Welcome to FWE’s weekly fundamental analysis about Trading Markets and News in the this week (Jan 22nd to Jan 26th, 2024)

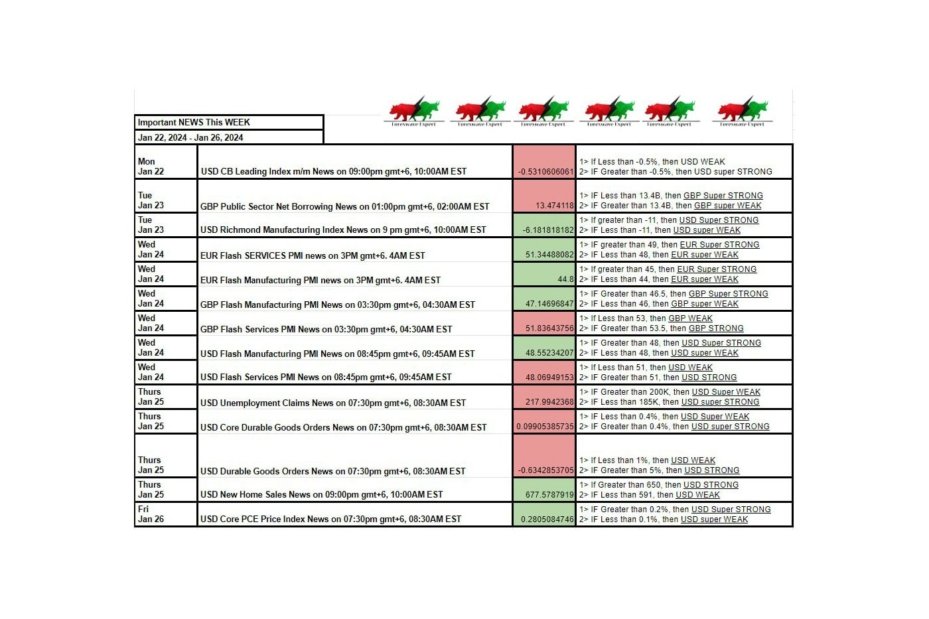

✅ UPCOMING Fundamental EVENTS:

Monday: PBoC LPR, New Zealand Services PMI.

Tuesday: BoJ Policy Decision, New Zealand CPI.

Wednesday: Australia/Japan/Eurozone/UK/US Flash PMIs, BoC Policy Decision.

Thursday: ECB Policy Decision, US Durable Goods Orders, US Jobless Claims, US Q4 Advance GDP.

Friday: Tokyo CPI, US PCE.

✅ Monday Fundamental Analysis:

The PBoC is expected to keep the LPR rates unchanged at 3.45% for the 1-year and 4.20% for the 5-year following the MLF decision last week. Deflationary forces remain present, and the Chinese stock market is on a free fall with the general sentiment being utterly dismal. It will likely require a strong catalyst to turn things around and aggressive rate cuts might do it, so it’s worth to keep an eye for eventual surprises.

👉🏾 FWE will be expecting weak CNY reports for Strong USD on the news release time. Later on that day US session, any WEAK Biasness of USD will be welcomed.

✅ Tuesday Fundamental Analysis:

The BoJ is expected to keep rates unchanged at -0.10% with the 10-year JGB yield target at 0% with 1% as a reference cap. The latest Japanese CPI eased further across all measures and the Average Cash Earnings were a big disappointment. The BoJ will likely reiterate once again that they are focused on wage growth and the spring wage negotiations and that they will not hesitate to take additional easing measures if needed.

The New Zealand CPI Y/Y is expected at 4.7% vs. 5.6% prior, while the Q/Q measure is seen at 0.6% vs. 1.8% prior. The data will have no bearing on the February rate decision but will certainly influence the market’s pricing with the first rate cut seen in May.

👉🏾 FWE will be expecting weak JPY and NZD scenario for Strong USD on the Asian Session. Later on that day US session, any STRONG Biasness of USD will be welcomed.

Wednesday will be the Flash PMIs day with a particular focus on the Eurozone, UK and US data.

The BoC is expected to keep rates unchanged at 5.00%. The data out of Canada supports the central bank’s patient approach as the underlying inflation measures surprised to the upside for the second consecutive month and the latest wage growth figure spiked to the highest level since 2021. The Bank of Canada has been highlighting that it places a lot of focus on those two measures and although it expects rate cuts to come this year, the timing is much more uncertain and data-dependent.

👉🏾 FWE will be expecting weak GBP and Strong EUR scenario on the Asian & UK Session. Later on that day US session, any STRONG Biasness of USD will be welcomed.

✅ Thursday Fundamental Analysis:

The ECB is expected to keep interest rates unchanged at 4.00%. The central bank officials have been consistently pushing back against the aggressive rate cut expectations with consensus for the first rate cut leaning for June compared to the market’s April forecast. The latest data saw the Core CPI Y/Y easing further although the M/M measure showed a worrying 0.6% increase. The Unemployment Rate continues to hover around record lows and wage growth remains elevated, which is something that the ECB doesn’t see as favourable for a return to their 2% target.

The US Jobless Claims continue to be one of the most important releases every week as it’s a timelier indicator on the state of the labour market. Initial Claims keep on hovering around cycle lows, while Continuing Claims after reaching a new cycle high started to trend lower. This week the consensus sees Initial Claims at 200K vs. 187K prior, while Continuing Claims are seen at 1840K vs. 1806K prior.

👉🏾 FWE will be expecting weak EUR on the UK Session. Later on that day US session, any WEAK Biasness of USD will be welcomed.

✅ Friday Fundamental Analysis:

The US PCE Y/Y is expected at 2.6% vs. 2.6% prior, while the M/M measure is seen at 0.2% vs. -0.1% prior. The Core PCE Y/Y is expected at 3.0% vs.3.2% prior, while the M/M figure is seen at 0.2% vs. 0.1% prior which would make the 3-month and 6-month annualised rates fall to 1.5% and 1.9% respectively.

👉🏾 FWE will be expecting weak USD on the UK Session. Later on that day US session, any STRONG Biasness of USD will be welcomed.

If you have any concerns, please reach us on telegram.

Thank you

Add a Comment

You must be logged in to post a comment