Order Block Forex Trading Strategy:

The banks use order blocks when they want to place a big position without upsetting the price. They do that by placing a bunch of small positions around similar prices; that way they achieve the same effect of placing a single large position without actually placing one into the market.

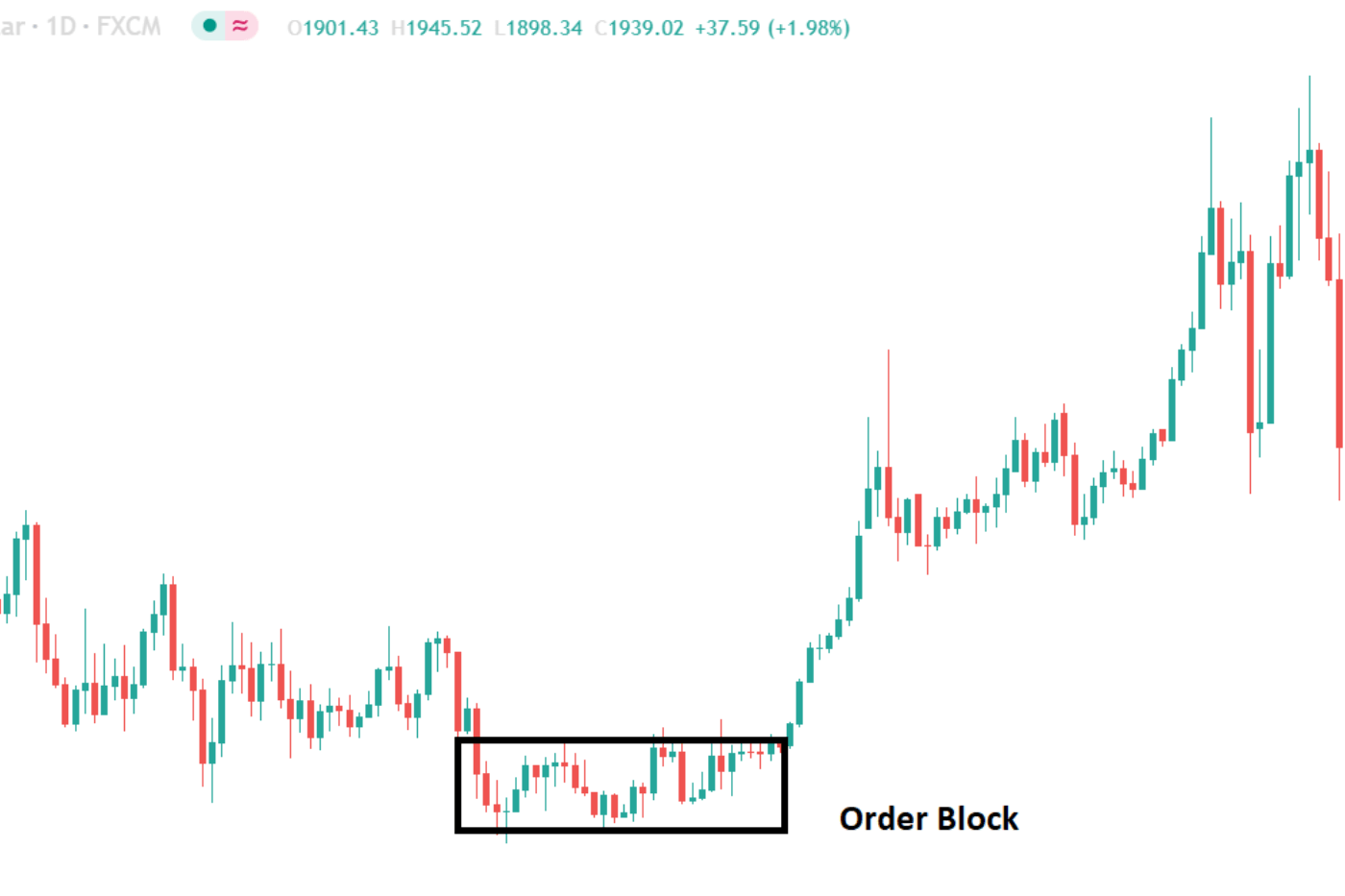

The banks placing a bunch of similar positions around similar prices causes a tight-range consolidation to form; each position creates a high (or low if they’re shorting) of the consolidation.

The zones themselves are structurally identical to normal supply and demand zones. However, they ONLY form when price moves away from a tight range consolidation that acts as a base. That’s because using a block order to enter a big position means placing smaller positions at similar prices, creating a consolidation with a small range.

order blocks are simply supply and demand zones, just a different type.

The key thing to remember is to look for a zone that forms from a consolidation created by a tight range, i.e. price rising and falling between two close prices. These consolidations ONLY form from the banks placing a block order, so an order block must exist at the source and create a supply or demand zone.

Order block is a market behavior that indicates order collection from financial institutions and banks. Prominent financial institutes and central banks drive the forex market. … When the market builds the order block, it moves like a range where most of the investing decisions happen. Therefore, traders must know what they are doing in the market

How Order Blocks Are Different From Normal Supply And Demand Zones

Now that we know order blocks are supply and demand zones – just a different type – the question is, how do they differ from the normal zones we see form all the time?

Really, there are two key differences…

First, order blocks have a much higher probability of resulting in a reversal than normal supply and demand zones.

And that’s regardless of where or when they form i.e. if they appear after a long rise or decline – which increases the probability of normal zones resulting in a reversal.

The reason why is that the zones are created from the banks buying or selling using a block order, which they only use when they have an especially large position to place. If they’re placing a big position, the banks obviously don’t want the price to break beyond the point they bought or sold – the S or D zone.

Therefore, the zone has a high probability of causing a reversal because the banks wouldn’t place a big position unless they were very confident the price was heading in the direction they want.

In general, order blocks look identical to normal supply and demand zones – they form from a sharp rise or decline away from a base like all zones do. However, the base is ALWAYS a tight-range consolidation. The other difference is how the order block zones look.

Add a Comment

You must be logged in to post a comment