**Corrective Patterns: Understanding Elliott Wave Mastering**

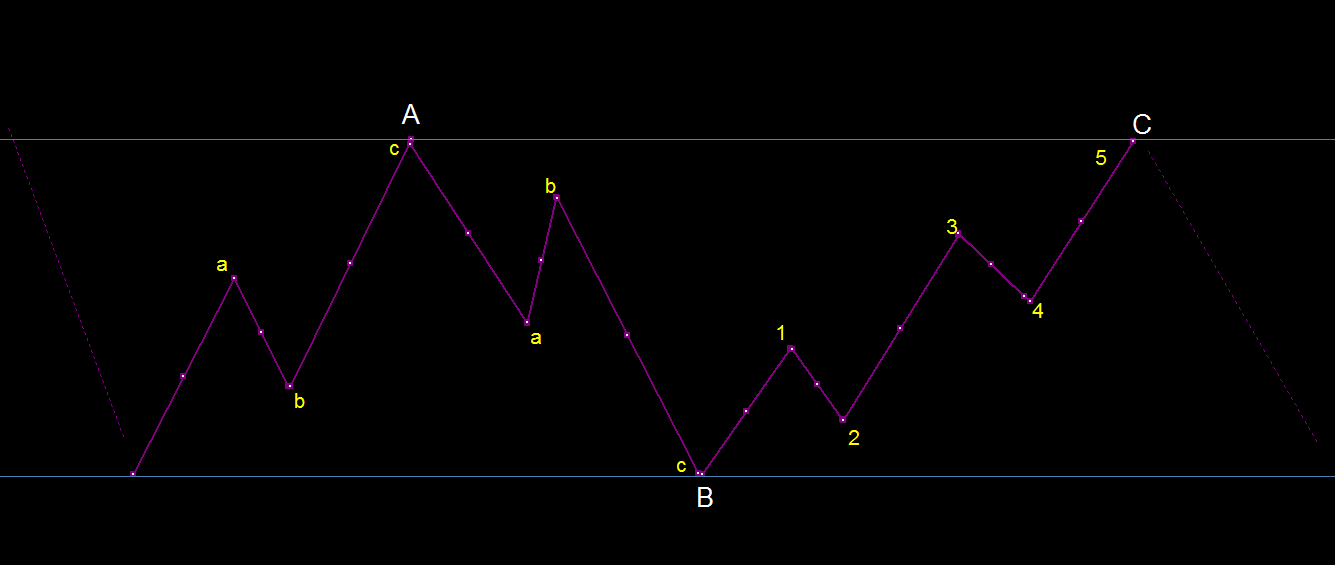

Corrective patterns, integral to Elliott Wave theory, play a crucial role in the market cycle by providing insights into moments when the market pauses, taking a “breath” post a trend before resuming its original direction. These patterns, denoted by three waves – A, B, and C, move against the trend at a larger degree, preventing trends from extending indefinitely and maintaining equilibrium within the market.

### Corrective Patterns:

### Corrective Patterns:

Corrective patterns occur as part of Elliott Wave theory and are labeled as waves 1, 3, or 5. Corrective waves are formed through three waves. Corrective waves primarily move against the running trend and conclude by moving towards the direction of the next trend.

In an uptrend or downtrend market, after waves 1, 3, and 5, we observe corrective patterns, and we can identify opportunities to trade after the correction. Corrective waves generally move in the opposite direction of the major trend and conclude before moving in the direction of the next market trend.

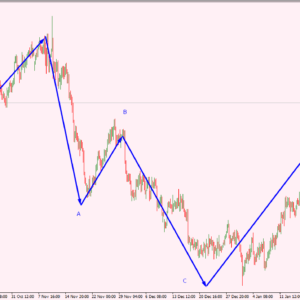

*”Since corrective waves consist of three waves and move in an A-B-C pattern in a running market, most traders make the mistake of trading here. For example, if we look at the USDJPY chart (from 15-12-2016 to 06-04-2017), we can hopefully understand the issue. In this or similar patterns, most traders buy at the end of wave A when B retraces. They think that the trend line has broken and it’s time to buy on retracement. But due to their lack of proper knowledge about waves, they don’t know exactly where to buy or sell when the trend line breaks and retraces… We will learn how to trade from corrective patterns in this and the next part.”*

*”Since corrective waves consist of three waves and move in an A-B-C pattern in a running market, most traders make the mistake of trading here. For example, if we look at the USDJPY chart (from 15-12-2016 to 06-04-2017), we can hopefully understand the issue. In this or similar patterns, most traders buy at the end of wave A when B retraces. They think that the trend line has broken and it’s time to buy on retracement. But due to their lack of proper knowledge about waves, they don’t know exactly where to buy or sell when the trend line breaks and retraces… We will learn how to trade from corrective patterns in this and the next part.”*

**”Corrective patterns make two types of movements:**

- **Fast:** Fast corrections move quickly against the major trend.

- **Sideways:** Sideways movements occur against the major trend.”

Corrective patterns come in three types:

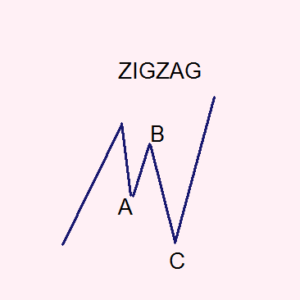

- **Zigzag:** A simple and rapid correction.

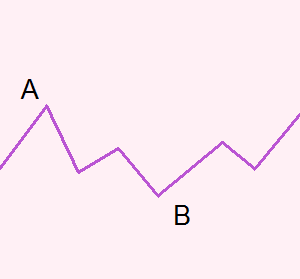

- **Flat:** A sideways movement, changing in three different ways.

- **Triangle:** A sideways movement, changing in four different ways.

### Zigzag Pattern:

### Zigzag Pattern:

The Zigzag pattern, a distinctive three-wave correction against the prevailing trend, unfolds as an A-B-C sequence. The A and C waves exhibit impulsive characteristics, while the B wave serves a corrective function. Crucially, the B-wave should not retrace more than 70% of the preceding A-wave, distinguishing zigzags from other corrective patterns. Zigzags often manifest as rapid movements, resembling impulsive activity and occasionally misleading investors. Notably, there are three variations of zigzags – normal, truncated, and elongated – each possessing distinct characteristics.

In an uptrend or downtrend market, the zigzag correction moves against the major trend. Through the zigzag correction, wave A moves quickly against the trend, wave B makes a small correction, and wave C continues to move quickly against the major wave.

*”Internal structure of the Zigzag pattern:

*”Internal structure of the Zigzag pattern:

- Wave A moves against the major trend with 5 sub-waves.

- Wave B makes a small movement towards the major trend with 3 sub-waves.

- Wave C is formed by moving against the major trend with 5 sub-waves.

- The Zigzag pattern ends with an impulse, corrective, and impulse movement.

- In the Zigzag, either wave A or C must be a diagonal or impulse, but one of them can be a diagonal.

- In the Zigzag, wave B can be any corrective pattern. For example: Zigzag, Flat, Triangle, or any complex pattern.

- Zigzag mainly occurs in wave 2 and after completing the Zigzag, it makes a long movement towards wave 3.

- Wave B can never cross wave A.

- Wave B retraces 38-70% of wave A.

- Wave C is equal to wave A or if it’s over 100%, it becomes 161% in Fibonacci extension.”*

**”More on the internal structure of the Zigzag pattern:

- Among the 5 waves in Wave A, waves 1, 3, and 5 are each a sub-zigzag pattern, and waves 2 and 4 are any three-wave pattern. Try to understand this from the picture.

- Now, Wave B is also a sub-zigzag.”**

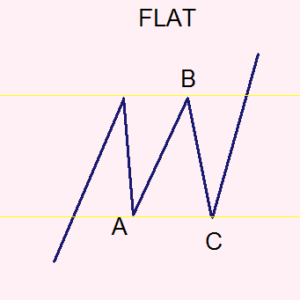

Flat Pattern:

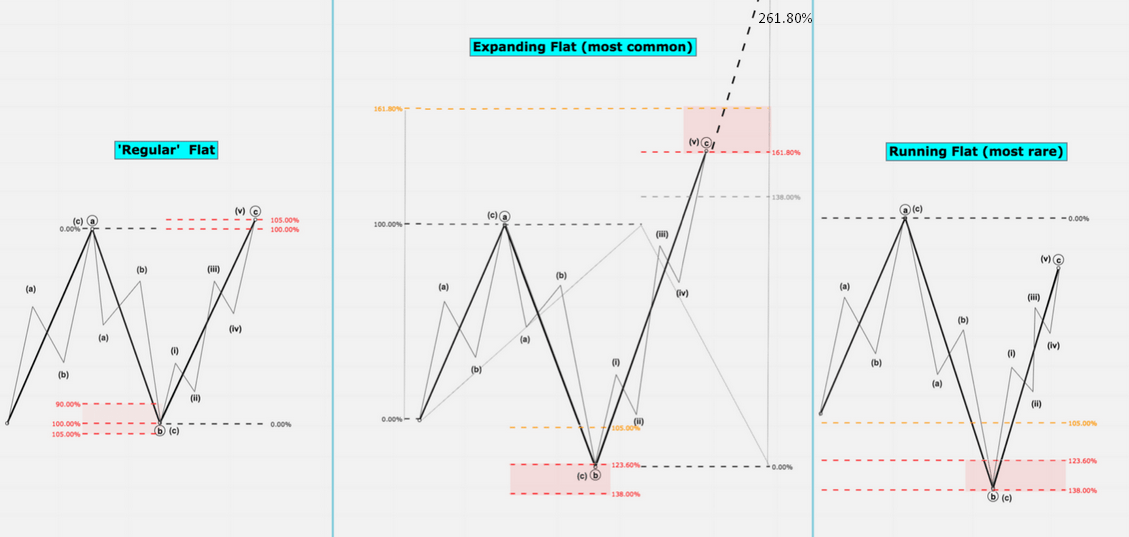

Flat corrections, representing lateral movements against the major trend, manifest in three forms: Regular, Expanded, and Running Flat. Characterized by a 3-3-5 sub wave sequence, flat corrections typically retrace less of the preceding impulse wave compared to zigzags. These corrections commonly occur when the larger trend is robust, either preceding or following an extension.

*”Flat mainly moves sideways against the major trend. Flat is primarily formed by three waves A, B, and C. Wave A can be formed by any sub-wave corrective pattern, but wave A can never be a triangle. Wave C will definitely be an impulse or ending diagonal. Wave B will retrace at least 90% of wave A.”*

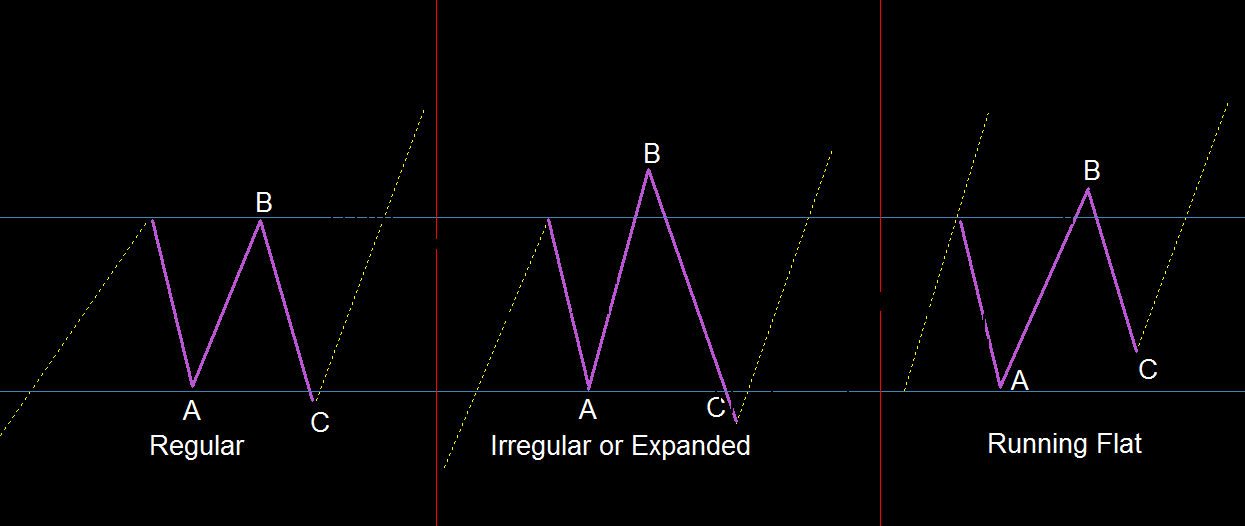

Flat is of three types:

– **Regular:** Flat In a Regular Flat, the start and end of waves B and C retrace from 90%. If wave B retraces 90-105% of wave A, then wave C will be 100-105% of wave A.

– **Expanded:** Irregular or Expanded Flat is quite common which we mostly find in the chart. In an Irregular or Expanded Flat, wave B exceeds the start of wave A and wave C retraces near the end area of wave A. In an Expanded Flat, wave B retraces wave A by 105-138% but wave C can go up to 127-261%.

– **Running:** In a Running Flat, wave B exceeds the start of wave A and wave C retraces before the end of wave A. Wave B can cross wave A but wave C cannot cross wave A.

*”Internal structure of the Flat pattern:

- Wave A is formed by 3 sub-waves and moves against the major trend.

- Wave B is formed by 3 sub-waves and moves towards the major trend.

- Wave C is formed by 5 waves and makes an impulse move against the major trend.

- The Flat pattern ends with a corrective, corrective, impulse movement. Flat mainly occurs in wave 4 and after completing the Flat, it moves towards wave 5.”*

Use Fibonacci in a flat pattern and set up the trade as shown in the picture below:

Triangle Pattern:

Triangle Pattern:

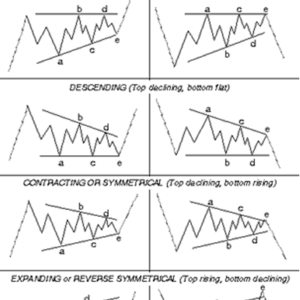

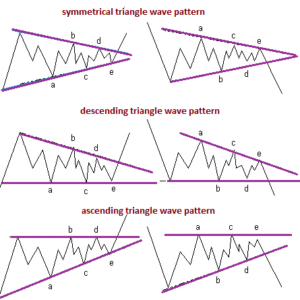

Triangles, fascinating patterns with lateral movements, come in four variations: Contracting, Expanding, Ascending, and Descending. Consisting of five overlapping waves subdivided as A-B-C-D-E, triangles are delineated by their movement within two channel lines drawn from Waves A to C and from Waves B to D.

*”Triangle – In an uptrend or downtrend, the triangle moves sideways against the major trend through a converging or diverging channel. The triangle moves sideways against the trend through a correction in the ABCDE wave with five waves.”*

“Triangles are of four types – The triangle is primarily a well-known corrective pattern that often appears in wave 4 of the Elliott Wave. In addition, it occurs as a sub-wave in zigzag, flat patterns, and various complex patterns. Contracting –

“Triangles are of four types – The triangle is primarily a well-known corrective pattern that often appears in wave 4 of the Elliott Wave. In addition, it occurs as a sub-wave in zigzag, flat patterns, and various complex patterns. Contracting –

- **Symmetrical (contracting)**

- **Ascending**

- **Descending Expanding -**

– **Reverse symmetrical (expanding)”**

A triangle wave is formed in four sub-waves and is often referred to as a continuation pattern. It is formed through a contracting channel, which converges from large to small, and an expanding channel, which diverges from small to large. An ascending triangle maintains a parallel movement upwards, while a descending triangle maintains a parallel movement downwards.

The internal structure of a triangle is formed by five waves.

The internal structure of a triangle is formed by five waves.

Each wave of the triangle is again formed by three corrective waves.

The triangle usually occurs in the major wave 4.

A triangle completes its corrective, corrective, corrective, corrective, corrective movement and then moves towards the trend.

**Contracting Triangle:**

In a Contracting Triangle, the channel lines converge, indicating a decreasing volatility. This pattern suggests a gradual decrease in the range of price movements, often leading to a breakout in the original trend.

**Expanding Triangle:**

Conversely, an Expanding Triangle sees the channel lines expanding, signifying an increase in volatility. This pattern may precede a reversal in the original trend, often marked by more significant price swings.

**Ascending and Descending Triangles:**

Ascending and Descending Triangles showcase different characteristics, with Ascending Triangles having a horizontal upper trendline and a rising lower trendline, and Descending Triangles featuring a horizontal lower trendline and a descending upper trendline.

Triangles, with their diverse forms, provide valuable insights into potential market movements, aiding traders in making informed decisions.

### Conclusion:

Corrective patterns are indispensable tools in Elliott Wave analysis, offering a deeper understanding of market dynamics. As you embark on your journey into wave theory, remember that combining technical analysis with corrective pattern recognition can significantly enhance your trading strategies.

Stay tuned for our upcoming articles, where we’ll delve into the practical aspects of trading with corrective patterns and explore real-world examples. Happy learning!

### Corrective Patterns:

### Corrective Patterns: ### Zigzag Pattern:

### Zigzag Pattern: *”Internal structure of the Zigzag pattern:

*”Internal structure of the Zigzag pattern:

Triangle Pattern:

Triangle Pattern:

Add a Comment

You must be logged in to post a comment