What changes the price of crude oil: How Forex Traders Can Achieve A new Level of Result

Introduction: Crude oil prices are highly volatile and influenced by numerous factors, making them crucial for Forex traders to understand. Knowing what drives these price changes can help traders make strategic decisions and achive a new level of resultsfrom market fluctuations.. This article delves into the key factors influencing oil prices and explores how Forex traders can leverage this knowledge to enhance their trading strategies.

What changes the price of crude oil:

Recent Trends:

- Price Drop: Recently, crude oil prices have experienced a decline due to several significant factors:

- Weaker Demand: One of the main reasons for the drop in oil prices is the weaker demand from major consumers like China. As the world’s largest oil importer, any slowdown in China’s economic growth or industrial activity can lead to reduced oil consumption and lower prices.

- High Global Inventories: The market is currently facing an oversupply situation, with high global oil inventories adding pressure on prices. When there is more oil available than the demand, prices naturally fall to balance the market.

- OPEC+ Production Decisions: The Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+) have been contemplating increasing oil production. Such decisions, if implemented, can lead to a flood of oil in the market, pushing prices downward.

- Strong US Dollar: Oil is traded globally in US dollars. A stronger dollar can make oil more expensive for buyers using other currencies, which may reduce global demand and lead to lower prices.

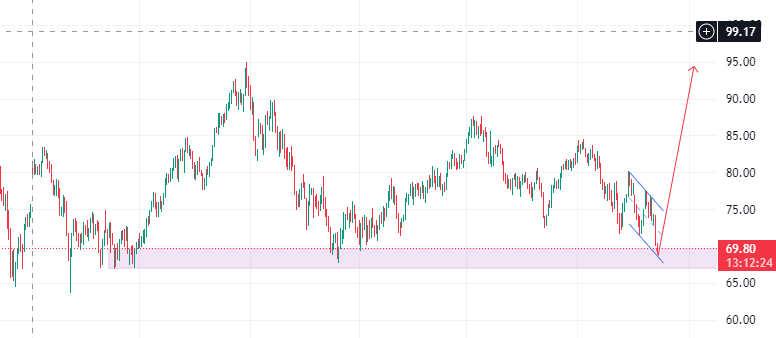

Current Prices: Currently, Brent crude is trading around $79 per barrel, while West Texas Intermediate (WTI) is approximately $74 per barrel.

Future Outlook

Short-Term:

- Potential for Increase: Oil prices might see a rise in the short term due to several factors:

- Increased Demand: A rebound in global economic activity, especially if major economies like China and the US show stronger growth, could boost oil demand and drive prices higher.

- Geopolitical Tensions: Any disruptions in key oil-producing regions, such as the Middle East, could lead to supply shortages and result in higher oil prices.

- Seasonal Factors: Seasonal changes, such as increased travel during summer months, can lead to higher oil consumption and push prices up.

Long-Term:

- Moderate Growth: Over the next few years, oil prices are expected to stabilize with moderate growth:

- Balanced Supply and Demand: OPEC+ efforts to manage production levels and prevent oversupply are likely to help maintain price stability.

- Energy Transition: The gradual shift towards renewable energy sources and improved energy efficiency could moderate long-term demand for oil, potentially keeping prices in check.

Key Factors Influencing Oil Prices: What changes the price of crude oil?

- Supply and Demand

- Supply: Changes in oil production levels significantly impact prices. An increase in production by major producers like the US, Saudi Arabia, or Russia often results in an oversupply, leading to lower prices. Conversely, a decrease in production can reduce supply and drive prices higher.

- Demand: Economic conditions play a pivotal role in determining oil demand. Strong economic performance in regions such as the US, China, or Europe typically boosts oil consumption, driving up prices. During economic downturns, reduced demand can cause prices to fall.

- OPEC+ Decisions

- OPEC+ decisions regarding production targets are critical in influencing oil prices. Production cuts by OPEC+ usually lead to a decrease in supply, thereby increasing prices. On the other hand, raising production targets can flood the market and drive prices down.

- Geopolitical Events

- Political instability or conflict in major oil-producing regions, such as the Middle East, can disrupt oil supply and cause price spikes. Stability in these regions generally helps stabilize oil prices.

- Natural Disasters

- Natural disasters, like hurricanes or earthquakes, can damage oil extraction and refining infrastructure, leading to supply disruptions and higher prices. For instance, hurricanes in the Gulf of Mexico can significantly impact US oil production.

- Economic Indicators

- Key economic indicators such as GDP growth, industrial production, and employment rates influence oil demand. Strong economic performance generally leads to increased oil consumption, pushing prices up. Forex traders can track these indicators on platforms like Myfxbook and Forex Factory to anticipate potential price changes.

- Currency Fluctuations

- Since oil is traded in US dollars, fluctuations in the dollar’s value affect oil prices. A stronger dollar can make oil more expensive for other currencies, reducing global demand and leading to lower prices. Conversely, a weaker dollar can boost demand and drive prices up.

- Technological Advances

- Technological advancements in oil extraction, such as fracking and deepwater drilling, have increased oil supply by accessing previously untapped reserves. This can lead to an oversupply and lower prices. However, setbacks in technology or higher production costs can reduce supply and drive prices higher.

- Market Speculation

- Speculation by traders and investors, such as buying futures contracts in anticipation of higher prices, can influence oil prices. Similarly, selling futures contracts due to expected declines can push prices down.

- Government Policies

- Government policies, including taxes on carbon emissions, subsidies for renewable energy, or fuel efficiency standards, can impact oil demand. For example, stricter environmental regulations can reduce oil consumption, leading to lower prices. Conversely, policies supporting fossil fuels can increase demand and push prices up.

Factors Influencing Oil Prices: How Forex Traders Can Profit?

Understanding these factors provides Forex traders with valuable insights for making informed trading decisions. By monitoring economic news and updates on platforms like Myfxbook and Forex Factory, and keeping an eye on OPEC+ production decisions, traders can better anticipate oil price movements. Additionally, trading currency pairs related to oil-exporting countries can offer opportunities to achieve a new level of results from fluctuations in oil prices.

In Conclusion: Grasping the “Factors Influencing Oil Prices: How Forex Traders Can Profit?” helps traders stay ahead of market trends. By analyzing OPEC+ decisions, geopolitical events, and economic indicators, and using resources like Myfxbook and Forex Factory, traders can enhance their strategies and maximize their trading potential.

Rana Das, CEO of Forex Wave Expert

Factors Influencing Oil Prices:

How Can Forex Traders Achieve New Levels of Results?

How do oil traders make money?

Add a Comment

You must be logged in to post a comment