Forex Fundamental News Facts for 11th July, 2024

➖➖➖➖➖➖➖➖➖

[Quick Facts]

➖➖➖➖➖➖➖➖➖

1. Democratic Leaders Challenge Biden to Prove His Ability to Outperform Trump.

2. Macron Urges Mainstream Parties to Forge a Coalition in France.

3. Fed’s Powell Reiterates Expectations for Interest Rate Reductions.

4. BOE’s Pill Unlikely to Support an August Rate Cut.

5. OPEC+ Oil Production Exceeds Quotas, Posing Threat to Prices.

6. Traders Anticipate Fed Rate Cut Amid Key Inflation Report on Thursday.

7. China’s Central Bank Prepares for Rare Bond Market Intervention.

8. New Zealand Dollar Declines Following RBNZ’s ‘Mini Pivot’.

➖➖➖➖➖➖➖➖➖

[News Details]

➖➖➖➖➖➖➖➖➖

U.S. Democratic leaders are urging President Joe Biden to demonstrate a clear path to victory against Trump in the upcoming general election. Recent polls indicate that Biden is slipping behind Trump in critical swing states, causing growing concern among Democrats. Additionally, top union leaders express skepticism about Biden’s candidacy. During a closed-door meeting, they questioned his ability to win the presidency and pressed his campaign for strategies to defeat Trump.

➖➖➖➖➖➖➖➖➖

French President Emmanuel Macron has called on mainstream political parties to unite and form a strong majority in the National Assembly. After the July 7 snap election, the left-wing coalition New Popular Front (NFP) surprisingly won the most seats but failed to secure a majority. Macron’s centrist camp came second, and the National Rally third. Although not explicitly excluding any party, Macron’s reference to “republican values” suggests a preference for excluding far-left or far-right parties. The challenge lies in breaking the parliamentary gridlock, with options ranging from a broad coalition to a technocratic government.

➖➖➖➖➖➖➖➖➖

Federal Reserve Chair Jerome Powell emphasized the central bank’s confidence in inflation returning to its 2% target. He assured that waiting for inflation to fall to 2% is unnecessary before implementing rate cuts. However, Powell acknowledged other risks beyond inflation, including cooling labor market conditions. His speech downplayed political factors, reinforcing market expectations of a rate cut in September. The CME FedWatch tool indicates a 73.3% likelihood of a 25bp rate cut. The key question now is whether the Fed will clearly signal its readiness to cut rates at the July meeting.

Inflation Trends: Inflation has significantly decreased from its peak, indicating a soft landing. The decline is attributed to the waning effects of commodity price shocks and the gradual normalization of global economic activity. Sectoral shortages that contributed to inflation have been resolved.

Labor Market Strength: Despite cooling down, the labor market remains robust. Tight labor markets are now the primary drivers of inflation. However, signs suggest that this tightness is easing.

Unemployment and Job Confidence: The ratio of job vacancies to unemployment has returned to pre-pandemic levels. Simultaneously, voluntary quits have declined, reflecting workers’ reduced confidence in finding better employment opportunities.

Baseline Forecast: Governor Cook’s baseline forecast, shared by many experts, predicts that inflation will continue moving toward the target without a significant rise in unemployment1.

➖➖➖➖➖➖➖➖➖

The Bank of England (BOE) is likely to lower its key rate in the future. However, recent data suggests that inflation may persist longer than anticipated. BOE Chief Economist Huw Pill highlighted uncomfortable strength in underlying inflation due to rising service prices and wages. While new data will be available before the August meeting, policymakers should approach rate decisions with caution and realism. Pill’s remarks indicate reluctance to back an August rate cut, although he doesn’t rule out future cuts. Traders adjusted their bets accordingly, with less than a 50% chance of an August rate cut.

The UK economy rebounded strongly in early 2024 after a technical recession in the second half of 2023. GDP grew by an impressive 0.7% quarter-on-quarter in the January-March period. However, growth stalled in April, prompting investors to closely monitor May data for signs of recovery or further weakness in the second quarter.

GDP Expectations: Analysts forecast a 0.2% month-on-month rise in GDP for May, pushing the annual rate up to 1.2%. Both the services sector and industrial production are also expected to expand by 0.2% month-on-month.

UK’s Position: Despite the turnaround, the UK’s GDP growth has not fully returned to its pre-Covid trend. Among major advanced economies, Britain lags behind only Germany in post-pandemic recovery.

Bank of England (BoE) Outlook: The UK economy is not at risk of overheating, and the May figures are unlikely to hinder the BoE from starting its easing cycle. Investors have priced in a 60% probability of a 25-basis-point rate cut at the August 1 meeting, with another cut expected by year-end.

Brighter Prospects: The BoE’s rate-cut expectations have not significantly impacted the pound. The British currency is the second-best performer in 2024, partly due to the brightening economic outlook under the new government led by Prime Minister Keir Starmer.

Pound’s Movement: The pound is testing the $1.2800 level, aiming to reclaim the March peak of $1.2893. However, disappointing growth numbers could lead to a dip toward the 50-day moving average at $1.2689.

GDP and BoE Rate Cut: Overall, GDP readings are not expected to significantly influence BoE rate cut bets. Attention will shift to the CPI report for June, which could seal the deal for an August move by the Bank of England if inflation remains close to 2.0% and the core rate declines further.

➖➖➖➖➖➖➖➖➖

Key OPEC+ countries (Iraq, Kazakhstan, and Russia) continue to exceed output limits. Despite Russia’s production cuts in June, the combined supply from these countries remains significantly above the quotas set at the beginning of the year. The International Monetary Fund estimates that current oil prices may still be too low for OPEC+ members, including Saudi Arabia. To cover government expenditures, oil prices close to $100 a barrel would be necessary. Failure to implement production cuts poses a further disadvantage for crude oil, which has experienced a price drop of over $2 recently.

Oil Market Overview:

Oil prices recently rallied due to a positive weekly inventory report from the EIA. US commercial crude oil inventories declined significantly, despite falling exports and growing imports. Refinery activity increased, leading to higher crude oil input. Gasoline inventories fell, but the 4-week average implied gasoline demand remains strong. This eases concerns about US gasoline demand during the driving season. Additionally, the US Department of Energy plans to buy more US-produced sour crude oil for the Strategic Petroleum Reserve at a capped price.

OPEC’s Outlook and Supply Trends:

OPEC’s latest monthly oil market report maintains aggressive demand growth forecasts. They expect demand to rise by 2.25m b/d YoY in 2024 and an additional 1.85m b/d in 2025. Non-OPEC+ supply growth remains unchanged. OPEC crude oil output declined in June, mainly driven by Saudi Arabia and Iraq. Meanwhile, OPEC+ output (including Russia) also fell. The IEA will release its monthly oil market report soon.

European Natural Gas and TTF Positioning:

European natural gas prices are under pressure as supply concerns ease. European storage is 80% full. Investment funds reduced their net long positions in TTF, but the market fundamentals remain bearish. Despite this, funds still hold a significant net long in TTF, which seems contradictory to the overall trend.

LME Copper Inventories and Chinese Exports:

LME copper inventories have surged to their highest level since 2021, with most inflows going to South Korea and Taiwan. Chinese copper exports hit an eight-year high in May, even though domestic demand lags. China, usually a net importer of refined copper, exports when profitable. Chinese metal now accounts for over 45% of copper stored in LME warehouses. Total on-warrant stocks rose, while cancelled warrants decreased. The cash/3m spread reflects a comfortable prompt market.

Ukraine Grain Shipments:

Ukraine’s Agriculture Ministry reports a significant rise in grain and legume exports in the 2024/25 season. Compared to the same period last year, corn shipments increased by 60% YoY, and wheat exports rose by 51% YoY. The surge in exports is driven by large beginning stocks for the season.

➖➖➖➖➖➖➖➖➖

Inflation Trends:

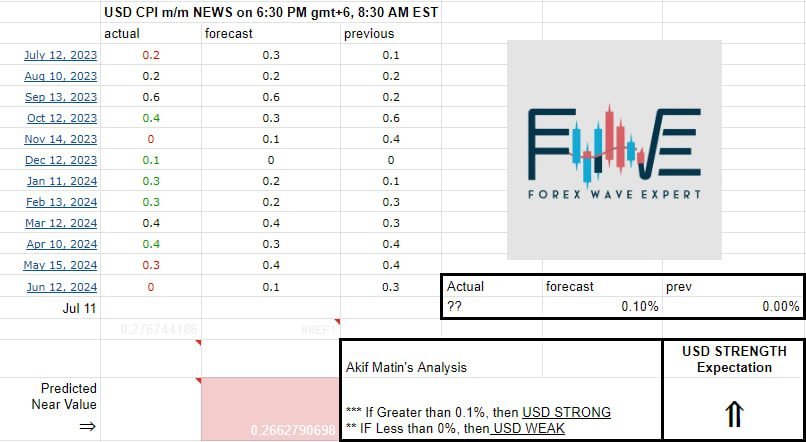

The consumer price index (CPI) for June is anticipated to rise by 0.1% month over month and 3.1% year over year.

Core CPI, which excludes volatile food and energy prices, is expected to increase by 0.2% from May and 3.4% since June last year.

Despite recent cooling, inflation remains elevated relative to the Federal Reserve’s (Fed) 2% target.

Labor Market Insights:

Unemployment ticked up to 4.1% in June, signaling a potential shift in labor market dynamics.

Historically, unemployment has been very low at 4.1%, but there are signs that it is gradually rising.

The Fed is now paying more attention to trends rather than absolute levels, which may influence rate cut decisions.

Focus Areas:

Analysts will closely examine components of the CPI index, particularly shelter and medical care services.

Medical services play a crucial role in the personal consumption expenditures index (PCE), the Fed’s preferred inflation measure.

Market Impact:

Markets have rallied in July, with growing confidence in an impending rate cut.

The S&P 500 reached a historic high.

Fed funds futures pricing suggests a rate hold in July, followed by a cut in September.

The CPI report’s impact on the market may be limited due to expectations and near-term pricing constraints.

Investor Considerations:

Investors should monitor inflation trends and adjust their strategies accordingly.

The potential rate cut could impact investment decisions.

According to our prediction, we’re expecting a STRONG USD on CPI News today.

➖➖➖➖➖➖➖➖➖

The People’s Bank of China (PBoC) has raised concerns about a bubble forming in the country’s sovereign bond market. Now, it has taken decisive action, signalling its intent to intervene directly in the market for the first time in decades.

Market Intervention: The PBoC has struck deals with institutions to borrow several hundred billion renminbi of long-dated bonds. These bonds will be sold into the market to manage demand. The central bank aims to prevent yields from plummeting to record lows, which could pose risks for investors and financial stability.

Yield Rebound: The PBoC’s actions have already had an impact. Yields on 10-year debt, which reached an all-time low of 2.18% last week, climbed above 2.3% after the central bank announced temporary bond repurchases. The goal is to reduce volatility in interbank interest rates.

Economic Context: China’s economy faces challenges, including a property downturn and sluggish price growth. Investors seeking safe havens have flocked to sovereign bonds, exacerbating the situation. However, some analysts doubt that the PBoC can indefinitely suppress demand for bonds.

Transitioning Strategies: The PBoC’s bond market intervention reflects a shift in its approach. Previously, it focused on controlling lending supply to influence banks. Now, as credit demand wanes and liquidity shifts to other assets like bonds, the PBoC adapts its strategies.

Long-Term Outlook: China plans to issue trillions of renminbi in long-dated bonds to increase central government leverage and spending. Currently, the PBoC holds Rmb1.52tn in government bonds, mostly with shorter maturities. The challenge lies in managing the bond market effectively.

Similarities to Japan: The PBoC’s approach shares similarities with Japan’s yield curve control. While the Bank of Japan aimed to set a ceiling for yields, the PBoC seeks to establish a floor. However, critical operational details remain undisclosed.

Balancing Act: Experts caution that pushing up yields in China’s deflationary environment is difficult. New loan growth has slowed unexpectedly. The PBoC also faces tension with the finance ministry, which benefits from lower yields for bond issuance.

Economic Impact: Although influencing long-term yields may have limited direct effects on corporate and household borrowing, the PBoC’s actions remain crucial for economic stability. Short-term policy rates and yield trends will continue to shape China’s economic outlook.

➖➖➖➖➖➖➖➖➖

Exchange Rate and RBNZ’s Assessment:

The Pound to New Zealand Dollar exchange rate has surged to 2.10, its highest level since May, capitalizing on NZD weakness. The Reserve Bank of New Zealand (RBNZ) predicts that “headline inflation will return to the 1 to 3 per cent target range in the second half of this year.” The RBNZ acknowledges the impact of restrictive monetary policy (high interest rates) but expects a gradual easing in response to declining inflation pressures. Investors responded swiftly, with bond yields falling and the NZD weakening, anticipating a future with lower interest rates.

Dovish Communication and Economic Concerns:

The RBNZ surprised markets by maintaining rates at 5.50% overnight while adopting a dovish tone in communication. Despite lacking hard data for Q2, the RBNZ expressed confidence in disinflation. However, the central bank remains concerned about the adverse effects of high interest rates on economic activity, as evidenced by recent “recessionary” business confidence data. Economists anticipate a cutting cycle to begin in November, with economic contraction and rising unemployment expected.

Risk of Rate Cuts and Inflation Outlook:

ANZ economists suggest that the first rate cut may occur in November rather than February, reflecting increased risks. ING Bank warns of substantial upside risks to New Zealand’s non-tradable inflation. All eyes are on next week’s second-quarter inflation data, which could counter recent NZD weakness if it exceeds expectations. The RBNZ projects a decline in the annual inflation rate from 4% to 3.6%.

➖➖➖➖➖➖➖➖➖

🔥Important News releases on This WEEK :

10/07 Wed 8:30pm USD Crude Oil Inventories

10/07 Wed 11:01pm USD 10-y Bond Auction

11/07 Thu 12:00pm GBP GDP m/m

11/07 Thu 6:30pm USD CPI m/m,y/y & Unemployment Claims

11/07 Thu 11:01pm USD 30-y Bond Auction

12/07 Fri 12:00am USD Federal Budget Balance

12/07 Fri 6:30pm CAD Building Permits m/m

12/07 Fri 6:30pm USD PPI m/m & Core PPI m/m

12/07 Fri 8:00pm USD Prelim UoM Consumer Sentiment

N.B. Time mentioned here is on Gmt +6

➖➖➖➖➖➖➖➖➖

➖➖➖➖➖➖➖➖➖

Sources :

– CNBC, Bloomberg, Reuters, Fastbull, Yahoo Finance, CNN, ForexFactory News, Myfxbook News etc

Prepared to you by “Akif Matin“

Join our FWE telegram, Facebook Page & Group

➖➖➖➖➖➖➖➖➖

Add a Comment

You must be logged in to post a comment