Welcome to FWE’s weekly fundamental analysis about Trading Markets and News in the coming week.

Monday Fundamental News: PBoC MLF, US Markets closed for MLK Day, BoC Business Outlook Survey.

Tuesday Fundamental News: UK Labor Market report, Canada CPI, Fed’s Waller.

Wednesday Fundamental News: China Industrial Production and Retail Sales, UK CPI, US Retail Sales, US Industrial Production, US NAHB Housing Market Index.

Thursday Fundamental News: Australian Labor Market report, ECB Minutes, US Building Permits and Housing Starts, US Jobless Claims, New Zealand Manufacturing PMI.

Friday Fundamental News: Japan CPI, UK Retail Sales, Canada Retail Sales, US University of Michigan Consumer Sentiment.

Monday Fundamental Analysis:

The PBoC will conduct the MLF operation on Monday and we will see if they decide to lower the rate or keep it unchanged at 2.50%. There are some expectations for a 10 bps cut tomorrow which would set the stage for a cut for the LPR rates as well. The latest Chinese inflation data continues to show deflationary pressures which gives the PBoC ample room to ease their policy further.

In the old continent, Germany’s full-year GDP Growth is up on January 15, seconded by the final Inflation Rate for the month of December and the Economic Sentiment measured by the ZEW Institute on January 16. In the FX universe, EUR/USD continues to face strong resistance around the psychological 1.1000 barrier. In the broader euro area, the ZEW’s Economic Sentiment is due (January 16), followed by the final Inflation Rate in December (January 17).

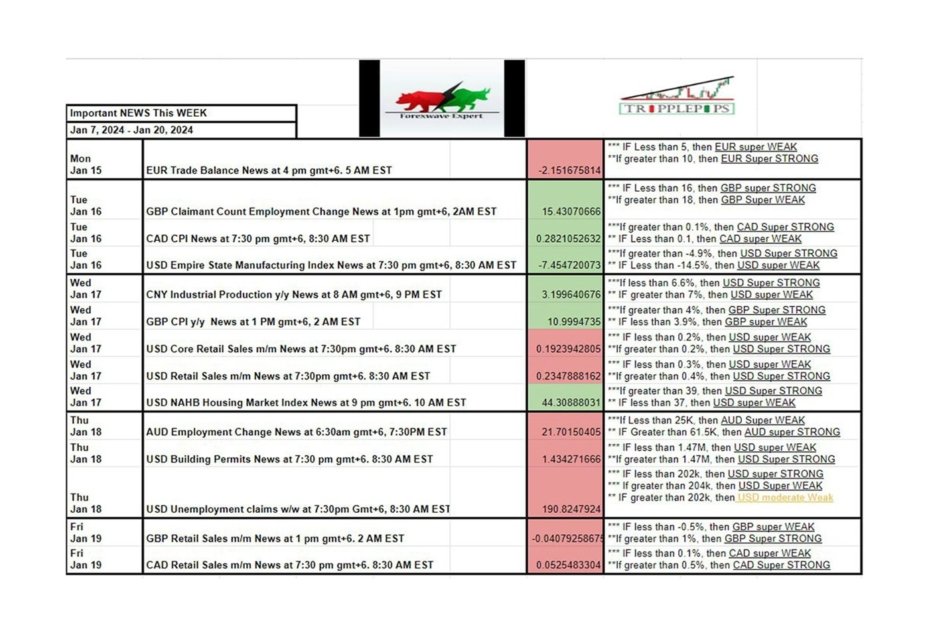

FWE is expecting a WEAK bias on EUR on the EUR Trade Balance news release.

Tuesday Fundamental Analysis:

The UK Unemployment Rate is expected to tick higher to 4.3% vs. 4.2% prior. The average earnings excluding bonus are seen at 6.6% vs. 7.3% prior, while those including bonus are seen at 6.8% vs. 7.2% prior. This report is unlikely to change anything for the BoE as the central bank continues to support a “wait and see” approach, but the market’s pricing will certainly be influenced by the data with more to come the following day with the release of the UK CPI report.

In the UK, the labour market report takes center stage (January 16) prior to the Inflation Rate in the last month of the past year (January 17). GBP/USD has started the week on a strong foot, retargeting the key 1.2800 hurdle in the relatively short-term horizon.

The Canadian CPI Y/Y is expected at 3.3% vs. 3.1% while the M/M measure is seen at -0.3% vs. 0.1% prior. The BoC is focused on the underlying inflation measures (common, median and trimmed-mean) and although the rates are getting closer to the 1-3% target range, Governor Macklem said that they want to see more progress both on inflation and wage growth fronts. As a reminder, the last reports went in the opposite direction with underlying inflation measures ticking higher and wage growth accelerating.

Given the recent aggressive easing in financial conditions, it’s worth noting that Fed’s Waller will give a speech at Brookings on the economy and monetary policy with a Q&A session to follow. Waller is a key FOMC member because he’s been a “leading indicator” for changes in Fed’s policy. He was the first one talking about QT in December 2021 and the first one mentioning rate cuts in November 2023.

FWE is expecting a STRONG bias on GBP, CAD & USD on the GBP Claimant Count change, CAD Cpi and USD empire state Mn Index News.

Wednesday Fundamental Analysis:

In China, the publication of the GDP Growth Rate in the October–December period (January 17) should shed further details on the ongoing economic recovery (or lack thereof). Additionally, Industrial Production and Retail Sales are also scheduled.

The UK CPI Y/Y is expected at 3.8% vs. 3.9% prior, while the M/M measure is seen at 0.2% vs. -0.2% prior. The Core CPI Y/Y is expected at 4.9% vs. 5.1% prior, with no consensus for the M/M figure although the prior release showed a -0.3% fall. Again, this report will have no bearing on the February BoE meeting but will certainly affect the market’s pricing with the first cut expected in May and a total of 125 bps of cuts seen by year-end.

The US Retail Sales M/M are expected at 0.4% vs. 0.3% prior, while the ex-autos measure is seen at 0.2% vs. 0.2% prior. Also watch the Control Group as it’s regarded as a better gauge of consumer spending, and it’s been beating expectations consistently for several months.

FWE is expecting a STRONG bias on GBP and USD in the GBP CPI & USD NAHB Housing Index news release. But we’re expecting WEAK Bias on USD in the USD Retail sales news release.

Thursday Fundamental Analysis:

The publication of the monthly jobs report will also be scrutinized in Australia (January 18), especially after lower-than-expected domestic inflation figures seem to have favored a pause by the RBA at its next meeting in February. AUD/USD still appears underpinned by the 0.6650 region, although further weakness should not be ruled out in case of a below-expectations readings from the jobs data.

The Australian Unemployment Rate is expected to remain unchanged at 3.9% with 18K jobs added in December compared to 61.5K seen in November. This report will have no bearing on the February RBA meeting, but it will influence the market’s pricing, with a weak report likely increasing rate cuts expectations after the recent miss in the Monthly Australian CPI data.

The US Jobless Claims continue to be one of the most important releases every week as it’s a timelier indicator on the state of the labor market. Initial Claims keep on hovering around cycle lows, while Continuing Claims after reaching a new cycle high started to trend lower. This week the consensus sees Initial Claims at 207K vs. 202K prior, while there’s no estimate at the time of writing for Continuing Claims, although last week’s number was 1834K vs. 1868K prior.

FWE is expecting a WEAK bias on AUD& USD in the AUD Employment, USD Building permits & US unemployment news release.

Friday Fundamental Analysis:

The Japanese Core CPI Y/Y is expected at 2.3% vs. 2.5% prior. The headline inflation measure has been easing steadily in Japan thanks to energy deflation but the Core-Core measure, which excludes food and energy prices, has been doing so at a slower pace. The Tokyo CPI, which is seen as a leading indicator for National CPI, decreased further recently and the Average Cash Earnings showed a much slower-than-expected growth rate.

FWE is expecting a WEAK bias in GBP & CAD on the GBP Retail Sales, Cad Retail Sales news release.

Follow us on Facebook, You tube and join our Telegram channel for more updates on the market. Thank you

Add a Comment

You must be logged in to post a comment