## **Navigating Market Swirls: A Trader’s Guide to Moving Averages**

### **Unlocking Trading Wisdom: Demystifying Moving Averages**

In the thrilling realm of Forex and stock trading, think of Moving Averages (MAs) as your trusty allies, cutting through the noise and revealing the heartbeat of market trends. Traders, buckle up, because understanding Moving Averages is your secret weapon to decoding the dance of financial markets.

### **Why Traders Can’t Ignore Moving Averages: The Core Insight**

Beyond the charts and numbers, Moving Averages tell tales about price trends. They’re like the backstage pass to the market concert, filtering out the chaos and showcasing the rhythmic flow of prices. For traders, this means understanding the melody beneath the market’s cacophony.

### **Dancing with Two Stars: Simple and Exponential Moving Averages**

**Simple Moving Averages (SMA): Your Reliable Beat:**

SMA is like the steady drumbeat, capturing historical prices to show the underlying rhythm. It’s your foundation, your go-to for spotting trends and keeping the trading tempo in check.

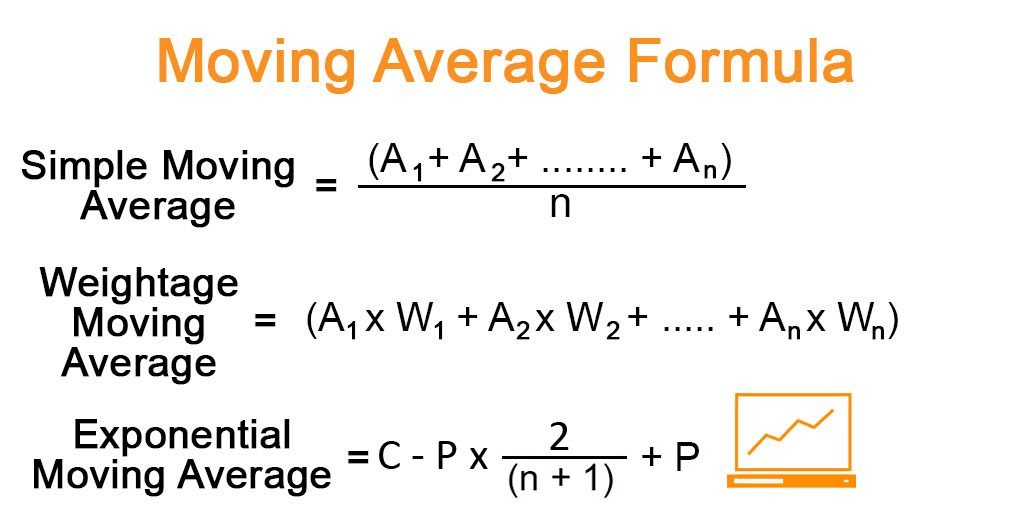

*Simple Moving Average Calculation:*

\[ SMA = A_1 + A_2 + \ldots + A_n \]

Here, \(A\) represents the average in period \(n\) over \(n\) time periods.

**Exponential Moving Averages (EMA): The Swift Violin Notes:**

EMA, on the other hand, is the nimble violin, focusing on recent prices and adjusting swiftly to market moves. It’s the trader’s partner in catching the latest market nuances, dancing to the pulse of the present.

*Exponential Moving Average Calculation:*

\[ EMA_t = V_t \times (s + d) + EMA_{t-1} \times [1 – (s + d)] \]

In this formula, \(V_t\) is the value today, \(EMA_{t-1}\) is the EMA yesterday, \(s\) is the smoothing factor, and \(d\) is the number of days.

### **Practical Moves: How Traders Tango with Moving Averages**

**Reading Market Trends: The Trader’s Ballroom Guide:**

Traders use moving averages as their compass, deciphering market trends. A rising average signals an upbeat tempo; a falling one paints a mellower picture. It’s a language traders speak, turning market sentiments into actionable insights.

**Crossovers: The Elegant Trading Choreography:**

Imagine a dance floor where short-term and long-term averages perform elegant crossovers. A bullish dance begins when the short-term steals the spotlight, hinting at potential market highs. Conversely, a bearish waltz starts when the short-term bows below the long-term, suggesting a dip in the market’s rhythm.

### **Behind the Scenes: How Moving Averages Crunch the Numbers**

**Simple Math for Simple Moving Averages: The Arithmetic Ballet:**

Calculating SMA involves a bit of arithmetic ballet—adding up a set of prices and dividing by the number of prices. It’s like finding the average groove in a historical dance of numbers.

**Exponential Moving Average Unveiled: The Market’s Nuanced Dance:**

EMA adds flair to the mix. It considers recent market moves more seriously, giving extra weight to the latest dance steps. The result? A more responsive reflection of the market’s current mood.

### **Beyond Basics: Tools for Trading Maestros**

**MACD: The Trading Maestro’s Baton:**

Enter the MACD, a conductor guiding traders through the symphony of moving averages. By monitoring crossovers and using a signal line, it helps traders tune into potential market shifts, turning the market into a captivating musical performance.

### **Fine-Tuning the Composition: Other Trading Strategies**

**Weighted Moving Averages: Tailoring the Trading Tune:**

In the financial world, traders have their own composition with Weighted Moving Averages. It’s not a one-size-fits-all melody; it’s a customizable composition. Imagine assigning different weights to data based on trading volume, fine-tuning the tune for a clearer market melody.

**Spencer’s 15-Point Moving Average: A Unique Trading Composition:**

In the world of actuaries, Spencer’s 15-Point Moving Average is a distinctive composition. Its symmetric weights create a harmonious blend, allowing actuaries to uncover the subtle movements in their trading data.

### **Guardians of Stability: The Moving Median**

**Moving Median: Resilience in Trading Statistics:**

Statisticians have their guardian in the Moving Median. It’s not swayed by outliers or sudden shocks, providing a robust estimate of trends. In a trading world where deviations can be disruptive, the Moving Median stands strong, ensuring stability in the face of anomalies.

### **Harmony Beyond Trading: Applications in Every Trading Cadence**

**From Trading to Pixels: Diverse Applications:**

Moving Averages extend their reach beyond trading. In image signal processing, they erase pixelization, revealing the true essence of visual data. Their applications span across trading strategies, from economic analysis to image enhancement.

### **Choosing Your Trading Melody: A Trader’s Dilemma**

**Meaningful Choices in Trading Filters:**

Selecting a moving average is like composing a symphony. Each choice, whether it’s Simple, Exponential, Weighted, or Cumulative, contributes to the melody of analysis. Understanding the unique nuances of each type empowers traders to compose their own financial symphony.

In the vast world of trading, Moving Averages conduct the melody, guiding traders through the intricate rhythms of trends, crossovers, and market shifts. As traders navigate the waves of data, let Moving Averages be their companions, unraveling the stories hidden within the numbers. The dance continues, and with each step, traders uncover the harmonies of financial markets and beyond. Happy trading!

Add a Comment

You must be logged in to post a comment