Unlocking the Power of Ending Diagonals in Elliott Wave Theory: Entry Model Rd Trading Zone strategy.

In the world of technical analysis, Elliott Wave Theory stands as a cornerstone for many traders and investors. Among its various patterns and formations, one particularly potent signal often overlooked is the ending diagonal. While Elliott Wave Theory itself can be intricate, understanding the dynamics and potential of ending diagonals can significantly enhance trading strategies and decision-making processes.

### Demystifying Ending Diagonals

An ending diagonal, residing within the framework of Elliott Wave Theory, emerges as a distinctive impulsive motive wave pattern. Typically manifesting in the fifth wave position, it serves as a harbinger of potential market reversals. Here’s what characterizes an ending diagonal:

**1. Structural Composition**:

– Comprised of five waves, it features three motive waves (labeled 1, 3, and 5) and two corrective waves (labeled 2 and 4), collectively forming a wedge-like shape.

– The most recognizable trait is its wedge pattern, with waves 1 and 4 overlapping, presenting a unique visual signature.

**2. Contextual Significance**:

– Ending diagonals often surface at the conclusion of a price trend, heralding substantial trend reversals.

– Their appearance can provide crucial insights into potential market shifts, offering traders an opportunity to capitalize on impending changes in direction.

**3. Rules Governing Ending Diagonals**:

– Wave 2 should not descend below the initiation point of Wave 1.

– Wave 3 typically emerges as the longest among Waves 1, 3, and 5, albeit not mandatorily the shortest in both waves.

– Wave 4 must commence prior to the inception of Wave 2.

– Structurally, Waves 1, 3, and 5 break down into smaller 5-wave patterns, while Waves 2 and 4 subdivide into three smaller correction waves.

### Leveraging Candlestick Patterns for Entry Confirmation

Upon identifying an ending diagonal, traders can ascertain potential entry points through the validation of candlestick patterns. Here’s a systematic approach to confirming entries:

**1. Completion of Sub-Waves**:

– Confirm that all five sub-waves of the ending diagonal have concluded. This ensures the pattern’s integrity and readiness for potential trading opportunities.

**2. Reversal Confirmation**:

– Await confirmation on the price chart, seeking bullish reversal patterns for buy trades and bearish reversal patterns for sell trades.

– For bullish trades, a Reversal candlestick following the ending diagonal serves as a compelling entry signal, indicating a shift in momentum favoring buyers.

– Conversely, for bearish trades, identification of a bearish reversal pattern reinforces the likelihood of a downward price movement, warranting a sell entry.

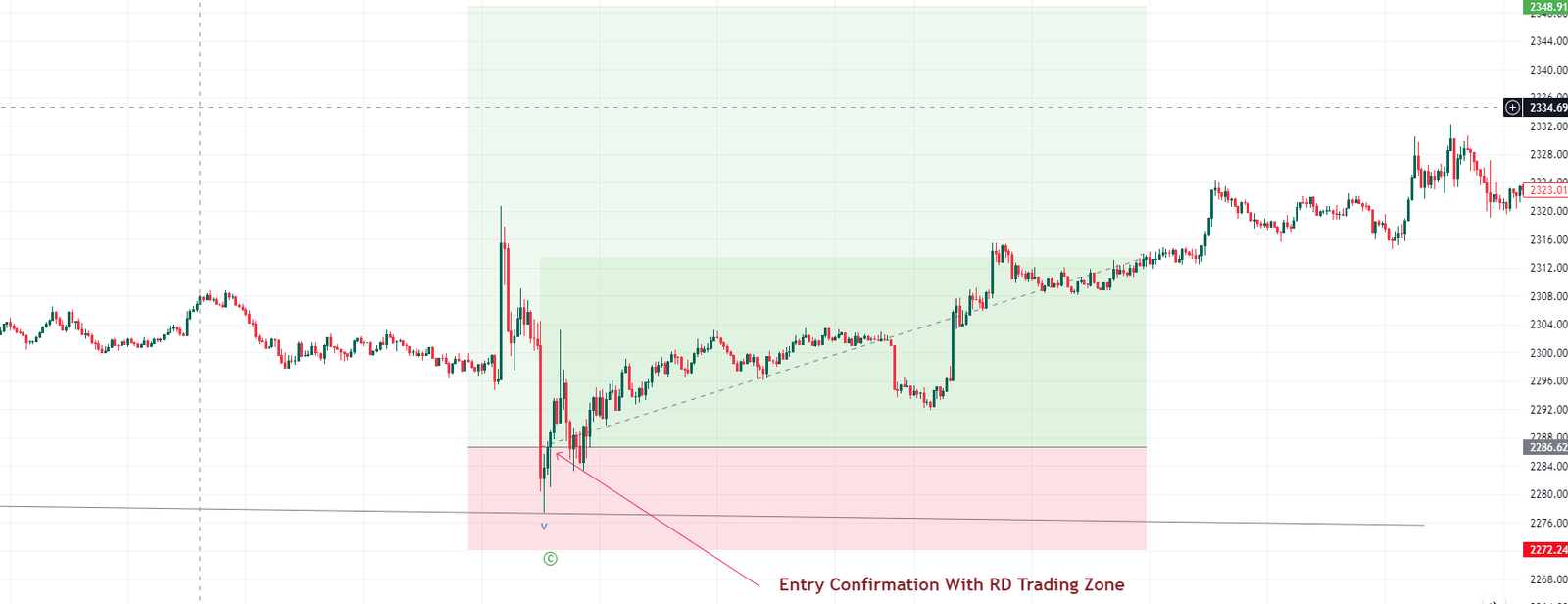

**Real-World Example: RD Trading Zone Strategy**

Let’s delve deeper into the practical application of the RD Trading Zone Strategy, where theory meets real-world trading scenarios.

### Getting In: Spotting the Opportunity

Traders utilizing the RD Trading Zone Strategy keep a keen eye on the charts, looking for the distinctive patterns of ending diagonals. Once they identify a potential ending diagonal, they don’t rush into action. Instead, they meticulously ensure that the pattern is complete before considering their next move. This attention to detail is crucial, as it confirms the reliability of the setup and reduces the risk of false signals.

After confirming the ending diagonal, traders take a closer look at shorter timeframes. This zooming in allows them to get a clearer picture of the market dynamics and pinpoint entry opportunities with precision. Here, they pay particular attention to specific candlestick patterns, such as reversal candlesticks, which serve as confirmation signals for initiating trades. These candlestick patterns act as guiding lights, signaling a potential shift in market sentiment and offering traders the confidence to enter the trade.

### Making the Trade: Executing with Precision

With the ending diagonal confirmed and entry signals identified, traders proceed with caution, adhering closely to the rules of the RD Trading Zone Strategy. This involves a disciplined and systematic approach, ensuring that each step of the trading process is executed with precision.

Traders follow a step-by-step methodology, relying on their predefined rules to guide their actions. These rules serve as a roadmap, steering traders away from impulsive decisions and towards calculated, well-informed trades. By sticking to their plan, traders can effectively manage risk and capitalize on opportunities presented by ending diagonals.

The RD Trading Zone Strategy exemplifies how theory translates into practice in the trading world. It’s not just about spotting patterns on a chart; it’s about having a clear strategy and the discipline to execute it consistently. This strategy empowers traders to navigate the complexities of the market with confidence, making informed decisions based on reliable signals.

### Real-World Example: Recent Gold Buy Entry Confirmation From RD Trading Zone Strategy

To illustrate the effectiveness of the RD Trading Zone Strategy, let’s consider a recent example of a gold buy trade. In the image provided, we can see a clear ending diagonal pattern forming in Wave C sub wave. Traders using the RD Trading Zone Strategy would have identified this pattern, confirmed its completion, and pinpointed entry opportunities using candlestick patterns on shorter timeframes. By adhering to the principles of the strategy and executing their trades with precision, traders could have capitalized on this setup, potentially realizing profitable outcomes.

### Conclusion

In conclusion, the power of ending diagonals lies in their ability to signal potential trend reversals within the framework of Elliott Wave Theory. By understanding their structural characteristics, contextual significance, and entry confirmation techniques using candlestick patterns, traders can enhance their decision-making processes and capitalize on lucrative trading opportunities. Incorporating strategies such as the RD Trading Zone Strategy offers traders a practical framework for leveraging ending diagonals in real-world trading scenarios. By combining theoretical understanding with practical application, traders can navigate the markets with confidence and precision, positioning themselves for success in their trading endeavors.

Rana Das, Ceo and founder. Forex wave expert

Add a Comment

You must be logged in to post a comment