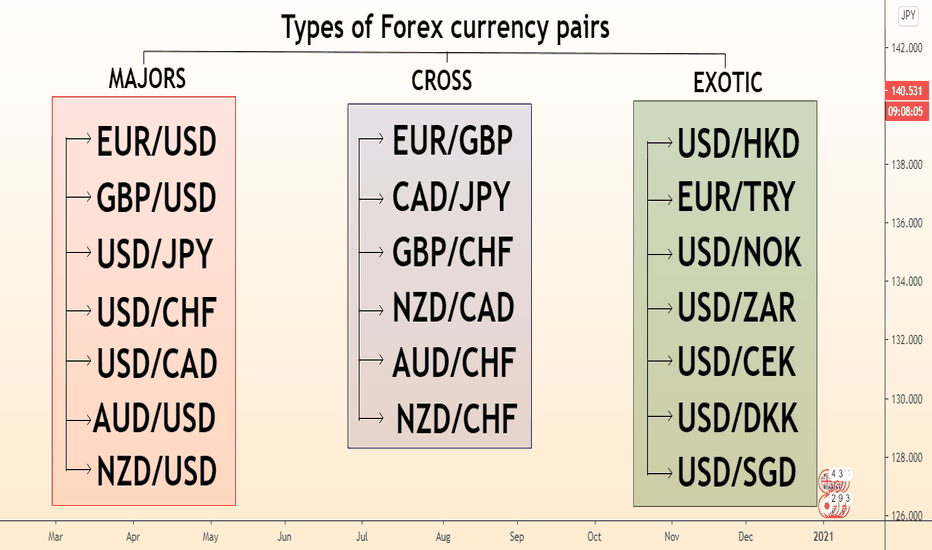

Discover the world of forex trading with our comprehensive guide on the 3 Types of Currency Pairs: Major, Cross, and Exotic. Explore the dynamics of these pairs, from the stability of major pairs to the unique opportunities offered by exotic pairs. Gain valuable insights into the forex market to enhance your trading strategy.

Currency trading, often referred to as forex trading, is a complex and fascinating financial market. It involves the buying and selling of different currencies in pairs, with the goal of making a profit based on the exchange rate fluctuations between these currencies. Understanding the various types of currency pairs is crucial for anyone looking to venture into the world of forex trading. In this article, we will explore the three main types of currency pairs: major pairs, cross pairs, and exotic pairs.

Major Pairs: The Core of Forex Trading

Major currency pairs are the foundation of the forex market. They consist of the most traded currencies globally and include the US Dollar (USD) as one of the currencies in the pair. Major pairs are highly liquid and offer tight spreads, making them popular choices for both beginners and experienced traders.

1. EUR/USD (Euro/US Dollar)

The EUR/USD is the most traded currency pair in the world, representing the Eurozone and the United States. It is known for its high liquidity and relatively stable price movements, making it an excellent choice for traders looking for consistency.

2. USD/JPY (US Dollar/Japanese Yen)

The USD/JPY pair is another major pair that plays a crucial role in the forex market. It represents the US Dollar and the Japanese Yen, two of the world’s largest economies. Traders often turn to this pair for its liquidity and the potential for profit due to Japan’s strong export-driven economy.

3. GBP/USD (British Pound/US Dollar)

The GBP/USD pair represents the British Pound and the US Dollar. It is particularly sensitive to economic and political developments in the United Kingdom and the United States. Traders closely monitor this pair for Brexit-related news and US economic indicators.

Cross Pairs: Expanding Your Trading Horizons

Cross-currency pairs, also known as cross pairs or minor pairs, do not include the US Dollar. Instead, they involve two other major currencies from different countries. Trading cross pairs can offer diversification and opportunities for traders who want exposure to currencies beyond the USD.

1. EUR/GBP (Euro/British Pound)

The EUR/GBP pair is an example of a cross-currency pair. It involves the Euro and the British Pound. Traders who have strong opinions about the economic conditions in the Eurozone and the United Kingdom may find this pair appealing.

2. AUD/JPY (Australian Dollar/Japanese Yen)

The AUD/JPY pair is another cross pair that combines the Australian Dollar and the Japanese Yen. This pair is often influenced by commodity prices and market sentiment.

Exotic Pairs: The Road Less Traveled

Exotic currency pairs are less commonly traded than major and cross-pairs. They involve one major currency and one currency from a smaller or emerging market. Exotic pairs are characterized by higher spreads and lower liquidity, which can lead to more significant price fluctuations.

1. USD/TRY (US Dollar/Turkish Lira)

The USD/TRY pair is an example of an exotic pair. It combines the US Dollar with the Turkish Lira. Traders interested in emerging markets may explore this pair, but they should be aware of the higher volatility associated with exotic currencies.

2. EUR/TRY (Euro/Turkish Lira)

The EUR/TRY pair involves the Euro and the Turkish Lira. It offers an alternative way to trade the Turkish economy and its interactions with the Eurozone.

Understanding the different types of currency pairs is essential for success in the forex market. Major pairs provide stability and liquidity, cross pairs offer diversification, and exotic pairs present opportunities for traders seeking higher risk and potentially higher rewards. When trading any type of currency pair, it’s crucial to conduct thorough research, manage risk, and stay informed about global economic developments that can impact exchange rates. Whether you’re a beginner or an experienced trader, choosing the right currency pair for your trading strategy is a critical decision that can significantly affect your trading success.

Add a Comment

You must be logged in to post a comment