Forex Fundamental News Facts for 25th April, 2024

[Quick Facts]

- Israeli warplanes pound northern Gaza Strip for a second day.

2. U.S. durable goods orders show firms cautious about capital spending.

3. Yen falls below 155 per dollar, not enough for BOJ to intervene.

4. Canada’s retail sales are flat in the first quarter of 2024.

5. Biden has no advantage across key swing states.

6. [U.S.] EIA: Crude Oil Inventories Drop Sharply.

7. RBA’s Next Move Amid US GDP Release.

8.Senate Sends Aid Package With Iran Oil Sanctions To Biden.

9. S&P and Nasdaq Futures Rise on Technology Sector Strength and Positive Earnings Sentiment

10. A New Reality of 7% Mortgage Rates Could Be Setting in, Top Economist Says.

Israeli Military Actions in Gaza:

For two consecutive days, Israeli aircraft have been heavily bombing the northern Gaza Strip, disrupting a period of relative peace. A representative for Prime Minister Benjamin Netanyahu’s administration announced that Israel is proceeding with its intention to initiate a ground assault in Rafah, although no specific timeline was provided.

Despite pleas from Western nations, including its ally the United States, for Israel to refrain from attacking Rafah, the U.S. National Security Advisor, Jake Sullivan, confirmed that discussions with Israel regarding Rafah are ongoing, with further meetings between officials from both countries anticipated soon.

U.S. Durable Goods Orders Indicate Business Spending Caution:

The U.S. Commerce Department reported a 2.6% increase in U.S. durable goods orders in March compared to the previous month, surpassing market predictions and outperforming the revised previous figure, which was adjusted from 1.3% to 0.7%. However, on a year-over-year basis, durable goods orders experienced a 2.2% decrease, marking the most significant drop since the pandemic began.

Orders for U.S. core capital goods, which exclude defense capital goods and aircraft, saw a modest rise of 0.2% in March compared to February, aligning with market forecasts. The previous figure was revised downward from 0.7% to 0.4%. Year-over-year, these orders decreased by 1.2%, the largest annual decline since the pandemic. This data is closely monitored as it reflects business investment plans.

The second year of growth in core capital goods orders indicates some stabilization in equipment investment, which has negatively impacted GDP in four of the past five quarters. This trend suggests businesses are exercising caution in capital expenditure, although some are still aiming to enhance productivity amidst increasing input costs.

Yen Drops Below Key Level, BOJ Does Not Intervene:

For the first time since June 1990, the yen has dropped below the crucial 155 per U.S. dollar mark, sparking speculation about potential intervention by Japanese authorities. Japanese officials have repeatedly stated their readiness to address excessive yen volatility if needed.

Japan’s Finance Minister, Shunichi Suzuki, stated on Tuesday that preparations have been made for Tokyo to intervene in the foreign exchange market if necessary. Last week, the U.S., Japan, and South Korea issued a joint statement pledging to continue close consultations on foreign exchange market developments, recognizing Japan and South Korea’s grave concerns about the recent sharp depreciation of their local currencies.

However, the Bank of Japan (BOJ) did not take action as the 155 level is not of significant importance to the Ministry of Finance and the BOJ, although it may be relevant to options traders. Japanese authorities consider the yen’s value against a range of currencies, not solely against the dollar. Furthermore, as the yen remained stable on the day, there was no incentive for authorities to intervene.

The Japanese yen is at its lowest in 34 years, which puts pressure on Kazuo Ueda, the Bank of Japan’s Governor. He needs to carefully manage the country’s monetary policy to avoid disrupting the currency while moving away from very low interest rates.

Ueda wants to avoid a repeat of 2022 when the yen fell sharply due to comments made by the previous governor. This fall forced Tokyo to step in and support the yen. Ueda has said that there won’t be any big increases in interest rates because Japan’s economy is weak. This has led people to believe that interest rates will stay low for a while, which has caused the yen to fall further.

Despite hints from Ueda that borrowing costs might increase later this year, the yen has continued to slide. The Bank of Japan is expected to keep interest rates steady at a meeting ending on Friday. They predict that inflation will stay close to their 2% target over the next few years due to steady wage increases.

The yen fell below 155 to the dollar on Thursday, a level that could trigger intervention by the authorities. The dollar reached its highest level against the yen since mid-1990 on Wednesday, before falling back slightly.

Finance Minister Shunichi Suzuki said the government will keep a close eye on the markets and take appropriate action. Chief Cabinet Secretary Yoshimasa Hayashi also said the authorities are ready to act if needed. He stressed the importance of stable currency rates and said big fluctuations are not good.

People are watching to see if Ueda will suggest that interest rates might increase soon. A former Bank of Japan official, Nobuyasu Atago, said the bank won’t raise rates just to stop the yen from falling. But if the yen’s movements have a big effect on the economy and prices, the bank will respond. This could lead people to think that an interest rate hike might happen sooner, which could help to support the yen.

Some people are worried about a repeat of September 2022, when Japan had to support the yen after it fell sharply. This was triggered by comments from the previous governor about keeping policy very loose. In Japan, it’s the Ministry of Finance, not the Bank of Japan, that decides when to step in and support the currency. This decision is very political and usually reflects the government’s views.

There’s no agreement within the ruling Liberal Democratic Party about whether it’s time to support the yen. The party hasn’t started discussing what level of the yen would trigger intervention, but if the yen falls towards 160 to the dollar, policymakers might feel they need to act.

People are also watching to see if the Bank of Japan will change its guidance from March about buying government bonds at the current rate of 6 trillion yen per month. If this guidance is removed or changed, people might think the bank will soon reduce its bond buying, which would allow bond yields to rise. Alternatively, the bank might announce a small reduction in its bond buying plans for May.

Last week, Ueda said the Bank of Japan will eventually start to reduce its balance sheet, regardless of the state of the economy. But he emphasized that the bank won’t change the pace of bond buying dramatically for now and won’t use the size of its asset purchases as a tool for monetary policy.

Canada’s Retail Sales Remain Unchanged in Q1 2024:

Statistics Canada data revealed that retail receipts remained unchanged in March. Given a 0.3% drop in January sales, this suggests that sales were flat for the first quarter of this year, representing the slowest growth rate since Q2 2023. The decrease in retail sales in February was primarily due to a fall in gas station sales and an increase in auto sales. Excluding these two categories, core retail sales remained the same. Overall, the data indicates that consumers are reducing expenditure on non-essential items, including clothing, accessories, and sporting goods.

Biden Lacks Advantage in Key Swing States:

Among the seven crucial swing states, Biden only has a 2-point lead in Michigan, while he is slightly behind Trump in Pennsylvania and Wisconsin and trails even more in Georgia, Arizona, Nevada, and North Carolina.

This suggests that Biden’s recent surge in support in key state polls has largely evaporated. The pessimistic economic outlook of American voters has affected Biden’s election prospects. Survey respondents expressed negative views about the current economic situation, a long-standing major concern. Most swing state voters anticipate worsening economic conditions in the coming months, and less than one in five respondents believe that inflation and borrowing costs will decrease by year-end. Despite the job market’s resilience, only 23% of respondents are optimistic that employment conditions will improve during the same period.

These findings indicate that the two candidates have largely returned to the state of affairs prior to Biden’s State of the Union address. Biden’s powerful speech appears to have contributed to his best performance in the March survey since the poll’s inception in October of the previous year.

[U.S.] EIA: Crude Oil Inventories Drop Sharply:

On April 24, the U.S. Energy Information Administration (EIA) reported its weekly crude oil inventory data. For the week ending April 19, U.S. EIA Crude Oil Inventories fell by 6.4 million barrels, contrasting with the anticipated increase of 0.825 million barrels and the prior increase of 2.735 million barrels.

The average daily input for U.S. crude oil refineries was 15.9 million barrels for the week ending April 19, 2024, marking a decrease of 42,000 barrels per day from the previous week. Gasoline production experienced a decline, averaging 9.1 million barrels per day, while distillate fuel production saw an increase, averaging 4.8 million barrels per day.

According to the latest EIA inventory report, U.S. commercial crude oil inventories (excluding the Strategic Petroleum Reserve) dropped by 6.4 million barrels from the previous week. Current U.S. crude oil inventories stand at 453.6 million barrels, approximately 3% below the five-year average. Total motor gasoline inventories decreased by 600,000 barrels from the previous week and are about 4% below the five-year average. Finished gasoline stocks saw an increase last week, while blending components inventories saw a decrease.

Distillate fuel inventories increased by 1.6 million barrels last week and are approximately 7% below the five-year average. Propane/propylene inventories increased by 1 million barrels last week, which is 14% higher than the five-year average. Last week, total commercial petroleum inventories decreased by 3.8 million barrels.

U.S. crude oil imports averaged 6.5 million barrels per day last week, an increase of 36,000 barrels from the previous week. Over the past four weeks, crude oil imports have averaged about 6.5 million barrels per day, slightly above the four-week level of the same period last year.

RBA’s Next Move Amid US GDP Release:

Despite the market risk sentiment, the Australian inflation figures, which were higher than expected, could mitigate potential losses. The Australian annual inflation rate dropped from 4.1% to 3.6% in Q1 2024, while consumer prices rose by 1.0% in the same quarter, following a 0.6% increase in Q4 2023.

The Reserve Bank of Australia (RBA) may reconsider increasing interest rates in May after dismissing further hikes in March. The RBA’s next interest rate decision will be announced on May 7, which is likely to attract significant attention.

On April 25, there will be no economic indicators from Australia due to ANZAC Day. However, Australian producer price figures for Q1 2024 will be released on April 26. If these figures exceed expectations, it could lead to discussions about RBA rate hikes.

US GDP numbers for Q1 2024 will be released on April 25.

To our concern, there is a high chance that US Advance GDP q/q data may have a small rise, and it will be around 3.36%. If that happens, after the news release USD will act much stronger and it may reflect directly on commodity supplies (bearish gold)

To our concern, there is a high chance that US Advance GDP q/q data may have a small rise, and it will be around 3.36%. If that happens, after the news release USD will act much stronger and it may reflect directly on commodity supplies (bearish gold)

Alternatively, if the value falls below 2.5%, then USD will act much weaker and it may directly reflect on commodity demands (bullish gold).

The US economy is expected to grow by 2.5% quarter-on-quarter in the first quarter, following a 3.4% growth in Q4 2023. If the actual figures exceed expectations, it could lower the likelihood of a Federal Reserve rate cut in September.

The AUD/USD exchange rate trends will depend on the US GDP data and the Personal Income and Outlays Report. If the US GDP figures are higher than expected and inflation remains high, it could affect investor expectations of a September Fed rate cut. However, Australian producer price numbers will also influence the RBA’s rate path and policy divergence.

The AUD/USD exchange rate is currently below the 50-day and 200-day Exponential Moving Averages (EMAs), indicating bearish price signals. If the Aussie dollar moves through the 50-day EMA, it could reach the 200-day EMA and the $0.65760 resistance level. If it breaks above this level, it could reach the $0.66 level. Conversely, if the AUD/USD exchange rate drops below the $0.64500 level, it could reach the $0.64582 support level. If it falls through this level, it could reach the $0.62713 support level. Given a 14-period Daily Relative Strength Index (RSI) reading of 49.03, the AUD/USD could drop to the $0.63500 level before entering oversold territory.

Senate Sends Aid Package With Iran Oil Sanctions To Biden:

The U.S. Senate has voted to send a foreign aid package to President Joe Biden. This package includes sanctions on Iran’s oil sector, which Biden has said he will sign into law.

The bill, passed with a 79-18 vote, expands sanctions to include foreign ports, vessels, and refineries that knowingly process or ship Iranian crude oil in violation of existing U.S. sanctions. It also extends secondary sanctions to cover all transactions between Chinese financial institutions and sanctioned Iranian banks used to buy petroleum and oil products.

The legislation also provides aid for Ukraine, Israel, and Taiwan. It requires an annual check to see if Chinese financial institutions have violated sanctionable conduct. According to a report by the House Financial Services Committee, 80% of Iran’s roughly 1.5 million barrels per day of exports go to China to be refined by small independent refineries known as “teapots.”

Analysts believe that Biden is likely to use the waiver authority built into the sanctions and could choose to avoid strict enforcement of the sanctions, which could lead to a rise in oil and gasoline prices. Bob McNally, president of consultant Rapidan Energy Group and a former White House official, said that President Biden will use any flexibility he has to ensure no major disruption in Iranian crude oil happens before the election. He said the White House’s top priority is to prevent an oil price spike this year.

A person familiar with the matter said the administration is analyzing the legislation, but no impact on oil markets is expected before the fall. The decision to waive the sanctions could change if Iran is seen as increasing its aggression toward Israel or continuing work on a nuclear weapon, said Kevin Book, managing director for ClearView Energy Partners LLC. ClearView has said the sanctions could add as much as $8.40 a barrel to global prices.

Ben Cahill, a senior fellow with the Center for Strategic and International Studies, said it’s hard to stop oil trade involving independent refineries because these companies don’t have a connection to the U.S. financial system. He said the key question is how tough the White House will be on enforcing sanctions in an election year.

S&P and Nasdaq Futures Rise on Technology Sector Strength and Positive Earnings Sentiment:

Investors are keenly awaiting upcoming economic data to understand the Federal Reserve’s potential interest rate path.

Tesla’s stock saw a significant premarket increase of 9.9% after announcing plans for new, affordable models, which also positively impacted other electric vehicle stocks like Lucid Group, Nikola, and Nio. Other growth stocks, including Amazon.com, Microsoft, Nvidia, Meta Platforms, and Snap, also saw gains.

The corporate earnings season is in full swing, with companies like Boeing, General Dynamics, and Biogen set to report their quarterly results. The market appears to be recovering from the previous week’s instability caused by Middle East tensions and a reassessment of the Federal Reserve’s rate-cut expectations.

Analysts predict a 6% year-on-year growth in adjusted blended earnings for the quarter. Investors are also awaiting the release of the Personal Consumption Expenditures (PCE) index for March, a crucial inflation measure for the Fed’s monetary policy decisions.

Money markets have revised their interest rate cut expectations, now pricing in about 41 basis points of cuts this year, compared to 150 basis points at the beginning of the year. Investors are also monitoring durable goods data for March and premarket movements in Dow e-minis, S&P 500 e-minis, and Nasdaq 100 e-minis.

Visa’s stock rose 2.8% in premarket trading after its second-quarter results surpassed Wall Street estimates, indicating robust consumer spending despite a potentially slowing economy. Texas Instruments also saw a 7.3% increase following its forecast of second-quarter revenue above analysts’ expectations, suggesting a rise in demand for analog semiconductors.

The rise in S&P 500 and Nasdaq futures reflects investor optimism, fueled by strong earnings from growth stocks like Tesla. As the earnings season progresses and more economic data is released, market participants remain alert to changes in macroeconomic conditions and central bank policies.

A New Reality of 7% Mortgage Rates Could Be Setting in, Top Economist Says:

Carl Riccadonna, chief U.S. economist at BNP Paribas, suggests that the 10-year Treasury yield is a key determinant of mortgage rates.

Riccadonna points out that homebuyers are realising that mortgage rates will not revert to the low levels seen during the pandemic due to the slow economic recovery and persistent inflation pressures. As a result, mortgage rates are expected to remain high.

Despite a decrease in inflation, mortgage rates have started to rise due to higher-than-expected consumer price index reports and the Federal Reserve’s reluctance to cut interest rates. Fed Chair Jerome Powell has indicated that if inflation continues, interest rates will be maintained at their current levels as needed.

Riccadonna describes the disinflation process as a three-act structure, with the current phase being the “shelter inflation” story. He anticipates further disinflation in the housing market.

While it’s uncertain whether mortgage rates will reach the 8% mark again, a level not seen in over two decades, it’s clear that home affordability has become a significant issue. The cost of homeownership is at a record high, and the salary required to purchase a starter home has nearly doubled since the pandemic began. This is not solely due to mortgage rates; home prices have also increased significantly during the pandemic. A shortage of sellers and an existing housing shortage have prevented prices from falling.

Riccadonna notes that higher mortgage rates significantly impact affordability, making housing the least affordable it’s been since the early 1980s. The current housing market situation, characterized by high inflation and high mortgage rates, is reminiscent of the early 1980s

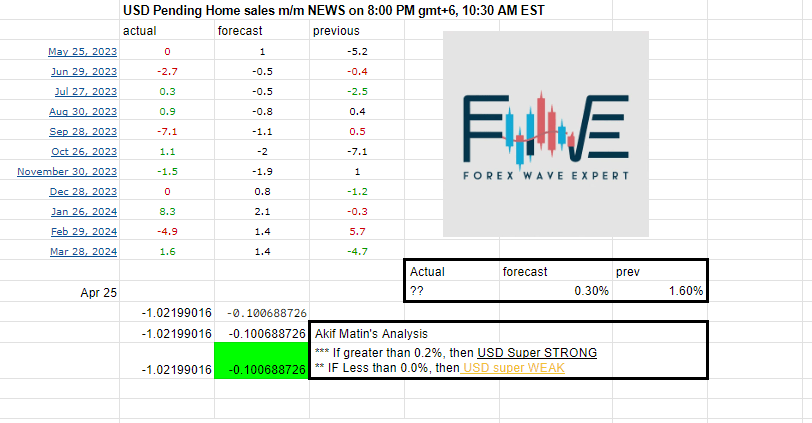

To our concern, there is a high chance that US pending home sales data will be less , and it will be around -0.1% or 0.00. If that happens, after the news release USD will act much weaker and it may reflect directly on commodity demands (bullish gold)

To our concern, there is a high chance that US pending home sales data will be less , and it will be around -0.1% or 0.00. If that happens, after the news release USD will act much weaker and it may reflect directly on commodity demands (bullish gold)

Alternatively, if the value rises above 1.6%, then USD will act much stronger and it may directly reflect on commodity supplies (bearish gold).

➖➖➖➖➖➖➖➖➖

🔥News releases on This WEEK :

25/04 Thu AUD+NZD Bank Holiday

25/04 Thu 6:30pm USD Advance GDP q/q & Unemployment Claims

25/04 Thu 8:00pm USD Pending Home Sales m/m

26/04 Fri Tentative JPY Monetary Policy Statement

26/04 Fri 6:30pm USD Core PCE Price Index m/m

26/04 Fri 8:00pm USD Revised UoM Consumer Sentiment

N.B. Time mentioned here is on Gmt +6

➖➖➖➖➖➖➖➖➖

Sources :

– CNBC, Bloomberg, Reuters, Fastbull, Yahoo Finance, CNN, ForexFactory News, Myfxbook News etc

Prepared to you by “Akif Matin“

Join our FWE telegram, Facebook Page & Group

Add a Comment

You must be logged in to post a comment