Impulse Waves and Corrective In Elliott Wave: Part 3

# Decoding the Market Symphony: A Comprehensive Guide to Impulse and Corrective Waves in Elliott Wave Theory.

## Part 3: Embracing the Waves – Impulse and Corrective Unveiled

Welcome back to the third chapter of our exploration into Elliott Wave Theory. Today, we’re delving deep into the intricate dance of Impulse and Corrective Waves, unraveling the essence of these market movements. Whether you’re a novice trader or an experienced market participant, let’s dive in and uncover the nuances of these waves with simplicity and depth.

### Riding the Momentum with Impulse Waves

**Impulse Wave 101: The Market’s Driving Force**

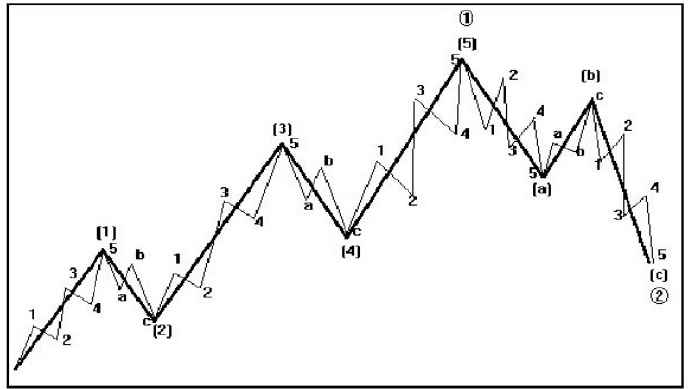

In the vast ocean of market dynamics, Impulse Waves are the powerful surges that propel the market forward, setting the tone for trends. They represent the directional movement of the market, driving prices in the direction of the prevailing trend. Let’s break it down into a more digestible rhythm:

**1. Wave 1 (The Starter):**

– Imagine Wave 1 as the opening chord in a musical piece, signaling the start of a new trend.

– It’s not a roaring wave, more like a gentle nudge saying, “Hey, something’s changing!”

**2. Wave 2 (The Breather):**

– After the initial excitement of Wave 1, the market takes a breath with a Wave 2 correction.

– Think of it as a quick pitstop before the journey continues.

**3. Wave 3 (The Powerhouse):**

– The star of the show, Wave 3 is like the market’s superhero – powerful and extended.

– It’s the longest and strongest wave, often surpassing the high of Wave 1.

**4. Wave 4 (The Chill):**

– After the adrenaline rush of Wave 3, Wave 4 is a chill moment, correcting without too much drama.

– It’s like the market saying, “Let’s take it easy for a bit.”

**5. Wave 5 (The Finale):**

– Wave 5 is the grand finale, completing the Impulse Wave and potentially showing a sign of slowing down.

– It might not be as strong as Wave 3, and you might notice a difference in the vibe.

**Trading Tips for Impulse Waves:**

– **Favorite Spot – Wave 3:**

– Wave 3 is often the sweet spot for traders. That’s where the action is!

– **Volume Check:**

– Keep an eye on trading volume, especially during Wave 3. It’s like the background music confirming the trend.

– **Stay Alert during Corrections:**

– Use corrections in Wave 2 and Wave 4 to fine-tune your positions. They’re opportunities in disguise.

### Navigating Market Corrections with Corrective Waves

**Corrective Waves: A Breather for the Market**

After the excitement of Impulse Waves, enter the Corrective Waves – the market’s way of taking a pause and making minor adjustments. Corrective Waves do not represent the primary trend but are essential for the overall health of the market. Let’s break it down in a way that’s easy to grasp:

**A. Wave A (The Correction Initiator):**

– Imagine this as the first gear shift – a gentle reminder that trends aren’t a straight line.

– It’s like the market saying, “Okay, let’s slow down a bit.”

**B. Wave B (The Rebound):**

– Following Wave A, the market rebounds with Wave B to correct part of the initial correction.

– It’s a bit of a rebound, a chance for traders who missed the initial trend to hop on.

**C. Wave C (The Completion):**

– Wave C is the final act, often extending beyond the starting point of Wave A.

– It’s a forceful move in the opposite direction, completing the corrective structure.

**Common Corrective Patterns:**

– **Zigzag (5-3-5):**

– Quick and sharp movements characterize Zigzag corrections.

– **Flat (3-3-5):**

– Flatter corrections suggest a pause in the overall trend.

– **Triangle (3-3-3-3-3):**

– Triangle corrections indicate a consolidation phase before the trend resumes.

**Trading Strategies for Corrective Waves:**

– **Patience in Wave C:**

– Before jumping into trades during Wave C, exercise patience and wait for clear signals.

– **Diversify for Safety:**

– Diversify your portfolio during corrective waves. It’s like having different dance moves ready for various tunes.

– **Fibonacci Magic:**

– Use Fibonacci retracement levels to spot potential reversal points within corrective waves. Think of it as your trading magic wand.

### The Harmony of Impulse and Corrective Waves

Now, let’s bring it all together and explore how Impulse and Corrective Waves dance in harmony:

**1. Recognizing Patterns:**

– Look for the dance between Impulse and Corrective Waves. It’s like a rhythm in the market.

**2. Fibonacci – Your Trading Ally:**

– Fibonacci retracement and extension levels are your allies. They help you spot potential turning points and extensions in the market melody.

### Real Trades Unveiled: Case Studies

Let’s take a peek at practical examples and apply our newfound knowledge to real trades:

**1. Currency Pairs:**

– Dive into major currency pairs, see how they groove to Elliott Wave patterns, and understand what it means for your trades.

*Example: EUR/USD Dance*

In 2020, the EUR/USD pair displayed a classic Elliott Wave pattern. Waves 1, 2, and 3 showcased a strong bullish trend, while Wave 4 provided a mild correction. Traders who recognized this pattern could have strategically entered during the corrective phase, anticipating the powerful Wave 5 to follow.

**2. Stock Markets:**

– Explore Elliott Wave patterns in popular stocks. It’s like reading the market’s story through the movements of your favorite characters.

*Example: Tech Stock Symphony*

Consider the Elliott Wave pattern in a leading tech stock. As Waves A and B unfolded, astute traders might have positioned themselves for the upcoming Wave C. This understanding allowed them to ride the upward surge, capitalizing on

the completion of the corrective structure.

**3. Crypto Adventures:**

– Venture into the world of cryptocurrencies, where Elliott Waves can be your compass in navigating the digital market seas.

*Example: Bitcoin’s Elliott Wave Ballet*

Bitcoin, being a volatile instrument, often exhibits clear Elliott Wave patterns. Traders employing this knowledge during corrective phases could have timed their entries, capitalizing on the subsequent impulse waves.

## Conclusion: Surfing the Waves of Success

Congratulations! You’ve not only survived but thrived in the world of Impulse and Corrective Waves within the Elliott Wave Theory. As you embark on your trading journey, may these waves be your companions, guiding you through the market’s ebb and flow with ease. Happy trading, and may your charts always sing the sweet melody of success!

With a solid understanding of these waves, you’re equipped to navigate the ever-changing seas of the financial markets. As you embark on your trading journey, remember that patience, discipline, and continuous learning are your greatest allies. May your trades be prosperous, and your journey in the world of finance be filled with success and fulfillment. Happy trading!

Add a Comment

You must be logged in to post a comment