Forex Market Update Today: Indices Surge on Dovish Federal Reserve Meeting Minutes, Australian Market on a Winning Streak

The global stock markets found support from the dovish minutes released from the latest Federal Reserve meeting, providing further momentum for a rally. At the same time, the Australian stock market celebrated its 10th consecutive day of gains, signaling a strong upward trend. #FOMC Meeting

US Stock Market Update

On Wednesday, the US equity markets closed in positive territory. The Dow Jones Industrial Average (DJIA) rose by 0.14%, the S&P 500 Index increased by 0.42%, and the NASDAQ, which is heavily weighted with technology stocks, closed up by 0.57%. This consistent upward movement can be attributed to several key factors that have been driving investor sentiment.

One of the most significant contributors to this rally was the revision in US payroll data, which revealed that the job market might not be as robust as previously thought. This revision suggested that the Federal Reserve may consider cutting interest rates sooner rather than later. The minutes from the recent Federal Reserve meeting showed that some officials were in favor of a rate cut as early as July, while a majority believed that a reduction in September would be more appropriate. Investors are now eagerly awaiting Federal Reserve Chairman Jerome Powell’s upcoming speech on Friday at the Fed’s annual symposium in Jackson Hole, Wyoming, where he is expected to provide further insights into the future direction of interest rates.

Revision of US Job Data

The US Labor Department’s Bureau of Labor Statistics recently announced a significant downward revision of job data, cutting 818,000 jobs from its employment figures for the year ending in March. This revision was much larger than the expected 600,000 and represented the largest negative adjustment since 2009. The weaker-than-expected job data could push the Federal Reserve towards a more accommodative monetary policy, including the possibility of interest rate cuts to support economic growth. The implications of this revision are far-reaching, as it reshapes the narrative around the strength of the US labor market and the broader economy.

European Markets in Green

Across the Atlantic, most European stock markets also closed in positive territory on Wednesday. Germany’s DAX gained 0.50%, France’s CAC 40 rose by 0.52%, Spain’s IBEX 35 advanced by 0.24%, and the UK’s FTSE 100 increased by 0.12%. The positive sentiment in European markets was largely driven by the dovish signals from the Federal Reserve meeting, as well as encouraging economic data from the region.

In Germany, strong earnings reports from major companies helped lift the DAX, while in France, optimism about consumer spending and industrial production bolstered the CAC 40. Spain’s IBEX 35 was supported by gains in the banking sector, as investors bet on continued economic recovery in the Eurozone. The UK’s FTSE 100, although gaining more modestly, was buoyed by strength in the energy and mining sectors, which benefited from rising commodity prices.

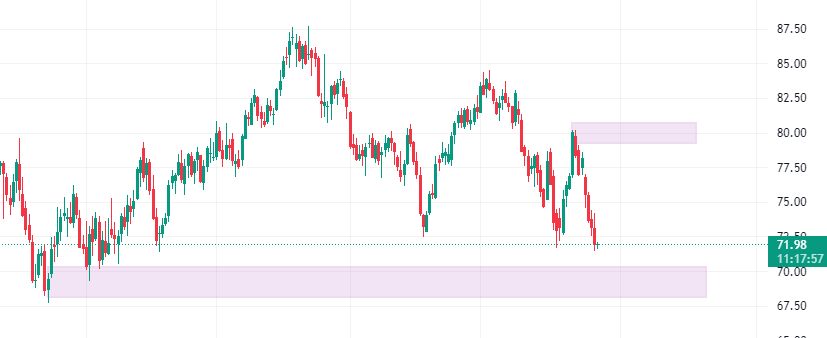

Oil Prices Drop

WTI Crude oil prices experienced a sharp decline of 1.7%, closing at $71.9 per barrel, the lowest level since January. This drop came on the heels of the release of the Federal Reserve meeting minutes and the downward revision of US job growth estimates. The market reacted to these developments with concerns about future demand for oil, particularly in light of slowing economic growth in China.

In addition to the impact of the Federal Reserve meeting minutes, the decline in oil prices was also influenced by the latest US crude oil inventory report. For the week ending August 16, US crude oil inventories fell by 4.6 million barrels, more than analysts had expected. While this drawdown would typically support higher oil prices, the ongoing concerns about weak economic growth in China have outweighed the positive effects of lower inventories, leading to a decline in prices.

Mixed Performance in Asian Markets

Asian stock markets delivered mixed results on Wednesday, reflecting the varied economic conditions across the region. In Japan, the Nikkei 225 retreated by 0.29%, driven by continued weakness in the manufacturing sector and concerns about the impact of slower global growth on Japanese exports.

China’s FTSE China A50 index also fell, declining by 0.17%, as investors remained cautious about the country’s economic outlook. The Chinese government has been grappling with a range of challenges, including a property market slump, weak consumer demand, and trade tensions with the United States. These factors have weighed on investor sentiment, leading to a pullback in Chinese stocks.

Hong Kong’s Hang Seng Index experienced a more pronounced decline, losing 0.69%, as ongoing political uncertainty and economic concerns dampened investor confidence. The market has been under pressure from a combination of factors, including rising interest rates, weak economic data, and geopolitical tensions.

Bucking the trend was Australia’s ASX 200 index, which rose by 0.21%, marking its 10th consecutive day of gains. The Australian market has been supported by stronger-than-expected business activity data, which has provided a boost to investor confidence. The Australian composite PMI (Purchasing Managers’ Index) increased to 51.4 in August, up from 49.9 in July, marking the fastest pace of growth in three months. The rebound was primarily driven by better performance in the services sector, which offset continued weakness in manufacturing.

Inflation in Malaysia

In Malaysia, the headline inflation rate remained stable at 2.0% year-on-year in July 2024, slightly below the median forecast of 2.1%. This marks the highest level of inflation since August 2023, driven by rising food prices. The country’s core consumer prices also increased by 1.9% year-on-year, a rate that has remained unchanged for four consecutive months.

The steady inflation rate in Malaysia suggests that the country’s economy is facing ongoing price pressures, particularly in the food sector. However, the central bank is likely to maintain its current monetary policy stance, as inflation remains within manageable levels. The challenge for policymakers will be to balance the need to support economic growth with the goal of keeping inflation under control.

Japan’s Manufacturing Woes

Japan’s manufacturing sector continues to struggle, as reflected in the final Au Jibun Bank Japan Manufacturing PMI for August, which came in at 49.5. This reading was only slightly higher than July’s four-month low of 49.1 and fell short of market expectations of 49.8. The sector has now contracted for six consecutive months, largely due to a decline in new orders.

The challenges facing Japan’s manufacturing sector are multifaceted. The country has been grappling with a strong yen, which makes Japanese exports less competitive on the global market. Additionally, slowing demand from key trading partners, particularly China and the United States, has weighed on the sector. The outlook for Japan’s manufacturing industry remains uncertain, as global economic conditions continue to be volatile.

Bank of Korea Leaves Rates on Hold

As widely expected, the Bank of Korea decided to keep its benchmark interest rate at 3.5% for the 13th consecutive meeting. This decision reflects the central bank’s cautious approach in the face of mixed economic signals. On the one hand, inflation in South Korea appears to be gradually declining, with short-term inflation expectations falling toward the upper limit of 2%. On the other hand, household debt continues to rise, reaching new record levels.

The Bank of Korea’s decision to leave rates unchanged is aimed at striking a balance between supporting economic growth and preventing further increases in household debt. The central bank has indicated that it will continue to monitor economic conditions closely and will adjust its policy stance as needed to ensure financial stability.

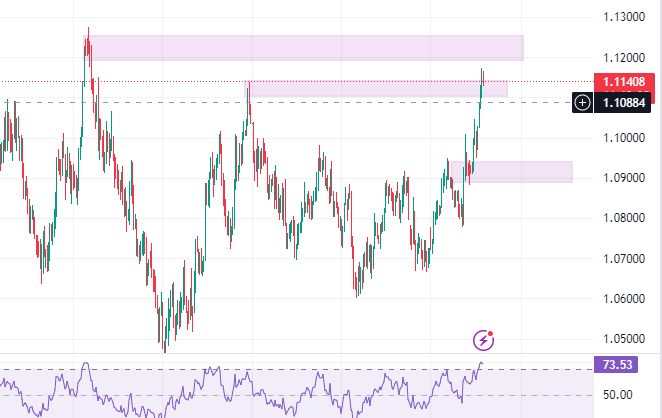

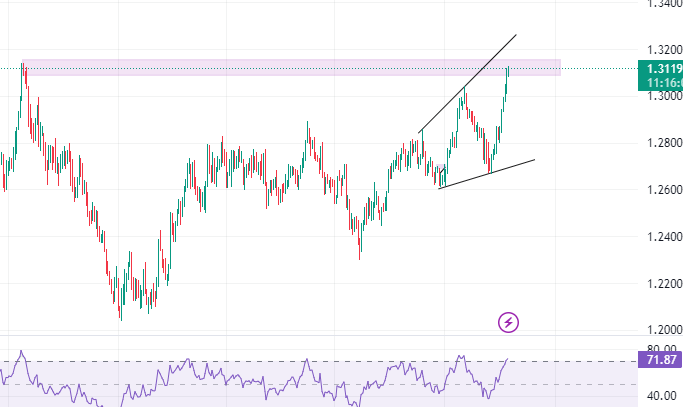

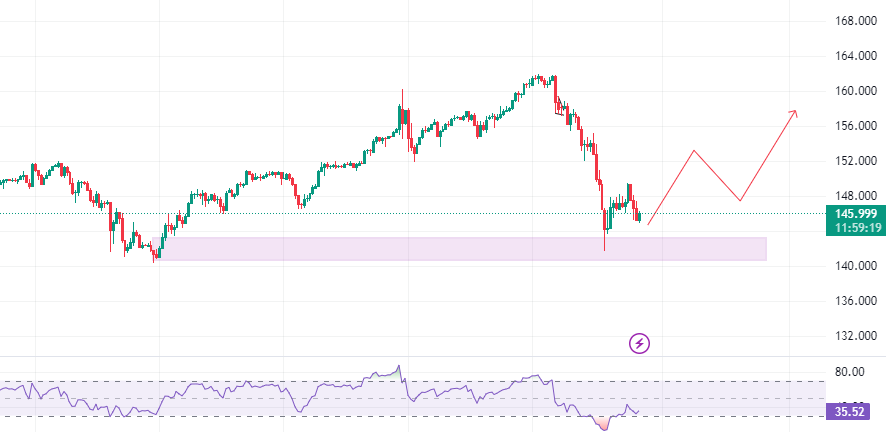

Forex Market Update Today : Currency Market Insights

- EUR/USD: The euro strengthened against the US dollar, reaching $1.117—the highest level since July 2023. This move was driven by expectations of an interest rate cut by the Federal Reserve, which has put pressure on the dollar. Traders are now focusing on upcoming economic data from Europe to see if the European Central Bank will follow suit and adjust its monetary policy.

- GBP/USD: The British pound also experienced an upward trend, reaching $1.30. The UK economy showed signs of growth during the second quarter, helping it recover from last year’s mild recession. However, the country continues to face significant fiscal challenges, as public borrowing in July reached 3.101 billion pounds. This indicates that the UK government will need to carefully manage its finances in the coming months.

- USD/JPY: The Japanese yen traded around 145 yen per dollar, near a two-week high. The yen was supported by the dovish Federal Reserve meeting minutes and expectations of continued inflation in Japan. The Bank of Japan’s ongoing commitment to its ultra-loose monetary policy has also contributed to the yen’s strength.

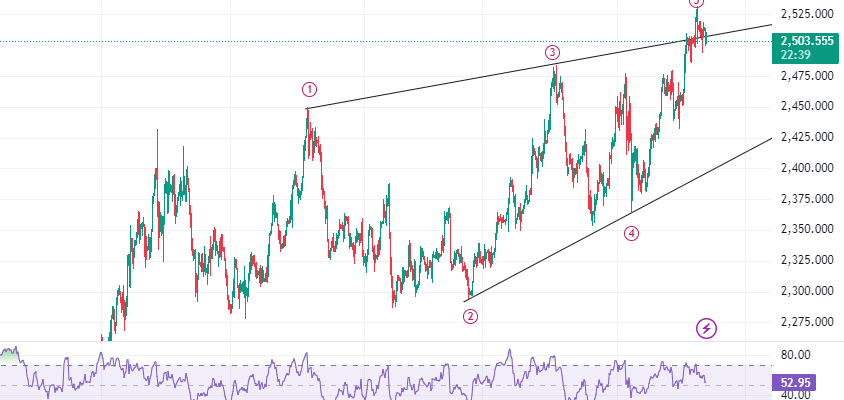

- Gold: Gold prices saw gains of over $2500.00 an ounce following the release of the Federal Reserve meeting minutes. With most FOMC members favoring an interest rate cut in September, attention has now shifted to Fed Chair Powell’s speech at Jackson Hole for further clues on future interest rate moves. Gold is often seen as a safe-haven asset during times of economic uncertainty, and the possibility of lower interest rates has boosted its appeal.

Conclusion

Global markets remain active and responsive to a mix of economic signals from various countries. The dovish tone of the latest Federal Reserve meeting minutes has provided support for stock markets, while economic data from different regions continues to shape investor expectations. As central banks around the world navigate these uncertain times, their decisions in the coming days and weeks will be closely watched by market participants, with the potential to significantly influence market movements.

Written by Rana Das, CEO and Founder of Forex Wave Expert

#MarketUpdate #FederalReserveMeeting #StockMarket #ForexTrading #GoldPrices #GlobalEconomy #RanaDas #ForexWaveExpert #JacksonHoleSymposium #InterestRates #Forex Market Update Today

Add a Comment

You must be logged in to post a comment