Currency Analysis and Recent XAU/USD Trade and Key Lessons

Welcome to today’s currency analysis! We’re taking a closer look at a recent XAU/USD (gold) trade that ended with notable losses. This example helps us understand the importance of being flexible in the market and managing risks effectively.

Trade Details:**- **Open Price: BUY at 2296

– Close Price: SELL at 2455

In this trade, the gold position faced a substantial loss. This situation teaches us the crucial lesson of setting stop-losses and adapting to changing market conditions to avoid major losses.

### Currency Analysis on Major Pairs – August 29, 2024

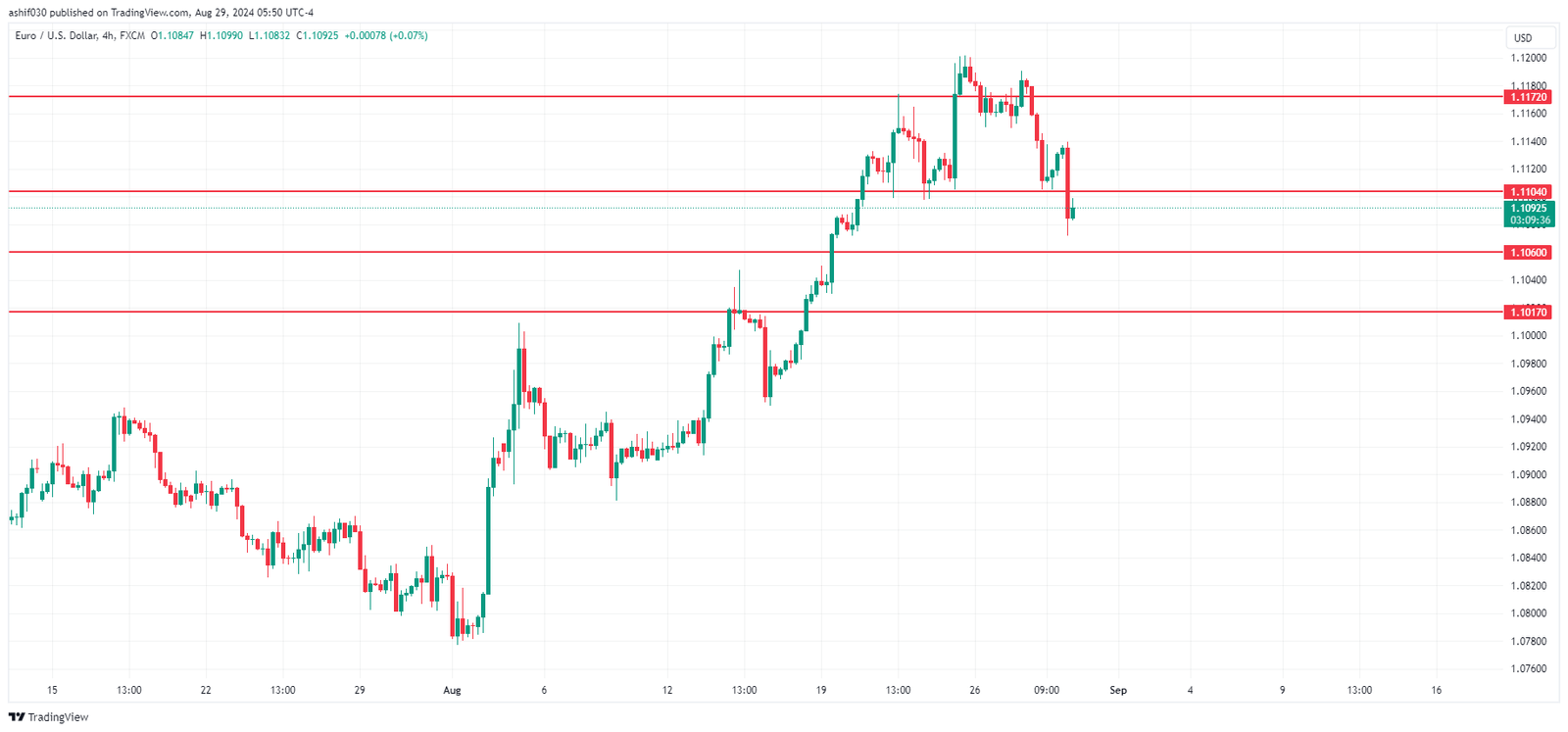

1. EUR/USD Currency Analysis

Technical Indicators:**- **Previous Open: 1.1176

– Previous Close: 1.1120- Change Over the Last Day: -0.50%

Market Overview:

The EUR/USD pair is experiencing pressure due to a stronger dollar and weaker economic data from the Eurozone. Recent data showed Eurozone M3 Money Supply Growth for July increased by 2.3% year-over-year, slower than the expected 2.7%. This weaker-than-expected data is impacting the Euro’s performance.

Trading Recommendations:**- **Support Levels: 1.1104, 1.1060, 1.1017, 1.0950, 1.0905, 1.0884

– Resistance Levels: 1.1172, 1.1275

Currently, the EUR/USD trend is bullish on the hourly chart. After a significant drop, buyers are stepping in. If the price moves higher, watch for resistance around 1.1172. Consider buying with a short stop-loss, and look for selling opportunities if the price reacts at 1.1172.

**Alternative Scenario:**If the price breaks below 1.1104 and stays there, a downtrend could start.

News Feed for Today:

– US FOMC Member Bostic Speaks at 07:00 (GMT+6)- German Consumer Price Index (m/m) at 20:00 (GMT+6)

– US Initial Jobless Claims (w/w) at 20:30 (GMT+6)- US GDP (q/q) at 20:30 (GMT+6)

– US Pending Home Sales (m/m) at 22:00 (GMT+6)- US FOMC Member Bostic Speaks again at 05:30 (GMT+6, next day

2. GBP/USD Currency Analysis

Technical Indicators:

– Previous Open: 1.3254- Previous Close: 1.3191

– Change Over the Last Day: -0.48%

**Market Overview:**The GBP/USD pair is trading near $1.32, showing a significant rise for August. This is due to expectations of different monetary policies between the US and the UK. Weaker US economic data and dovish statements from the Federal Reserve have weakened the dollar, while stronger UK data and the Bank of England’s cautious stance support the pound.

Trading Recommendations:

– Support Levels: 1.3175, 1.3137, 1.3075, 1.2973, 1.2932, 1.2848, 1.2800- Resistance Levels: 1.3306

The GBP/USD trend is currently bullish. After a correction to 1.3175, buyers are taking control. The price could rise towards 1.3306. Monitor resistance levels at 1.3306 for potential selling opportunities.

Alternative Scenario:

If the price falls below 1.3075 and consolidates, the downtrend may resume.

3. USD/JPY Currency Analysis

Technical Indicators:**- **Previous Open: 143.91

– Previous Close: 144.58- Change Over the Last Day: +0.46%

Market Overview:

The Japanese yen is strengthening as expectations of US Federal Reserve rate cuts impact the dollar. Recent statements from the Bank of Japan suggest a possible adjustment in monetary policy if economic conditions support it.

Trading Recommendations:**– **Support Levels: 144.12, 142.69, 142.80, 140.22, 137.26

– Resistance Levels: 145.24, 146.62, 148.29, 150.88, 151.26, 153.80

The USD/JPY pair is showing a bearish medium-term trend. The resistance level at 145.24 is key. If the price tests this level, look for selling opportunities. Buying is not recommended at this time due to current market conditions.

**Alternative Scenario:**If the price moves above the resistance level of 146.48, the uptrend may resume.

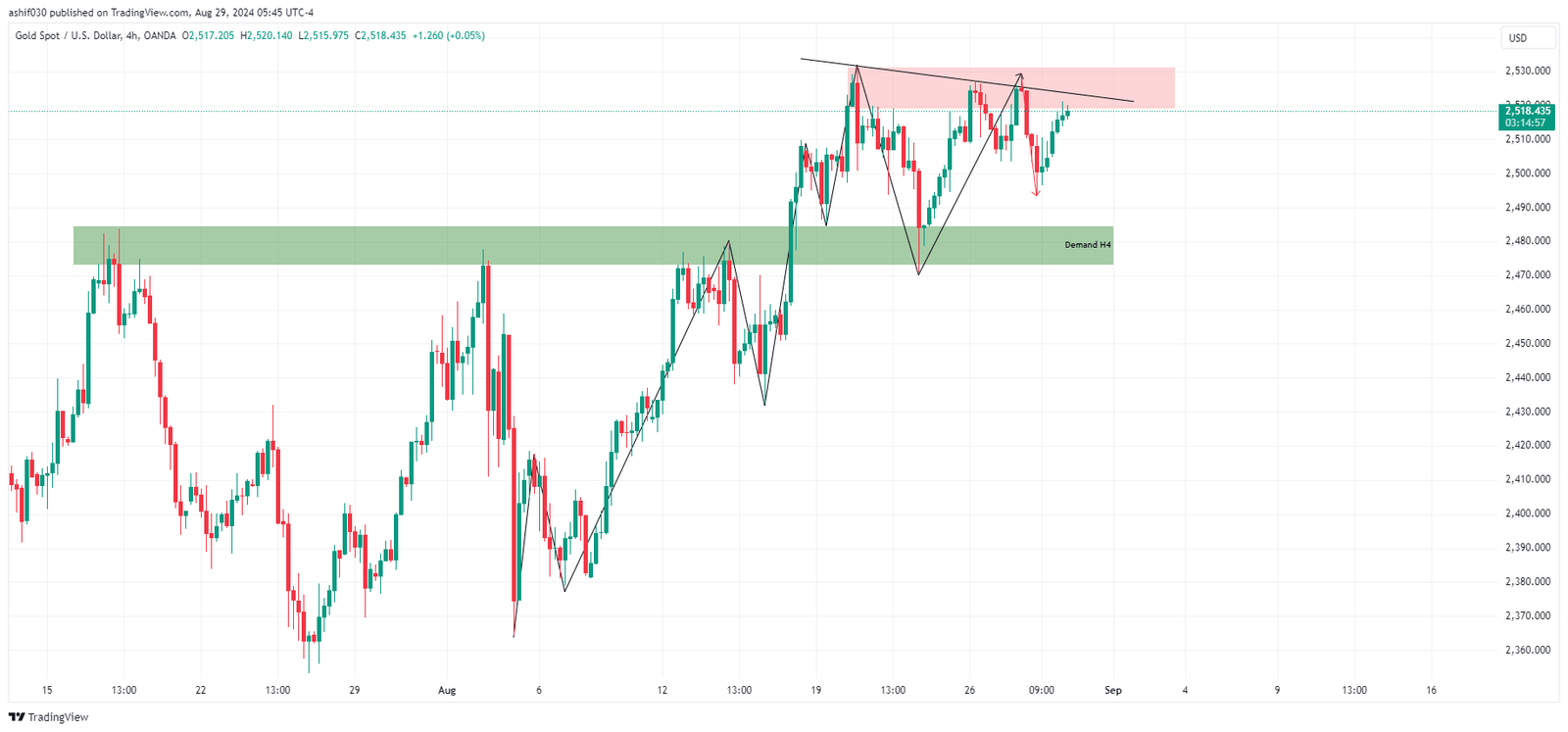

4. XAU/USD (Gold) Currency Pair Analysis

Technical Indicators:

– Previous Open: 2525- Previous Close: 2505

– Change Over the Last Day: -0.79%

**Market Overview:**Gold prices are influenced by expectations of US Federal Reserve rate cuts. Traders expect a 71% chance of a 25bps cut and a 29% chance of a 50bps cut in September. These expectations, combined with dovish Fed statements, are supporting gold prices.

Trading Recommendations:

– Support Levels: 2503, 2494, 2479, 2451, 2440, 2416, 2367, 2343- Resistance Levels: 2522, 2532

Gold is showing a bullish trend. Buyers are active from the support level of 2494, aiming to test resistance at 2522. A move above 2522 could lead to gains towards 2532.

Alternative Scenario:

If the price drops below 2451, a downtrend might follow.

5. USD/CAD Currency Pair Analysis

News Feed for Today:

– US FOMC Member Bostic Speaks at 07:00 (GMT+6)- US Initial Jobless Claims (w/w) at 20:30 (GMT+6)

– US GDP (q/q) at 20:30 (GMT+6)- US Pending Home Sales (m/m) at 22:00 (GMT+6)

– US FOMC Member Bostic Speaks again at 05:30 (GMT+6, next day)

Conclusion

Understanding market trends and staying adaptable are key to successful forex trading. Whether managing trades in gold or navigating major currency pairs like EUR/USD, GBP/USD, and USD/JPY, staying informed with the latest economic news and technical analysis is crucial. Tools like Myfxbook and Forex Factory can help you track market trends and news updates.

Add a Comment

You must be logged in to post a comment