Impulse Waves: Unlocking the Magic of Elliott Waves – Let’s Explore Impulse Moves and Simple Rules

Welcome to the fifth chapter of our journey into the world of Elliott Waves! In this part, we’re diving into something powerful – Impulse Waves. These are the big moves in the market, and we’ll also touch on some essential rules to make sense of it all.

**Getting the Basics Right:**

To start, remember, Elliott Waves are like a roadmap for predicting where prices might go. Ralph Nelson Elliott, the brain behind this theory, believed that prices move in cycles and patterns, reflecting what traders collectively think and feel.

**Cracking the Code: Basic Rules:**

**Cracking the Code: Basic Rules:**

Before we jump into Impulse Waves, let’s quickly review some basic rules:

1. **Waves 1, 3, and 5 – The Trendsetters:** These waves are where the main action happens. Think of them as the driving force, made up of five smaller waves.

2. **Wave 2 – Corrective, but Not Too Much:** After the first wave, we get a breather – a corrective phase. But it shouldn’t erase everything from the first wave, usually around 50% or less.

3. **Wave 3 – The Power Move:** This one is a powerhouse. The strongest and longest wave, showing a clear direction.

4. **Wave 4 – Corrective, Again:** Another breather, but not as much as the second wave. It corrects a bit after the strong Wave 3.

5. **Wave 5 – The Closer:** The final act. It’s either another strong move or forms a specific pattern.

**Now, Let’s Talk Impulse Waves:**

Alright, the star of the show – Impulse Waves. These are the big, sustained movements, and they have five parts:

1. **Wave 1 (Impulse):** This starts a new trend. Think of it as the early buyers making their move.

2. **Wave 2 (Corrective):** After the first wave, there’s a bit of a step back. People take profits, and it corrects around 50% of the first wave.

3. **Wave 3 (Impulse):** Here comes the heavy hitter. The biggest and longest wave, as more folks join the trend.

4. **Wave 4 (Corrective):** After that strong move in Wave 3, there’s a bit of a pullback. But it doesn’t go as far as Wave 2.

5. **Wave 5 (Impulse or Ending Diagonal):** The grand finale. It either makes another strong move or forms a specific pattern to end the trend.

**Picture a Bullish Trend:**

Imagine a stock on the rise:

– **Wave 1:** The stock goes up as early buyers jump in.

– **Wave 2:** A bit of a step back as people take profits.

– **Wave 3:** The big move, as more and more people join the trend.

– **Wave 4:** A small pullback after that strong Wave 3.

– **Wave 5:** The final move that wraps up the trend.

**Three Important Conditions:**

Now, let’s remember three key things:

1. Wave 2 shouldn’t erase everything from Wave 1.

2. Wave 3 is usually the strongest and longest.

3. Wave 4 shouldn’t go back to where Wave 1 started.

**Understanding Different Timeframes:**

We also need to think about how these waves work on different charts – daily, hourly, and even minute charts. It’s like looking at the bigger picture versus zooming in on the details.

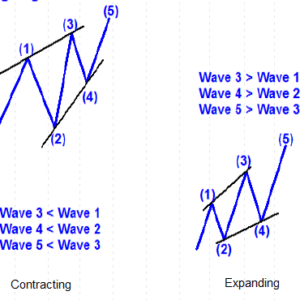

Different Types of

Different Types of

Add a Comment

You must be logged in to post a comment