Elliott Wave Guidelines: Unveiling Essential Guidelines from a Decade of Observation in Elliott Wave Trading (Part 12)

**Introduction:**

Welcome to Part 12 of our ongoing series on Elliott Wave Learning, where we delve into crucial insights gained from a decade of dedicated observation in Elliott Wave trading. Over the years, we have meticulously studied market patterns and behaviors, aiming to empower fellow traders with valuable guidelines for navigating the complexities of Elliott Wave Theory.

**Understanding Elliott Wave Guidelines:**

In the dynamic world of financial markets, adhering to well-established guidelines can significantly enhance the precision of Elliott Wave analysis. Here, we present a compilation of essential guidelines derived from a decade of experience:

**Elliott Wave Guidelines:**

Simple Patterns in Early Waves: The first waves, Wave 1 and Wave 2, usually show simple patterns like corrective wave zigzags and flats. These patterns are easy to spot and understand, making them great for beginner traders. Think of them as the basic building blocks of elliott wave analysis.

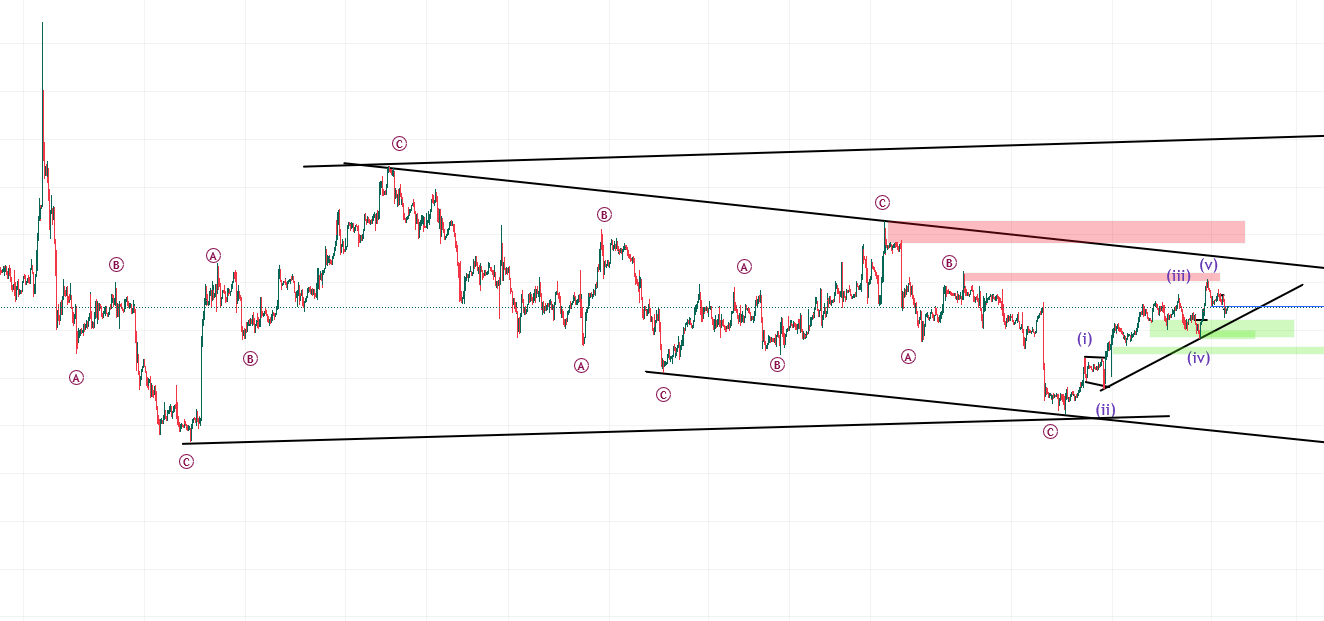

More Complex Patterns After Wave 2: As we move into Wave 3 and beyond, the patterns get more complicated. You’ll start seeing things like triangle patterns and combinations of different patterns like double zigzag, triple zigzag or etc. These require a bit more experience to identify and understand. It’s like moving from basic shapes to more complex designs.

Impulse Movements: In impulse wave movements, Waves 1, 3, and 5 tend to get longer. Wave 3 is often the longest and strongest of the three. This wave is driven by strong market momentum and can be very powerful. Imagine it as the wave that really pushes the market trend forward.

Extended Waves: Extended waves are interesting because they can have smaller or sub waves inside them. This creates a kind of wave within a wave, making the pattern more detailed and layered. It’s like looking at a big wave and then noticing smaller waves riding on top of it.

Rare Wave 5 Changes: Changes in Wave 5 don’t happen very often. When they do, it’s usually because Wave 3 was very long and strong. These changes can signal the end of a major market trend. Think of it as a rare event that marks a significant shift in the market.

Wave 5 Diagonals: Wave 5 diagonals are also rare and usually occur if Wave 3 was very long. When you see a Wave 5 diagonal, it often means the market trend is about to end. It’s like the final push before the market takes a break or changes direction.

**Fibonacci Guidelines:**

- **Retracement in Extended Waves:** When Wave 1 extends, Waves 2 and 4 tend to retrace within the 23-38% range, with less complex patterns.

- **Caution in Wave 2 Retracement:** A Wave 2 retracement of 78-80% of Wave 1 warrants caution, as it may indicate corrective structures (Wave A and B).

- **Parallel Movement of Wave 3 and 5:** In instances of Wave 3 extension, the retracement of Wave 5 often hovers around 61%, providing potential opportunities.

- **Structure of Extended Wave 4:** When Wave 3 extends, Wave 4 retraces within 23-38%, displaying relatively simpler patterns.

- **Wave 4 Retracement Signals:** A Wave 4 retracement exceeding 50% of Wave 3 often signals that Wave 4 may not be complete.

- **Similar Price Movements in Waves 1 and 3:** When Waves 1 and 3 exhibit comparable price movements, the likelihood of Wave 5 extension increases.

- **Avoidance of Wave 5 in Diagonals:** Diagonal patterns seldom give rise to Wave 5.

- **Diagonal Impact on Wave 3:** A diagonal Wave 1 often leads to the extension of Wave 3.

- **Diagonals and Wave 2:** Diagonals usually do not take the form of a triangle or triple three pattern in Wave 2.

- **Leading Diagonal Patterns:** Leading diagonal patterns in Wave 2 and 4 typically follow zigzag structures, such as simple, double, or triple zigzags.

**Conclusion:**

In conclusion, these guidelines serve as a testament to the insights gained from a decade of hands-on experience in Elliott Wave trading. By incorporating these observations into your analytical toolkit, you can navigate the complexities of the financial markets with greater confidence and precision. Stay tuned for more valuable insights in our continuing Elliott Wave Learning series.

**Additional:**

As we reflect on the wealth of knowledge shared in the preceding 11 articles, it becomes evident that each installment has been a stepping stone in our collective journey of mastering Elliott Wave Theory. These articles, born from real-world experiences and honed through a decade of market observation, have been instrumental in shaping our understanding of market dynamics.

In the earlier segments of our Elliott Wave Learning series, we explored foundational concepts, dissected wave structures, and delved into the intricacies of impulse and corrective waves. The Fibonacci connection provided a crucial bridge between Elliott Waves and retracement/extension levels, offering traders a powerful tool for validation.

As we navigated through the nuances of channeling techniques and recognized the significance of diagonal patterns, we started bridging the gap between theory and practical application. Trading strategies took center stage, highlighting the importance of risk management and the fusion of Elliott Wave principles with effective decision-making.

In our exploration of advanced Elliott Wave patterns, including ending diagonals and expanding triangles, we aimed to elevate your perspective, preparing you for the complexities of the ever-evolving financial landscape.

Now, in Part 12, we stand at the intersection of accumulated wisdom and future possibilities. The guidelines presented encapsulate not just theoretical concepts but actionable insights extracted from years of navigating the markets. These guidelines are the result of countless hours spent analyzing price movements, identifying patterns, and adapting to the ebb and flow of market sentiment.

Our commitment to your growth as a trader remains unwavering. As we continue to unravel the intricacies of Elliott Wave Theory, stay prepared for deeper dives into market dynamics, refined strategies, and insights that go beyond the surface.

This ongoing journey of Elliott Wave Learning is a testament to our dedication to your success in the forex market. Happy trading, and let’s continue riding the waves of knowledge together!

I am Rana Das, CEO of Forex Wave Expert and an Elliott Wave forex trader, drawing from my 10 years of experience in Elliott Wave trading. It’s important to note that while this series is based on Elliott Wave Theory, not all aspects are covered, and the content includes my personal insights. Additionally, some points in this series have been adapted from the main Elliott Wave Theory PDF, and certain images have been included for reference from search engines.

Add a Comment

You must be logged in to post a comment