Gold Technical Analysis: Elliott Wave Insights and Market Trends from CEO Rana Das

Introduction

As gold prices soar to new heights, understanding the underlying technical dynamics becomes crucial for traders and investors. In this blog, we will explore the latest gold price trends, provide an in-depth gold market analysis, and incorporate Elliott Wave insights from CEO Rana Das. Whether you are interested in gold investment, tracking the gold price today, or seeking to enhance your gold trading strategies, this analysis offers a comprehensive view of the precious metal’s current trajectory.

Gold Price Trends and Market Dynamics

Gold has recently made headlines by breaking all-time highs and hitting record prices. This impressive performance reflects strong bullish sentiment in the market. The gold price has experienced significant fluctuations, influenced by various factors including central bank gold buying and global economic conditions.

Historical Performance and Current Record Highs

The gold price history shows that such record-breaking movements are often driven by a combination of geopolitical tensions, inflation fears, and central bank policies. As investors seek refuge in gold, its value continues to climb, presenting both opportunities and challenges in the market.

Technical Analysis of Gold

In the context of gold market trends, it is essential to delve into technical analysis to forecast future movements accurately. Recent gold price news highlights the influence of stable core PCE prices and a resilient US economy, which have tempered expectations for a substantial Federal Reserve rate cut. Despite this, ongoing central bank purchases and market expectations of future rate cuts continue to support the gold price increase.

Impact of Central Bank Actions on Gold Prices

Central bank gold buying plays a significant role in supporting gold prices. As central banks around the world add to their gold reserves, the demand for gold rises, contributing to its value and influencing market trends.

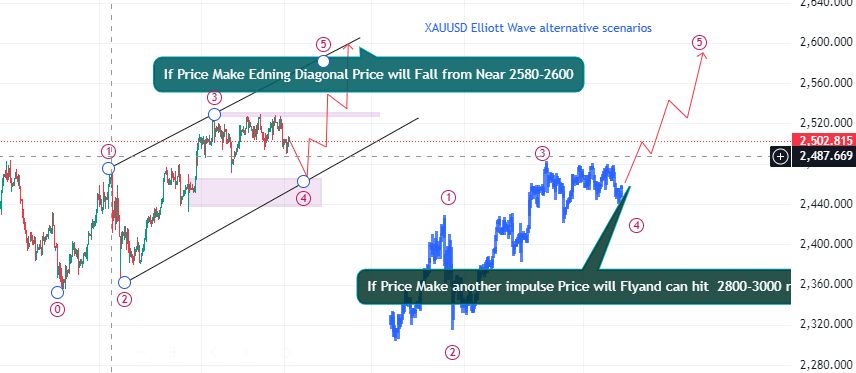

Elliott Wave Analysis from CEO Rana Das

CEO Rana Das offers a nuanced perspective on the gold price forecast through Elliott Wave analysis. According to Rana Das, gold is currently navigating through Wave 5 of the Elliott Wave cycle, a critical phase marked by complex sub-wave corrections. Here’s a detailed breakdown of the Elliott Wave insights:

Wave 5 Sub-Wave Correction

Gold is in the final stages of Wave 5, with a focus on its sub-wave correction. If gold completes a running flat pattern within the 2460-2440 range, it could develop into an ending diagonal structure. This pattern may push the gold price towards 2580-2600.

Potential for Further Gains

Alternatively, if a regular flat correction unfolds, the gold price could extend its rise significantly, reaching levels between 2800-3000. This scenario would represent a dramatic bullish phase, reflecting a powerful upward movement akin to a rocket launch.

Traders should be vigilant in identifying these Elliott Wave patterns to effectively navigate potential price movements. Understanding these technical formations can help in making informed decisions and optimizing gold trading strategies.

Investment Opportunities and Strategies

Given the current bullish outlook and the potential for significant price movements, now is an opportune time to consider gold investment. The rise in gold price today and positive gold price prediction indicate favorable conditions for investing in gold stocks and gold forex trades.

Using Forex Live Charts for Trading

Utilizing tools such as forex live charts and monitoring XAU/USD live updates will provide valuable insights for traders. Staying informed with the latest gold price updates and market analysis will enhance your trading strategies and investment decisions.

Conclusion

As gold continues its impressive ascent, driven by strong market dynamics and Elliott Wave patterns, staying updated with the latest gold market trends and technical analysis is essential. By incorporating insights from CEO Rana Das and understanding the nuances of Elliott Wave theory, investors and traders can better navigate the complex landscape of gold trading.

This detailed analysis not only provides valuable insights into the current gold market trends but also offers practical advice for navigating the volatile world of gold investment and trading.

Questions to Consider:

- How does the Elliott Wave analysis from CEO Rana Das impact your gold trading strategy?

- What are the implications of the current gold price history for future price movements?

- How does central bank gold buying influence the gold price forecast?

- What strategies can you implement based on the latest gold price news and technical analysis?

- How can forex live charts assist in tracking the XAU/USD live price?

Add a Comment

You must be logged in to post a comment