change data will be less than previous value. If that happens, after the news release, USD will act much weaker and it may directly reflect on USD supply and commodity demand. (BULLISH Gold).

Alternatively, if the value rises than the previous, then USD will act much stronger and it may directly reflect on USD demand and commodity supply (Bearish Gold).

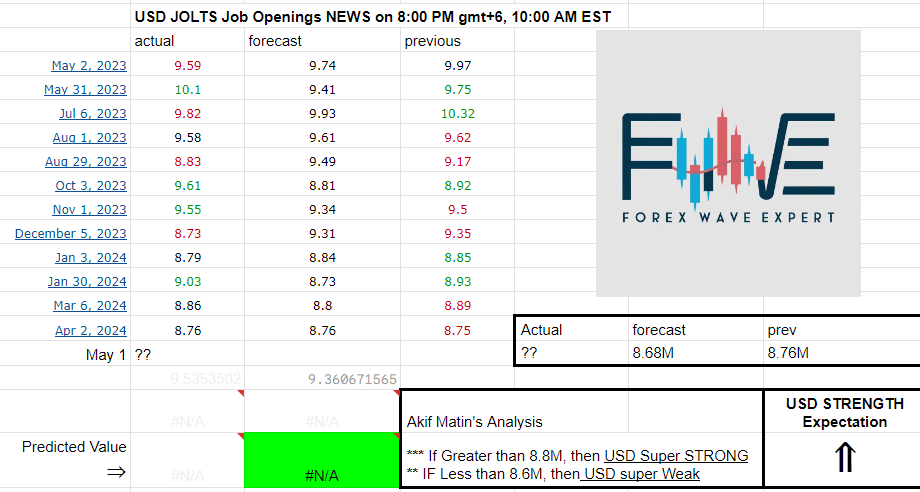

Also JOLTS Job Openings data will also be released today before the FOMC meetings.

To our concern, there is a high chance that US JOLTS Job Openings data will be greater than previous value. If that happens, after the news release, USD will act much stronger and it may directly reflect on USD demand and commodity supply. (Bearish Gold).

Alternatively, if the value rises than the previous, then USD will act much weaker and it may directly reflect on USD supply and commodity demand (Bullish Gold).

It’s Going to Be A Massive Week for the Stock Market:

Larry Adam, the Chief Investment Officer at Raymond James, has outlined five key factors to monitor this week that could significantly influence stock market prices. These include:

Federal Reserve Chairman Jerome Powell’s Press Conference: Powell is expected to deliver a speech as part of the Fed’s May FOMC meeting. While interest rates are anticipated to remain unchanged, Powell’s stance on future rate cuts could provide crucial insights. He is expected to maintain his data-dependent approach, emphasising that rates may need to stay restrictive for a bit longer.

Quarterly Refunding Announcement: The Treasury Department is set to disclose its borrowing requirements for the upcoming quarter. Given the surge in tax receipts this year, there is less need for the Treasury to issue new bonds this quarter, which would be welcomed by the market.

Earnings Growth: This week is one of the busiest for earnings releases, with over 170 S&P 500 companies set to report their Q1 earnings. The focus will be on guidance from company CEOs for the rest of the year.

Manufacturing and Service Activity: The release of ISM Manufacturing and Services data will provide insights into the economy’s expansion. The services sector, which makes up a larger portion of the economy relative to manufacturing, is particularly important.

Labor Market Resilience: The April jobs report will be closely watched by investors. Despite signs of a slowing jobs market, if the unemployment rate remains below 4%, it will tie the second-longest consecutive streak below 4% on record.

These factors collectively provide a comprehensive overview of the potential market dynamics in the coming week.

Bank of Japan’s Hawkish Whispers Drowned Out by Rowdy Yen Sell-off:

The Bank of Japan (BOJ) recently decided to maintain its policy, which led to a sell-off of the yen. Despite this, there were indications that the central bank might increase rates in the future, possibly in the fall. The market’s focus on the BOJ’s decision to keep interest rates near zero and the absence of clear signals from Governor Kazuo Ueda about the currency’s decline potentially hastening the next rate hike led to the yen hitting a 34-year low.

The BOJ’s quarterly report and Ueda’s comments suggest that consecutive rate hikes are possible, but the bank’s failure to effectively communicate its policy intentions has intensified the yen’s sell-off. The BOJ’s quarterly report, which forms the basis for long-term monetary policy, predicts that inflation will remain around its 2% target for the next three years and that price growth will likely be generally consistent with its target from late 2025 onwards.

The report also included new language indicating that the central bank would “adjust the degree of monetary accommodation” if the economy and prices meet projections, which BOJ observers interpret as a code for rate hikes. Former BOJ official Nobuyasu Atago believes that the BOJ essentially has a plan for consecutive rate hikes in mind and expects the next hike to occur in September.

Despite traders ignoring Ueda’s warnings about the weak yen, he stated that the BOJ could preemptively increase rates if the inflation boost from the currency’s declines persists and influences corporate wage-setting behaviour. A source familiar with the BOJ’s thinking stated that recent yen falls won’t start to significantly affect inflation until around autumn this year, suggesting that the next rate hike could occur around that time.

The BOJ, having ended eight years of negative interest rates and other remnants of its massive stimulus program in March, now sets the short-term policy rate in a 0-0.1% range. Many market players expect the BOJ to raise the rate to 0.2% or 0.25% later this year, though opinions vary on how quickly it could move thereafter.

In a sign that the BOJ might not wait too long after its next hike, Ueda said he expects short-term rates to rise near Japan’s neutral rate of interest, which many economists believe is between 0.5% and 1.5%, around late 2025 through 2026. The BOJ currently does not disclose its estimates on Japan’s neutral rate of interest, which is the rate at which monetary policy is neither contractionary nor expansionary. However, Ueda stated last month that the BOJ will be “extracting insights on the neutral rate” in the process of raising rates.

The market’s dovish interpretation of Ueda’s comments accelerated the yen’s declines, leading to suspected yen-buying intervention by Japanese authorities on Monday. There are no guarantees that more explicitly hawkish BOJ signals would ease the massive downward pressure on the yen given the other factors affecting the currency. However, the BOJ’s failure to get its hawkish message across underscores the communication challenge it faces in countering yen bears, particularly with the Federal Reserve seen keeping U.S. interest rates high for longer than expected.

Japan has a long history of market interventions to weaken or prop up its currency. Several times since the 1990s, Japan, either unilaterally or with help from its main trading partners, has tried to turn the tide for the yen. A quick look at the most recent market interventions, including the yen’s post-intervention performance, could provide valuable insight into what can be expected in the short term for the yen after Monday’s activity.

Before delving into the analysis, it is important to explain how Japan intervenes. The Japanese finance ministry is responsible for such a move. It then instructs the BOJ, due to its established links with the main banks and investment houses, to buy/sell the yen. The US dollar/yen pair appears to be the decisive factor in Japan’s reaction function. If the yen is deemed to be very expensive against the dollar and not reflecting the underlying economic disparities, then the BOJ sells yen (buys dollar) in the market aiming to weaken its currency. Alternatively, when the yen is deemed to be too weak against the dollar, the BOJ buys yen (sells dollars) in the market.

In conclusion, the yen is not expected to stage a sustainable rally against the dollar, most likely forcing the BOJ to intervene again in the market in low liquidity sessions. Unless the Fed surprises with dovishness in the near future and a rate cut follows at the June meeting, the BOJ will need to adopt a much more hawkish monetary policy stance in order to stabilise the yen.

Hard-Right Tidal Wave About to Hit Europe – And It Will Only Make the Economic Crisis Worse:

By the time of the European parliament elections in June, the rightward shift in European politics is expected to have intensified significantly. Ultra-nationalist and populist-nationalist leaders are now topping the polls in several countries, including Italy, the Netherlands, France, Austria, Hungary, and Slovakia, and are running second in Germany and Sweden. These factions are influencing traditional centre-right parties across Europe, including Britain, pushing them towards increasingly extreme anti-immigration, anti-trade, and anti-environment stances.

This rightward shift is not exclusive to Europe, with Trump 2.0 advocating a more aggressive protectionist and nationalist agenda than Trump 1.0. However, Europe differs from the US in one key aspect. While the US economy continues to grow robustly, Europe, particularly Germany, is experiencing near-zero growth and stagnant living standards. After a decade of consistently low growth, Europe is now split between a dwindling optimistic minority and a growing pessimistic majority who view life as a zero-sum game.

In the largest Western European countries, many people are pessimistic about their future, believing they will fare worse than their parents’ generation. According to a seven-nation poll by Focaldata, only a small percentage of people in France and Italy believe they will do better in the future. In the Netherlands and Germany, pessimists and optimists are evenly split. Even in Ireland and Sweden, which top the league for optimism, less than half of the population feel they will fare better, with a significant percentage taking the opposite view.

The poll also tested the zero-sum proposition that one can only get rich at the expense of others. The results were dramatic: a majority of respondents in every major European country agreed with this proposition. This mindset, once adopted, is hard to shake and leads to a blame culture, which in turn fuels more pessimism. People vote for parties that target those they perceive as holding them back – immigrants, foreigners, and minorities. These parties offer no economic policies to stimulate long-term growth, resulting in zero-sum politics that exacerbate economic decline and further promote zero-sum thinking.

Europe now faces the challenge of escaping this vicious cycle. The measures it needs to adopt – new investment in technology, clean energy, and medical advances – are being hindered by its policy of fiscal retrenchment. The European growth and stability pact prohibits member states from running deficits above 3% and makes no distinction between public spending on consumption and investment. Germany’s constitutionally enshrined debt brake, which limits the government’s structural deficit to 0.35% of GDP, casts a shadow over the whole of Europe. This fiscal bind leaves Europe stuck while China can subsidise new technologies to the point of undercutting Europe, and Bidenomics in the US is stimulating the economy with huge deficits. The European recovery and resilience facility ends for good in 2026, with no replacement. The stability and growth pact, which has restrictive conditions that were suspended during the Covid crisis, resumes its tough regime next year. France and 11 other European countries are already in trouble, unable to invest more because they are already running allegedly unsustainable deficits.

➖➖➖➖➖➖➖➖➖

🔥News releases on This WEEK :

01/05 Wed 3:00am NZD RBNZ Financial Stability Report

01/05 Wed 4:45am NZD Employment Change q/q

01/05 Wed All Day CNY, CHF, EUR (french,german,italian) Bank Holiday

01/05 Wed 7:00am NZD RBNZ Gov Orr Speaks

01/05 Wed 6:15pm USD ADP Non-Farm Employment Change

01/05 Wed 7:45pm USD Final Manufacturing PMI

01/05 Wed 8:00pm USD ISM Manufacturing PMI & JOLTS Job Openings

02/05 Thu 12:00am USD Federal Funds Rate & FOMC

02/05 Thu 12:30am USD FOMC Press Conference

02/05 Thu 2:15am CAD BOC Gov Macklem Speaks

02/05 Thu 12:30pm CHF CPI m/m

02/05 Thu 6:30pm CAD Trade Balance

02/05 Thu 6:30pm USD Unemployment Claims

02/05 Thu 6:45pm CAD BOC Gov Macklem Speaks

03/05 Fri All Day JPY & CNY Bank Holiday

03/05 Fri 6:30pm USD Average Hourly Earnings m/m & Non-Farm Employment Change

03/05 Fri 7:45pm USD Final Services PMI

03/05 Fri 8:00pm USD ISM Services PMI

N.B. Time mentioned here is on Gmt +6

➖➖➖➖➖➖➖➖➖

Sources :

– CNBC, Bloomberg, Reuters, Fastbull, Yahoo Finance, CNN, ForexFactory News, Myfxbook News etc

Prepared to you by “Akif Matin“

Join our FWE telegram, Facebook Page & Group

Add a Comment

You must be logged in to post a comment