Introduction

Welcome to the exhilarating world of forex supply and demand trading, where fortunes are won and lost in the blink of an eye. Among the myriad of strategies and techniques at your disposal, one stands tall as the bedrock of forex trading: the fascinating interplay of supply and demand. In this article, we’ll unlock the secrets of supply and demand in forex trading, revealing how this dynamic duo can propel you to success in the foreign exchange market.

The Enigmatic Heartbeat of Forex Markets

Picture the forex market as a living, breathing entity driven by the eternal dance of forex supply and demand. In this bustling global bazaar, traders exchange currencies, and the price of each currency pair is a reflection of the ceaseless tug-of-war between supply and demand.

Forex Supply and Demand in the Forex Universe

Supply: Supply represents the volume of a currency available for trading in the market. It’s swayed by influences like central bank policies, government interventions, and economic conditions. When the supply of a currency grows, its value tends to slip, and when it shrinks, its value soars.

Demand: Demand, on the other hand, is the fervor of traders to acquire a specific currency. It’s fueled by economic indicators, geopolitical tremors, and market sentiment. High demand for a currency propels its value upward, while low demand sends it on a downward spiral.

The Delicate Balance

Forex prices converge at the crossroads of forex supply and demand. When these forces harmonize, prices remain steady. But when an imbalance occurs, be ready for the rollercoaster ride. Successful traders are those who anticipate these imbalances and seize the opportunity to ride the waves to profit.

The Anchors of Support and Resistance

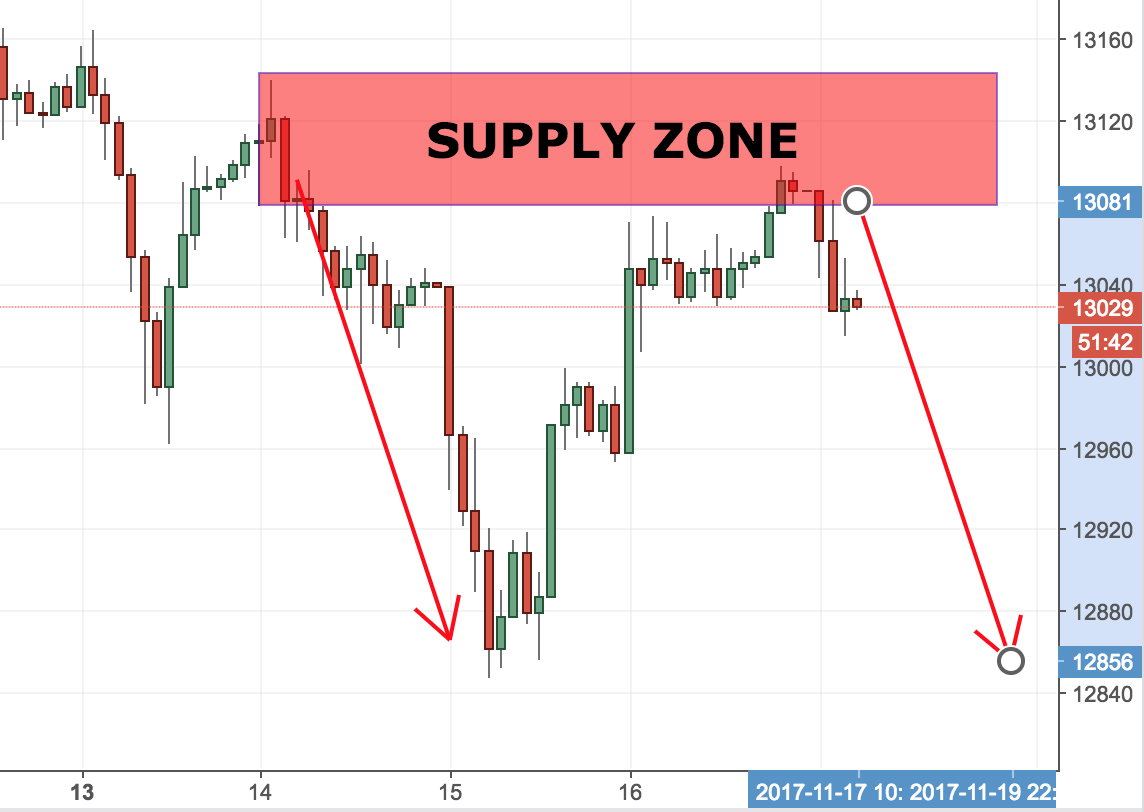

Think of supply and demand as your map in the forex wilderness. Support levels signify a currency’s price point where demand emerges to prevent further descent, while resistance levels mark where supply steps in to halt the ascent. These are your guiding stars for entry and exit points.

Trading Strategies That Harness the Power

To navigate this thrilling terrain, traders employ a variety of strategies deeply rooted in forex supply and demand dynamics:

Breakout Trading: At key supply and demand levels, traders watch for a potential breakout, launching their ship into the direction of the prevailing tide.

Range Trading: In range-bound markets, traders scoop up bargains at support and cash in at resistance, trading within the established boundaries.

Trend Trading: Like seasoned sailors, trend traders sail with the wind. They detect trends, born from the imbalances of supply and demand, and ride them to profit.

Chart Your Course with Risk Management

While supply and demand are your compass in forex trading, always ensure your vessel is seaworthy with effective risk management. Employ strategies like setting stop-loss orders and managing position sizes to protect your capital and sail through the choppy waters of the market.

Conclusion

Mastering the art of forex supply and demand is your passport to success in the exhilarating world of forex trading. Whether you’re an intrepid newcomer or an experienced mariner, incorporating these principles into your trading strategy will give you a commanding edge in understanding market dynamics and making informed decisions. But remember, in the world of forex trading, as in the high seas, fortune favors the well-prepared.

Disclaimer: Forex trading carries substantial risk and should be approached with caution. This article is for informational purposes only and does not constitute financial or trading advice. Before entering the forex market, conduct thorough research, assess your risk tolerance, and consider professional guidance.

Add a Comment

You must be logged in to post a comment