Forex Fundamental News Facts for 3rd May, 2024

[Quick Facts]

- Bond traders bet on the Fed’s first rate cut in November.

2. The Eurozone saw strong wage growth in Q1.

3. Oil prices are volatile on increased stocks and a potential truce deal.

4. BOC Macklem says the central bank may start cutting rates soon.

5. U.S. initial jobless claims held steady last week.

6. Production cuts may be extended if oil demand fails to pick up.

7. Happy Jobs Friday.

8. RBA to Hold Rates in May, Only Cut Once by End-Year.

[News Details]

Federal Reserve’s Rate Cut Prediction:

The U.S. short-end Treasuries experienced significant gains following the Federal Reserve’s decision on interest rates in May. The yield on the 2-year Treasury note, which is highly sensitive to interest rate changes, dropped by 17 basis points to 4.87% from its annual high of 5.04% on Tuesday. Jerome Powell, the Fed Chairman, indicated that a rate hike is unlikely, and a rate cut is anticipated once there is concrete evidence of decreasing inflation. Bond traders are predicting the Fed’s first rate cut to occur in November.

Despite the significant increase in Western government debt since the pandemic, there has been no major investor backlash. Although bond prices have been affected by global inflation and interest rate increases, they have been re-priced in an orderly manner.

The International Monetary Fund (IMF) has warned that governments need to take action on excessive spending and budgets, especially in the US, which has the largest government bond market. The IMF is particularly concerned about the US’s fiscal stance, which is not sustainable in the long term.

The Congressional Budget Office predicts that US government debt will rise to a record 107% of national output by the end of the decade and over 150% in 20 years. Despite this, the bond market has remained relatively calm.

The Federal Reserve and other global central banks gradually withdraw from bond markets, investors will start to price the debt more cautiously. The shift in the buyer base of US Treasuries from price-insensitive investors to price-sensitive ones could lead to a larger market adjustment.

If investors struggle to absorb the scale of new debt without a change in fiscal policy, there may be trouble ahead. The Treasury universe has grown too large and investors need to consider the potential for increased bouts of illiquidity, poor functioning, and heightened volatility when thinking about valuations. Whether this will lead to a change in Washington’s thinking after the election remains to be seen.

The potential financial risks persist due to the increasing government debt and the withdrawal of central banks from bond markets. It highlights the need for governments to address excessive spending and budget deficits. The article also suggests that the shift in the buyer base of US Treasuries could lead to a larger market adjustment. It concludes with a warning that if the scale of new debt is not managed properly, it could lead to financial instability.

Wage Growth in the Eurozone:

The Eurozone witnessed robust wage growth in the first quarter. According to a report, wages are projected to have increased by 4.5% year-on-year in the three months leading up to March. This growth is primarily due to the accelerated wage growth in Germany, where public-sector workers received substantial one-time paychecks, leading to a 5.6% increase.

Volatility in Oil Prices:

Oil prices have been fluctuating due to an increase in U.S. crude stockpiles and the potential for a ceasefire in the Middle East. WTI crude futures dropped below $79, reaching their lowest in over a month, as Hamas expressed positive sentiments towards current ceasefire proposals that could alleviate geopolitical tensions.

Potential Rate Cuts by the Bank of Canada:

Tiff Macklem, the Governor of the Bank of Canada (BOC), suggested at a Treasury Board meeting that a rate cut might be imminent as inflation shows signs of decreasing. However, the central bank needs more assurance that this trend will persist. With inflation declining and remaining low, the BOC may soon begin reducing rates.

Stability in U.S. Initial Jobless Claims:

U.S. initial jobless claims remained stable at a low of 208,000 last week. These claims have been fluctuating between 194,000 and 225,000 this year, indicating a relatively tight labor market that could continue to bolster the economy in the second quarter.

Potential Extension of Production Cuts by OPEC+:

OPEC+ has not yet started discussions on extending its voluntary production cut of 2.2 million barrels per day (bpd) past June. If demand does not increase, some OPEC+ members may extend the cuts, which are due to expire at the end of June. One source suggested that the cuts could be extended until the end of the year, while another stated that OPEC+ would need to witness an unexpected surge in demand before making any alterations.

Happy Jobs Friday:

Market Sentiment and Federal Reserve’s Stance: The market sentiment remains positive despite the Federal Reserve’s decision not to reduce interest rates. Stocks have recovered, with the S&P500 maintaining a level above the significant 5000 mark and the Nasdaq 100 increasing by 1.30%. Despite an unexpected rise in unit labour costs and a decrease in productivity, the US 2-year yield fell below 4.90%. April saw a decline in factory orders, but instead of being a positive sign for those hoping for a rate cut from the Fed, input prices experienced their highest increase since the inflation peak in 2022. The conclusion drawn is that investors are keen to see stocks rally, even in May, challenging the common adage ‘sell in May and go away’.

Apple’s Performance: Apple performed well following the announcement of its quarterly results, which were eagerly anticipated. Concerns had been raised due to a 10% decrease in iPhone shipments to China. Sales fell by 4%, slightly less than analysts had predicted, but a 14% increase driven by App Store sales, better-than-expected earnings, a higher dividend, and a $110bn stock buyback resulted in a 6% increase in the stock price in after-hours trading. No new information was provided about Apple’s AI efforts, with more details expected on June 10th. The post-earnings rally could potentially help Apple break above its year-to-date descending channel top, leading to further gains.

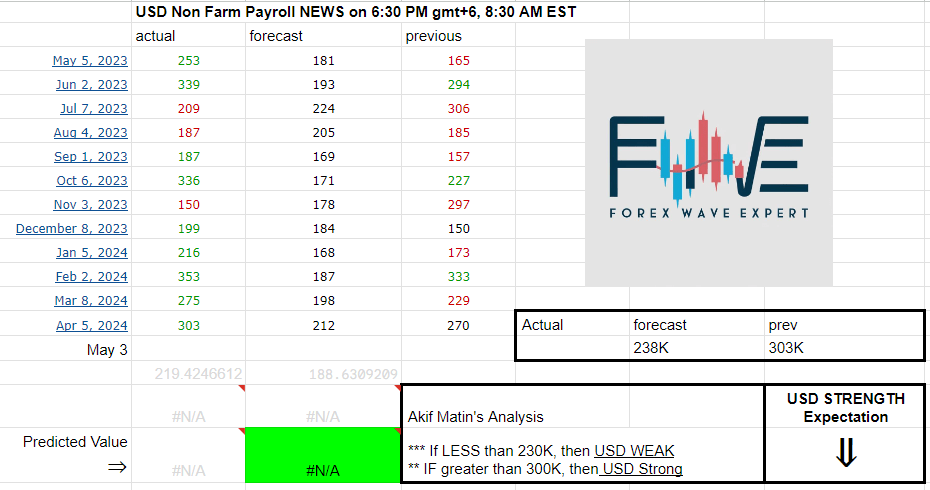

US Jobs Data: US futures are rising following Apple’s better-than-expected results and in anticipation of important US jobs data. This data is particularly significant due to increased uncertainty about the Fed’s future policy. The US economy is projected to have added approximately 240K new nonfarm jobs in April, with average pay expected to have grown slightly slower on a yearly basis, and unemployment predicted to remain steady at 3.8%. Data that exceeds expectations, particularly regarding wages, could strengthen expectations of a hawkish Fed stance and put pressure on equity and bond prices. Conversely, data that falls short of expectations could provide some relief to those hoping for a rate cut from the Fed.

To our concern, there is a high chance that US Non farm payroll data will be Less than previous value. If that happens, after the news release, USD will act much weaker and it may directly reflect on USD supply and commodity demand. (Bullish Gold).

Alternatively, if the value rises than the previous, then USD will act much stronger and it may directly reflect on USD demand and commodity supply (Bearish Gold).

FTSE 100 Performance: In other news, the British FTSE 100 continues to perform well, with a nearly 2% increase in Shell following a profit beat of over $1bn certainly helping to maintain a positive mood in the British blue-chip index. They also announced a $3.5bn stock buyback. The FTSE 100 has risen by 10% since the dip in January. The UK economy isn’t particularly inspiring, with the OECD cutting its outlook for the UK economy and predicting growth of just 0.4% this year. However, as Britain’s largest companies earn the majority of their revenues from abroad, all the British blue-chips need is a strong global economy. The OECD predicts that the global economy will grow more than 3% this year, 0.2 percentage points better than their February forecast.

Currency Market: In the currency market, the US dollar is facing selling pressure this morning, with the EURUSD rising above a minor Fibonacci retracement level, but there is a risk of gains being reversed after today’s US jobs report. The USDJPY continues to fall due to intervention and speculation about intervention from the Bank of Japan (BoJ) this week, while Cable is testing the 200-DMA to the upside. The US jobs report is the common factor determining what happens next. A strong report could easily reverse gains in major peers, support expectations of a hawkish Fed stance, and lead to a dollar appreciation before the weekly closing bell.

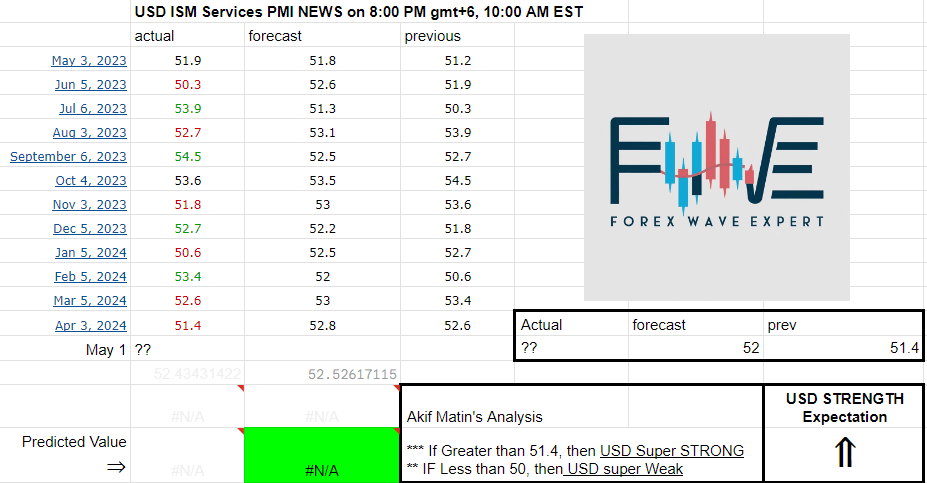

USD ISM Services PMI news will also be released today.

To our concern, there is a high chance that US ISM Services PMI data will be greater than previous value. If that happens, after the news release, USD will act much stronger and it may directly reflect on USD demand and commodity supply. (Bearish Gold).

Alternatively, if the value rises than the previous, then USD will act much weaker and it may directly reflect on USD supply and commodity demand (Bullish Gold).

RBA to Hold Rates in May, Only Cut Once by End-Year:

Australia’s Central Bank’s Policy Rate: Australia’s central bank is expected to maintain its key policy rate at 4.35% for the fourth consecutive meeting on Tuesday and at least until the end of September, according to a Reuters poll of economists. They predict only one interest rate cut this year, a change from the two 25 basis point cuts expected in an April survey. This shift in expectations follows the news that inflation fell less than anticipated last quarter and the labor market remains robust.

Inflation and Interest Rates: Despite inflation slowing down to 3.6% from 4.1%, it is not expected to fall below the Reserve Bank of Australia’s 2-3% target range until 2025. This suggests that the central bank will need to maintain higher rates for a longer period. Craig Vardy, head of fixed income at BlackRock Australasia, stated that dealing with services inflation is still a significant issue, and the most straightforward solution for a central banker is to keep cash rates higher for longer.

Rate Cut Expectations and Predictions: The Reserve Bank of Australia (RBA) has been managing rate cut expectations in recent months, maintaining a stance of “not ruling anything in or out”. This has led financial markets to anticipate an extended pause, a more hawkish stance than economists in the poll. All but one of the 37 economists in the April 30-May 2 poll expected the RBA to hold its official cash rate at 4.35% at the end of its two-day policy meeting on May 7. One economist predicted a 25 basis point increase.

Forecasts for the Australian and New Zealand Dollars: Even with the U.S. Federal Reserve expected to maintain higher rates for longer, the Australian dollar and the New Zealand dollar are forecasted to appreciate by over 2% against the US dollar in the next six months, according to another Reuters poll. The Australian and New Zealand dollars are expected to trade around $0.67 and $0.61 by the end of October, respectively. Analysts predict that both currencies will recover all their year-to-date losses, 4% and 6% respectively, 12 months from now, a significant change from last month’s poll.

➖➖➖➖➖➖➖➖➖

🔥News releases on This WEEK :

03/05 Fri All Day JPY & CNY Bank Holiday

03/05 Fri 6:30pm USD Average Hourly Earnings m/m & Non-Farm Employment Change

03/05 Fri 7:45pm USD Final Services PMI

03/05 Fri 8:00pm USD ISM Services PMI

N.B. Time mentioned here is on Gmt +6

➖➖➖➖➖➖➖➖➖

Sources :

– CNBC, Bloomberg, Reuters, Fastbull, Yahoo Finance, CNN, ForexFactory News, Myfxbook News etc

Prepared to you by “Akif Matin“

Join our FWE telegram, Facebook Page & Group

Add a Comment

You must be logged in to post a comment