Introduction

In the world of forex trading, mastering Fibonacci analysis is the key to understanding the intricate dynamics of currency markets. Among the multitude of tools available to traders, one of the most intriguing and effective is the Fibonacci sequence. In this comprehensive guide, we will unravel the Fibonacci concept, explore its historical significance, and delve into its practical applications in deciphering forex price movements.

The Fascination of the Fibonacci Analysis Sequence

The Fibonacci sequence, discovered by the 13th-century Italian mathematician Leonardo of Pisa, is a numerical pattern where each number is the sum of the two preceding ones. The sequence begins as 0, 1, 1, 2, 3, 5, 8, 13, 21, and so on. What sets this sequence apart is its connection to the “Golden Ratio,” an approximately 1.618 constant.

Fibonacci Analysis Retracement Levels: Mapping Price Corrections

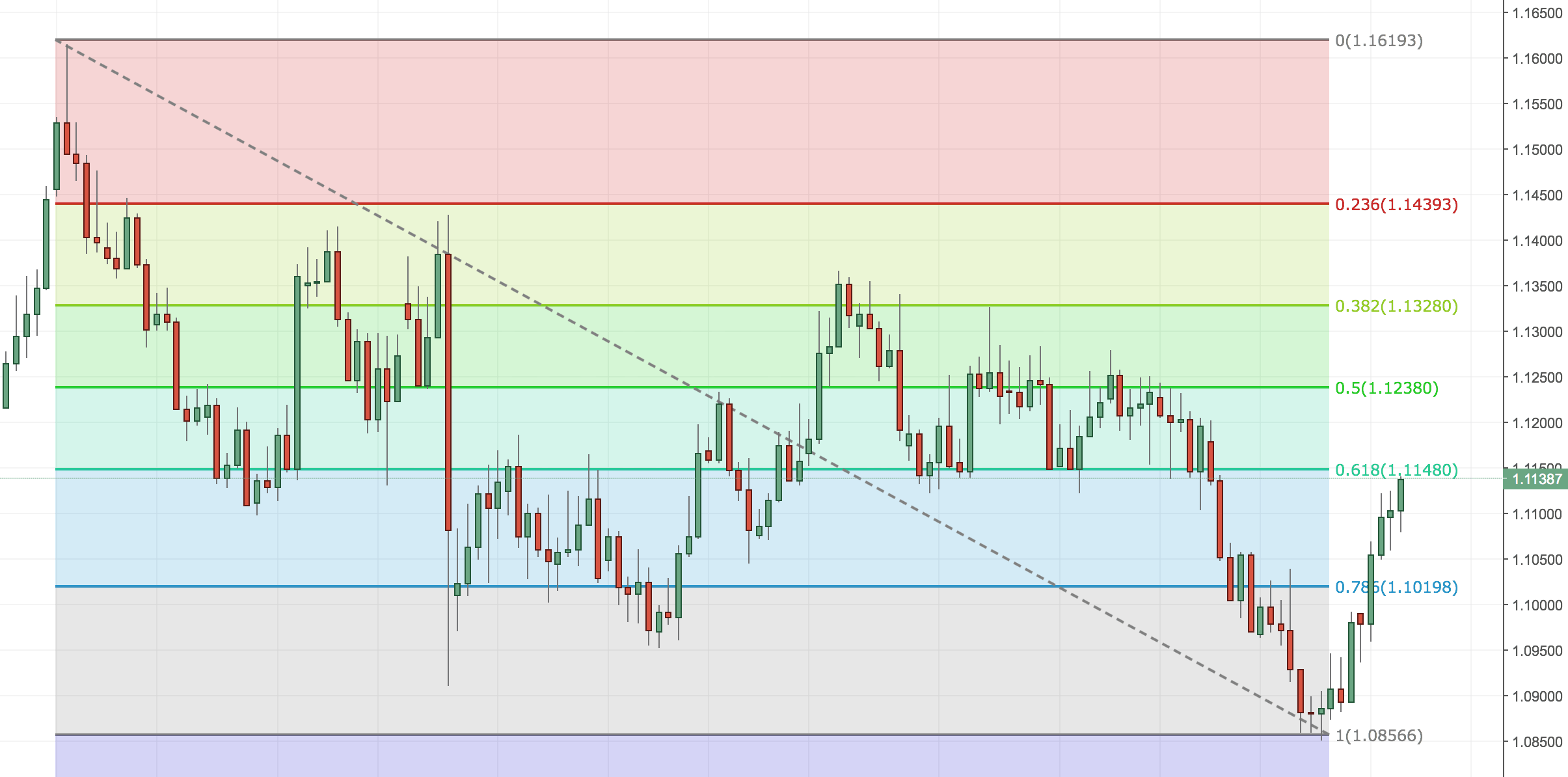

In forex trading, Fibonacci retracement levels are instrumental in identifying potential support and resistance areas. Traders commonly use the following key Fibonacci levels:

23.6%: Representing a shallow pullback, the 23.6% level is often observed in strong trends, indicating a minor correction before the trend resumes.

38.2%: The 38.2% level signifies a slightly deeper retracement and holds significance in gauging potential support or resistance levels.

50%: At the halfway point, the 50% level holds psychological importance and can act as a strong support or resistance point.

61.8%: The “Golden Ratio” level, at 61.8%, is considered a pivotal retracement level, frequently playing a critical role in trend analysis.

100%: The 100% level represents the original price point and serves as a reference.

Fibonacci Extensions: Predicting Future Price Levels

Fibonacci extensions are indispensable in pinpointing potential price targets within an existing trend. The most commonly employed extensions include 161.8%, 261.8%, and 423.6%, which help traders estimate how far a price may travel within a trend.

Practical Application of Fibonacci in Forex Trading

Traders apply Fibonacci in several ways:

Retracement Entry: When a currency pair is in an uptrend or downtrend, traders search for potential reversals or retracements at Fibonacci levels to initiate positions. These retracement zones can provide entry points with a favorable risk-to-reward ratio.

Extension Targets: Fibonacci extensions guide traders in identifying potential target levels when a trend is underway. This knowledge is invaluable for setting profit-taking points.

Confluence with Other Indicators: Fibonacci levels are most powerful when they align with other technical indicators, such as moving averages or trendlines. This confluence enhances the reliability of potential price points.

Risk Management and Caution: While Fibonacci retracement and extension levels are valuable tools, it’s crucial to acknowledge that they are not infallible. Forex trading involves inherent risks, and no tool can guarantee success. To mitigate these risks, prudent risk management practices, such as setting stop-loss orders and position sizing, are essential.

Conclusion: The Fibonacci sequence remains a time-tested and captivating tool in the realm of forex trading. By comprehending the Golden Ratio and the practical applications of Fibonacci retracement and extension levels, traders gain profound insights into potential reversal and target points in currency markets. Nonetheless, success in forex trading requires a holistic strategy, risk management protocols, and a commitment to continuous learning.

Disclaimer: This article is for informational purposes only and does not constitute financial or trading advice. Forex trading carries risk, and it is essential to conduct thorough research, assess your risk tolerance, and consider professional guidance before engaging in the forex market.

Add a Comment

You must be logged in to post a comment