Elliott Wave Diagonal Patterns Demystified: Essential Elliott Wave Insights for Forex and Stock Traders.

In this sixth article of our comprehensive Elliott Wave Learning Series, we delve into the intricate realm of diagonal patterns. Mastering Elliott Wave Theory is an essential skill for traders, and understanding diagonals is key to decoding complex market movements. Join us as we explore the distinctions between Elliott Wave Diagonal Patterns leading and ending diagonals, dissect their rules and characteristics, and provide real-world examples to enhance your comprehension.

## 1. Overlapping Waves: A Conundrum in Impulse Waves

Before we unravel the mysteries of diagonals, let’s address the potential conundrum of overlapping waves in impulse waves. While the fourth wave of an impulse ideally shouldn’t overlap the first wave’s ending point, occasional overlaps occur. Traders must discern whether these overlaps signal anomalies or align with Elliott Wave patterns.

## 2. Diagonal Patterns: Unveiling the Beginning and End of Movements

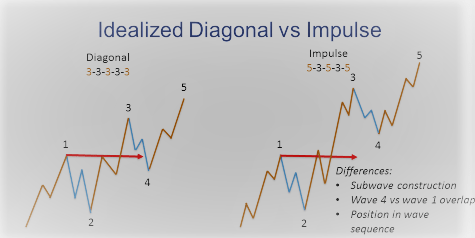

When faced with a 5-wave price movement displaying an overlap between waves one and four, it suggests a potential diagonal formation. Diagonals manifest in two primary types: leading diagonals and ending diagonals.

### a. Leading Diagonal: The Precursor to Change

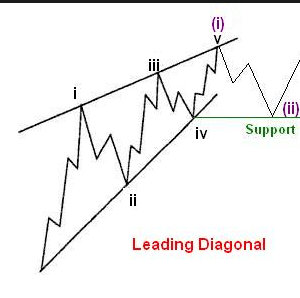

### a. Leading Diagonal: The Precursor to Change

**Formation:** Occurs in wave 1 of an impulse or wave A of a zigzag.

**Subdivision:** Comprises five waves (1-2-3-4-5).

**Distinctive Traits:**

– Overlapping waves 1 and 4, often forming a wedge shape.

– Serves as an early warning for trend reversals.

### b. Ending Diagonal: Culmination of Trends

**Occurrence:** Typically in the fifth wave of an impulse or the C-wave of A-B-C formations.

**Structural Elements:** Comprises five sub-waves (1-2-3-4-5).

**Characteristics:**

– Shorter waves 5 and 3 compared to waves 1 and 3.

– Implies an impending sharp reversal in the market trend.

## 3. Rules for Identifying Diagonals

Understanding the nuances of diagonals involves adherence to specific rules:

- **Wave Subdivision:** Comprises 5 waves with a typical 3-3-3-3-3 structure.

- **Wave 2 Constraint:** Wave 2 must not end beyond the starting point of wave 1.

- **Wave 3 Breakout:** Wave 3 must surpass the ending point of wave 1.

- **Wave 4 Boundary:** Wave 4 usually extends beyond the ending point of wave 1.

- **Wave 5 Conclusion:** In the majority of cases, wave 5 breaks the ending point of wave 3.

- **Wave 3 Duration:** Wave 3 should not be the shortest among the five waves.

- **Wave 2 Structure:** Wave 2 cannot be a triangle or a triple three structure.

- **Motive Wave Possibilities:** Waves 1, 3, and 5 can manifest as either impulses or zigzags.

## 4. Structure of Motive Waves in Diagonals

The structure of leading diagonals unfolds in a 5-3-5-3-5 pattern. While zigzags are more common, impulses may replace waves 1, 3, and 5. An Ending diagonals structure of 3-3-3-3-3, resembling an impulse, is also plausible.

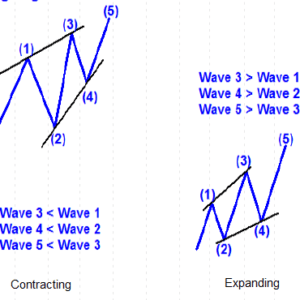

## 5. Types of Diagonals: Contracting and Expanding

Understanding the variations in Diagonals enhances predictive accuracy:

**Expanding Diagonal:**

– Each motive wave is longer than the preceding one.

– The third wave surpasses the first.

– The fifth wave is longer than the third.

– Considered riskier than contracting diagonals.

**Contracting Diagonal:**

– Typically sees the longest first wave.

– The third wave is smaller than the first.

– The fifth wave is smaller than waves one and three.

– Occasional exceptions with the longest third wave.

## 6. Real-World Examples: Navigating Complexity

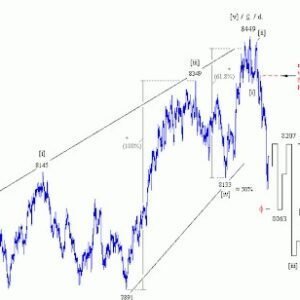

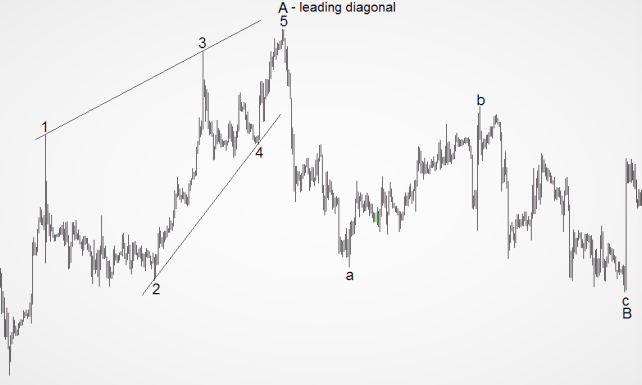

Examining charts with practical examples aids in understanding the intricacies of Diagonals:

- **Example 1: Expanding Leading Diagonal**

– Unfolding waves exhibit an expanding leading diagonal.

– Each motive wave extends beyond its predecessor.

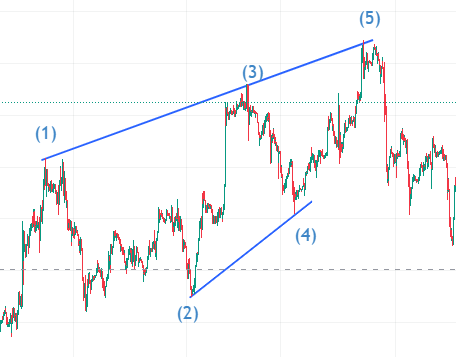

**Example 2: Ending Diagonal with Complex Corrections**

**Example 2: Ending Diagonal with Complex Corrections**

– Demonstrates a Ending diagonal with zigzags and a double zigzag.

– Highlights the potential complexity beyond simple impulse waves.

**Example 3: Expanding Diagonal During Fundamental Events**

– An expanding diagonal formed during a Fundamental event.

– Illustrates the impact of external factors on wave patterns.

## 7. Confirmation Strategies for Diagonal Patterns

Seeking confirmation is imperative when dealing with zigzag-based diagonals. Waiting for a correction post-diagonal and subsequent formation of an impulse wave enhances pattern validation.

## 8. Expanded Diagonals: Rare Scenarios

Occasionally, an expanding diagonal may extend beyond expected limits, breaking the line from waves one and three. This rare occurrence, often influenced by significant events, exemplifies the dynamic nature of financial markets.

## 9. Leading Diagonals with Impulses Inside

Leading diagonals can manifest with impulses within waves 1, 3, and 5. A closer look at the chart reveals a leading diagonal in wave A with motive waves resembling impulses.

## 10. Ending Diagonals with Impulses Inside

Ending diagonals also can moved impulses within waves 1, 3, and 5. A closer look at the chart reveals an Ending diagonal in this wave pattern with motive waves resembling impulses.

## 11. Conclusion: Mastering Diagonal Patterns

In conclusion, mastering diagonal patterns empowers traders with a profound understanding of market dynamics. Recognizing the diverse patterns, adhering to rules, and validating through confirmation contribute to the successful navigation of financial markets. Armed with this knowledge, traders can embark on their journey with confidence, ready to decipher and capitalize on diagonal patterns.

Add a Comment

You must be logged in to post a comment