Forex Fundamental News Facts for 2nd May, 2024

- OPEC’s crude oil outputs hold steady with no new production cuts.

2. EIA crude stocks surge, which is bearish for oil prices.

3. The U.S. adds 192,000 jobs and sees slower wage growth in April.

4. WSJ’s Timiraos says hawkish Fed officials become more confident.

5. Fed leaves rates unchanged and will slow balance sheet runoff from June.

6. Pound to Dollar Rate Rebounds After Fed Rate Hike Bets Put to Bed.

7. US Oil and Gas Production Rebounds After Winter Storm.

8. RBA Decision: Will A Rate Hike Be Back on The Table?

9. Happy Apple Day.

10. A Strong U.S. Dollar Weighs on the World.

11. US Trade Balance news ahead !

OPEC’s Crude Oil Production Remains Unchanged:

The Organization of Petroleum Exporting Countries (OPEC) didn’t reduce its crude oil production last month. The production in April was 26.81 million barrels per day, slightly less than the previous month. While Libya and Iraq increased their production, Iran and Nigeria reduced theirs. The production in Iraq and the UAE was more than the agreed limit. OPEC+ members will meet on June 1 to decide whether to continue the current production limits for the rest of the year.

Increase in EIA Crude Stocks Leads to Drop in Oil Prices:

Oil prices fell as U.S. crude inventories reached their highest level since June. The U.S. Energy Information Administration reported a significant increase in U.S. crude inventories last week. A potential ceasefire between Israel and Hamas and signs of ongoing inflation have also affected oil demand.

U.S. Adds More Jobs, But Wage Growth Slows Down:

The U.S. private sector added 192,000 jobs in April, more than expected. Despite rising interest rates, the demand for workers is strong and unemployment is low. However, wage growth has slowed down.

Fed Officials More Confident, According to WSJ’s Timiraos:

Nick Timiraos of the Wall Street Journal suggests that Federal Reserve officials are becoming more confident due to stronger-than-expected wage growth. Some officials believe that there’s no need to cut rates this year as the economy is strong and they worry that inflation will stay above 2.5%.

Fed Keeps Rates Unchanged and Will Reduce Balance Sheet Runoff:

The Federal Reserve has decided to keep the target range for the federal funds rate unchanged at 5.25%-5.50%. The Fed will continue to reduce its holdings of U.S. Treasuries, agency debt, and agency mortgage-backed securities, but at a slower pace starting in June. The market now expects the Fed’s interest rate cuts to be less and delayed this year due to higher than expected inflation and hawkish remarks from Fed officials. Fed Chairman Powell believes that delaying the rate cut may be appropriate as the U.S. labor market demand remains strong and inflation growth is higher than expected.

The U.S. Federal Reserve (Fed) has decided to keep the interest rates unchanged at 5.25% to 5.5%, the highest since 2007, due to persistent inflation in the U.S. economy. Despite expectations of a rate cut, the inflation rate has consistently exceeded 3%, which is above the Fed’s target of 2%. The Fed has stated that it won’t consider lowering the target range until it is more confident that inflation is steadily moving towards 2%.

Inflation has been varying between 2% and 4% in recent months. It dropped to 3.1% in January from 4.1% in December, which led investors to hope for potential interest rate cuts later this year. However, the rate increased in February and March, reaching 3.5% in March.

Inflation reached a 40-year high of 9.1% in June 2022. In April, after the release of March’s inflation figures, U.S. President Joe Biden acknowledged that while inflation had fallen 60% from its peak, more efforts are needed to reduce costs for families. He noted that prices for housing and groceries were still too high, even though prices for key household items like milk and eggs were lower than a year ago.

In April, Fed Chair Jerome Powell confirmed that Fed officials were hesitant to change rates given the recent inflation data. Earlier in the year, some economists believed the Fed would cut rates up to three times before the end of the year. However, March’s inflation data cast doubt on any foreseeable cuts.

Powell reiterated the Fed’s lack of confidence in inflation cooling enough to cut interest rates at a press conference following the announcement. He stated that the Fed is prepared to maintain interest rates for “as long as appropriate”. He also noted that it is unlikely that the next interest rate move will be a rate hike, and officials are considering how much longer they should maintain the current rate.

The Fed is also closely monitoring the labor market, which has remained strong despite higher rates. The next Federal Open Market Committee will take place on June 11 and 12.

In Asia, many markets are set to resume full operations on Thursday after the May Day holiday. The U.S. Fed’s guidance, a surging yen, and manufacturing PMIs from across the continent are all potential market indicators. The economic calendar for Asia is packed on Thursday, with highlights including manufacturing PMIs from seven countries, consumer inflation from South Korea and Indonesia, Hong Kong’s first quarter GDP, Australian trade figures, and consumer confidence from Japan.

Moves in U.S. trading on Wednesday will likely set the early market tone. Wall Street fluctuated, yields fell, and the dollar dropped after Powell said an interest rate hike was “unlikely”, and that his baseline scenario is still for inflation to cool and pave the way for lower interest rates.

This came after the Fed announced a more aggressive tapering of its quantitative tightening program than had been expected. The overarching signal was dovish. Treasuries and the dollar responded positively, but Wall Street did not – stocks surged as much as 1.5% on Powell’s comments before the S&P 500 and Nasdaq closed in the red.

Global stocks started the new month on Wednesday on the defensive, as doubts over the U.S. economy’s resilience, high bond yields, and some U.S. earnings misses sapped risk appetite. Some of that gloom may lift, if only temporarily.

There may also have been a few sighs of relief at the Bank of Japan and Ministry of Finance in Tokyo – the dollar’s fall relieves pressure on the yen, and by extension, pressure for further yen-buying intervention from Japanese authorities. The yen staged an extraordinary rally in late U.S. trade on Wednesday, strengthening more than 2% past where it was just before the BOJ’s policy decision last Friday.

Looking beyond Wednesday’s Fed frenzy, the extraordinary upward shift in implied U.S. rates this year is being widely felt – easing expectations around the world have been pared back, and rates in Australia, for example, are more likely to be raised this year than cut.

One central bank that has raised rates is Bank Indonesia, with its surprise move last month. Sticky inflation numbers on Thursday could bolster expectations of further tightening – rates markets currently expect another quarter-point increase by the summer. South Korea’s annual inflation rate, meanwhile, is seen slowing slightly to 3.0% – probably not enough of a decline to move the dial on the Bank of Korea’s rate outlook.

Current and expected risks warrant the FOMC holding off on the first cut until September and then carefully assessing lingering inflation risks as each subsequent step is taken. A low of 3.375% is expected for fed funds mid-2026, a modestly contractionary rate.

Following a run of data pointing to inflation being more persistent, the updated views of Chair Powell and the FOMC were eagerly awaited. In the event, the tone of their guidance was balanced, with the FOMC again emphasizing they will decide meeting by meeting on the appropriate timing of rate cuts. Very clear in Chair Powell’s remarks though is that they need to see a number of months of good progress on inflation before considering a cut. Given recent momentum, the additional three months of data to come ahead of the July meeting are unlikely to be enough. We now see September as the most probable timing for the first cut, followed by one cut per quarter until June 2026, when we see the fed funds rate troughing at a modestly contractionary 3.375%.

The FOMC is not ignoring the recent momentum in inflation. In the statement, the Committee noted in “recent months, there has been a lack of further progress toward the Committee’s 2 percent inflation objective” and that they do “not expect it will be appropriate to reduce the target range until [they have] gained greater confidence that inflation is moving sustainably toward 2 percent”. However, Chair Powell made clear in the press conference that they still expect inflation will move down over the year. The current stance of policy is deemed “sufficiently restrictive” and the labor market coming into balance. From this guidance and other comments in the press conference, it is evident the Committee is focused on when to cut, not whether.

In gauging the most likely timing of a first cut and the pace thereafter, the persistence of activity and labor market momentum will prove key. Our baseline view is that momentum holds up around trend for activity and above zero for job growth. Wages growth will remain solid with risks skewed upwards. Recall also that most US borrowers are insulated from rate hikes and household wealth is still rising. If our baseline view on the economy plays out, the FOMC are likely to take their time easing policy. The persistence of this economic resilience, and so pricing pressure, also favors our baseline view of a one cut per quarter profile over two years.

Conversely, if the labor market suddenly deteriorates, with employment contracting and the unemployment rate rising materially above 4.0%, then expectations for wages and demand will sour. This would justify an earlier and potentially more rapid policy easing. While this should be seen only as a risk scenario, it cannot be ruled out completely. Business surveys such as the ISMs have, on average, been pointing to net job losses for the past six months.

Jumping ahead and considering our forecast end point for this cycle of 3.375%, two points are worthy of note. First, we do expect FOMC policy to be effective in bringing inflation back around target and so see a material easing over the period, a cumulative 200bps. But second, Westpac continues to see need for restrictive policy into the medium-term, with 3.375% materially above the FOMC’s longer run end point of 2.6%. We expect modestly restrictive policy will be needed into the medium-term because supply-side inflationary pressures evident across the economy, most notably in rents and house construction costs, are likely to persist. Further, with the continuing support to demand from highly expansionary fiscal policy, regardless of which party wins, investment is also likely to be sustained across the economy and with it demand for resources and financial capital.

The latter point is important for both Treasury yields and the US dollar. Over the course of the next two years, we forecast the US 10-year yield will retreat to around 4.0% as inflation declines. But that level is expected, on average, to prove the low point. We see the 10-year yield edging higher during 2026. The result is a swing in the cash/10-year spread from around -80bps to +60bps at end-2025 and rising. Underlying this view is also a belief that, irrespective of which party wins in November’s elections, the US fiscal position is unlikely to improve in coming years and will instead remain at risk of deteriorating further.

For the US dollar, whil the extraordinary support from actual and expected rate differentials has abated somewhat in 2024, with the ECB and Bank of England now expected to cut sooner than the FOMC and likely by a similar amount over two years, aid for the US dollar from this factor is expected to remain at or above-average over the period. Around the time of November’s elections, policy expectations should also be constructive for US growth. Consequently, we have flattened out our US dollar profile, seeing DXY only edge lower from the 105–107 range recently traded to 103.5 end-2024 and 99.0 end-2025. Some further weakening is likely in 2026, but it is more probable that the US dollar will remain above long-run average levels than break through.

Pound to Dollar Rate Rebounds After Fed Rate Hike Bets Put to Bed:

Pound to Dollar Exchange Rate Increases The exchange rate of Pound to Dollar increased to 1.2550 after Jerome Powell, the Chair of the Federal Reserve, stated that he expects inflation to decrease over the year and that another rate hike is “unlikely”. Before this week’s Federal Reserve Open Market Committee (FOMC) decision, investors were expecting the Fed’s next move to be a rate hike, with a 20% probability shown in the options markets. Powell’s statement erased these expectations, causing a decrease in U.S. bond markets and the Dollar.

Fed’s Stance on Interest Rates Despite the Dollar’s losses, it is expected to be contained as the Fed appears willing to keep interest rates at 20-year highs for an extended period. This is in response to a series of inflation prints that were above consensus, indicating that inflationary pressures were building again in early 2024. The market’s base assumption before the FOMC was that the Fed would likely cut interest rates for the first time in December, and this expectation remains relatively unchanged after the midweek events.

Goldman Sachs’ Forecast Goldman Sachs has kept its forecast unchanged and expects two rate cuts this year, in July and November. If this happens, there will be a significant repricing in U.S. interest rates, which can lead to more lasting weakness in the Dollar. However, this turn of events will require upcoming data to be on the soft side and confirm Powell’s expectation that the inflation increase in Q1 is not the start of a renewed spike in price pressures.

Dollar’s Trend of Appreciation Despite the setback, the Dollar continues to appreciate against most G10 currencies. Chester Notifor, a foreign exchange strategist at BCA Research, suggests that there could be more downside in cable if speculators build short positions, but the 1.22 level will likely be a near-term floor. If Friday’s U.S. job report is stronger than expected, it could result in another decrease in Pound-Dollar. However, a softer-than-expected job print could indicate that the U.S. disinflation process is still ongoing, and more than one rate cut in 2024 becomes a probability once more. This would lead to further USD weakness and allow Pound-Dollar to break its downtrend, thereby making the outlook more positive.

US Oil and Gas Production Rebounds After Winter Storm:

U.S. Oil and Gas Production Recovers After Winter Storm: In February, U.S. oil and gas production recovered significantly after being severely disrupted in January due to Winter Storm Heather. The storm caused wells to freeze and other outages, particularly affecting the Permian Basin in Texas and New Mexico, the country’s top producing area. However, as the storm passed and normal operations resumed, production bounced back. The U.S. Energy Information Administration (EIA) reported that nationwide crude and condensates output increased by 0.6 million barrels per day (b/d) in February, reversing a decline of 0.7 million b/d in January.

Signs of Stabilization in U.S. Oil Production: There are indications that U.S. oil production is stabilizing after a sharp drop in prices from mid-2022 to mid-2023. Production in the Lower 48 states was up by almost 0.7 million b/d in February compared to the same month a year earlier, but there has been little or no growth in the last six months. In response to lower prices, the number of oil drilling rigs has averaged 500-510 per month since September 2023, down from an average of 623 in December 2022.

U.S. Gas Production Rebounds: U.S. dry gas production also rebounded in February, increasing by 2.3 billion cubic feet per day (bcf/d) after declining by 3.1 bcf/d in January due to the storm. However, there has been essentially no growth in daily output since November, which could indicate that gas output is also stabilizing after a more severe drop in prices. The number of rigs drilling primarily for gas has decreased, averaging between 115 and 120 each month from September 2023 to February 2024.

Gas Inventories Remain High: Despite the decrease in drilling, gas inventories have remained well above normal due to an exceptionally warm winter in 2023/24, which more than offset the impact of ultra-low prices and record gas consumption by power generators. In late February, several of the largest gas producers announced cuts to drilling programs and/or output in an effort to reduce excess inventories and lift prices. The number of rigs drilling for gas declined even further to an average of just 108 in April, the lowest since the pandemic and its aftermath in 2020/21. If there is a heatwave this summer boosting air conditioning, the adjustment would be accelerated.

RBA Decision: Will A Rate Hike Be Back on The Table?:

Inflation Concerns: The Reserve Bank of Australia (RBA) is known for its policy changes, and the decision in May might be another example. They had recently dropped their tightening bias in March, but now they’re facing a challenging inflation scenario. The monthly Consumer Price Index (CPI) increased to 3.5% year-on-year in March, and two key underlying measures were higher than expected in the first quarter. Despite the labour market cooling down over the past year, wage growth has continued to speed up, reaching 4.2% year-on-year in the fourth quarter of 2023.

Upcoming Data: The first quarter figure for wage costs will be released on May 15, and the next CPI report will be out even later on May 29. These data could be crucial in determining whether the recent inflation setback is just a temporary issue or a sign that monetary policy isn’t restrictive enough.

New CPI Forecasts: Without the additional data, the RBA is likely to maintain a neutral stance in May, keeping the cash rate at 4.35%. However, the Bank will also release its quarterly Monetary Policy Statement with updated economic projections. In the previous report, the Bank didn’t expect inflation to fall within its 2-3% target range before the end of 2025. It’s unlikely that Governor Michelle Bullock would accept any further delay in achieving the inflation goal, so the new forecasts could provide a crucial hint about future policy.

Economic Growth: Looking at the broader economy, recent indicators suggest that the RBA should adopt a wait-and-see approach. Employment unexpectedly dropped in March, and the unemployment rate slightly increased. Retail sales also didn’t increase as forecasted, indicating that consumers are still cautious about spending. However, there’s been a significant improvement in the services PMI since December, and the housing market is booming again. More importantly, for Australian exporters, China’s economy appears to be steadily recovering.

Aussie’s Downward Trend: If the RBA adopts a hawkish stance and reinstates its tightening bias, the Aussie could recover above its moving averages and challenge the descending trendline around $0.6590. If the RBA ignores the recent signs of price stickiness, the Aussie could head back towards the April low of $0.6360 before revisiting the October low of $0.6268.

Risk of a Surprise Rate Hike: With sticky inflation also being a problem for the Fed in the US, there’s already been a sharp repricing of rate cut expectations for the major central banks. For the RBA, investors have gone a step further and priced in around a 40% probability of a 25-basis-point rate increase by year-end. However, considering Governor Bullock’s greater urgency in combating inflation compared to her predecessor, a surprise rate hike cannot be completely ruled out, especially as policymakers have the option of a smaller increase of 15 basis points at their disposal.

Happy Apple Day:

The U.S. Federal Reserve (Fed) has decided to maintain its interest rates, which are currently at their highest since 2007, due to ongoing inflation concerns. The Fed’s Chair, Jerome Powell, reassured that the next move is unlikely to be a rate hike. The decision led to mixed reactions in the market, with stocks initially rising before falling again.

The ADP report showed stronger than expected job additions in April, but job openings decreased and the ISM manufacturing PMI fell into the contraction zone. Meanwhile, U.S. oil inventories increased significantly, pushing the price of U.S. crude below $80 per barrel. The U.S. dollar also weakened, partly due to a sharp fall in the USDJPY.

In the tech sector, Amazon’s shares rose as its cloud business grew more than expected in Q1, thanks to AI. However, AMD’s shares fell due to a weak outlook for game chip demand, and Super Micro Computer’s shares also fell as earnings missed expectations. Cannabis stocks, which had risen following the U.S. decision to reclassify marijuana as a less dangerous drug, fell.

Apple is set to report its Q1 results, with expectations being low due to a major hit to Apple’s Chinese business in Q1. However, investors are hopeful about Apple’s plans to integrate AI into its devices and catch up with its AI delay. If investors are convinced that Apple has a robust AI plan, we could see a positive reaction to the quarterly results, despite them likely being weak. Apple’s shares are currently down by 15% since the December peak.

Overall, the Fed’s decision to maintain interest rates, ongoing inflation concerns, and various market reactions are key points in the current financial landscape. The next few months will be crucial in determining the direction of these trends.

A Strong U.S. Dollar Weighs on the World:

This year, the U.S. dollar has risen against every major currency in the world, a shift that could have significant impacts on the global economy. About two-thirds of the approximately 150 currencies tracked by Bloomberg have weakened against the dollar. This strength of the dollar is due to changes in expectations about when and how much the Federal Reserve may cut its benchmark interest rate, which is currently at a 20-year high.

High Fed rates, a response to persistent inflation, mean that American assets offer better returns than much of the world, attracting investors who need dollars to buy them. This has resulted in a significant inflow of money into the United States, affecting policymakers, politicians, and people worldwide.

The dollar index, a measure of the U.S. currency’s general strength against a basket of its major trading partners, is at levels last seen in the early 2000s. The yen is at a 34-year low against the U.S. dollar, and the euro and Canadian dollar are also weak. The Chinese yuan has shown signs of weakness, despite officials’ intent to stabilize it.

A strong dollar can have far-reaching effects. It intensifies inflation abroad, as countries need to exchange more of their own currencies for the same amount of dollar-denominated goods. Countries that have borrowed in dollars also face higher interest bills. However, a strong dollar can benefit some foreign businesses, particularly exporters that sell to the United States.

The effects of a strong dollar depend on why the dollar is stronger, which in turn depends on why U.S. interest rates might remain high. If U.S. rates remain high because inflation is persistent even as economic growth slows, the effects could be more negative.

The strong dollar’s effects have been particularly sharp in Asia. The finance ministers of Japan, South Korea, and the United States recently met in Washington and pledged to closely consult on foreign exchange market developments. They also expressed serious concerns about the recent sharp depreciation of the Japanese yen and the Korean won.

Japan’s central bank began raising interest rates only this year after struggling for decades with low growth, in contrast to the Fed in the United States. This means Japanese officials must strike a delicate balance — increase rates, but not too much to stifle growth. The result is a weakened currency, as rates have stayed near zero. If the yen continues to weaken, investors and consumers may lose confidence in the Japanese economy and shift more of their money abroad.

China, whose economy has been battered by a real estate crisis and sluggish spending at home, has recently allowed the yuan to weaken, showing the pressure exerted by the dollar in financial markets and on other countries’ policy decisions.

In Europe, policymakers at the European Central Bank have signaled that they could cut rates at their next meeting, in June. However, there is a concern that by lowering interest rates before the Fed, the E.C.B. would widen the difference in interest rates between the eurozone and the United States, further weakening the euro.

Other policymakers are facing similar complications, with central banks in South Korea and Thailand among those also considering lowering interest rates. By contrast, Indonesia’s central bank unexpectedly raised rates last week, partly to support the country’s depreciating currency, showing how the dollar’s strength is affecting the world in different ways. Some of the fastest-falling currencies this year, like those in Egypt, Lebanon, and Nigeria, reflect domestic challenges made even more daunting by the pressure exerted by a stronger dollar.

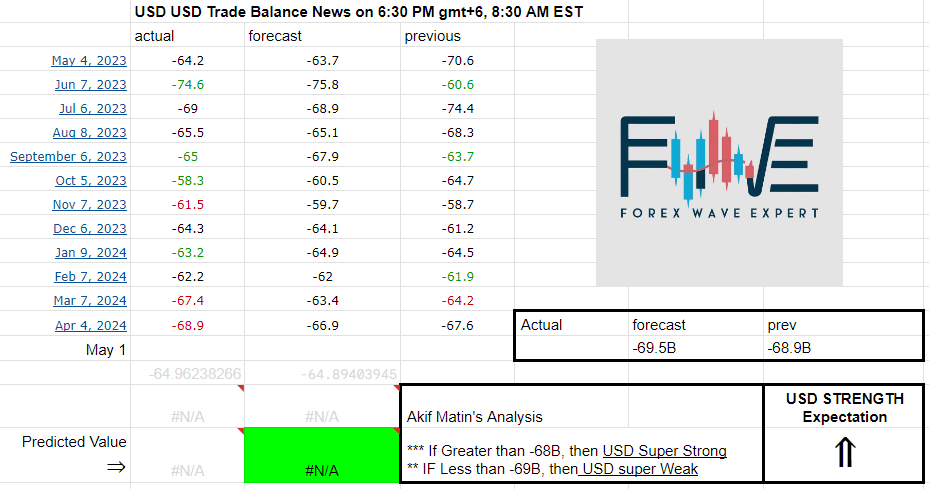

US Trade Balance news ahead !:

To our concern, there is a high chance that US Trade Balance data will be greater than previous value. If that happens, after the news release, USD will act much stronger and it may directly reflect on USD demand and commodity supply. (Bearish Gold).

Alternatively, if the value rises than the previous, then USD will act much weaker and it may directly reflect on USD supply and commodity demand (Bullish Gold).

➖➖➖➖➖➖➖➖➖

🔥News releases on This WEEK :

02/05 Thu 12:00am USD Federal Funds Rate & FOMC

02/05 Thu 12:30am USD FOMC Press Conference

02/05 Thu 2:15am CAD BOC Gov Macklem Speaks

02/05 Thu 12:30pm CHF CPI m/m

02/05 Thu 6:30pm CAD Trade Balance

02/05 Thu 6:30pm USD Unemployment Claims

02/05 Thu 6:45pm CAD BOC Gov Macklem Speaks

03/05 Fri All Day JPY & CNY Bank Holiday

03/05 Fri 6:30pm USD Average Hourly Earnings m/m & Non-Farm Employment Change

03/05 Fri 7:45pm USD Final Services PMI

03/05 Fri 8:00pm USD ISM Services PMI

N.B. Time mentioned here is on Gmt +6

➖➖➖➖➖➖➖➖➖

Sources :

– CNBC, Bloomberg, Reuters, Fastbull, Yahoo Finance, CNN, ForexFactory News, Myfxbook News etc

Prepared to you by “Akif Matin“

Join our FWE telegram, Facebook Page & Group

Add a Comment

You must be logged in to post a comment