The Real Story of ICT Concept Failure Unveiling Exposed

A Cautionary Tale for Forex Traders: The ICT Concept Exposed

ICT Concept a Failure? The Inner Circle Trader known as the ICT concept which is equivalent to Michael J Huddleston in reality trading has never been well-liked by every trader. Other trading concepts that are associated with him include Smart Money Concepts (SMC) and liquidity trading of the stock has created a cult like following. He has a large following of forex traders who regard him as their guru, often referring to him as part of a ‘cult’. However, events in the recent period and emerging scandals have put his approach into a rather murky shade thereby challenging the effectiveness and viability of the described strategies.

Controversies and Criticisms

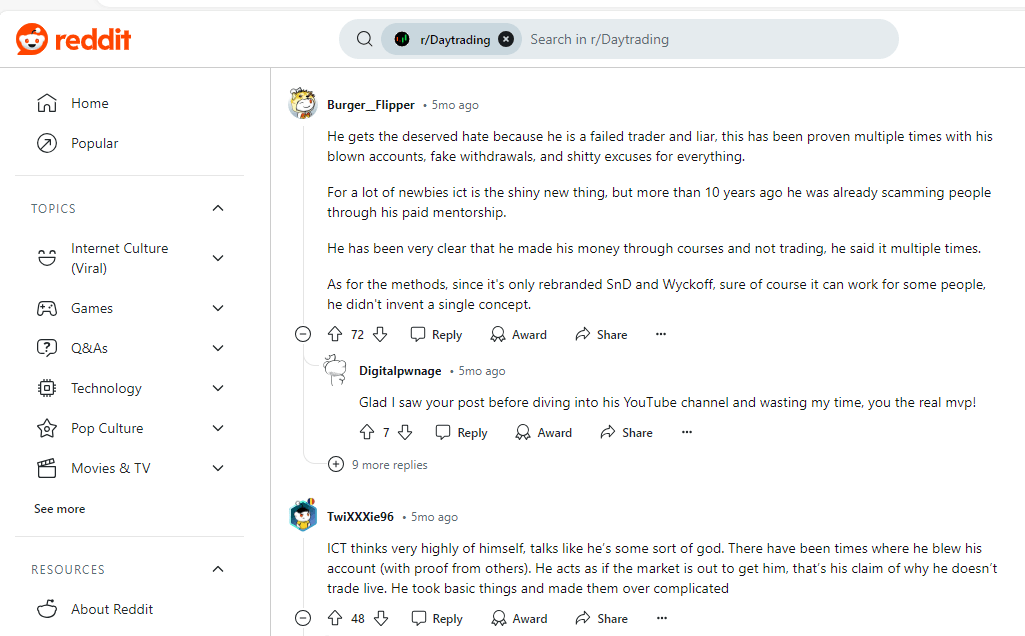

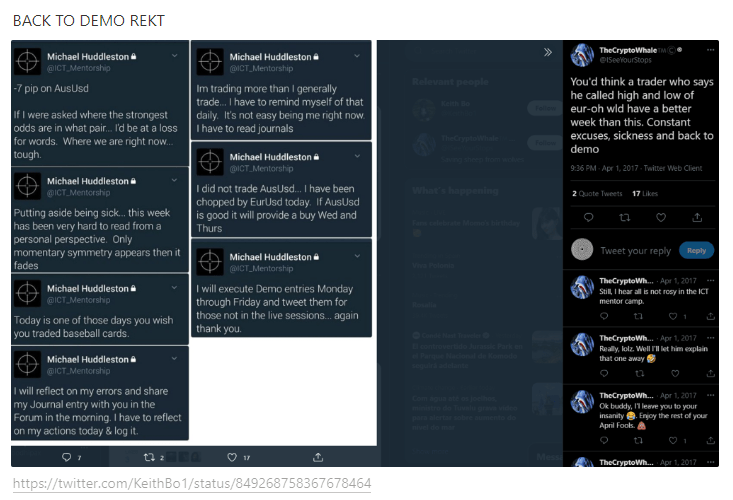

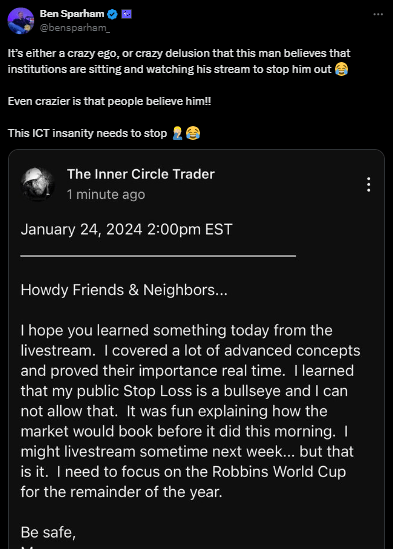

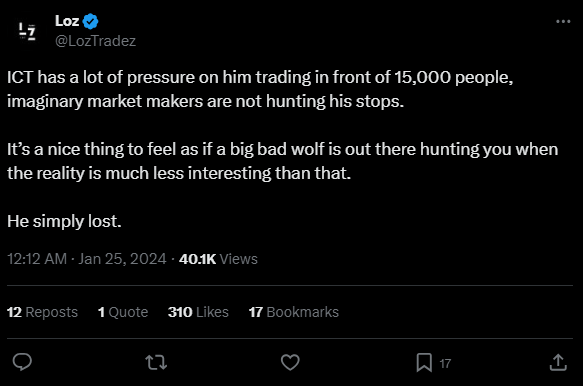

However, with great popularity comes great scrutiny. One of the most significant controversies surrounding ICT is his apparent tendency to blame external factors for his trading losses. During a recent livestream, which was viewed by over 15,000 traders, ICT concept faced a series of losses, with most of his trades hitting stop-losses. Rather than acknowledging these losses as part of the trading journey, he attributed them to institutions allegedly hunting his stop-losses—a claim that many in the trading community found to be far-fetched.

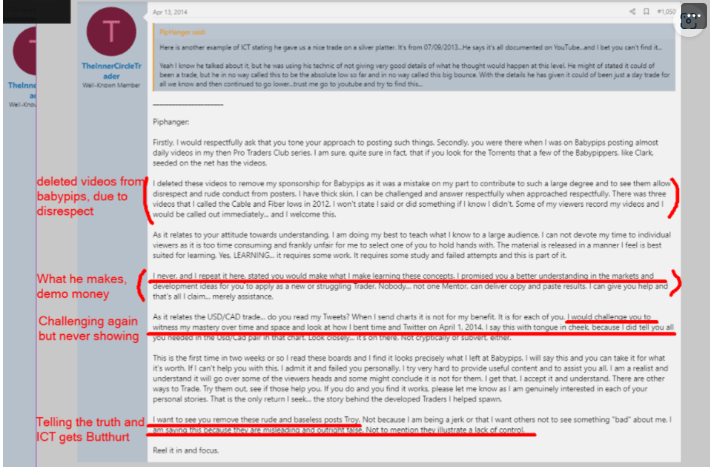

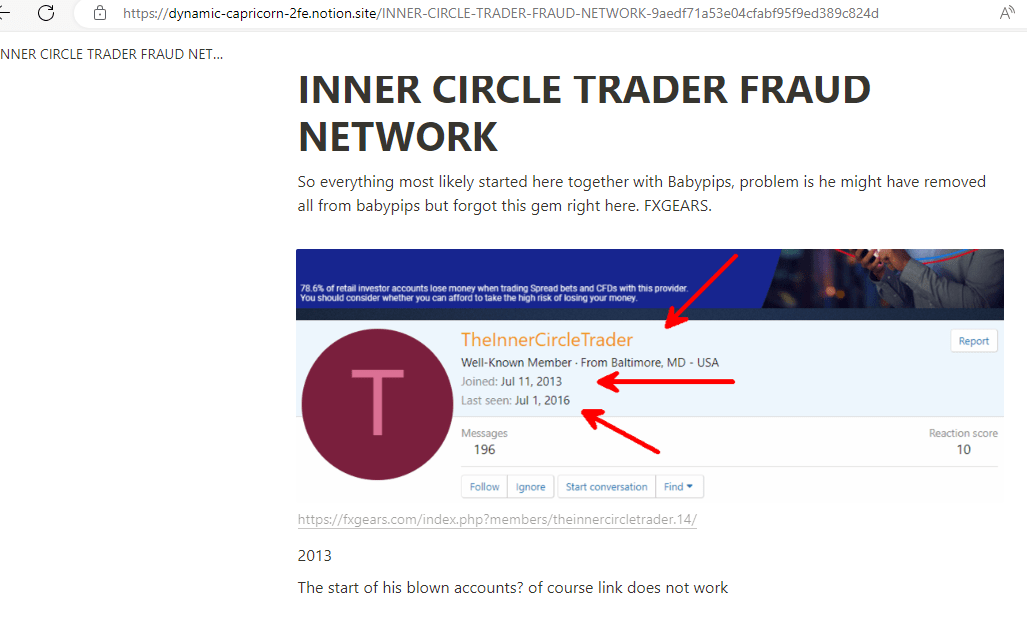

The notion that major financial institutions like Blackrock are targeting small retail traders’ stop losses is widely regarded as a conspiracy theory. This claim has further fueled the skepticism surrounding ICT, leading many to question the credibility of his teachings. For a more in-depth look at these controversies, check out the discussions on forums like BabyPips and FXGears, where many traders share their experiences and concerns about ICT.

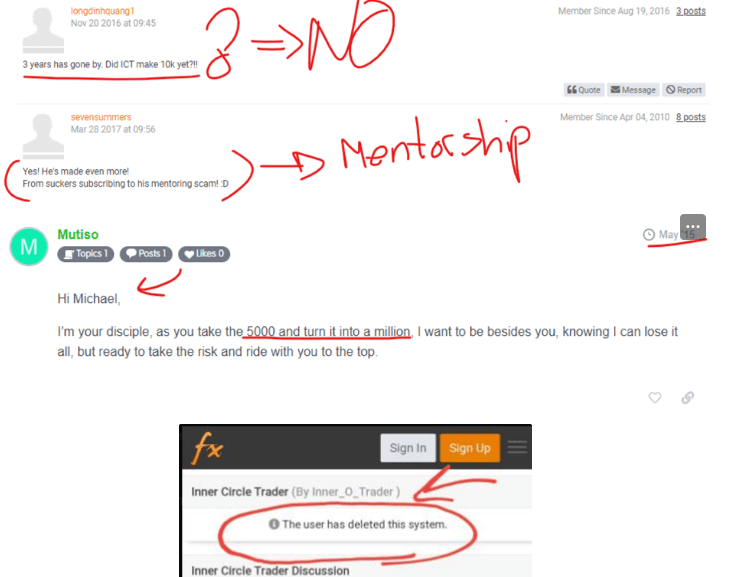

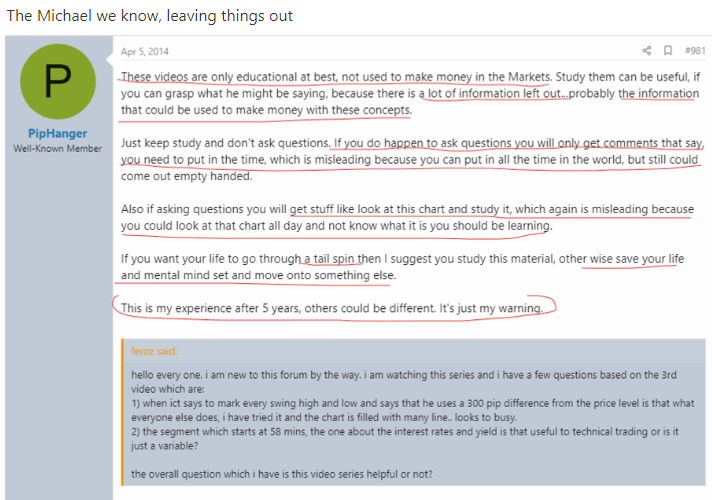

Adding to the controversy are reports that ICT has blown multiple trading accounts. Critics argue that his strategies, while intricate and appealing to those seeking a deeper understanding of market dynamics, are overly complicated and not as effective as advertised. Some former followers have accused him of prioritizing the sale of mentorship programs over actual trading success. This accusation is bolstered by claims that ICT has made far more money selling courses and YouTube content than he has from trading itself. To explore these claims further, you can refer to this detailed YouTube exposé that delves into ICT’s trading history and practices.

Voices from the Community

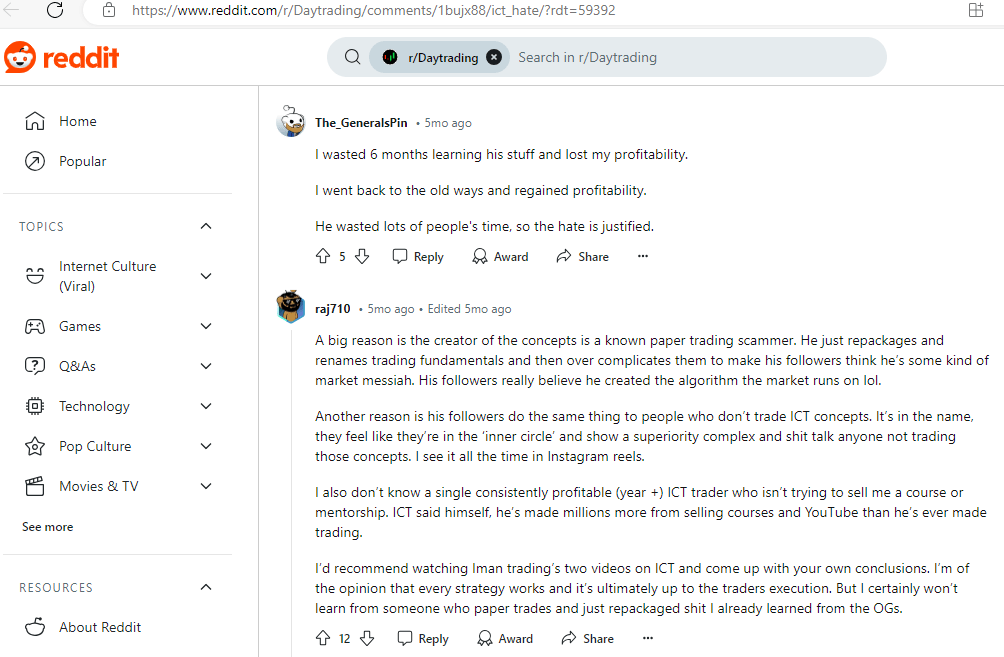

The skepticism isn’t limited to a few isolated incidents. Many traders in online communities, including platforms like Reddit and forums like BabyPips, have expressed their doubts about ICT’s legitimacy. A notable comment by a user named raj710 encapsulates this sentiment:

“The creator of the concepts is a known paper trading scammer. He just repackages and renames trading fundamentals and then overcomplicates them to make his followers think he’s some kind of market messiah. His followers really believe he created the algorithm the market runs on.”

Another common criticism revolves around the behavior of ICT’s followers. Some traders have observed a sense of superiority among ICT adherents, who often dismiss those who do not follow his methods. This attitude has led to further alienation within the trading community, with many traders viewing ICT followers as part of an exclusive “inner circle” that is closed off to outside perspectives.

Another common criticism revolves around the behavior of ICT’s followers. Some traders have observed a sense of superiority among ICT adherents, who often dismiss those who do not follow his methods. This attitude has led to further alienation within the trading community, with many traders viewing ICT followers as part of an exclusive “inner circle” that is closed off to outside perspectives.

Moreover, the lack of consistently profitable ICT traders who are not simultaneously selling courses or mentorship programs is another red flag for many. As one critic noted,

“I don’t know a single consistently profitable ICT trader who isn’t trying to sell me a course or mentorship. ICT himself admitted that he’s earned millions more from selling courses and YouTube content than he ever did from actual trading.

Lessons for Forex Traders

The story of ICT serves as a cautionary tale for all forex traders. Here are some key lessons to take away from this saga:

- Simplicity is Key: Overly complicated trading strategies can lead to confusion and poor decision-making. As Steve Jobs famously said, “Simplicity is the ultimate sophistication.” Traders should aim for strategies that are straightforward and easy to execute.

- Beware of Cults: Many forex traders follow ICT, SMC, and liquidity concepts in their forex trading strategies. However, it’s essential to remain objective and critical, even when following popular trading influencers. Blindly following any one person’s methods can be risky, especially if those methods are shrouded in complexity and conspiracy theories.

- Accountability Matters: Successful traders take responsibility for their losses and learn from them. Blaming external factors, like institutions hunting stop losses, can prevent growth and improvement. A trader’s ability to adapt and learn from mistakes is crucial for long-term success.

- Question the Source: When evaluating trading strategies, consider the source. If the person promoting a strategy is making more money from selling courses than from actual trading, it might be worth questioning the validity of their methods.

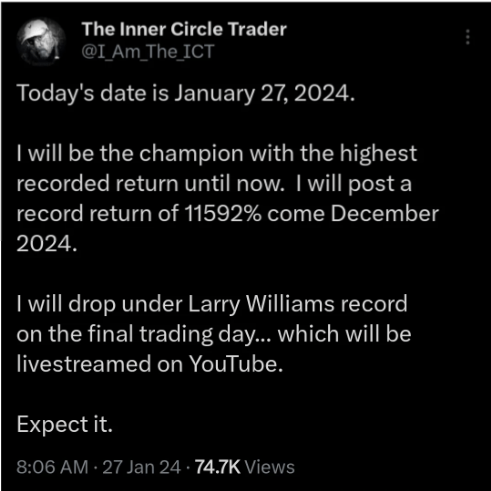

This is bound to give you a good laugh.

Conclusion

While ICT concepts have undoubtedly influenced many traders, the recent controversies highlight the importance of critical thinking and simplicity in trading. The allure of a secretive, complex strategy can be tempting, but traders must remember that the forex market is a dynamic and often unpredictable environment. No single method guarantees success, and it’s crucial to develop a personal strategy grounded in sound principles and personal accountability.

By staying informed and skeptical, traders can navigate the forex market more effectively and avoid the pitfalls of following trading “gurus” without question. The rise and fall of ICT is a stark reminder that in the world of forex trading, critical thinking and simplicity often pave the way to success.

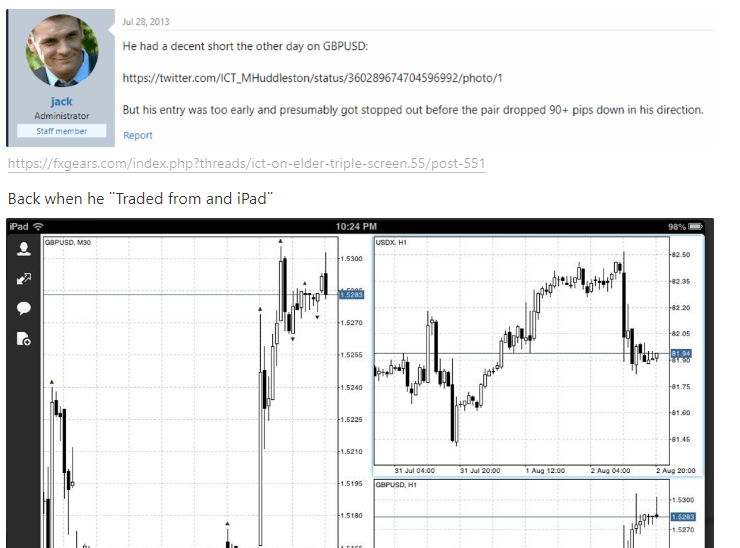

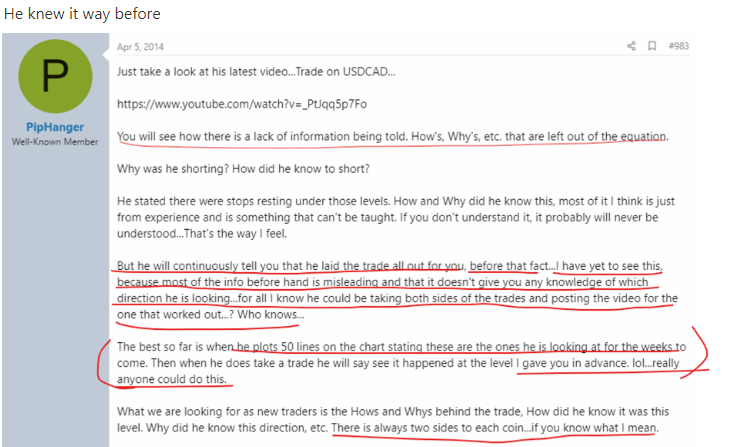

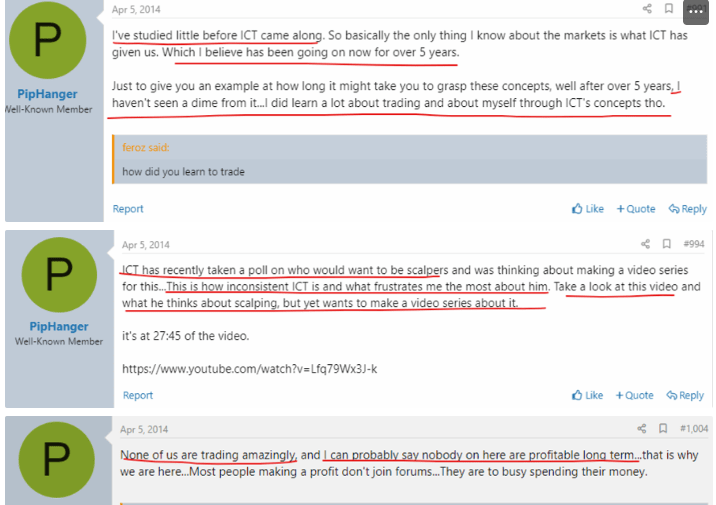

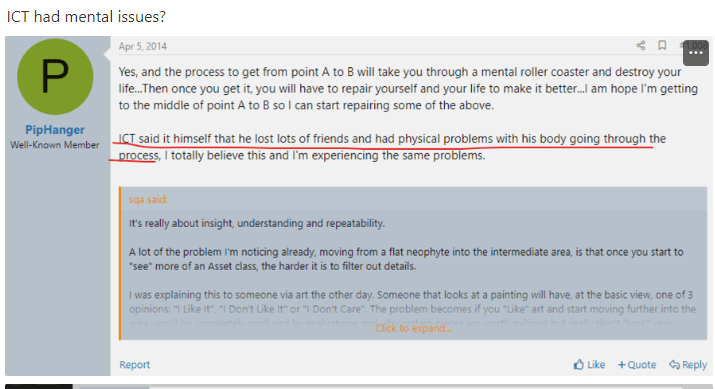

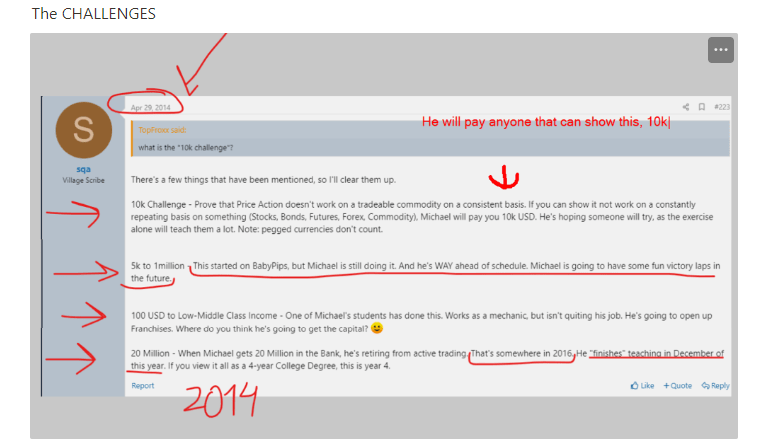

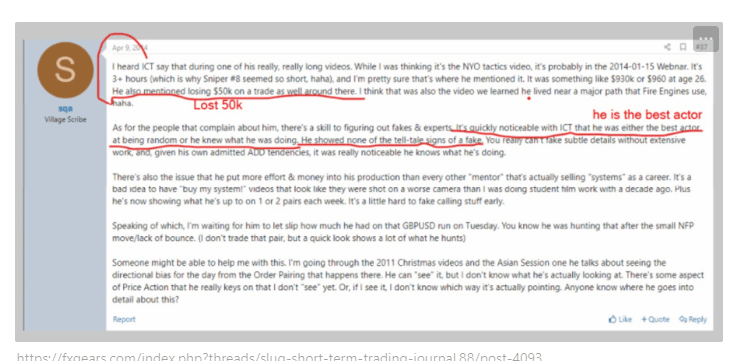

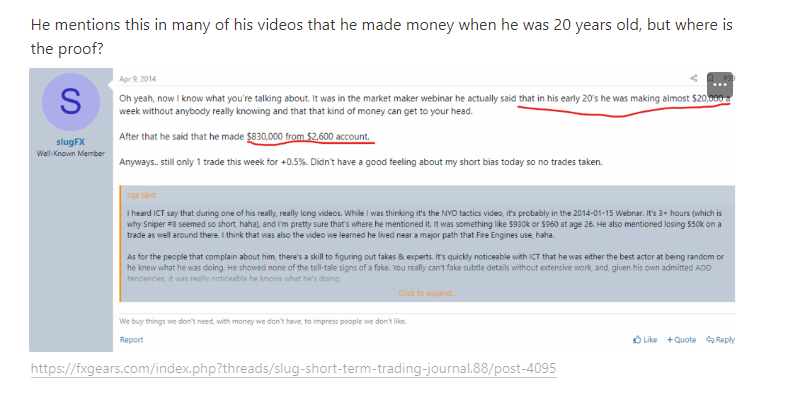

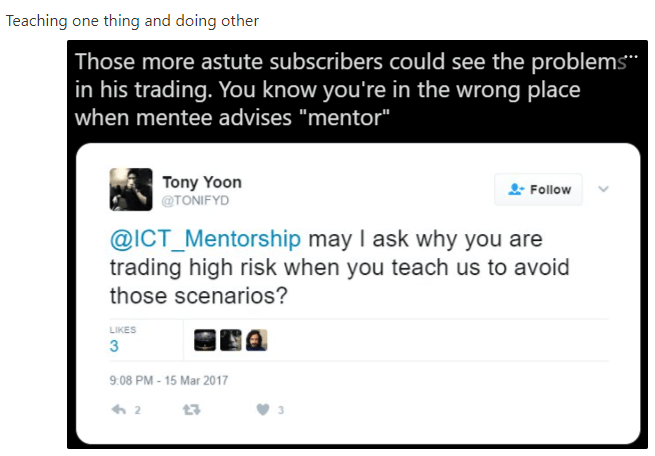

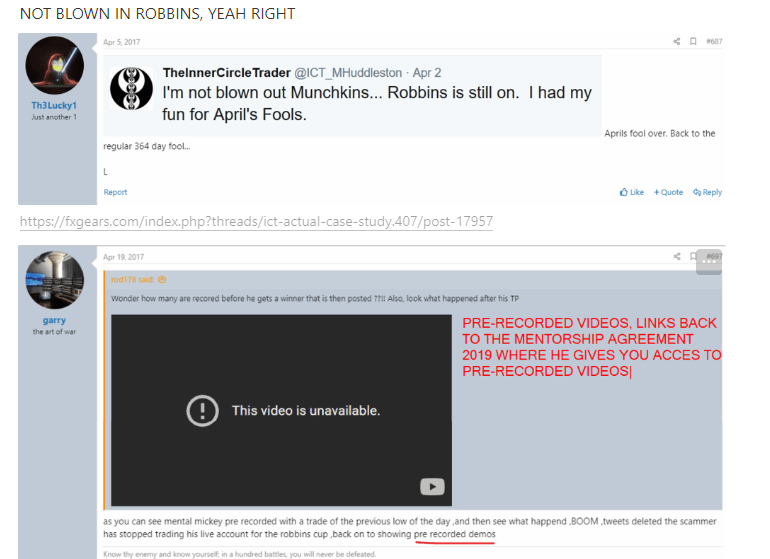

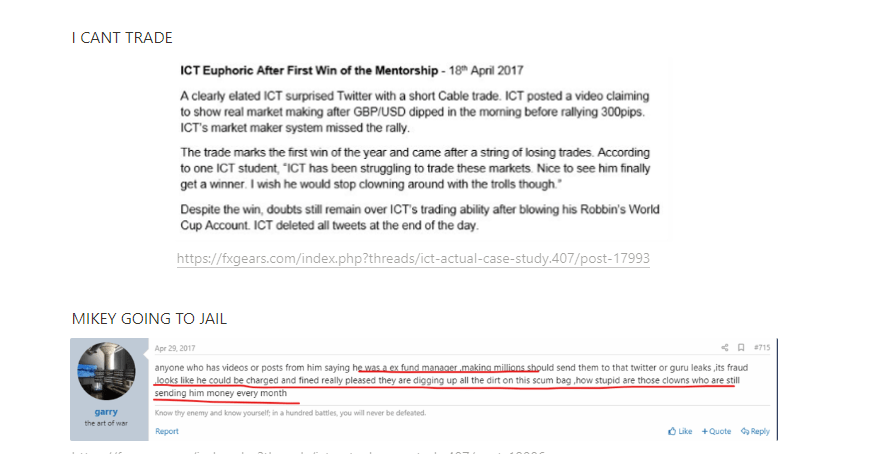

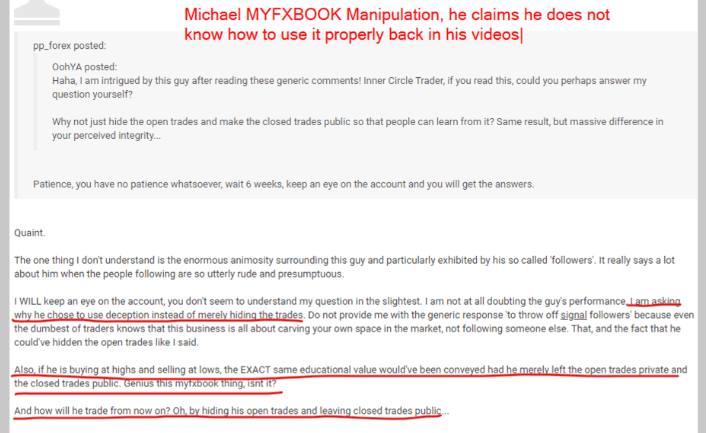

Some Screenshots from Online. INNER CIRCLE TRADER FRAUD NETWORK – FXGEARS

#forextraders, #forex trading, #ICT concept, #SMC trading, #liquidity trader, #trading controversies, #trading accountability, #stop-loss hunting, #trading strategies. #forexwaveexpert

References:

- How quickly is he going to blow his account up and blame it on the Algo?

- So ICT is a liar who blew his acc in myfxbook

- INNER CIRCLE TRADER FRAUD NETWORK – FXGEARS

Add a Comment

You must be logged in to post a comment